TQ Morning Briefing

Belief Meets Reality as Earnings Flood In

From the T&Q Desk

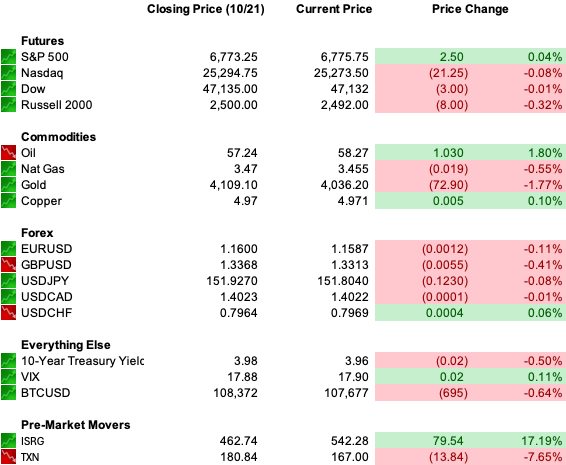

Markets paused for breath Tuesday as a torrent of corporate earnings met an atmosphere thick with anticipation. The S&P 500 held near record territory, the Dow notched its twelfth all-time high of the year, and the Nasdaq drifted modestly lower as traders weighed a rush of results against the week’s looming inflation test.

Netflix and Texas Instruments both stumbled after hours, setting a cautious tone for today’s open, while GM, 3M, and Coca-Cola carried the industrial and consumer complex higher with strong results and improved guidance.

The rotation was telling, evidence that profits are broadening beyond the usual tech leaders.

Gold’s stunning plunge continued into Wednesday’s session, a flash crash that snapped its nine-week winning streak and reminded traders how stretched sentiment had become. Bitcoin caught some of the outflow, bouncing sharply off its lows, while Treasury yields drifted below 4 percent for the first time in a year.

The U.S. government shutdown has now entered its twenty-second day, keeping economic data dark and heightening the focus on Friday’s consumer price index release, the first major window into inflation since the blackout began.

Premier Feature

The AI Stocks Every Pro Is Watching

AI isn’t a tech trend – it’s a full-blown, multi-trillion dollar race. And these 10 companies are already pulling ahead.

One dominates AI hardware with a full-stack platform and rising analyst targets.

Another ships accelerators to major hyperscalers with ~28% revenue growth ahead.

Get those tickers and 7 more in The 10 Best AI Stocks to Own in 2025 for free today.

Word Around the Street

Futures were flat overnight as investors digested the flood of earnings and a swirl of trade headlines. Netflix dropped more than 6 percent in premarket trading after an earnings miss tied to a Brazilian tax dispute, while Texas Instruments fell nearly 9 percent on soft forward guidance.

Overseas, the Nikkei edged down slightly after brushing record highs, Shanghai and Hong Kong slipped, and European markets opened mixed with the DAX off modestly and the FTSE higher.

The session’s narrative extends beyond corporate profits. Washington and New Delhi are reportedly nearing a trade deal that would slash U.S. tariffs on Indian exports from 50 percent to roughly 15–16 percent, in exchange for India curbing imports of Russian oil.

Meanwhile, Trump hinted that his upcoming meeting with Xi Jinping “might not happen,” injecting fresh uncertainty into the U.S.–China thaw.

Oil climbed nearly 2 percent on optimism surrounding both negotiations, with Brent back above $62 and WTI near $58. The dollar firmed modestly, and equities in the energy sector looked poised for follow-through.

Global Policy Watch

The Federal Reserve enters next week’s policy meeting with more questions than data. With the shutdown halting most official releases, policymakers are relying on market signals and private surveys to guide decisions.

Futures markets are fully pricing a quarter-point cut next week, followed by another before year-end, as falling yields and stable inflation expectations reinforce a path toward normalization.

The 10-year Treasury yield has slipped to 3.95 percent, its lowest in over a year, and the 2-year is down to 3.44 percent, levels that imply confidence in the Fed’s eventual easing cycle rather than fear of deeper weakness.

Abroad, the Bank of England received a welcome surprise as September inflation held steady at 3.8 percent, below forecasts. Sterling weakened, and traders swiftly increased bets on a December rate cut. The data gave Chancellor Rachel Reeves some political breathing room ahead of next month’s budget.

In Japan, new Prime Minister Sanae Takaichi is preparing a fiscal package expected to exceed last year’s $92 billion initiative, underscoring her commitment to “responsible proactive fiscal policy.” The Bank of Japan meets next week, with little expectation of tightening.

Trade Winds & Global Shifts

A U.S.–India trade accord could reset regional dynamics, offering Washington a counterweight to Beijing while deepening ties with a country projected to be the world’s third-largest economy within the decade.

China, meanwhile, is attracting renewed bullishness from global strategists. Goldman Sachs joined the chorus describing the country’s “slow bull market,” forecasting 30 percent upside in Chinese equities by 2027 driven by profit growth, policy support, and rising domestic liquidity.

The phrase captures Beijing’s preference for a controlled, durable ascent, a long climb rather than another speculative sprint.

From Our Partners

Claim Your Share of $5.39 BILLION in “AI Equity Checks”

The U.S. government just enforced Public Law 81-774 — forcing AI companies to pay up to everyday Americans.

Why? Because nearly every AI model was trained using your personal data — from Facebook posts to Alexa recordings.

Now, a $5.39 billion pot is being distributed as “AI Equity Checks,” with average payments reaching $3,452.50 per month.

And it only takes a few minutes to get set up.

D.C. in the Driver’s Seat

The shutdown grinds on, leaving officials improvising around absent data while agencies triage critical functions. The CPI report on Friday will be the first major release since the government went dark and is expected to show annual inflation holding near 3.1 percent.

Meanwhile, the White House’s evolving industrial policy continues to ripple across sectors.

Reports that the government has taken equity stakes in Intel, MP Materials, and Lithium Americas signal a new model of U.S. state capitalism, one aimed at securing supply chains and generating returns for taxpayers.

Whether it endures beyond the current administration or proves too interventionist remains an open question, but markets are watching closely.

Economic Data

No notable releases

Earnings Reports

TSLA

IBM

TMO

T

LRCX

GEV

APH

BSX

CME

ORLY

MCO

URI

HLT

KMI

CCI

LVS

Overnight Markets

Asia: Nikkei -0.02%, Shanghai -0.07%

Europe: FTSE +0.86%, DAX -0.1%

Overnight Markets

From Our Partners

Nvidia's Worst Nightmare?

Instead, it could be this overlooked $20 company that's already won NASA's trust - and is positioned to dominate the potential $2 trillion quantum computing explosion.

Opening Outlook

Investors face a convergence of narratives: resilient earnings, volatile commodities, fragile trade diplomacy, and a Federal Reserve navigating blind. The tone may be cautious, but it is not fearful.

Markets remain elevated because belief, for now, outweighs doubt. As profits broaden beyond technology and policy support persists, the rally’s foundation looks increasingly durable. Momentum is not charging, it’s enduring.