TQ Morning Briefing

Markets Hit Records as Fed Flies Blind Amid Shutdown

From the T&Q Desk

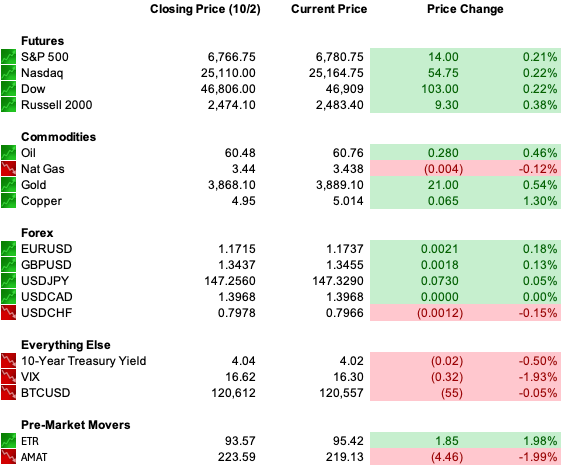

Markets extended gains Thursday even as the government shutdown stretched into its second day and sidelined key economic releases. The S&P 500 and Nasdaq closed at fresh record highs, with materials and technology leading the way while energy and consumer discretionary lagged.

Treasury yields slipped, with the 10-year settling near 4.09%. Overseas, Asia posted broad gains on strength in Korean chipmakers after Samsung and SK Hynix announced deeper AI chip partnerships with OpenAI, while European markets climbed despite unemployment rising to 6.3%. The dollar firmed after recent softness, and oil prices slid to four-month lows on supply concerns.

Labor-market visibility remains constrained, with jobless claims and Friday’s payrolls report delayed by the shutdown. Economists had been looking for 50,000 jobs added in September, unemployment steady at 4.3%, and wage growth of 3.7%, a cooling but still resilient backdrop.

With wage growth continuing to outpace inflation, households retain positive real income, leaving consumption as a pillar of economic momentum. For now, the absence of official data has not derailed optimism that the Fed will cut rates later this month.

Politics in Washington remain stalled. The House passed a short-term funding measure, but Senate resistance tied to healthcare provisions in the summer tax bill is blocking progress.

Federal furloughs are spreading and non-essential services are shutting down. Still, equities pressed higher, with Nvidia crossing $4.6 trillion in market cap and the SOX semiconductor index doubling since April on unrelenting AI enthusiasm.

Technology, power infrastructure, crypto, and drone names led a “melt-up” afternoon, with sentiment indicators showing little fear. NAAIM exposure remains elevated at 80.7, AAII’s bull-bear spread widened to +3.7, and all four major equity ETFs have now logged five consecutive up sessions, something last seen in early 2019.

Premier Feature

This $300 Crypto Could Be the Next 10x Play

Wall Street isn’t talking about it yet… but insiders are.

A little-known DeFi token is quietly attracting billions — with BlackRock and pension funds already circling.

Why?

Because the numbers don’t lie:

Revenue actually growing (unlike most cryptos)

Token supply shrinking fast

Yet today, it trades around $300. Analysts are whispering it could hit $3,000+ once new regulations unleash trillions in institutional money.

The smart money is already moving.

Don’t wait until this story hits the mainstream.

Word Around the Street

The juxtaposition of slowing jobs growth and surging output is fueling debate about a potential productivity revival. The economy expanded at an estimated 3.8% annual pace in Q3, even as ADP reported private-sector payroll declines. Some analysts see evidence that AI investment may be lifting productivity, echoing the 1990s internet boom when heavy upfront tech spending translated into faster growth years later.

Others caution that AI’s aggregate impact remains limited and that structural forces, demographics, deglobalization, and labor shortages, may offset efficiency gains.

In the absence of official payrolls, investors are relying more heavily on alternative data. The question is whether this can serve as a reliable substitute if the shutdown drags on. For now, futures markets price a near-certain Fed cut at the Oct. 29 meeting, with expectations of further easing into year-end.

Meanwhile, equity valuations remain elevated. The S&P 500 trades at more than 22 times forward earnings, well above its five-year average. Analysts still expect Q3 earnings to rise nearly 8% year-over-year, with financials set to kick off reporting in mid-October. For now, strong corporate profits and easy policy expectations continue to outweigh political dysfunction.

