TQ Morning Briefing

Positioning Over Pursuit

MARKET STATE

This is a market operating at altitude with restraint.

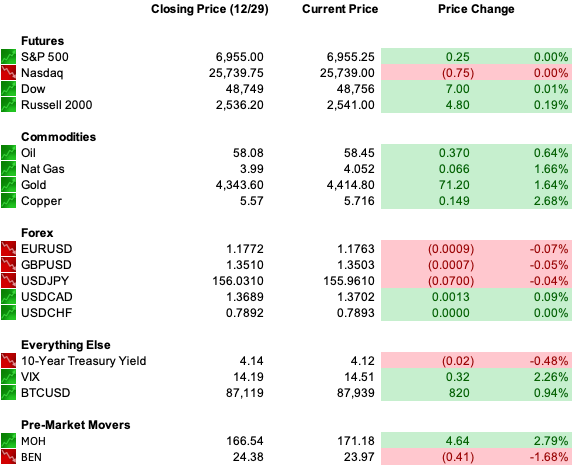

U.S. equity futures are little changed this morning, with the S&P 500 and Dow sitting less than one percent below record closes.

Participation is thin, leadership is selective, and price action is muted. That is not fragility. It is late year discipline.

Mechanics are in the driver’s seat, not momentum.

The more informative moves are happening away from headline equity indices.

Precious metals are rebounding sharply after Monday’s forced selloff.

Rates remain pinned in a tight range. The dollar continues to weaken. China’s currency just crossed a level it has not seen since 2023.

Governance and mechanics are doing more work than narratives.

Risk remains on.

But it is being carried carefully.

Premier Feature

On January 15th, a powerful new law signed by President Trump will trigger a radical shift in America’s money system...

When a small group of private companies — not the Fed — will perform a major mint of a new kind of money.

And those who act before this new system fully kicks in could see gains as high as 40X by 2032.

But those who fail to prepare will be blindsided by this sea change to the U.S. dollar.

WHAT’S ACTUALLY MOVING MARKETS

Metals Are Repricing Mechanics, Not Belief

Silver is rebounding more than five percent this morning after suffering its steepest one day drop in nearly five years. Gold, platinum, and copper are also higher after Monday’s slide.

CME raised margin requirements across metals contracts, forcing rapid deleveraging into thin liquidity. The result was violent but contained.

Today’s rebound reinforces the point. This was a positioning reset, not a thesis collapse.

Structural demand tied to electrification, data centers, and reserve diversification remains intact, even as leverage was flushed.

Fed Governance Is Back on the Tape

Markets are waiting for the minutes from the Federal Reserve’s December meeting this afternoon, but the focus is already drifting beyond rate math.

President Trump again signaled that he has a preferred successor to Chair Powell and reiterated that he might remove him before his term expires in May.

That rhetoric matters even if policy does not change today. Markets are increasingly sensitive to governance risk and institutional independence, not just the number of cuts in 2026.

Rates reflect that posture. The 10 year yield remains stuck between roughly four and four point two percent, signaling calm rather than conviction.

China Is Allowing the Currency to Speak

China’s onshore yuan has strengthened through seven per dollar for the first time since May 2023. This is not a free market signal. It is a controlled one.

Beijing appears willing to tolerate gradual appreciation to support domestic consumption and ease external pressure.

The move coincides with a weak dollar backdrop and reinforces a broader theme. Currency policy is becoming a tool of diplomacy again, not just competitiveness.

Crypto Optimism Meets Reality

Bitcoin trades near eighty eight thousand, up on the day but still down year to date. The gap between early year predictions and realized performance is widening.

Institutional adoption has not disappeared, but the market is relearning the difference between narrative enthusiasm and sustained inflows.

From Our Partners

Less Bitcoin, More Buyers — This Is What Happens Next

For the first time in nearly seven years, less than 15% of all Bitcoin remains on exchanges. At the same time, institutions are accumulating BTC faster than new supply can be mined.

ETFs, corporations, and even governments are tightening the float — creating the conditions for a real supply shock.

When demand overwhelms supply, price pressure doesn’t happen slowly.

It happens suddenly.

That’s why 27 veteran crypto analysts are sharing how they’re positioning ahead of this shift — including where they see opportunity before the next major move unfolds.

TAPE & FLOW

U.S. equities eased lower Monday, led by profit taking in large technology winners.

Nvidia, Palantir, Tesla, and Oracle all retreated as valuation sensitivity reasserted itself near highs. Materials dragged on metals weakness, with miners like Newmont hit hard.

This morning’s futures action is flat to slightly lower across indices. Nasdaq futures underperform marginally. Small caps lag. Volume remains light.

Rates are steady. The 10-year sits near 4.12 percent.

Volatility is elevated from last week but remains compressed by historical standards.

This is not distribution.

It is supervision.

POWER & POLICY

Global Friction Is Rising Without Forcing Repricing

Geopolitics continues to add background pressure rather than shock.

The U.S. has intensified pressure on Venezuela through a partial oil blockade, while President Maduro signals he expects to outlast it.

In the Middle East, President Trump publicly threatened renewed strikes against Iran while also leaving room for talks.

Iran, facing protests tied to currency collapse and inflation, has signaled openness to dialogue even as sanctions bite.

In Europe, equity markets are printing fresh record highs, led by banks, miners, and defense stocks.

Defense spending expectations remain structurally elevated as peace talks around Ukraine show signs of strain.

Markets are not panicking over geopolitics.

They are normalizing it.

From Our Partners

Hidden $5 AI manufacturer revealed

The company manufacturing Nvidia's AI servers trades under a secret name.

AI revenue: $30B this year. Stock price: $5.

ONE LEVEL DEEPER

Margins, Minutes, and the Market’s Message

Low volatility does not mean nothing is happening. It means rules are doing the work.

Monday’s metals selloff was a clean example. Constraints tightened. Positions adjusted. The system held.

Today’s rebound confirms that belief never left. Only leverage did.

The same logic applies to equities and policy.

At record levels, the market demands discipline. Governance matters. Liquidity matters. Mechanics matter.

This is how late cycle markets preserve gains without abandoning risk.

MARKET CALENDAR

Data: S&P/Case-Shiller Home Price Index, Chicago PMI, FOMC Minutes

Earnings: No notable reports

Overnight: Nikkei -0.37%, Shanghai +0.00%, FTSE 100 +0.44%, DAX +0.56%

U.S. PRE-MARKET

THE CLOSE

This is not a market searching for a catalyst.

It is a market protecting altitude.

Leverage is being managed.

Governance is being priced.

Risk remains on.

But it is being carried with discipline as the calendar closes and liquidity thins.

Nothing is breaking.

Nothing is being chased.