TQ Morning Briefing

Markets Regain Momentum as Earnings and Easing Steady the Tape

From the T&Q Desk

Markets ended October on a strong note Friday, shaking off early-week volatility and finding footing in the final session of a busy stretch for policy and earnings.

The S&P 500 gained 0.7%, the Nasdaq rose 1.3%, and the Dow added 0.4% as traders leaned back into megacaps following upbeat results from Amazon and Apple.

The pair’s performance capped a week that restored confidence in the durability of the AI and consumer tech cycle, offsetting earlier weakness tied to Meta’s sharp post-earnings decline.

The Fed’s quarter-point cut to a 3.75–4.00% range midweek set the tone, even as Chair Powell’s insistence that a December move was “not a foregone conclusion” kept the front end of the curve firm.

Earnings continued to outperform expectations, with roughly 60% of S&P 500 companies now reported and profit growth tracking near 10.7% year-over-year. Technology names remain the largest single contributor to that strength, responsible for more than half of the index’s aggregate earnings gains.

Friday’s rally sealed a sixth consecutive monthly advance for the S&P 500 and seventh for the Nasdaq, the longest streak since 2018. Behind the headline strength, however, is a market that’s become acutely concentrated.

Nvidia’s $5 trillion market value now represents nearly one-tenth of the S&P 500, and the “Magnificent Seven” cohort accounts for the majority of both capex growth and index-level earnings gains. For now, investors appear content with that imbalance, confident that policy easing and AI infrastructure spending can keep the bull market alive as it enters its third year.

Premier Feature

7 Income Machines Built to Make You Rich

The 7 Stocks to Buy and Hold Forever aren’t just plays for the next quarter - they’re built to deliver for decades.

These are blue-chip companies with fortress balance sheets, elite dividend track records, and the staying power to outperform in bull and bear markets alike.

Some are Dividend Kings, others are on the path there, and all are proven wealth compounding machines.

Word Around the Street

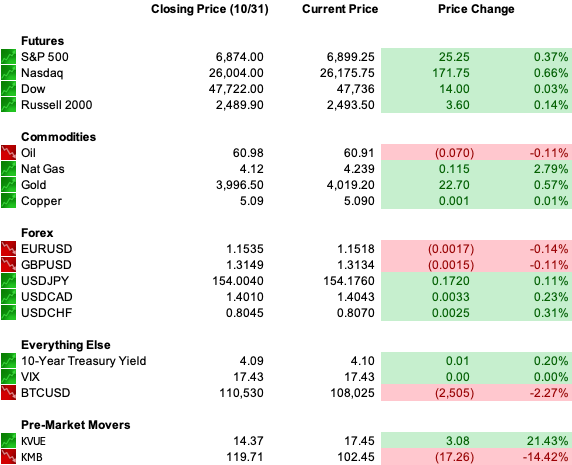

Futures are higher to start the week, with the S&P 500 up 0.3%, Nasdaq 100 up 0.6%, and Dow Jones flat. The upbeat tone follows October’s strong finish and is being fueled by AI optimism, easing trade tensions, and a Fed now in quiet-support mode after ending balance-sheet runoff.

Palantir and AMD headline this week’s earnings slate, two of the market’s most visible proxies for the durability of the AI rally. Investors will watch whether their results justify year-to-date gains that have outpaced even the megacap benchmarks.

Berkshire Hathaway is also in focus after revealing record cash reserves of $382 billion and a lighter equity portfolio, a signal that some of Wall Street’s most disciplined capital allocators see limited value at current multiples.

Bond yields are little changed early, with the 10-year at 4.09%. Oil is firmer near $61 a barrel after OPEC+ confirmed plans to pause production hikes early next year, while gold trades just above $4,000 and Bitcoin starts the week a bit lower, around $107,500.

Despite the cautious tone from Fed officials late last week, risk appetite remains intact. Traders view Powell’s pause on further cuts less as a pivot than as an invitation to stay positioned for easing in 2026.

With earnings momentum still strong and policy uncertainty partially defused, the path of least resistance for now is higher, but it’s a narrow one. Concentration in a handful of megacaps continues to mask thin leadership beneath the surface, leaving this morning’s strength more a vote of confidence than conviction.

Global Policy Watch

The Fed’s decision to halt balance-sheet runoff by December effectively ends a multi-year liquidity drain.

As the central bank begins reinvesting proceeds from maturing Treasurys and agency debt, cash will flow back into short-term markets, easing funding pressures and supporting risk assets. Analysts equate the move to a de facto quarter-point rate cut.

Across the Atlantic, a role reversal is underway. Southern Europe’s former “crisis economies,” Spain, Portugal, and Greece, are now fiscal standouts, while France, Germany, and the U.K. face widening deficits and political gridlock.

