TQ Morning Briefing

Markets Pull Back as Fed Caution and Tech Weakness Test Nerves

From the T&Q Desk

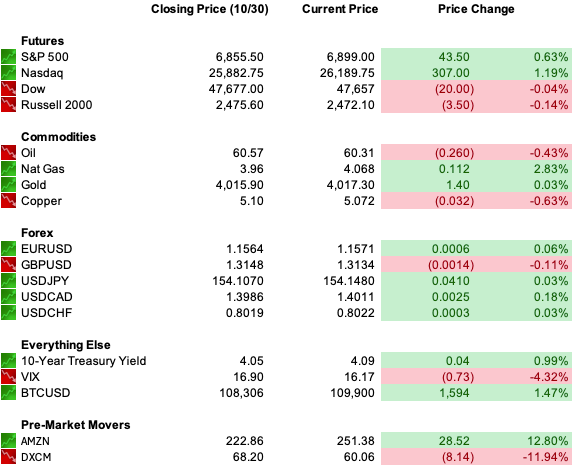

Markets retreated Thursday as the post-Fed glow gave way to reality checks from Big Tech earnings and rising Treasury yields. The S&P 500 slipped 0.9%, the Nasdaq fell over 1%, and the Dow managed a fractional gain as investors rotated into value and cyclicals.

The day’s tone was defined by two forces: a Federal Reserve that refused to pre-commit to another cut, and a market realizing that even $400 billion in annual AI spending may not be enough to keep valuations justified.

Meta dropped more than 10%, Microsoft declined nearly 3%, and Chipotle cratered 20% after projecting a slowdown in same-store sales. Alphabet was the lone standout, gaining 2.5% on stronger-than-expected cloud growth.

The Fed’s quarter-point cut to a 3.75%–4.00% range on Wednesday had already been priced in, but Jerome Powell’s warning that a December move was “far from a foregone conclusion” sent bond yields higher and equity enthusiasm lower.

The 10-year Treasury closed above 4.09%, its sharpest two-day climb since July, even as the Fed ended its balance-sheet runoff effective December 1.

Gold settled at $4,015 an ounce, the dollar firmed 0.3% to 99.50, and oil held near $60.50 per barrel.

Premier Feature

90% of AI Runs Through This Company

Case in point:

The database provider now embedded into the big three cloud platforms - with access to 90% of the market.

You’ll find the name and ticker of this newly-minted giant in our 10 Best AI Stocks to Own in 2025 report, along with:

The chip giant holding 80% of the AI data center market.

A plucky challenger with 28% revenue growth forecasts.

A multi-cloud operator with high-end analyst targets near $440.

Plus 6 other AI stocks set to take off.

Word Around the Street

Today closes a volatile week that has tested both conviction and patience. Markets are entering Friday’s session on firmer footing, with futures bouncing back this morning. The Nasdaq is up over 1.1%, the S&P 0.6% higher, and the Dow flat.

The optimism that followed the Fed’s second consecutive rate cut has been tempered by Powell’s insistence that policy is entering a “fog-bound” phase due to the government data blackout.

The result: investors are adjusting to an unfamiliar mix of slower easing, persistent inflation around 2.8%, and record-high valuations.

The broader mood to close out October is one of cautious status quo. The tariff truce between Washington and Beijing has removed a layer of geopolitical risk, and with earnings mostly clearing the bar, the question now shifts from how far this rally can run to how disciplined it will be when it does.

The AI trade justifying its cost is a large part of that question. Wall Street analysts estimate that Microsoft, Alphabet, Meta, and Amazon will spend nearly $400 billion on AI infrastructure this year alone, and most executives insist that even this won’t be enough.

“When you see these kinds of demand signals and we know we’re behind, we do need to spend,” Microsoft CFO Amy Hood said.

Global Policy Watch

The Fed’s message to markets was one of strategic restraint. Policymakers cut rates by 25 basis points but emphasized division within the committee: one member called for a 50-basis-point move, another voted to hold steady.

