TQ Morning Briefing

Markets Search for Direction as Data Returns and Policy Uncertainty Builds

From the T&Q Desk

Markets enter the week still feeling the aftershocks of Friday’s whipsaw session. A sharply lower open gave way to a forceful rebound as dip buyers stepped back into technology and growth names, helping the major indexes finish near flat.

It was the second consecutive Friday where early weakness around rate-cut expectations met determined buying into the close.

The S&P 500 ended the week slightly higher while the Nasdaq logged its second loss in a row, pressured by valuation concerns tied to AI and infrastructure spending.

Sector leadership continued to rotate with healthcare, biotech, and industrials stabilizing performance as mega-cap tech absorbed the selling pressure that has defined the first half of November.

Bond yields drifted higher into the weekend and Fed officials continued to lean against expectations for a December cut. Futures now assign roughly a forty-five percent probability to a move next month, marking a significant reset from the near-certain expectations that followed October’s meeting.

Now that federal agencies have begun restoring their release calendars, investors will finally receive delayed labor, inflation, and spending data over the next ten days.

The market enters the week still navigating the data fog, and the stakes around the Fed’s December decision remain unusually fluid.

Premier Feature

Former Illinois Farmboy Built a Weird A.I. System to Expose His Wife's Killer…

After his wife's untimely death, he used Artificial Intelligence to get sweet revenge...

But what happened next could change everything... while making a select few early investors very rich.

Word Around the Street

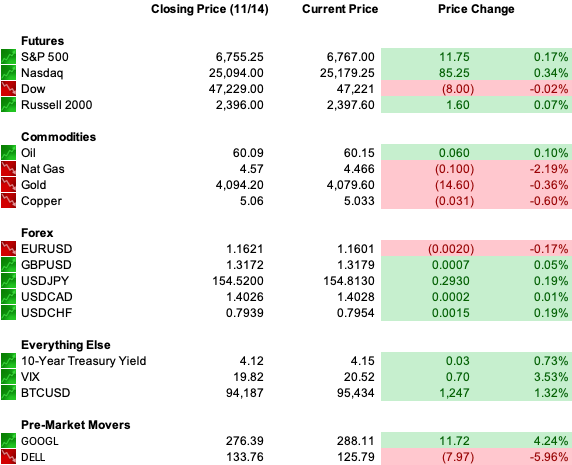

U.S. equity futures are mixed this morning as investors digest last week’s volatility and brace for a series of long-delayed economic releases.

Overseas trading set a cautious tone with Asia lower following softer industrial production numbers out of China, and Europe slipping as growth concerns weighed on sentiment.

The leadership shift remains intact. Healthcare and biotech outperformed last week with meaningful strength in M&A sensitive names, while technology saw another round of de-risking.

Tech fell more than four percent on the week, but the rotation helped stabilize market breadth, with value and cyclicals absorbing some flows that had previously been concentrated in AI beneficiaries.

Berkshire Hathaway disclosed a new stake in Alphabet, adding a rare large-cap tech holding to its portfolio. The move helped spark a rebound in Google shares and added a stabilizing influence to the broader tech complex after two weeks of selling tied to valuation and AI-spending concerns.

Bitcoin remains under pressure after sliding into a technical bear market, falling more than twenty percent from its October peak and spending the weekend below ninety-six thousand.

Gold steadied after Friday’s sharp drop, and crude is holding firm after supply disruptions in the Black Sea temporarily halted exports.

Investors begin the week focused on the return of macro data and the extent to which incoming numbers can resolve the policy divide inside the Fed. With the unemployment rate for October not being published, traders expect outsized reactions to the first clean data of the week.

Global Policy Watch

The debate inside the Federal Reserve intensified late last week as hawkish regional presidents reiterated their preference for patience while Governor Stephen Miran made the case for another cut.

Jeffrey Schmid, Lorie Logan, and Beth Hammack argued that the labor market is cooling gradually and that further easing risks undermining the Fed’s inflation objective.

Miran countered that the available data justify an additional move and echoed the administration’s view that policy remains too restrictive.

Futures markets reacted swiftly. By Friday afternoon, odds of no December cut had climbed to sixty percent, up sharply from earlier in the week.

In Japan, political hesitancy around further tightening continues to weigh on the yen, while in Europe, shifting tax assumptions kept gilt markets volatile ahead of next week’s budget.

The euro held steady near recent highs as the dollar regained modest strength after Friday’s equity rebound.

Trade Winds & Global Shifts

Geopolitical tensions remained elevated over the weekend. Washington assessed a refined nuclear posture from Russia and ongoing procurement efforts by China, while monitoring troop movements around Pokrovsk.

In the Western Hemisphere, Venezuela’s political trajectory is drawing fresh scrutiny as President Maduro sets the stage for a contested election cycle.

On the trade front, the United States and Switzerland advanced negotiations toward a bilateral agreement, adding another chapter to this year’s push for selective tariff realignment.

Meanwhile, China slowed purchases of U.S. soybeans amid domestic demand uncertainty and heightened policy sensitivity around agricultural imports.

Global equity flows continued to favor Latin America, with Brazil, Mexico, and Colombia attracting renewed interest as investors search for relative stability outside the U.S. and Europe.