Global Policy Watch

Normally, the first Friday of the month would be dominated by the Bureau of Labor Statistics jobs report, but the shutdown has pushed that release off the calendar. With official data blacked out, traders and economists are leaning on private-sector indicators to fill the gap.

ADP payrolls this week flagged a 32,000 decline in private-sector jobs, while Revelio Labs, a newcomer using networking platform data, estimated a smaller gain of 60,000 positions. Job postings from Indeed also remain subdued. The mosaic suggests a labor market that is cooling, but not collapsing.

The Federal Reserve is watching this closely, especially after it cut rates in September for the first time this year. A softer labor backdrop provides cover for more easing later this month, with futures markets already pricing in a near certainty of a quarter-point cut.

But the Fed is flying partly blind, without BLS surveys, policymakers will have less hard data to guide them into their October meeting. Alternative sources like credit-card spending and retirement-plan enrollment are being leaned on more heavily as makeshift substitutes.

Trade Winds & Global Shifts

Abroad, the Pentagon is facing bipartisan pushback in Congress over its strikes on alleged Latin American drug boats. Senators pressed defense officials for a clearer legal basis, questioning the reliance on cartel “terrorist” designations as justification for military action.

The Trump administration insists the strikes fall under the president’s constitutional authority and international law, but lawmakers warn of overreach and a lack of transparency. The issue underscores growing unease in Washington over the scope of executive war powers.

Meanwhile, tensions with Russia escalated after President Vladimir Putin warned that supplying Ukraine with U.S. long-range Tomahawk missiles would mark a “new stage of escalation.”

Putin argued such a step would require direct U.S. involvement, crossing a dangerous threshold. His comments followed reports that Washington has already approved intelligence sharing on deep-strike targets inside Russia.

At the same time, EU leaders endorsed plans for a “drone wall” to counter repeated airspace incursions in Eastern Europe, with defense firms eyeing major contracts.

Geopolitical risks remain a secondary driver for markets but could quickly resurface. Rising Russian rhetoric, expanded U.S. military operations in Latin America, and widening partisan divides in Europe all feed into the broader picture of global instability. Investors may discount headlines day to day, but these risks set the stage for potential shocks.

From Our Partners

Year-End Rally Starts Now (4 Stocks to Watch)

After a volatile summer of tariffs, inflation pressures, and rising energy costs, a powerful shift is setting up for a year-end rally.

America’s core industries—energy, manufacturing, and defense—are emerging as clear winners, with momentum building as we head into Q4.

In our FREE report, we reveal 4 stocks positioned to lead this next phase of the bull market—companies already attracting smart money and analyst attention.

Don’t wait until the rally is in full swing. The race is on.

(By clicking the links above, you agree to receive future emails from us and bonus subscriptions from our partners. You can opt out at any time. - Privacy Policy)

DC in the Driver’s Seat

Healthcare is emerging as a political flashpoint in the shutdown fight. Inside the White House, advisers are increasingly worried Republicans will take the blame if Affordable Care Act subsidies expire, raising costs for millions of Americans.

While President Trump has publicly projected confidence, aides are quietly considering proposals to extend subsidies, a move that could blunt voter backlash in next year’s midterms.

Critics say the cancellations threaten jobs, raise energy costs, and undermine U.S. competitiveness in hydrogen and renewables. The administration argues the projects were rushed through in the final months of the Biden presidency and lacked sufficient oversight.

The cuts land hardest in California, Washington, and New York, adding another layer of political calculation to the shutdown standoff.

With Republicans clinging to a razor-thin House majority and Democrats looking to capitalize on voter frustration, the shutdown is shaping into a key campaign battleground. Healthcare costs and energy policy may ultimately prove more decisive than the shutdown itself.

