TQ Morning Briefing

Markets in the Dark as Shutdown Halts Data Flow

From the T&Q Desk

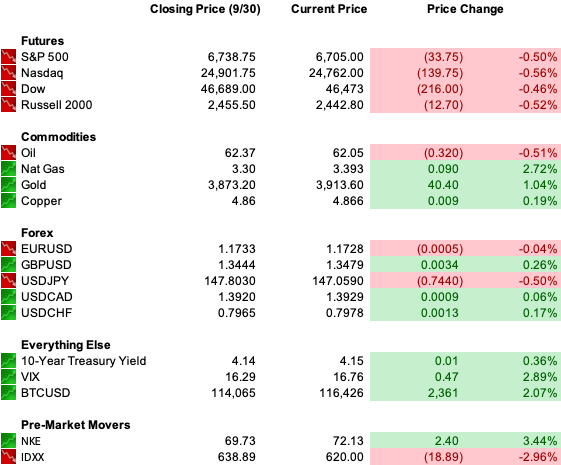

Good morning Traders and Quants! Markets woke up today under the shadow of a federal government shutdown. The funding lapse, which began at midnight, is already reverberating through futures pricing: Dow, S&P 500, and Nasdaq contracts are all pointing lower, Treasury yields are nudging up, the dollar is slipping, and gold is climbing to fresh record highs.

The shutdown may prove temporary, but the loss of data flow from the Bureau of Labor Statistics means investors are flying with less visibility into the labor market at a delicate moment. September’s payrolls release, originally due Friday, is almost certainly delayed. That puts unusual weight on today’s ADP private-sector report, expected to show about 50,000 jobs added.

Markets had just capped their best September in more than a decade, with the S&P 500 advancing 3.3% for the month and more than 33% since April’s tariff lows. But the rally has stretched valuations, leaving equities vulnerable to any catalyst that unsettles momentum. Shutdown brinkmanship qualifies.

The mood today is less about panic than about recalibration: investors weighing whether to take chips off the table after such an extraordinary run.

Premier Feature

Undervalued & Ready to Pop:

Right now, a rare window has opened in the Nasdaq…

A handful of high-potential stocks—some trading for $5 or less—are flying under the radar. These are quality companies with strong fundamentals that Wall Street has seriously overlooked.

But not for long.

Smart investors are already positioning themselves for potential triple-digit gains once the market catches on.

We’ve just released our FREE report revealing 4 of the most undervalued Nasdaq stocks with breakout potential.

These stocks are cheap.

The upside could be massive.

And the time to act is now—before prices start to run.

Click below to get your free report now and receive two complimentary bonus subscriptions to help sharpen your edge in today’s fast-moving market.

(By clicking the links above, you agree to receive future emails from us and our partners. You can opt out at any time. - Privacy Policy

Word Around the Street

Tuesday’s close masked crosscurrents. The S&P 500 finished higher, breadth improved into the bell, and healthcare led gains with a +2.5% surge. Yet small caps lagged, sector dispersion widened, and the Fear & Greed Index has slipped back to neutral. Concentration risk is at an extreme, 39% of the S&P 500 is now accounted for by its top 10 holdings. That degree of narrow leadership can keep the tape green even as much of the market struggles underneath.

Overnight, futures rolled over as shutdown headlines hit. Gold jumped past $3,900, up nearly 48% year-to-date, on safe-haven buying. The dollar weakened as investors factored in delayed data releases and the possibility of protracted political gridlock. Treasuries sold off modestly, with the 10-year back at 4.15%. Chip stocks led premarket declines as AI-linked names extended their recent slide, while European drugmakers outperformed after a White House initiative on direct-to-consumer pricing.

Global Policy Watch

The shutdown complicates the Fed’s job. Policymakers meet Oct. 28–29, but the lack of fresh BLS labor data could tilt them toward patience. Officials have already cut once this year and remain split between concerns about inflation persistence and labor market fragility. Alternative sources, ADP, credit card spending, job postings, will gain prominence in the interim, but investors won’t have the same clarity. As BNY’s Vincent Reinhart noted, the Fed may be able to act, but without official public data it will be harder to explain decisions. That opacity risks amplifying volatility.

Outside the U.S., central banks face their own binds. The ECB is juggling stagnating growth with energy-driven inflation. The BOJ’s loose stance has kept the yen volatile, while Europe’s shutdown of Russian shadow-fleet vessels has traders eyeing supply disruptions. Global easing momentum remains intact, but the timing and sequencing are highly uneven.

Trade Winds & Global Shifts

Europe is once again confronting the shadow war at sea. NATO officials warn Russia’s “dark fleet” of disguised tankers is expanding beyond sanction evasion into espionage and sabotage. Denmark’s prime minister has pressed allies to treat recent drone incursions and cable sabotage as the opening moves in a broader campaign to divide Europe. NATO’s new “Eastern Sentry” mission and the mooted “drone wall” along the eastern frontier show how seriously the alliance is taking hybrid threats. Markets can’t ignore the asymmetry: cheap drones and deniable sabotage force expensive defensive responses, diverting resources and adding to geopolitical tail risks.

At the same time, escalation ladders once familiar in the Cold War are resurfacing in analysis of Russian provocations. Border incursions over Poland and Estonia test NATO unity, while Western leaders debate rules of engagement for grey-zone conflict. The lesson for markets: Europe’s security environment is becoming structurally riskier, with implications for defense budgets, energy infrastructure, and investor psychology around safe havens like gold.

From Our Partners

"Biggest Social Security Change Ever"

The Financial Times called this new Trump initiative "a big pot of money for the American people."

And The Motley Fool said that it could "pave the way for the biggest Social Security change ever."

Click here to see the details because this is also creating an EVEN BIGGER opportunity in the stock market.

D.C. in the Driver’s Seat

The political fight driving the shutdown is anchored in health care. Democrats insist any funding deal must restore enhanced ACA subsidies, which keep premiums affordable for 22 million Americans. Without them, out-of-pocket costs could more than double in 2026, with the CBO projecting 4.2 million more uninsured. Republicans counter that Democrats are seeking over $1 trillion in health care spending, including for immigrant coverage, and argue the subsidies should be capped or phased out. The fight has become entangled with Trump’s broader push to politicize institutions, from railing against “woke” generals to threatening mass federal layoffs. For investors, the common thread is rising policy unpredictability.

Compounding the tension is the student-debt overhang. Gen X borrowers are now entering their 50s and 60s with record balances, weighing on retirement saving and consumption. Trump’s education team has emphasized enforcement, wage garnishments, stricter repayment rules, rather than relief. That adds another drag on household sentiment as discretionary income gets squeezed.

Economic Data

MBA 30 Year Mortgage Rate

ADP Employment Change

ISM Manufacturing PMI

Earnings Reports

RPM International (RPM)

Overnight Markets

Asia: Nikkei -0.85%, Shanghai 0.52%

Europe: FTSE 0.73%, DAX 0.47%

U.S. Pre-Market

Final Thoughts

Shutdowns are not new, history shows markets typically weather them with only modest, temporary setbacks. What’s different this time is the intersection of three forces: (1) a rally that has pushed equities to record valuations, (2) a Fed forced to navigate blind without official labor and inflation data, and (3) an increasingly volatile geopolitical backdrop marked by Russian hybrid warfare and U.S. political brinkmanship. That combination makes the shutdown more than just background noise.

For now, bulls will lean on strong September returns, easing Fed policy, and robust corporate earnings growth forecasts. But stretched positioning, delayed data, and headline-driven volatility argue for caution. The market can absorb a short shutdown. A long one could leave policymakers, traders, and households alike operating in the dark.