TQ Morning Briefing

Markets Rise as Trump–Xi Trade Breakthrough Lifts Global Sentiment

From the T&Q Desk

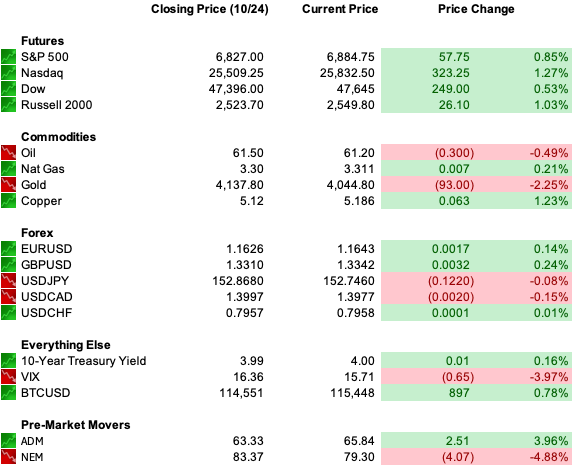

Good morning Traders and Quants! Stocks closed Friday at fresh record highs after the long-delayed September CPI report showed inflation easing more than expected.

The S&P 500 gained 1.9% for the week, the Nasdaq rose 2.3%, and the Dow climbed 2.2%, closing above 47,000 for the first time.

Technology and communications led the advance, extending a seven-month rally as investors bet on a soft-landing scenario and another Fed rate cut this week.

Bond yields slipped, with the 10-year finishing near 4.0%, while oil prices ended higher for the week but eased Friday after sanctions volatility.

The cooler CPI print, 3.0% headline versus 3.1% expected, reinforced confidence that disinflation is intact even with tariff noise. Both services and manufacturing PMIs remained in expansion territory, underscoring that growth has moderated but not broken.

Premier Feature

When the Fed Cuts, These Go First

The rate-cut rally is already taking shape — and our analysts just pinpointed 10 stocks most likely to lead it.

They’ve dug through every chart, sector, and earnings trend to find companies positioned for explosive upside once the Fed eases.

From AI innovators to dividend aristocrats, these are the names attracting billions in early institutional money.

Miss them now, and you’ll be chasing the rally later.

Word Around the Street

Futures indicate a strong open after Treasury Secretary Scott Bessent confirmed a “substantial framework” had been reached with Beijing, one that would defer rare-earth export controls and avert the threatened 100% U.S. tariffs.

The S&P, Nasdaq, and Dow are all set to start the week at new all time highs. Oil eased back after last week’s sanctions-driven spike, while gold remained steady near $4,130 an ounce.

Investors now shift focus to the two major catalysts ahead: the Fed’s policy decision and the deluge of big-tech earnings. Microsoft, Meta, and Alphabet report Wednesday, followed by Apple and Amazon Thursday.

Analysts expect double-digit revenue growth for the group, but cost pressure from AI infrastructure spending could weigh on margins.

The AI narrative remains both the engine and the uncertainty of this cycle. Hedge-fund giant Coatue reaffirmed its bullish stance, arguing that productivity gains from AI are still in the early innings despite bubble chatter. Markets appear to agree, as tech continues to lead despite stretched valuations.

Bond markets are quieter but poised for movement. Investors have scaled back exposure to long-dated Treasuries, preferring the five-year and shorter maturities as the Fed nears an inflection point.

Quantitative tightening’s end, now widely expected to be telegraphed this week, could offer a mild tailwind to bonds in the weeks ahead.

Global Policy Watch

The Federal Reserve enters its two-day meeting facing a finely balanced mandate: cooling inflation at 3%, a labor market losing momentum, and a government shutdown limiting data visibility.

Markets fully price a 25-basis-point cut, taking the federal funds range to 3.75%–4.00%.

Powell’s tone will matter more than the cut itself. Investors expect him to emphasize employment risks and signal flexibility on future moves, while potentially outlining an exit path from balance-sheet runoff.

Ending quantitative tightening would tighten supply conditions less aggressively and act as a quiet stimulus to credit markets.

Looking ahead, markets are far more dovish than the Fed’s own forecasts. Futures imply rates around 2.8% by the end of 2026, versus policymakers’ median projection of 3.4%. That divergence may become a story of 2026, but for now, easing expectations continue to buoy risk assets.

Trade Winds & Global Shifts

President Trump’s Asia tour is reshaping trade expectations in real time. Washington and Beijing have reached a preliminary framework that would delay new tariffs and defer China’s planned rare-earth export controls by a year.

The announcement drove a 1% pullback in oil and metals Monday, as fears of renewed escalation eased.

In parallel, the U.S. signed new trade and mineral cooperation agreements with Malaysia and Cambodia, and frameworks for deals with Thailand and Vietnam. Malaysia agreed to lift export restrictions on critical minerals, bolstering U.S. access to non-Chinese supply chains.

Argentina added a surprise positive note to global sentiment. President Javier Milei’s Liberty Advances party scored a sweeping midterm victory, validating Milei’s market-liberal reforms and signaling continuity for fiscal tightening and IMF cooperation, a confidence boost for emerging-market investors watching political stability return to Latin America.

