TQ Morning Briefing

Markets Rebound as Washington Nears Shutdown Deal

From the T&Q Desk

Stocks staged a sharp late-session comeback Friday, snapping a three-day losing streak and ending the week on a steadier note as Washington inched closer to ending the 38-day government shutdown.

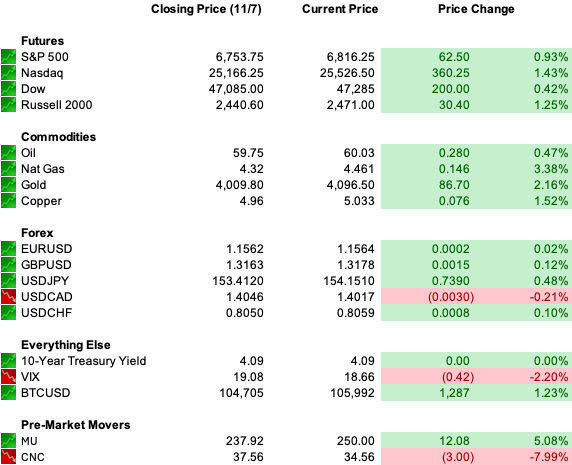

The S&P 500 finished higher by 0.1% after bouncing nearly 100 points off its intraday lows, while the Dow gained 0.2%. The Nasdaq slipped 0.1%, dragged by persistent weakness in large-cap technology and communication services.

Despite Friday’s recovery, the S&P still closed the week down 1.6%, its largest decline in nearly two months, though it remains up more than 14% year-to-date.

The rotation underneath the surface was notable. Materials, energy, and consumer staples each climbed more than 1%, offsetting continued pressure on AI-linked names. The Philadelphia Semiconductor Index fell 7% on the week but also bounced late Friday.

Bond yields were little changed, with the 10-year Treasury ending near 4.1%. Gold settled at $4,009 an ounce, oil rose to $59.75 a barrel, and Bitcoin reclaimed $103,800 after dipping below $100,000 earlier in the week.

Economic readings, limited to private-sector data due to the shutdown, painted a picture of a cooling but still resilient economy. With official releases frozen, markets have been forced to triangulate from scattered sources, heightening the sense of uncertainty even as overall activity appears stable.

Premier Feature

#1 Memecoin to Own Right Now

Two of our top analysts have done the impossible — they’ve consistently spotted memecoins before they exploded.

I’m talking gains like 8,200%... 4,915%... and 3,110%, all triggered by a proven system that’s delivered 20+ big wins.

Now they’ve uncovered a brand-new memecoin showing the same explosive signals — and it could be next.

That’s why we’re revealing the #1 Memecoin to Own Right Now (time-sensitive).

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Word Around the Street

Futures are pointing to a resounding start to the week, as optimism grows that the Senate’s weekend compromise could bring the government back online within days.

The move follows Friday’s dramatic reversal, when both the S&P 500 and Nasdaq bounced from technical support and reclaimed their 50-day moving averages.

Market sentiment remains cautious but constructive. Traders are debating whether the rally reflected genuine buying interest or a round of short-covering ahead of potential good news from Capitol Hill.

The CBOE Volatility Index spiked to 22 early Friday before easing to 19 by the close, signaling reduced, but not absent, anxiety.

Small caps and cyclicals have shown relative strength, with the Russell 2000 reversing early losses to close in positive territory. The tech-heavy Nasdaq 100 remains the market’s weak spot after a week that saw Nvidia, Palantir, and Broadcom each lose more than 7%.

With valuations stretched and data sparse, sentiment around AI has turned from exuberance to scrutiny.

The University of Michigan’s sentiment index fell to 50.3 in November, its weakest reading since the spring, while inflation expectations ticked higher to 4.7% over one year and 3.6% over five years.

The limited data underscores the market relief at the prospect of an end to the shutdown and the increased visibility government data will provide.

Global Policy Watch

The week ahead brings a full slate of Federal Reserve speakers, with investors looking for clues on how policymakers are interpreting the shutdown’s economic fallout. Scheduled remarks from Barr, Williams, Paulson, Waller, Bostic, Miran, Hammock and Schmid will provide the market’s only direct guidance in the absence of official data.

Traders expect the tone to remain balanced, acknowledging persistent inflation near 3% while signaling comfort with current policy. Futures pricing now implies roughly a 70% chance of a December rate cut, though most Fed officials are likely to emphasize patience until the data flow normalizes.

Globally, the monetary message remains the same: easing is coming, but timing, not intent, is the open question.