Treasury yields jumped as investors digested Powell’s unusually hawkish tone, with the 2-year closing near 3.62% and the 10-year at 4.09%. Futures pricing for a December cut slipped from 95% to 70%.

Analysts at Morgan Stanley described the meeting as “a test of Powell’s legacy” as his term nears its end next May, while Goldman Sachs noted that opposition within the Fed “is now visible and vocal.”

Globally, the European Central Bank held policy steady for a third straight meeting, reporting that Eurozone firms are seeing modest improvement in business conditions, led by booming AI-related investment in software and data infrastructure.

Trade Winds & Global Shifts

The truce between Washington and Beijing brought a pause, not peace. Presidents Trump and Xi agreed in Busan to lower average U.S. tariffs on Chinese goods from 57% to 47%, halving fentanyl-related levies to 10% while China promised to resume soybean purchases and suspend rare-earth export curbs for a year.

The deal gives both economies breathing room and the markets a reason to exhale, but it’s largely tactical. “All that makes the Busan summit a pause rather than a conclusion,” noted one European analyst.

With Taiwan untouched and U.S. export controls still in force, the world’s two largest economies remain locked in a wary interdependence.

Europe, meanwhile, faces its own stress test: how to fund Ukraine’s defense as U.S. aid dwindles. Economists estimate the continent will need to provide $389 billion through 2029 to sustain Kyiv’s budget, rebuild infrastructure, and maintain arms supplies.

A new EU “reparations loan” backed by frozen Russian assets is being debated but faces political resistance in Belgium and Germany.

From Our Partners

Bitcoin Just Crashed — Here’s What Happens Next

Bitcoin’s drop from $126K spooked traders… but the pros are buying harder than ever.

Bitcoin ETFs are scooping up 6× more coins than miners can produce — and when that imbalance snaps, prices could explode.

Those waiting for “the bottom” will miss it.

Get the Buy the Dip Blueprint — and see how elite investors turn corrections like this into life-changing gains.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

