TQ Morning Briefing

Fed Week Begins With Futures Firm and Policy Risk Center Stage

From the T&Q Desk

The market opens one of its most consequential weeks of the year with futures modestly higher, risk assets leaning constructive, and policy uncertainty fully priced into the tape.

A December that began with volatility, stalled liquidity, and geopolitical noise has transitioned into a market once again anchored to one question. Will the Fed validate what futures already assume.

Positioning reflects near universal acceptance of a quarter point cut at Wednesday’s FOMC meeting. The tension now sits entirely in the forward path. Traders are not debating whether rates fall this week. They are debating how quickly the easing cycle dies after it begins.

At the same time, the fundamental picture remains uneven. Consumers feel pressured. Labor data continues to soften at the margins. Inflation has cooled but remains persistent. Growth is holding near trend. The macro neither breaks nor accelerates.

The market is trying to decide whether policy confirmation becomes upside fuel, or whether the trade turns into a sell-the-news reset.

Premier Feature

When the Fed Cuts, These Go First

The rate-cut rally is already taking shape — and our analysts just pinpointed 10 stocks most likely to lead it.

They’ve dug through every chart, sector, and earnings trend to find companies positioned for explosive upside once the Fed eases.

From AI innovators to dividend aristocrats, these are the names attracting billions in early institutional money.

Miss them now, and you’ll be chasing the rally later.

Word Around the Street

Global markets open Fed week with risk assets leaning constructive but conviction could prove fickle.

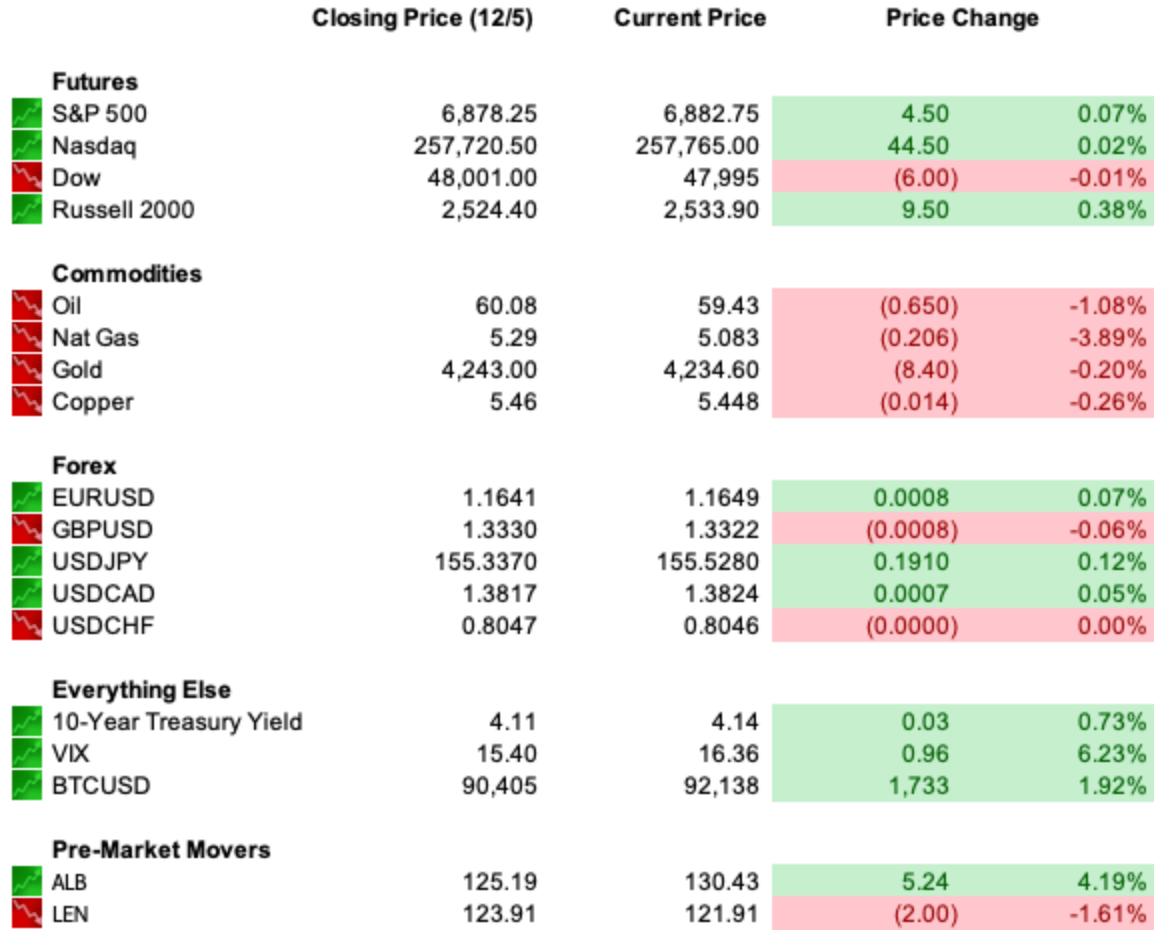

U.S. equity futures are modestly higher with the S&P 500 hovering just below record territory after nine wins in the last ten sessions. The Nasdaq continues to lead as rate cut expectations support duration-sensitive assets, while small caps have stalled just below recent highs.