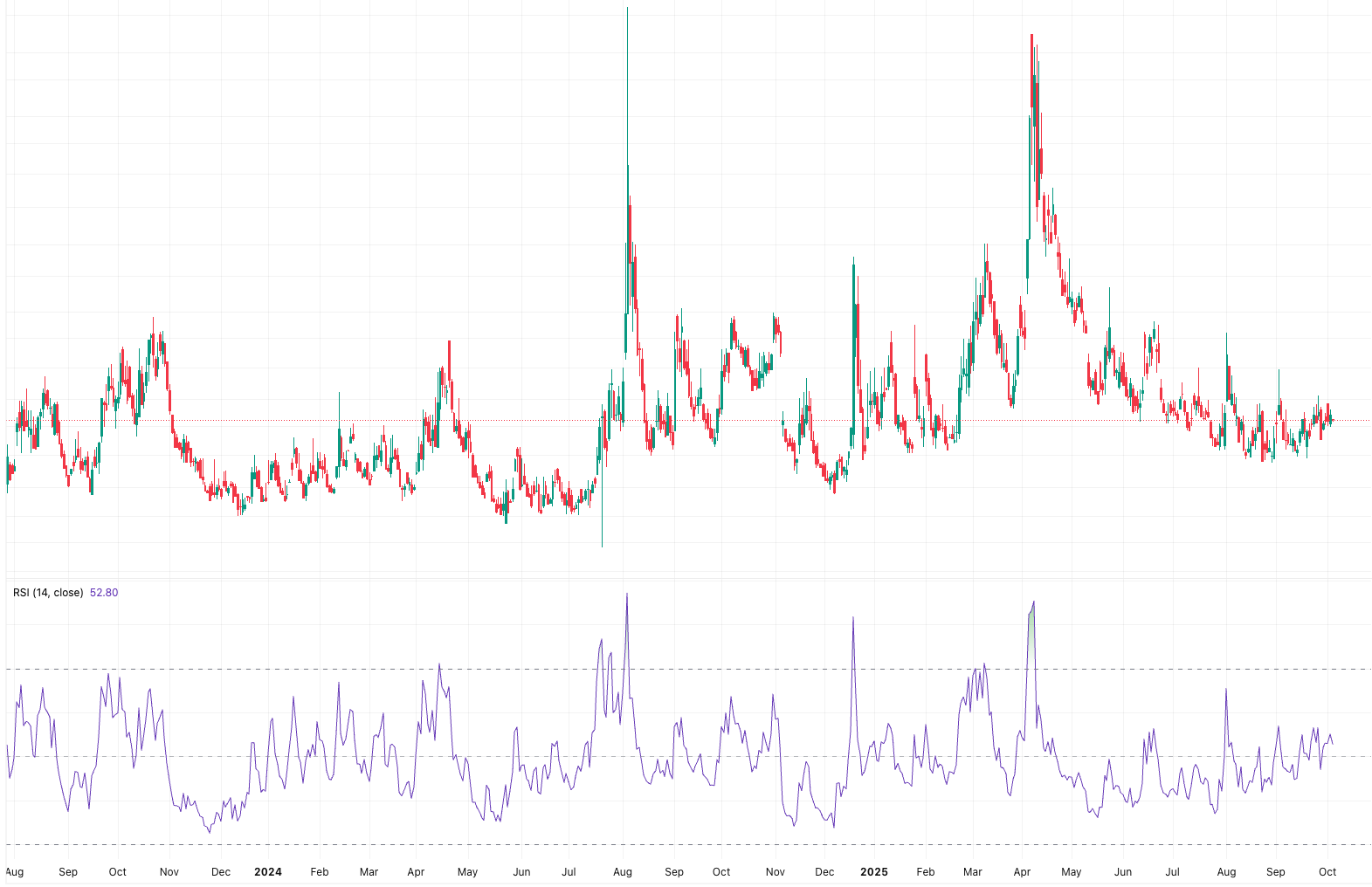

Friday Chart Check

Are you a buyer, seller, or staying away?

No deep dive, no overthinking, just a quick pulse check of market sentiment. Cast your vote below to find out what’s behind the chart!

Find out what's behind the chart.

Economic Data

ISM Services PMI

Fed Speeches: Williams, Logan, Jefferson

Non Farm Payrolls(Shutdown Preventing Reporting)

Earnings Reports

No notable reports

Overnight Markets

Asia: Nikkei 1.85%, Shanghai 0.52%

Europe: FTSE 0.67%, DAX 0.16%

U.S. Pre-Market

Final Thoughts

Markets continue to look past Washington dysfunction and geopolitical noise, focusing instead on earnings momentum and the likelihood of further Fed easing. The disconnect between politics and price action is stark: shutdown risks are real, legal disputes are mounting, and global tensions are high, yet stocks keep climbing.

For now, liquidity and AI-driven optimism remain in control. The real test will come if the shutdown lingers into earnings season and the data blackout leaves investors flying blind. Until then, momentum rules.