TQ Morning Briefing

Nvidia’s Best Wasn’t Enough

From the T&Q Desk

Nvidia did everything the market asked for and still could not keep the tape together.

Earnings beat, guidance raised, bookings reaffirmed, and Jensen Huang once again dismissed the idea that AI is a bubble. For a few hours on Thursday, that was enough. Futures ripped, global tech followed, breadth was strong, and it looked like the market finally had a clean catalyst after weeks of trading inside a data blackout.

The Nasdaq swung from up 2.6 percent to down more than 2 percent. The S&P 500 gave back a 1.9 percent gain to close off 1.6 percent. Nvidia went from up about 5 percent to down more than 3 percent. Bitcoin slid again. Global chip names in Asia and Europe sold off hard overnight. VIX printed its highest close since April.

Nothing in the fundamental story changed between the open and the close. What flipped was positioning, confidence, and tolerance for AI at current valuations. Nvidia confirmed demand. The market used it as liquidity.

Across the desk, the takeaway is basic: this is what it looks like when a leadership trade is still fundamentally intact but emotionally tired. Nvidia is fine. The ecosystem around it is under stress. And the Fed is back in the frame whether investors like it or not.

Premier Feature

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession.

It’s something we haven’t seen in America for more than a century.

Word Around the Street

U.S. equities staged the biggest intraday reversal since April. Early on, the setup looked almost textbook: Nvidia’s revenue jumped 62 percent year over year to 57 billion dollars, data center sales drove the beat, guidance for the current quarter came in around 65 billion versus roughly 62 billion expected, and Huang reiterated roughly 500 billion dollars in AI chip bookings through 2026. That lit up futures from Tokyo to New York.

Breadth at the open was strong. Advancers beat decliners nearly 5 to 1, small caps outperformed, and all eleven S&P sectors were green. Technology, consumer discretionary, and energy led. Sentiment gauges even ticked off the floor as AAII bears backed off and the Fear & Greed Index climbed, still in Extreme Fear but improving.

Then around 10:45 a.m., the air pocket hit.

Mega-cap AI reversed together. Nvidia, AMD, Oracle, and peers rolled over in a single sentiment block.

The Nasdaq gave back more than 1,000 points from its intraday high. The S&P 500 slid more than 235 points off the highs and closed near the lows. More than three-quarters of NYSE listings finished lower. New 52-week lows swamped highs on both the NYSE and Nasdaq.

Credit markets reinforced the message. Oracle’s credit default swap spreads have jumped sharply since mid-October as investors price the cost of funding cloud and AI buildouts.

Globally, chip suppliers from Samsung and SK Hynix to TSMC, ASML, and SoftBank all sold off in sympathy, extending the AI rethink into Asia and Europe.

On the crypto side, Bitcoin fell below 90,000 dollars again during the U.S. session and then pushed under 84,000 in early Friday trade.

There were a few bright spots. Walmart rallied more than 6 percent on robust earnings and raised guidance, leading the Dow and S&P. Gap and Ross Stores delivered solid results and upbeat outlooks. But those wins were not enough to offset broad de-risking from AI, semis, and high-beta tech.

Underneath the noise, the structural question is straightforward: can AI and mega-cap tech keep pulling the tape higher as the cost of funding the boom migrates from equity stories into bond issuance, credit spreads, and balance sheet leverage.

Global Policy Watch

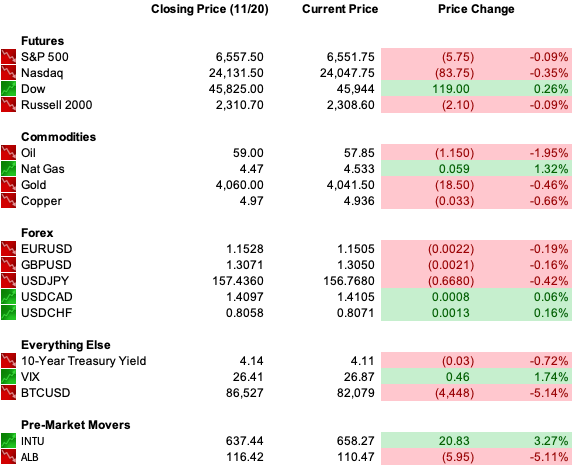

The September jobs report finally arrived after the shutdown delay and managed to complicate, not clarify, the Fed’s December decision.

Headline nonfarm payrolls rose by 119,000 versus expectations near 51,000, the strongest gain since April. Private payrolls added 97,000. At first glance, that looks like an economy still creating jobs.

At the same time, the unemployment rate ticked up to 4.4 percent, the highest in roughly four years, as nearly half a million people returned to the labor force and only about half found work. Wage growth printed at 0.2 percent month over month and 3.8 percent year over year, still running ahead of roughly 3 percent inflation and keeping real incomes positive.

Markets read the report as neither hot nor cold enough to force the Fed’s hand. The probability of a December rate cut has dropped dramatically from around 99 percent a month ago and now sits in the high 20s to low 40s depending on the measure.