Trade Winds & Global Shifts

China’s latest trade figures confirmed the slowdown weighing on global growth. Exports fell 1.1% in October, the sharpest drop since February, while imports rose just 1%, both missing expectations. The country’s $90 billion surplus undershot forecasts as Trump’s tariffs continue to reshape trade routes.

At the same time, Beijing’s new agreement with Washington to purchase 12 million metric tons of U.S. soybeans by year-end and 25 million annually through 2028 has given Midwestern farmers a temporary reprieve.

But analysts caution the U.S. may never fully reclaim the market share lost to Brazil, which now supplies the majority of China’s soybean demand. The truce stabilizes prices but doesn’t erase years of structural realignment.

Elsewhere, Canada is bracing for its first technical recession in a decade amid rising unemployment linked to U.S. tariffs on autos, steel, and lumber. And in Europe, fresh political fractures, from Georgia’s pivot toward Moscow to protests in Germany over energy policy, signal how the global ripple effects of trade realignment continue to test alliances.

From Our Partners

Small Unelected Group (Not the Fed) Could Crash U.S. Market

Most people have no idea, but a single, unelected group of Americans through a series of questionable decisions over a period of 40 years…

now holds the future of the entire country and the world - in their hands.

D.C. in the Driver’s Seat

Washington’s gridlock showed its first cracks over the weekend. The Senate passed a bipartisan framework 60–40 to fund key agencies and reopen most of the government, though the House must still vote before the measure reaches the president’s desk.

The shutdown’s economic toll has grown visible: the FAA has ordered airlines to cut 4% of flights at major airports, with that reduction set to reach 10% by mid-November if the impasse continues.

Transportation Secretary Sean Duffy warned Friday that a 20% reduction could follow without resolution, affecting millions of holiday travelers.

Meanwhile, President Trump floated the idea of $2,000 “tariff dividend” checks for most Americans, framing them as a way to share the benefits of his trade policies.

Treasury Secretary Scott Bessent suggested any benefit might come instead through tax relief, citing proposed cuts on tips, overtime, and Social Security income.

The administration is also preparing for a potential Supreme Court showdown over Trump’s authority to impose reciprocal tariffs under emergency powers, a case with major implications for executive trade policy.

Friday Chart Check Results

A big thank you to all those who participated!

Friday’s chart was the PHLX Semiconductor Index (SOX), the heartbeat of the AI trade and one of the market’s most sensitive indicators of growth sentiment. After peaking in late October, the SOX has slipped about 6%, testing its 50-day moving average as investors recalibrate expectations for chip demand, margins, and valuation multiples across the sector.

Semiconductors have been the tip of the spear for 2025’s bull market, up more than 50% year-to-date before this week’s reversal, and their leadership remains critical to sustaining broader risk appetite. Still, short-term cracks are emerging. Recent breaks below near-term support in Nvidia, AMD, and Broadcom have triggered algorithmic selling and narrowed the AI narrative’s momentum.

Heading into year-end, the setup is binary: either the group consolidates and reasserts leadership, or it confirms a rotation toward defensives. Historically, the SOX has led both recoveries and reversals across major indices, making its current test a crucial read on whether the market’s faith in AI growth remains conviction, or complacency.

Economic Data

No notable releases

Earnings Reports

TSN, DDS, STWD, PLUG

Overnight Markets

Asia: Nikkei +1.26%, Shanghai +0.53%

Europe: FTSE +0.99%, DAX +1.90%

U.S. Pre-Market

From Our Partners

Inside the A.I. That Trades Like a Human, Only Faster!

For the first time, traders have access to an A.I. that doesn’t just react to markets — it masters them.

Born from breakthroughs in machine learning, this system trained itself on millions of price patterns until it could read the market like a seasoned pro.

It builds its own rules, learns from every outcome, and executes with machine-level precision — no emotion, no hesitation.

Each session makes it sharper, faster, and more confident.

Opening Outlook

Markets open Monday with cautious optimism as the Senate’s compromise edges the U.S. closer to ending the longest government shutdown on record. Futures point to modest gains after Friday’s dramatic reversal, suggesting investors are ready to reward any sign of resolution.

The focus now shifts to whether the bounce holds. AI valuations remain under scrutiny, but the week’s rotation into value and cyclicals hints at a healthier market beneath the surface. With Treasury yields steady, commodities firm, and the dollar easing, traders appear to be positioning for stabilization rather than stress.

The S&P’s 6,665 level remains the first test of conviction. Hold it, and the bull run may find fresh footing heading into Thanksgiving. Lose it, and the next chapter of this data-blind market could turn far more uncertain.