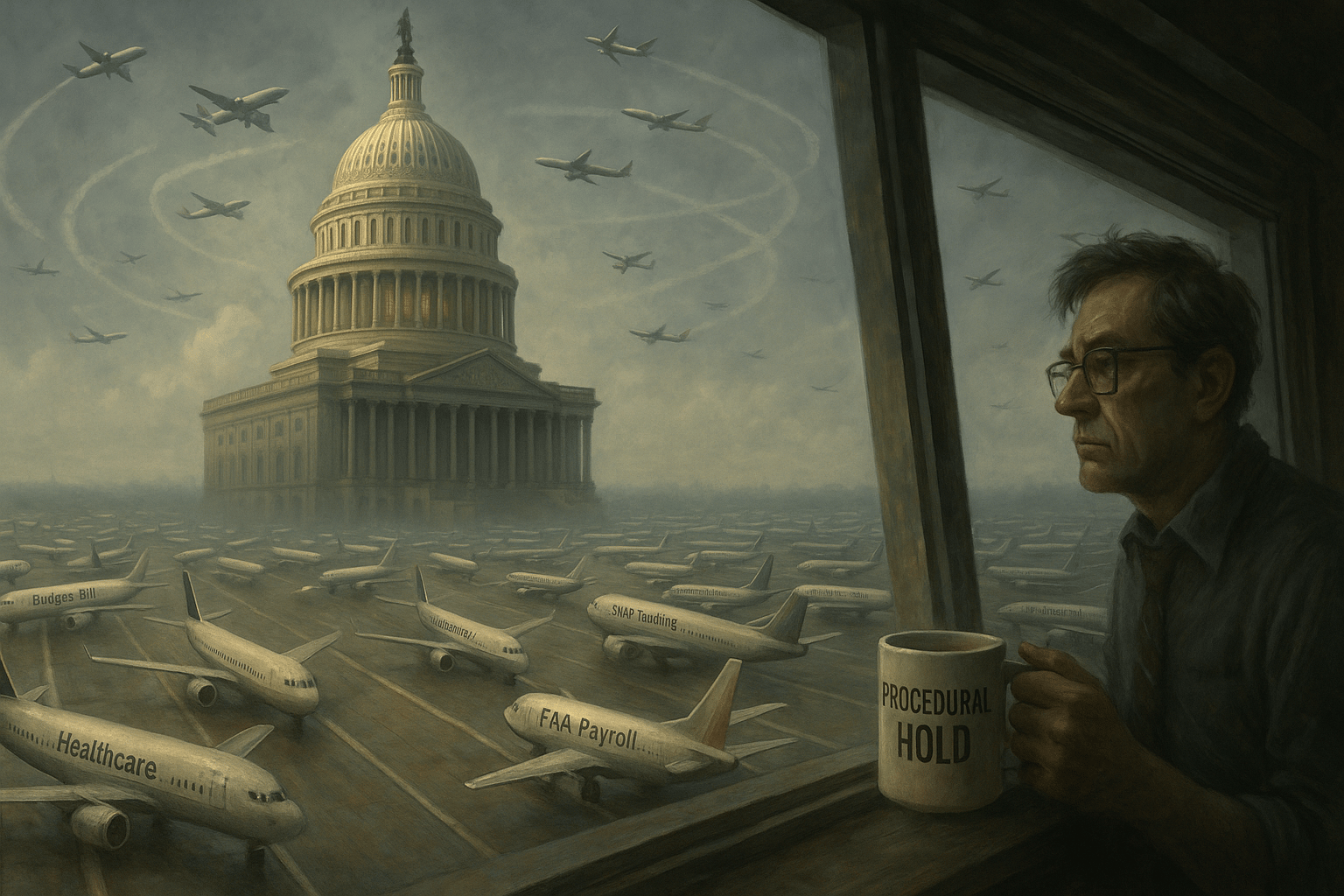

D.C. in the Driver’s Seat

The U.S. government shutdown entered its 31st day Friday, now poised to become the longest in American history. President Trump returned from Asia calling for an immediate end to the “ridiculous” standoff and pressed Senate Republicans to invoke the “nuclear option” by scrapping the filibuster.

The economic toll is mounting. The Congressional Budget Office estimates an eight-week shutdown could cost up to $14 billion in GDP losses, while Delta and United Airlines warned Congress that unpaid air traffic controllers are jeopardizing safety and the coming holiday travel season.

The National Air Traffic Controllers Association reports staffing shortfalls of 3,800 certified workers below target levels.

Behind the scenes, the White House has floated the possibility of funding temporary payments to essential workers, but no bipartisan framework has emerged. With food assistance (SNAP) due to lapse November 1, public pressure on both parties is building rapidly.

Friday Chart Check

Are you a buyer, seller, or staying away?

No deep dive, no overthinking, just a quick pulse check of market sentiment.

Cast your vote below to find out what’s behind the chart!

Find out what's behind the chart.

Economic Data

Chicago PMI

Fed Speakers: Logan, Bostic, Hammack

Earnings Reports

XOM

ABBV

CVX

CL

D

GWW

UBNT

CHTR

Overnight Markets

Asia: Nikkei +2.12%, Shanghai -0.81%

Europe: FTSE -0.53%, DAX -0.47%

U.S. Pre-Market

From Our Partners

How You Can Spot Wall Street’s Next Move…

Most traders guess where a stock might go.

But when I worked at a $1.7 trillion Wall Street firm, I saw how real money does it.

Wall Street projects months ahead — and those projections quietly shape the next big move.

If you can spot those shifts before prices react…

Research shows you could have caught double-digit moves in just days.

Now, I’m revealing exactly how to track them — and the top trade on my radar right now.

Opening Outlook

Markets open on Halloween morning balancing restraint and reality.

Powell’s caution has removed the safety net of automatic easing, while tech investors are discovering that boundless AI spending doesn’t guarantee boundless profits.

The U.S.–China truce offers calm without clarity, and Washington’s gridlock continues to drag on sentiment.