TQ Morning Briefing

Earnings Season Looms as Shutdown Drags | Geopolitics Redefine Risk Appetite

From the T&Q Desk

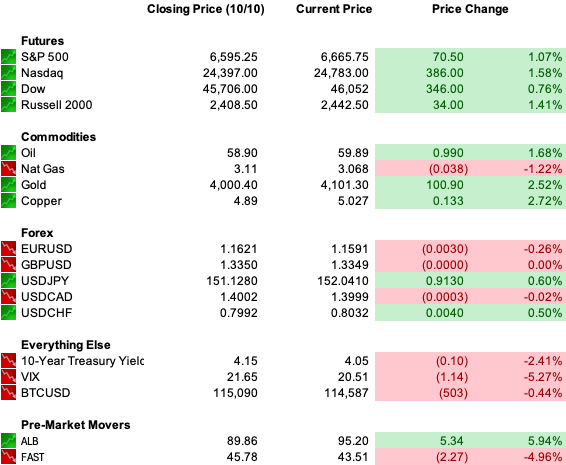

Markets ended last week on their back foot, snapping a monthlong stretch of calm as trade tensions reignited between the U.S. and China. President Trump’s threat of a “massive increase” in tariffs sent stocks tumbling Friday, wiping out earlier gains and marking the S&P 500’s sharpest weekly drop since May.

Technology and consumer discretionary names bore the brunt, while staples stood out as the lone sector in the green. The selloff came after Beijing announced fresh export controls on rare earth minerals, critical to semiconductors, defense systems, and battery technology, followed by Washington’s warnings of reciprocal measures.

Bond yields fell, with the 10-year Treasury settling near 4.06% as investors sought safety amid geopolitical and political crosscurrents.

Oil slid below $60 per barrel for the first time since spring after the Gaza cease-fire reduced supply risk, while gold extended its rally to $4,000 an ounce, its eighth straight weekly gain.

The dollar eased after a four-day surge, and Bitcoin retreated from record highs near $126,000. The CBOE Volatility Index spiked above 21 for the first time since June, a reminder that sentiment can turn quickly after an extended stretch of complacency.

The University of Michigan’s consumer sentiment survey offered a rare data point during the shutdown, showing confidence dipping to 55.0, its lowest level since May, as inflation and job worries linger.

While spending has held up, weakening expectations point to a cautious household backdrop heading into year-end. With government data delayed, corporate earnings will now serve as the market’s primary window into economic health.

Premier Feature

Most People Will Miss the Biggest Crypto Window of the Decade

Every cycle, the same thing happens.

A handful of investors spot the signal — and everyone else realizes it too late.

✓ Fed rate cuts = liquidity surge

✓ 90+ altcoin ETFs about to launch

✓ Institutional money pouring in

Q4 has always been crypto’s “money season”… but 2025 could dwarf them all.

Altcoins have historically outperformed Bitcoin by up to 10x during runs like this — and the window is closing fast.

If you sit this one out, you might spend years watching others cash in on what you ignored.

You won’t get a second chance at a setup like this.

Word Around the Street

Futures steadied overnight, with traders looking ahead to a heavy week of bank earnings that will mark the unofficial start of reporting season. JPMorgan, Goldman Sachs, Citigroup, and Wells Fargo headline Tuesday, followed by Bank of America, Morgan Stanley, and ASML midweek, and American Express to close Friday.

Analysts expect roughly 8% year-over-year S&P 500 earnings growth, led by technology, utilities, and materials, with seven of eleven sectors projected to post higher profits.

State Street’s Michael Arone described himself as “uncomfortably bullish,” arguing that while valuations remain stretched, earnings breadth should support rotation beyond the AI complex.

Still, the market’s margin for error is thin after months of uninterrupted gains. In the absence of key government reports, CPI now due October 24, investors will parse corporate guidance and Fed commentary for macro clues.

Monday’s bond market closure for Columbus Day may keep early volume light, but volatility has returned, and positioning looks fragile at elevated levels.

Global Policy Watch

The Federal Reserve’s internal divide is sharpening even as its tone softens. Minutes from the September meeting show a narrow majority favoring two additional rate cuts this year, while several officials caution against moving too quickly. Vice Chair Michael Barr urged “patience” and Atlanta Fed President Raphael Bostic admitted his inflation concerns now hold “a narrower margin.”

By contrast, New York’s John Williams and governors Michelle Bowman and Stephen Miran advocate more decisive easing, arguing that labor-market weakness poses the greater risk. Miran, a Trump appointee, dissented for a half-point cut last month. Powell remains deliberately noncommittal, calling forecasting “particularly challenging” without fresh data amid the shutdown.

Futures markets still price in two more quarter-point reductions before year-end, signaling investors may be more confident in the Fed’s dovish tilt than the Fed itself.

Trade Winds & Global Shifts

Middle East: Trump’s high-profile diplomacy took center stage this weekend as he arrived in Israel for the signing of a cease-fire deal between Israel and Hamas. The agreement triggered the release of 20 hostages and the first sustained pause in fighting since March.

U.S. troops from CENTCOM have joined a multinational team to monitor the truce and aid flow, though the long-term governance of Gaza remains unresolved. Hamas gunmen reappeared in parts of the Strip, raising questions over enforcement as reconstruction begins.