Rates remain the primary driver. The 10-year Treasury yield is holding near 4.15% as the bond market continues to price a hawkish cut rather than a clean pivot.

The dollar is flat to slightly weaker after a multi-week pullback that has supported commodities and precious metals. The euro remains firm and the yen continues to stabilize ahead of potential Bank of Japan tightening.

Volatility remains compressed and valuations stretched. The S&P 500 trailing P/E now sits near 26 with forward multiples well above long-run averages. Crypto continues to lag as Bitcoin remains below $90,000 and more than 30 percent off its October highs, reflecting tightening liquidity conditions as bank reserves decline.

Precious metals remain supported with gold consolidating near $4,240 and silver extending its historic breakout. Energy is firm but not accelerating, with WTI near $60 and natural gas extending a powerful multi-week rally.

China remains a dominant cross-current. November exports surged nearly 6 percent, pushing the year-to-date trade surplus beyond one trillion dollars for the first time. U.S.-bound shipments continue to collapse under tariffs while rerouted flows into Europe and ASEAN accelerate. Asian equities traded firmer overnight while European markets are modestly lower into the open.

Consumer signals remain conflicted. Sentiment sits near historic lows even as holiday spending remains solid. Treasury Secretary Bessent is forecasting full-year GDP near 3 percent, underscoring the widening divide between growth and psychology.

Sector leadership continues to rotate beneath the surface. Technology remains dominant, energy and consumer led last week’s gains, and healthcare sits in focus with ASH data ongoing. Index rebalancing remains in play with several additions expected later this month.

The tape remains defined by one tension. Equities are supported by policy expectations. Rates remain cautious. Liquidity is tightening at the margin. And positioning remains stretched into a week where the forward path matters far more than the cut itself.

Global Policy Watch

The Federal Reserve enters its December meeting with markets pricing an approximately 87 percent probability of a 25 basis point cut. What matters is not the cut itself, but the dot plot and Powell’s framing of 2026.

Labor data without the official jobs report is increasingly consistent. ADP showed private payrolls down 32,000 in November, concentrated in small businesses. Initial jobless claims remain historically low. The Chicago Fed unemployment tracker holds November near 4.4 percent. The labor market is softening, not breaking.

Fed officials are split. Some remain focused on inflation still above target. Others increasingly prioritize labor risk. Several dissents are possible. A hawkish cut remains the base case.

Beyond the Fed, global central banks are largely on hold this week. The ECB signals policy stability with growing sensitivity to upside inflation risks. Australia and Canada are expected to remain unchanged. Currency markets reflect this divergence with the euro stable, the yen firming on Japan rate hike expectations, and the dollar easing modestly.

Trade Winds & Global Shifts

China’s record trade surplus reinforces the structural challenge facing global manufacturing. Even under aggressive tariffs, exports remain resilient through rerouting across Europe, Southeast Asia, Africa, and Latin America.

European leaders are increasingly signaling that trade defense actions may be unavoidable. Markets are slowly repricing the persistence of competitive pressure from Chinese industrial capacity.

In the Middle East, capital investment flows continue to accelerate into AI infrastructure. Sovereign wealth deployment across data centers, cloud, and chip partnerships is reshaping global investment geography. The region is rapidly positioning itself as a neutral capital hub for next generation digital infrastructure.

Ukraine negotiations enter another delicate phase. Talks between U.S. and Ukrainian officials ended without agreement over the weekend. European leaders now assume a more central role as discussions shift to London and Brussels. Russia continues to resist concessions. Markets remain sensitive to the risk premium embedded in energy, defense, and European credit.

From Our Partners

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

The world's wealthiest individuals are making huge moves with their money.

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

D.C. in the Driver’s Seat

Domestic policy risk continues to rise across three distinct fronts.

Republicans remain divided on healthcare strategy ahead of an expected Senate vote on extending enhanced ACA subsidies. Failure to agree risks millions facing higher healthcare costs early next year and introduces reopening political vulnerability on cost of living issues.

The Supreme Court prepares to hear arguments on Trump’s authority to remove independent agency officials. A broad ruling in favor of executive control would reshape the regulatory framework across finance, labor, consumer safety, and media. Markets continue to underappreciate the potential structural implications.

Food inflation has returned to the political spotlight as beef prices hit record highs. The administration is pursuing antitrust probes, import adjustments, and cattle policy changes to ease supply. Ranchers and processors remain squeezed by herd shortages and processing capacity closures.

Economic Data

No notable releases

Earnings Reports

Toll Brothers (TOL)

Overnight Markets

Asia: Nikkei +0.18%, Shanghai +0.54%

Europe: FTSE 100 -0.05%, DAX +0.22%

U.S. Pre-Market

From Our Partners

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

Opening Outlook

The market enters Fed week positioned for policy validation, not policy surprise. Futures reflect confidence in a cut. Volatility pricing reflects uncertainty about what follows.

Growth is holding. Inflation is sticky. Labor is softening. Consumers feel strained, yet spend. Policy sits at an inflection rather than a turning point.

If Powell signals that December marks the near end of easing, risk assets may struggle to sustain current momentum. If forward guidance reopens the door to mid-2026 cuts, the year-end rally remains alive.

The cut is priced. The path is not.