The net monetary backdrop: policy is not on a preset course, but it is also not in crisis. Liquidity conditions are stable, yields are range-bound, and the case for near-term easing now relies heavily on November data that will arrive too late to matter for the next Fed meeting. Markets will continue to trade that gap between data dependence and data availability.

Trade Winds & Global Shifts

Washington is moving to designate the Cartel of the Suns, a diffuse network of Venezuelan generals and senior officials, as a foreign terrorist organization.

For more than two decades, this network has allegedly facilitated the movement of thousands of tons of Colombian cocaine through Venezuela to the U.S., Europe, and the Caribbean in exchange for large bribes and logistics support.

U.S. indictments portray President Nicolás Maduro and his circle as using cocaine flows both for personal enrichment and as a “weapon” against the United States.

Over in Europe, the leaked Trump administration peace plan for Ukraine is forcing investors to think differently about war risk.

The proposed framework would require Kyiv to cede additional territory in the Donbas, accept Russia’s control over other occupied regions, cap its military at 600,000 personnel, abandon NATO membership, and live under a looser set of security guarantees rather than a full alliance backstop.

In return, Russia would receive staged sanctions relief, reentry into the G8, and new economic cooperation in areas like energy, data centers, AI, and Arctic minerals.

Ukraine has signaled a willingness to “work” with the proposals but has reiterated that sovereignty, borders, and dignity remain non-negotiable. Key European officials are already pushing back and are assembling a counterplan more aligned with Kyiv’s stated red lines. The Kremlin, for its part, says it has not yet been formally engaged.

The immediate market read is not “peace is imminent” but “ownership of the conflict is shifting.” Sanctions on Russian oil are intensifying, Russia continues to make incremental battlefield gains, and Europe is calibrating its own leverage.

Oil prices have slipped as traders price in the possibility of a peace framework that eventually relaxes some export constraints, but the path from draft plan to durable settlement remains highly uncertain.

From Our Partners

7 Buy-and-Hold Stocks You’ll Wish You’d Found Sooner

Not every great buy-and-hold stock is a household name.

Our 7 Stocks to Buy and Hold Forever report includes under-the-radar leaders quietly dominating their niches - alongside global brands with unmatched staying power.

Together, they form a portfolio core that can produce rising income and steady growth year after year.

D.C. in the Driver’s Seat

Domestic politics added another layer of institutional stress to an already fragile backdrop.

President Trump called for the arrest and possible capital punishment of Democratic lawmakers who appeared in a video reminding U.S. military personnel of their duty to refuse illegal orders. The video did not cite any specific order but framed the issue generically.

The Justice Department is also investigating whether some Trump allies and federal officials improperly shared confidential information related to a mortgage-fraud probe into Senator Adam Schiff.

On the policy side, the Department of Energy is dismantling two of its biggest clean-energy funding vehicles: the Office of Clean Energy Demonstrations and the Office of Energy Efficiency and Renewable Energy.

More than 7 billion dollars in awards for over 200 projects have already been canceled, along with additional climate and grid investments across hydrogen, storage, EVs, and carbon capture.The signal is straightforward. The administration is pulling federal capital away from clean energy and redirecting it toward fossil-fuel development and critical minerals.

Finally, the Transportation Department announced 10,000 dollar bonuses for 776 air-traffic controllers and technicians who maintained perfect attendance during the federal shutdown, while hinting at potential penalties for those who missed work.

Taken together, these threads point to the same conclusion: U.S. institutions are still functioning, but the political incentives around them are increasingly at odds with predictable policy formation. Markets are trading that narrowing bandwidth.

Economic Data

S&P Global Composite Flash PMI

Michigan Consumer Sentiment Final

Fed Speakers: Williams, Barr, Jefferson, Collins, Logan

Earnings Reports

No notable reports

Overnight Markets

Asia: Nikkei +2.65%, Shanghai -0.40%

Europe: FTSE 100 +0.50%, DAX +0.84%

U.S. Pre-Market

From Our Partners

Robotics Stocks to Watch for the Next Tech Wave

Defense spending is driving demand for autonomous systems… healthcare robotics is expanding fast… and retailers are rapidly automating warehouses.

The result: a robotics market now topping $200B and accelerating.

Our FREE report reveals 3 robotics stocks leading this surge—companies earning analyst upgrades, attracting institutional capital, and positioned to ride the next leg of this megatrend.

Opening Outlook

The tape just passed a stress test. Nvidia delivered the numbers the bulls wanted, the labor data gave the Fed room to stay patient, and the market still sold the rally.

That does not mean the AI trade is over. It does mean leadership has to earn every inch from here, particularly with bond markets now sharing the load of financing the boom and central banks walking into meetings with partial data and political pressure on all sides.

Today, watch three things.

Whether AI names stabilize or extend the de-risking that started yesterday.

Whether rate expectations drift toward “no rush to cut” as the default December setting.

Whether political and geopolitical signals tighten or widen the market’s risk bandwidth.

The rally is being reminded that multiple expansion and momentum alone do not clear the bar when positioning is stretched and the cost of capital is rising.