TQ Morning Briefing

Government Set to Reopen, Markets Eye Data Deluge Ahead

From the T&Q Desk

U.S. equities surged to start the week as optimism over an end to the record-long government shutdown lifted sentiment across asset classes.

The S&P 500 gained 1.5 percent and the Nasdaq rallied 2.3 percent, its strongest single-day advance since May. Tech and communication services stocks paced the rebound, with Tesla, Nvidia, Alphabet, Meta, Amazon, and Microsoft all rising more than 2 percent.

Market breadth was solid, with advancers outpacing decliners two to one on the NYSE, while defensive sectors like staples and REITs lagged.

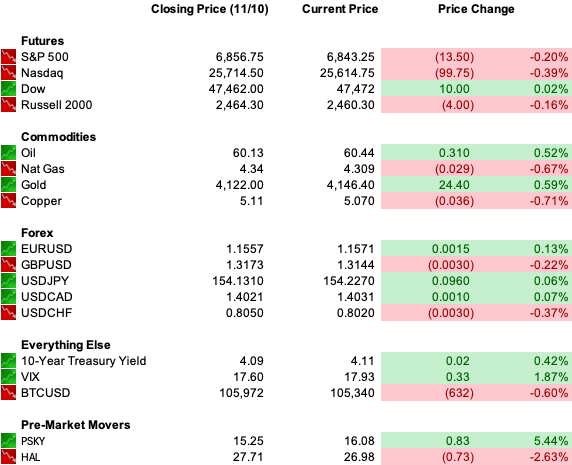

Treasuries were little changed, with the 10-year yield at 4.11 percent, up just two basis points. Gold surged 2.7 percent to 4,122 dollars, silver climbed nearly 5 percent, and WTI crude added 0.6 percent to 60.13 dollars per barrel. The dollar softened modestly against major peers.

Investors welcomed signs of progress in Washington, while Fed commentary and delayed economic data releases continued to frame expectations for a potential December rate cut.

Premier Feature

90% of AI Runs Through This Company

Case in point:

The database provider now embedded into the big three cloud platforms - with access to 90% of the market.

You’ll find the name and ticker of this newly-minted giant in our 10 Best AI Stocks to Own in 2025 report, along with:

The chip giant holding 80% of the AI data center market.

A plucky challenger with 28% revenue growth forecasts.

A multi-cloud operator with high-end analyst targets near $440.

Plus 6 other AI stocks set to take off.

Word Around the Street

Futures are trying to hold their ground following Monday’s sharp gains as traders weigh the timeline for Congress to formally pass the shutdown-ending bill and how quickly economic data will resume. The S&P is lower by 0.2%, the Nasdaq by 0.4%, and the Dow is flat.

The 10-year Treasury yield holds near 4.11 percent. Gold is steady above 4,100 dollars per ounce, and oil hovers around 60 dollars. The dollar index is marginally weaker, reflecting renewed appetite for risk assets.

Overnight, Asian equities extended Wall Street’s rally, led by tech-heavy markets in Taiwan and South Korea, while European stocks opened mixed with energy and industrials underperforming.

The economic calendar remains light, but attention is turning to the long-awaited September jobs report, expected to be released within days of the government reopening. This morning’s NFIB Business Optimism Index release showed sentiment among US small businesses at a six-month low.

Fed funds futures now price roughly a 64 percent probability of a December rate cut, with odds climbing to 77 percent by January.

Global Policy Watch

Federal Reserve officials appear increasingly cautious about adding another rate cut before year-end even as markets anticipate one.

St. Louis Fed President Alberto Musalem warned that there is limited room to ease policy further without becoming overly accommodative, while Vice Chair Philip Jefferson said it makes sense to proceed slowly as the Fed approaches the neutral rate.

Their remarks, along with lingering inflation concerns and steady financial conditions, suggest the Fed’s center of gravity is shifting toward a pause in December.

Economists note the Fed may not receive key October or November data before its December 9–10 meeting, complicating efforts to calibrate policy.

Gregory Daco of EY-Parthenon said September’s jobs report could appear within days of reopening, but later releases may lag, leaving policymakers to navigate in a fog.

Trade Winds & Global Shifts

Europe’s uneasy calm is being tested by an intensifying wave of drone incursions, sabotage, and cyberattacks that leaders increasingly attribute to Russia’s hybrid campaign.

Germany has recorded over three drone incidents per day this year, while Belgium, Denmark, and Poland have also reported increased activity.

In Asia, China is developing a validated end-user system to manage rare-earth exports, ostensibly to ease flows to the United States while blocking materials from reaching American military suppliers.

The move, modeled on U.S. export-control frameworks, underscores Beijing’s intent to remain the gatekeeper for critical minerals while appearing cooperative under the recent Trump–Xi truce.

Meanwhile, trade diplomacy is warming elsewhere. The United States and Switzerland are finalizing a deal to cut tariffs from 39 percent to roughly 15 percent, while President Trump hinted at lowering tariffs on India following the appointment of close ally Sergio Gor as ambassador.

The White House sees these as confidence-building steps in rebalancing strained trade relationships after months of friction.

From Our Partners

Bitcoin to $300K? See Why Insiders Say “This Time Is Different”

The greatest wealth transfer in modern history is underway — but most people won’t realize it until it’s too late.

After interviewing hundreds of crypto’s brightest minds (17 million+ podcast downloads), we've compiled everything into our book "Crypto Revolution" – and we want to send it to you at no cost.

Inside, you’ll discover why top experts predict Bitcoin $300,000 this year, how to invest with as little as $50, and the formula for buying at rock-bottom prices.

Plus, you’ll receive three bonus reports worth $491 — including Our Top Coin to Own Right Now.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

D.C. in the Driver’s Seat

After 41 days, the Senate voted 60–40 to end the government shutdown, with eight Democrats joining Republicans to move the bill forward. The measure funds key agencies through January 30, 2026, while guaranteeing back pay for furloughed workers.

The House is expected to vote within the next 36 hours, with Speaker Mike Johnson calling the bill the beginning of the end.

The vote has exposed deep divisions within the Democratic Party. Senate Minority Leader Chuck Schumer faces criticism from progressives for failing to hold the caucus together, with several voices on the left calling for new leadership.

Meanwhile, Republicans aim to use the episode to portray Democrats as weak negotiators ahead of next year’s midterms.

The White House and Senate GOP leaders are framing the deal as a return to fiscal stability, but its short-term nature ensures that the next funding battle, likely over healthcare subsidies and defense appropriations, will emerge early in the new year.

Economic Data

ADP Employment Change (Weekly)

Fed Speaker: Barr

Earnings Reports

No notable reports

Overnight Markets

Asia: Nikkei -0.14%, Shanghai -0.39%

Europe: FTSE +0.94%, DAX +0.18%

U.S. Pre-Market

From Our Partners

Want a Peek at Some Details of Alex Green's Own Portfolio?

Alex is one of a small circle of people to use this tiny company's groundbreaking AI technology...

And he believes in it so strongly, he scooped up thousands of shares.

You'll want to know what it is.

Opening Outlook

Traders will watch closely for progress in the House vote to officially end the shutdown and for updates on the timing of delayed economic data releases.

Barring surprises, the path into mid-November looks constructive, with risk sentiment underpinned by easing political tension, resilient corporate earnings, and the prospect of policy visibility returning soon.