France’s 5.4% fiscal gap has triggered an S&P downgrade, Germany’s industrial model remains strained by tariffs and weak growth, and Britain prepares tax hikes to stabilize its debt trajectory.

The north’s fiscal fatigue contrasts sharply with the discipline imposed on the south during the last debt crisis.

Trade Winds & Global Shifts

OPEC+ announced it will pause output hikes in the first quarter of 2026 after one final 137,000-barrel-per-day boost in December. The cartel’s move aims to head off a potential glut, with oil hovering near $61 a barrel, down roughly 15% year-to-date. The pause underscores a market wary of oversupply and seasonally weaker demand.

Auto stocks rallied in Europe after China agreed to consider exemptions for Nexperia chip exports, easing a semiconductor bottleneck that had threatened production lines. Renault, Mercedes, Stellantis, and Volkswagen all gained more than 2%. The detente between Beijing and The Hague is the latest sign that post-Busan trade diplomacy is beginning to thaw key supply chains.

Elsewhere, U.S.–India relations have cooled as tariffs on Indian goods climbed to 50%, exceeding the 47% levied on Chinese imports. Analysts call the shift emblematic of President Trump’s transactional foreign policy, which has revived friction even among allies.

While Washington and Beijing move toward a managed truce, New Delhi finds itself recalibrating between competing superpowers.

From Our Partners

Forget AI, This New Tech is Projected to Grow 3x Faster

President Trump's new law #S.1582 unlocks a new tech that could trigger a $21 trillion financial revolution.

And said that it represents "American brilliance at its best."

Click here to see the details because the market for this tech…

Is projected to grow more than THREE times FASTER than AI in the coming years.

D.C. in the Driver’s Seat

The U.S. government shutdown entered its 34th day, on track to set a record. Democratic senators are urging President Trump to join negotiations linking government funding with expiring health-care subsidies under the Affordable Care Act.

Airport delays worsened over the weekend, and Treasury Secretary Scott Bessent said court-ordered SNAP food benefits could resume by Wednesday.

Political tension mounts ahead of Tuesday’s elections in Virginia, New Jersey, and New York City, where Democrats are favored to retake Virginia’s governorship and hold New Jersey but face ideological rifts within the party.

A likely victory by New York’s progressive candidate Zohran Mamdani could deepen debates over whether the path forward lies with centrist pragmatism or economic populism.

Meanwhile, polling shows 63% of voters dissatisfied with Trump’s handling of the economy and 66% critical of his inflation response, numbers that underscore rising voter fatigue as the shutdown drags on.

Friday’s Chart Check Results

A big thank you to all those who participated!

Friday’s chart was XLK, the Technology Select Sector SPDR Fund, the benchmark ETF that tracks the S&P 500’s tech sector. It’s one of the market’s most important gauges of sentiment, not just for Big Tech but for the entire growth trade that has defined 2025.

Now that nearly all of the “Magnificent 7” have reported, XLK’s price action captures the market’s verdict: confidence is intact, but conviction is waning. The ETF remains well above key support levels, suggesting faith in long-term profitability, yet its recent stall reflects exhaustion after a year of record optimism.

In short, XLK is the heartbeat of market momentum, and watching whether buyers defend the 50-day moving average in the weeks ahead will tell us if this rally is simply catching its breath or starting to lose altitude.

Economic Data

ISM Manufacturing PMI

Fed Speakers: Daly, Cook

Earnings Reports

PLTR

O

VRTX

WMB

SPG

IDXX

UBNT

PEG

FANG

Overnight Markets

Asia: Nikkei +2.12%, Shanghai +0.55%

Europe: FTSE +0.15%, DAX +1.08%

U.S. Pre-Market

From Our Partners

AI's NEXT Magnificent Seven

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

Opening Outlook

Markets head into the first week of November with momentum and a measure of restraint. The AI-fueled earnings surge has restored confidence in growth, but the combination of high valuations, uncertain Fed timing, and uneven global data keeps traders selective rather than euphoric.

The Fed’s second rate cut in as many meetings, paired with the decision to end quantitative tightening on December 1, has reintroduced liquidity support just as the government shutdown begins to test political patience. Washington gridlock remains the main domestic drag, while tariffs and fiscal rebalancing continue to shape the tone abroad.

For now, the rally’s foundation rests on three pillars: policy easing that’s steady but not excessive, earnings that keep surprising to the upside, and capital still flowing toward AI, chips, and data infrastructure.

How long that equilibrium lasts will depend on whether breadth improves and liquidity can offset fatigue. The first few sessions of November will set the tone, confidence is back, but conviction still costs extra.