From Our Partners

There's a HUGE Downside to This Bull Market (And It's Not a Crash)

It's hard to deny we're in a bull market.

But one multi-millionaire investor says this is unlike any bull run we've seen before.

"There's a dark reason why so many assets are levitating—it's a sign we've entered the Most Terrifying Bull Market in History."

D.C. in the Driver’s Seat

At home, the 27-day government shutdown has entered its most disruptive phase, but markets remain unfazed. Investors are trading around the blackout using corporate earnings and private-sector data as proxies.

Politically, attention is shifting to November’s gubernatorial races. In Virginia, Democrat Abigail Spanberger continues to lead Republican Winsome Earle-Sears despite Republican efforts to tie her to a scandal involving the Democratic attorney-general nominee. Spanberger’s pragmatic, centrist platform has resonated with suburban voters as federal-worker layoffs weigh on the state’s economy.

In New Jersey, Representative Mikie Sherrill maintains a narrow edge over Jack Ciattarelli in a tightening race, with both parties calling in former President Obama to rally turnout. Together, the two contests underscore how moderation, not ideological brinkmanship, is defining the current political mood, mirroring investor preference for predictability over volatility.

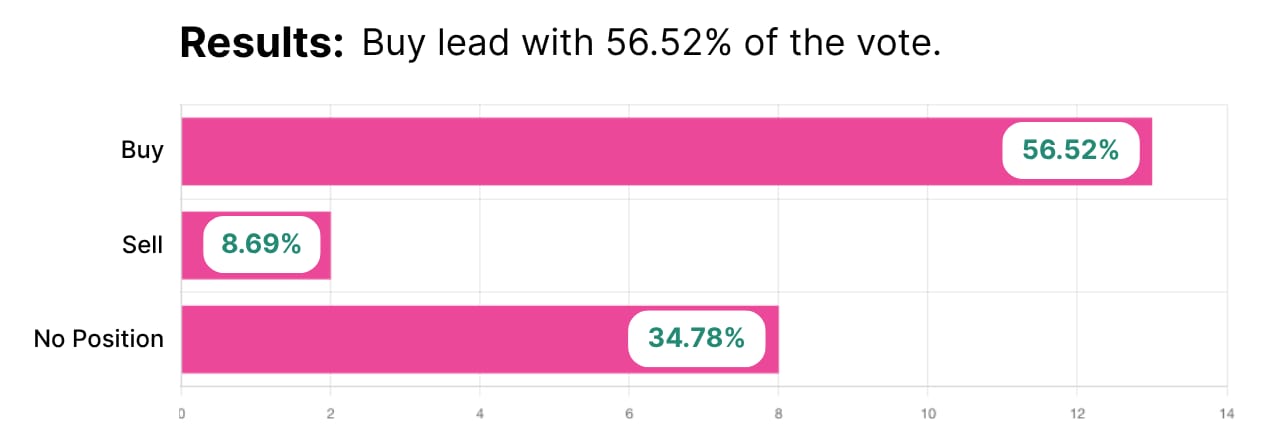

Friday’s Chart Results

A big thank you to all those who participated!

Friday’s chart was USD/CAD, the exchange rate between the U.S. dollar and the Canadian dollar, often called “the loonie.” It’s one of the most closely watched currency pairs because it reflects both trade dynamics and commodity sentiment, especially oil.

When investors buy USD/CAD, they’re betting on U.S. strength, higher yields, stronger growth, or risk aversion that sends money toward the dollar. Selling it means confidence in Canada’s economy or rising oil prices that tend to lift the loonie. With Trump’s abrupt decision to end trade talks and new sanctions roiling energy markets, the pair’s move toward 1.40 highlighted just how quickly geopolitics can ripple through FX.

Economic Data

Dallas Fed Manufacturing Index

Earnings Reports

WELL

WM

KDP

CDNS

HIG

Overnight Markets

Asia: Nikkei +2.46%, Shanghai +1.18%

Europe: FTSE -0.00%, DAX +0.06%

U.S. Pre-Market

From Our Partners

The Crypto That’s Making Wall Street Salivate

The floodgates have opened.

Bitcoin and Ethereum ETFs are hitting record inflows — Wall Street’s finally all-in on crypto.

But while everyone’s chasing the big names, one undervalued altcoin is quietly rewriting the rules of finance.

It’s already processing billions… turning investors into their own banks… and outpacing Wall Street’s old money machine.

Now, with the Fed Pivot igniting a new bull run, this crypto is primed for liftoff.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Opening Outlook

Monday opens on a note of renewed conviction. Inflation is cooling, the Fed is poised to ease, and the U.S.-China thaw has reduced the risk of a trade-shock recession. With global supply chains recalibrating and corporate earnings broadly exceeding forecasts, investors are leaning into the idea that this rally still has room to run.

If the past week proved anything, it’s that the defining theme of 2025 remains the same: resilience, rewarded.