TQ Morning Briefing

Markets Shift Weight From Momentum to Durability

From the T&Q Desk

Markets are not reacting to inflation. They are reacting to what inflation allows next.

After four straight down sessions, yesterday’s tape looked less like panic and more like position management.

Mega-cap tech continued to deflate, energy stabilized, and rates stayed pinned.

The common thread was not fear of higher prices, but uncertainty over how much policy flexibility still exists once the data curtain lifts.

Today’s CPI print is the first inflation read since the shutdown distorted the data flow. It will be incomplete, backward looking, and methodologically awkward. Markets know that.

What they care about is whether inflation stays psychologically anchored in the two’s or drifts back toward a three handle. That distinction matters far more for rates, multiples, and leadership than the decimal points themselves.

The broader setup remains intact. AI is being repriced, not abandoned. Policy is active but uneven. Growth is slowing, but earnings power is broadening. Capital is rotating toward balance sheets, cash flow, and visibility rather than exiting risk altogether.

This is not a market looking for reassurance. It is a market narrowing its tolerance.

Premier Feature

Trump's Secret Retirement Fund

His salary is $400,000 a year. But his tax returns show he collects up to $250,000 a MONTH from one source.

It's not real estate.

It's not stocks.

Word Around the Street

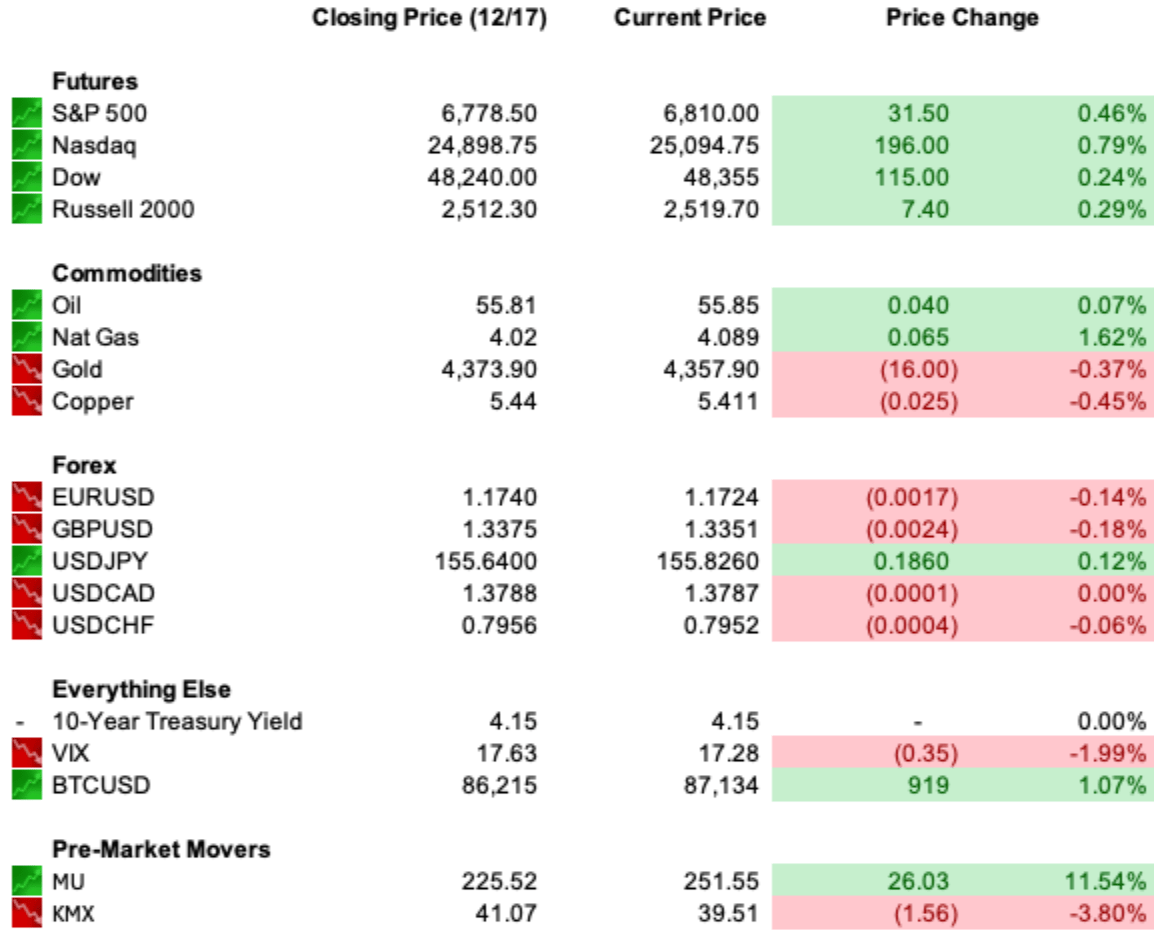

The tape is sorting, not sliding.

After Wednesday’s broad tech pullback, futures are indicating a higher open this morning with the Nasdaq leading gains, the S&P 500 higher, and the Dow more muted, a clear sign that sentiment is stabilizing around selective exposures rather than across the board.

Oracle’s data-center financing setback became the latest stress test for AI infrastructure economics, pulling semiconductors, power plays, and hyperscalers lower in sympathy.

Micron offered the counter-point. The memory-chip maker’s results and upbeat guidance posted late Wednesday offered a fundamental counterweight to the narrative of indiscriminate AI derating.

Its shares rallied in extended hours, driven by real revenue and margin expansion tied to AI workloads, not just structural ambition. That helped spur risk appetite in semis and hardware names this morning, even as broader growth names remain under pressure.