Asia-Pacific: In Beijing and Washington, trust continues to erode. China’s new rare-earth export restrictions and port fees on U.S. ships were met with Trump’s tariff threats and talk of export controls on “critical software.”

Analysts see both sides misreading the other’s intentions, with little faith in a lasting truce before next month’s APEC summit. Markets fear the dispute could spill into semiconductors, where Beijing’s new 0.1% content rule could snare global chipmakers.

Europe: Poland has quietly become NATO’s most heavily armed European state, spending nearly 5% of GDP on defense and fielding the alliance’s third-largest standing army. Its wargames with U.S. and Dutch forces underscore how seriously Warsaw views recent Russian drone incursions. The buildup aligns with Trump’s calls for greater European burden-sharing but risks drawing Poland deeper into the front line of renewed East-West tension.

Ukraine: Trump escalated rhetoric Sunday, warning he may send Tomahawk cruise missiles to Kyiv if Moscow refuses to engage in peace talks. The remark, delivered aboard Air Force One en route to Tel Aviv, signals a tougher edge after months of diplomatic frustration.

The White House insists it still seeks a negotiated settlement, but the mere mention of Tomahawks raised the temperature across Europe’s capitals.

From Our Partners

Wall Street Legend’s Bold New Pick

AI stocks minted 600,000 new millionaires. But 50-year Wall Street veteran Marc Chaikin says the next wave of winners won’t be biotech, cryptos, or even Nvidia.

In a new on-camera interview, Marc reveals the name and ticker of his #1 free stock pick—and why it could be hiding in plain sight.

The last time he made a call like this, over 11 million viewers tuned in… and the stock he named doubled.

D.C. in the Driver’s Seat

The government shutdown entered its third week with no resolution in sight and visible strain spreading through the economy. Museums are shuttered, small-business loans frozen, and federal contractors furloughed without pay guarantees.

President Trump defused one flashpoint by ordering the Pentagon to use unspent funds to pay the military, ensuring 1.3 million servicemembers receive their Oct. 15 paychecks. The move, financed through $8 billion in unused R&D allocations, buys the administration breathing room but may reduce pressure on Congress to act.

On Capitol Hill, negotiations remain circular. Republicans accuse Democrats of “hostage taking” over demands to extend enhanced Affordable Care Act subsidies; Democrats counter that GOP leaders refuse to negotiate until the government reopens.

Meanwhile, layoffs across federal agencies have begun, over 4,000 so far, prompting lawsuits from unions and warnings from economists that consumer spending could falter if the impasse drags on.

Frustration is mounting on both sides, but optimism for a quick resolution is thin. Lawmakers have compared the standoff to “Groundhog Day,” with neither party willing to move first. Each week of closure is expected to shave up to 0.2% from quarterly GDP.

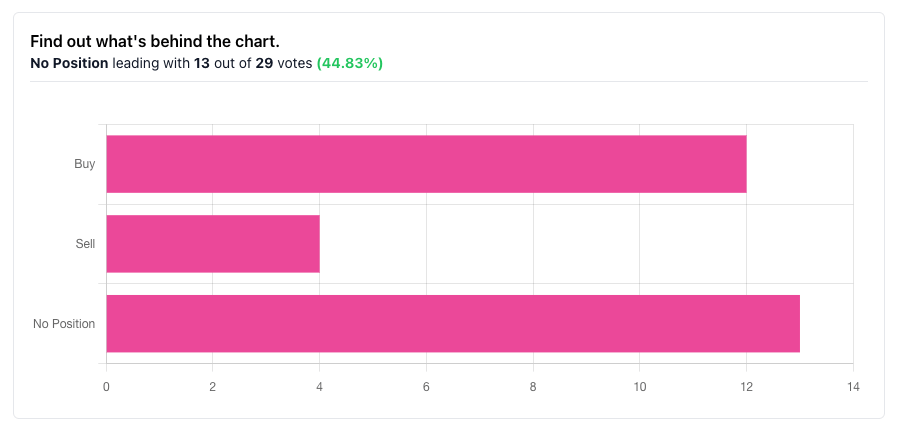

Friday Chart Check Results

A big thank you to all those that participated!

The trend has not been our friend with this one for some time, and the break below $60 is the latest proof point that the bulls are not in control here. It will be an interesting one to follow through the end of the year as it continues to balance increasing supply from OPEC+ against the backdrop of weakening global demand.

Economic Data

No notable releases

Earnings Reports

Fastenal (FAST)

Overnight Markets

Asia: Nikkei -1.01%, Shanghai -0.19%

Europe: FTSE 0.07%, DAX 0.46%

From Our Partners

3 Stocks to DOUBLE This Year

We just released a brand-new special report:

These stocks were pinpointed by the same AI-driven quant model that has already selected 407 double-digit winners.

After scanning 115 factors daily, the model’s top picks were then reviewed by an investor with 45 years of proven success — leading to the 3 stocks featured in this special report.

Opening Outlook

Markets open the week searching for balance between policy risk and profit optimism. The selloff in growth stocks has restored some discipline to positioning, while earnings from the banks may re-anchor sentiment in fundamentals.

Geopolitics remain volatile, China’s trade moves, Gaza’s cease-fire, and Trump’s signals to Moscow all hang over the tape, but the broader tone leans toward stabilization rather than crisis.

In a market still running on narrative rather than data, clarity could be its own catalyst. For now, the story is one of resilience: a fragile calm that persists even as the ground keeps shifting.