TQ Morning Briefing

Authority was tested. Markets recalibrated.

MARKET STATE

Credibility Is Being Repriced, Not Abandoned

This is a Monday that carries more institutional risk than price risk, and markets are behaving accordingly.

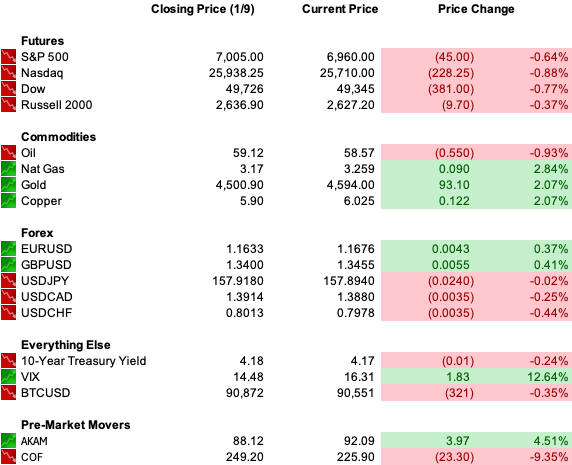

U.S. equity futures are mixed but orderly.

Gold is pushing decisively through new highs.

Silver is extending its momentum.

The dollar is weaker.

Long-dated Treasury yields are edging higher rather than falling.

Bank stocks are under pressure, while much of the rest of the equity market continues to function normally.

That mix matters because it tells you what this tape is not.

It is not panic. It is not liquidation. It is not a growth shock.

Markets are responding to a change in how authority is being applied to systems they assumed were insulated. Capital is not leaving risk indiscriminately.

It is becoming more selective about where trust is required and where it is optional.

This is a credibility repricing, not a confidence collapse.

Premier Feature

AI's NEXT Magnificent Seven

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

WHAT’S ACTUALLY MOVING MARKETS

The Powell Investigation Turned Independence Into a Tradable Variable

The investigation into Federal Reserve Chair Jerome Powell was not processed as a renovation scandal. It was processed as a governance signal.

For years, markets have discounted political pressure on the Fed as noise. Presidents complained. Rhetoric escalated. Independence ultimately held.

That subtle shift explains the reaction profile.

Gold surged through $4,600.

The dollar weakened.

Long-term yields rose rather than falling.

Financial stocks sold off despite strong earnings expectations.

None of those moves make sense under a traditional risk-off framework. They make sense if markets are hedging against institutional interference.

This was not about whether Powell will be removed. Markets are not pricing that outcome.

They are pricing the precedent that independence is no longer assumed.

Once that boundary becomes contestable, even temporarily, the risk premium shifts.

That is why the response showed up first in hedges rather than equities.

Geopolitics Is Reinforcing, Not Leading, the Same Narrative

The situation in Iran is deteriorating, not just economically but politically.

The regime is weaker than it has been in years after last summer’s war stripped away its last claim to providing security.

Protests are intensifying. Trump is openly signaling potential intervention.

Venezuela, meanwhile, remains unresolved beneath the optics of regime change, with energy access now subject to political discretion.

Yet markets are not reacting as though a global shock is imminent.

Oil prices are restrained. Energy equities are selective. Defense names remain firm but not euphoric. Precious and industrial metals are doing most of the work.

The message is not that geopolitics does not matter. It is that markets are interpreting these events as persistence risks rather than immediate supply shocks.

Energy flows can be rerouted. Supply chains can adjust. Institutional credibility, once questioned, is harder to repair.

That distinction explains why metals are leading and crude is not.

Gold Is Pricing Rule Uncertainty, Not Economic Fear

Gold’s move is being widely described as a fear trade. That framing is incomplete.

This is not a rush out of equities. It is not a bet on recession. It is not even primarily an inflation call, despite persistent fiscal stress.

It is an allocation toward assets that do not depend on political discretion, regulatory interpretation, or institutional trust.

Central banks continue to accumulate gold as they diversify away from dollar dependence.

Private investors are following the same logic. Silver and industrial metals are reinforcing the signal.

Gold is not trading macro weakness.

It is trading governance uncertainty.

From Our Partners

You Missed the Crypto Bottom — This Is the Do-Over

Let’s be real.

Most investors froze at the bottom. Fear won. That window is gone.

But the recovery just opened a second chance — and in some ways, it’s even better. This time, there’s confirmation.

The crash wiped out hype and exposed which cryptos actually matter. What survived? Fundamentals.

One crypto is flashing the same setup we saw before massive runs:

8,600% (OCEAN)

3,500% (PRE)

1,743% (ALBT)

Strong on-chain data. Growing network. Active development.

Yet the price still hasn’t caught up.

That gap won’t stay open for long.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

TAPE & FLOW

Growth Holds While Trust Gets Expensive

Equity markets are still functioning normally. AI leadership remains intact. Liquidity is available. Volatility is contained. Credit is open.

At the same time, protection is being layered in. Havens are bid. Banks are being discounted for policy exposure. Hard assets are outperforming.

This is not contradiction. It is coexistence.

Markets are holding two ideas at once. Growth can persist. Rules can weaken.

When those conditions coexist, capital does not flee. It reallocates toward assets that require less belief in process and more confidence in durability.

That is what this tape reflects.

POWER & POLICY

Discretion Risk Is Now Being Explicitly Priced

Trump’s call for a 10% credit-card rate cap mattered less for its feasibility than for its signal.

They only needed to see that discretionary intervention in pricing is politically acceptable again.

Banks sold not because earnings power is deteriorating. They sold because policy risk is no longer abstract.

The same logic applies to the Powell investigation, to Iran, and to Venezuela. Markets are responding to how authority is being exercised, not just to the outcomes it produces.

This kind of shift does not break markets overnight. It changes how risk is structured over time, and where capital chooses to hide when uncertainty rises.

ONE LEVEL DEEPER

Why Metals Lead While Oil Waits

This tape is another example of horizon mismatch.

Metals benefit from long-cycle narratives. AI infrastructure buildout. Power and grid constraints. Capital-intensive expansion. Institutional hedging.

They do not require near-term supply disruption to move.

Oil prices barrels. And near-term barrel supply remains flexible. Geopolitics adds noise, but not immediate scarcity. That keeps crude anchored even as energy equities price optionality.

Gold and copper do not need clearance.

They need conviction.

Right now, that conviction exists.

From Our Partners

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

The world's wealthiest individuals are making huge moves with their money.

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

MARKET CALENDAR

Data: Fed Speakers: Bostic, Barkin, Williams

Earnings: No notable reports today, but big week ahead

Overnight: Nikkei +1.61%, Shanghai +1.09%, FTSE 100 -0.01%, DAX +0.32%

U.S. PRE-MARKET

THE CLOSE

This is not a market under stress. It is a market adjusting its assumptions.

Authority was tested. Liquidity held. Growth leadership survived.

But the price of trust moved higher.

Gold is reflecting that. So is silver. So is the dollar.

The signal this morning is not fear.

It is adaptation.

Order still exists.

But it now carries a cost.