From Our Partners

The New Secret Edge for Robinhood Users

There’s a market phenomenon I’ve been tracking since my days managing millions for private clients and it appears almost every trading day — quietly setting the tone for what follows.

A few traders already use it to target quick payouts right before the close and after months of studying and leveraging it myself, I can tell you this pattern is one of the most consistent forces I’ve seen in my career.

Most Robinhood users have no idea it exists which is why I’ve decided to go public with what I’ve found.

D.C. in the Driver’s Seat

President Trump reversed course on the upcoming House vote to release Epstein-related files, urging Republicans to support the measure after facing growing defections inside the party. The move sidestepped what would have been a significant display of division in the GOP and shifts the spotlight to the Justice Department as Congress prepares for the vote.

The FAA announced that it will lift shutdown-related flight restrictions early Monday morning, clearing the way for normal operations heading into the busy Thanksgiving travel window. Airlines expect several days of logistical cleanup as crews reposition and schedules normalize.

The White House is developing a broader suite of cost-of-living initiatives following voter pressure in recent elections. Discussions include tariff reductions on key food imports, potential direct payments, energy and housing proposals, and new pharmaceutical pricing efforts.

While the administration acknowledges the limits of executive action, lowering prices remains a central imperative.

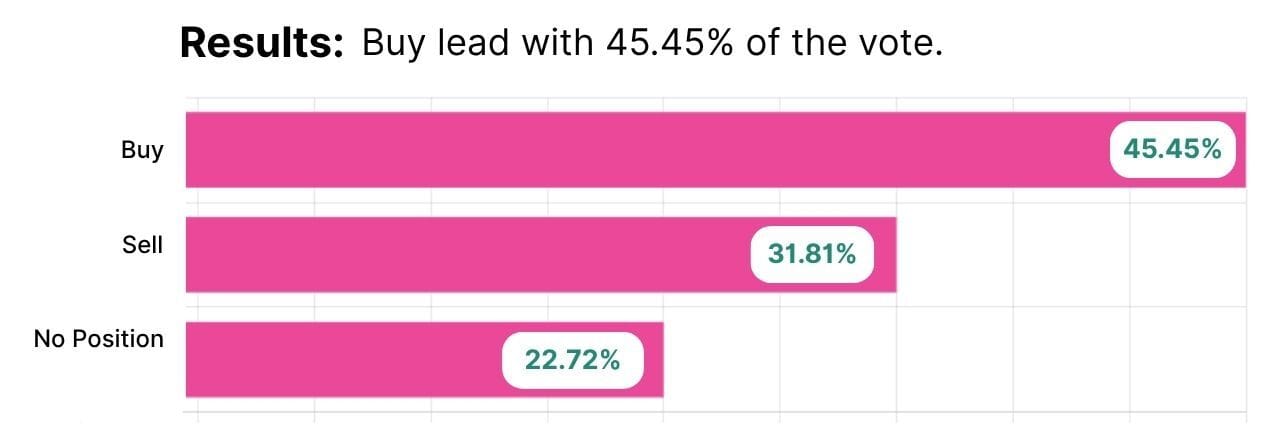

Friday Chart Check Results

A big thank you to all those who participated!

Friday’s chart was Bitcoin on the 4-hour timeframe, a clean snapshot of how short-term traders experience momentum shifts inside a much larger trend. After topping in early November, BTC rolled over into a sharp 20% drawdown, breaking below key intraday support levels as liquidity thinned and risk appetite faded across tech and AI-linked assets.

But the 4-hour view only tells part of the story. On the daily, and even more clearly on the weekly, Bitcoin remains in a well-defined uptrend, holding higher lows and staying comfortably above its long-term moving averages. The apparent breakdown on shorter timeframes has been more about positioning, leverage resets, and headline-driven volatility than a structural change in direction.

That’s the broader lesson of last week’s chart: context matters. In fast markets, shorter windows exaggerate noise and compress sentiment, while higher timeframes continue to track the prevailing cycle. Heading into year-end, and with macro visibility still limited, Bitcoin’s multi-timeframe picture serves as a reminder that trend, not turbulence, carries more weight in sustained market moves.

Economic Data

Fed Speaker: Williams, Jefferson, Kashkari, Waller, Logan

Earnings Reports

No notable reports

Overnight Markets

Asia: Nikkei -0.10%, Shanghai -0.46%

Europe: FTSE 100 -0.12%, DAX -0.54%

U.S. Pre-Market

From Our Partners

Your A.I. Filter for Trading Less and Earning More

This A.I. fixes that with surgical precision — filtering thousands of setups, slicing away noise, and surfacing only trades with real statistical strength.

It never chases. Never forces. It waits for math to align, then moves fast and clean.

Think of it as your intelligent gatekeeper — protecting time and capital while amplifying precision.

Opening Outlook

Monday opens with a tentative feel as markets weigh last week’s violent swings against the return of meaningful economic data. Traders remain cautious around technology leadership and the path of December policy, and the rotation into healthcare, industrials, and select cyclicals continues to act as a stabilizer.

Bond yields hover near 4.15 percent, crude holds above sixty dollars, and the dollar is modestly firmer.

With key labor and inflation reports finally resuming later this week, investors enter Monday looking for signals that the shutdown’s data gap has not fundamentally altered the underlying economic trajectory. Risk appetite should remain restrained until those reports begin to land.