Energy continues to be a theme. Crude prices have edged higher on renewed enforcement activity against Venezuelan-sanctioned tankers, supporting energy equities after weeks of downward drift. Precious metals remain elevated, consistent with hedging behavior ahead of today’s inflation print.

Rates are drifting slightly lower with the long end stable and the front end still anchored by uncertainty around whether an annualized CPI near 3 percent alters the next policy pivot. The dollar is flat to modestly firmer, reflecting cautious positioning ahead of the report.

Taken together, futures this morning are not signaling risk-off panic. They’re signaling rotation and discrimination, capital is being moved toward earnings visibility and tangible demand signals (see Micron) rather than narrative momentum alone.

Global Policy Watch

Central banks take center stage today, but the divergence matters more than the decisions themselves.

In the U.S., the Fed remains boxed in by credibility. Officials have been clear that inflation is cooling, but not yet conquered. The CPI report will not change that stance unless it meaningfully surprises. The absence of month-over-month data reinforces the Fed’s bias toward patience rather than urgency.

Across the Atlantic, the picture is clearer. U.K. inflation undershot expectations, all but locking in a Bank of England cut. The ECB is expected to hold, signaling caution amid weak growth and lingering price pressures. In Japan, a rate hike is widely expected, underscoring how far global policy paths have diverged.

For markets, this matters because global easing is broadening even as the Fed stays deliberate. That dynamic favors income, defensives, and quality credit while keeping pressure on rate-sensitive cyclicals and leveraged growth.

Liquidity is available, but no longer generous. Policy is supportive elsewhere, neutral at home. Capital is adjusting accordingly.

Trade Winds & Global Shifts

Geopolitics continues to shape commodities and capital flows without triggering systemic stress.

In Europe, leaders face a consequential decision on using frozen Russian assets to finance Ukraine. The debate is less about moral clarity than financial liability. Markets are watching for precedent. The use of sovereign assets as collateral would reinforce a world where capital access is increasingly conditional, with long-term implications for reserve currencies and legal risk premia.

Russia, for its part, is signaling escalation rather than compromise. Defense spending remains elevated, and the conflict looks more likely to freeze than resolve. That supports sustained demand for defense, logistics, and reconstruction-related spending across Europe.

Energy geopolitics added another layer. The U.S. escalation against Venezuelan oil exports tightened enforcement without disrupting supply. Crude prices barely flinched, reinforcing the view that surplus capacity remains ample even as political risk rises.

Meanwhile, trade friction continues to redirect flows. Trump’s tariffs have pushed Chinese e-commerce exports into Europe, rewiring logistics, warehousing, and retail economics across the continent. The result is margin pressure for European retailers and rising scrutiny from regulators, with downstream effects for transport, infrastructure, and consumer pricing.

These are not shocks. They are slow-moving reallocations that reward policy awareness over headline chasing.

From Our Partners

Forget Amazon’s 1997 IPO… This Could Be 287 Times Bigger

Early Amazon investors saw extraordinary gains after its IPO. But if you missed that moment, a far larger opportunity may be forming.

According to Capital.com, Elon Musk’s Starlink could be preparing to go public — and Fortune says it may become the biggest IPO in history.

With an estimated $100+ billion valuation, Starlink’s potential IPO would be 287x larger than Amazon’s, and significantly bigger than Apple, Microsoft, and Nvidia’s debuts.

That level of scale could create a rare early-stage window — before Wall Street fully steps in.

Now, James Altucher is revealing how individual investors may be able to gain pre-IPO exposure to Starlink with as little as $100.

D.C. in the Driver’s Seat

Washington’s influence over markets continues to grow more explicit.

The president’s prime-time announcement of a one-time “warrior dividend” to service members underscores how fiscal tools are being used tactically ahead of an election cycle. While the dollar amount is modest in macro terms, the signal matters. Cash transfers funded by tariff revenue blur the line between trade policy, fiscal stimulus, and political calculus.

At the same time, the administration reaffirmed its intent to appoint a Fed chair aligned with lower rates. Markets are not pricing a policy overhaul, but they are increasingly sensitive to signals around independence, credibility, and communication discipline.

Defense policy moved in the opposite direction. The passage of a $901 billion defense bill locks in funding visibility for contractors tied to security, cyber, and supply-chain resilience. That certainty contrasts sharply with the volatility facing healthcare, retail, and consumer-facing sectors where policy risk remains elevated.

The message is consistent. Alignment earns visibility. Friction raises premia.

Economic Data

CPI

Initial Jobless Claims

Philly Fed Manufacturing Index

Earnings Reports

Nike (NKE)

Cintas (CTAS)

FedEx (FDX)

Darden Restaurants (DRI)

Micron Technology (MU)

Overnight Markets

Asia: Nikkei -1.03%, Shanghai +0.12%

Europe: FTSE 100 +0.26, DAX +0.24%

U.S. Pre-Market

From Our Partners

This Crypto Call Could Ruin My Reputation

I’ve never been more nervous to hit “send.”

What I’m about to share could destroy my standing in crypto.

Critics will say I’ve lost it. Some colleagues may walk away.

But I don’t care.

I uncovered something so important about the 2025 crypto market that I stopped everything and wrote a book about it — a roadmap to what I believe could be the biggest wealth opportunity of the decade.

The evidence is so strong, I’m giving the entire book away for free.

If I’m right, this will change how you see crypto forever.

Opening Outlook

Today’s CPI is not about precision. It is about permission.

If inflation holds near 3 percent or drifts lower, markets will read that as confirmation that easing remains on the table in 2026. If it surprises higher, the reaction is likely contained, not violent, as positioning has already adjusted.

The bigger picture remains one of rotation, not retreat. Leadership is broadening. Earnings growth is expected to widen beyond tech next year. Bonds are providing ballast, not competition.

Markets are not asking whether growth survives. They are asking where durability deserves a premium next.