TQ Morning Briefing

Markets Find Their Footing Even as the CME Goes Dark

From the T&Q Desk

The tape heads into the holiday weekend with two competing forces shaping the psychology of the market.

On one side, the post–Thanksgiving drift toward calm is real. Wednesday delivered the fourth consecutive rally for U.S. equities, a broad advance led by both cyclical and defensive sectors.

Rate-cut odds tightened even further, durable goods and jobless claims confirmed a labor market that is softening without breaking, and mortgage rates slid toward fresh monthly lows. In any other November, the market would be gliding into the quiet.

On the other side, the CME outage injected a dose of unease into the one corner of the market that was supposed to be predictable this week.

A cooling failure at CyrusOne’s Chicago data center froze swaths of futures, Treasuries, commodities, FX, equity index benchmarks, leaving traders without live prices and forcing brokers into risk they didn’t want to hold. Thin liquidity is one thing. Blind liquidity is another.

Investors treated Wednesday’s price action as confirmation that the macro regime is still bending in their favor: peace optimism is easing the energy complex, Fed communication is converging on a December cut, and the consumer, miserable as they say they are, keeps spending.

That being said, structural stressors are getting louder. The bond market is bracing for an 85 percent probability of a rate cut. Shale output is projected to decline in 2026. Corporate dealmaking is accelerating under looser antitrust scrutiny. And the geopolitical map of Europe is being quietly re-architected by a newly cohesive E3.

The market wants calm. The backbone of the tape says calm is justified. But the CME failure was a reminder that the most fragile points in the system are often the ones that don’t show up in models.

Premier Feature

BLACK FRIDAY STOCK ALERT

One company to replace Amazon... another to rival Tesla... and a third to upset Nvidia.

These little-known stocks are poised to overtake the three reigning tech darlings in a move that could completely reorder the top dogs of the stock market.

And for Black Friday, Eric Fry is giving away the names, tickers, and full analysis in a first-ever free broadcast — an exclusive opportunity typically locked behind a paywall.

This Black Friday event won't be available for long.

Word Around the Street

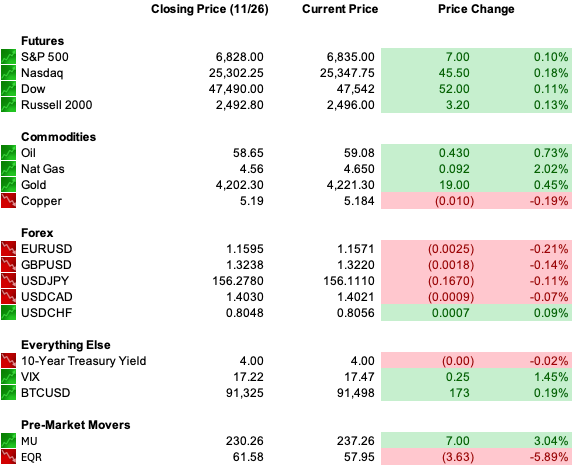

U.S. equities notched their fourth straight gain on Wednesday, with the S&P 500 and Nasdaq hitting two-week highs and reversing the downward momentum that pushed them below key moving averages just days ago.

Nearly every S&P sector finished higher, with healthcare the lone laggard. The Dow added almost 0.7 percent, the S&P climbed 0.69 percent, and the Nasdaq rose 0.82 percent.

The shift in sentiment is almost entirely tied to the change in expectations around the December meeting of the Fed. Rate-cut probabilities have surged from under 40 percent a week ago to roughly 87 percent today. Dovish remarks from New York Fed President John Williams and Governor Christopher Waller supplied the spark, and every data release since has reinforced the narrative.

Durable goods rose 0.5 percent, jobless claims ticked down to 216,000, and the Beige Book showed employers leaning more on hiring freezes and attrition than layoffs.

Small caps responded instantly. The Russell 2000 is up roughly 7 percent across the last four sessions. Gold is up nearly 3 percent this week. Bond yields hovered around the 4 percent line, with the 10-year near a clean technical break.

Bitcoin, down more than 20 percent for November, finally caught a bounce, rising more than 3 percent late Wednesday. Oil ticked higher but remains near year lows as peace expectations reset supply anxiety.

Overseas, Asian markets were mixed, Japan’s Nikkei firmed, and Europe traded higher even as CME’s outage rippled across global liquidity.

Global Policy Watch

Central banks remain the fulcrum of global positioning, but November’s data blackout has amplified every voice in the room.

In the U.S., the divide is sharp but drifting dovish. Waller argues inflation is cooling quickly enough to justify “insurance easing.” Williams has constructed a public case for a cut without endangering the disinflation path. Daly is signaling caution but no resistance.

Critics remain. Collins, Schmid, and Musalem are still uneasy cutting again without CPI or jobs data. The Beige Book offered anecdotes but not ammunition.

Mortgage rates reacted exactly as the Fed’s dovish coalition wanted. The 30-year slid to 6.2 percent, the lowest since late October, triggering an eight percent jump in purchase applications.

Abroad, the decision that could matter most isn’t the Fed’s, it’s Japan’s. BOJ signaling is growing more coordinated, political cover is deepening, and market pricing now assigns a roughly 30 percent chance of a December hike. Tokyo CPI accelerated, JGB yields hit fresh cycle highs, and jawboning has done little to contain the yen’s slide.

Europe’s central-bank picture is calmer but not passive. ECB minutes pointed to no urgency to cut. Australia warned that global financial conditions are dictating domestic tightening more than the cash rate.

Trade Winds & Global Shifts

Geopolitics tightened again Thursday after Vladimir Putin finally broke his silence on the U.S.–Ukraine peace framework.

In Bishkek, he said the 19-point draft emerging from U.S.–Ukraine talks could serve as a “basis for future agreements” and that Washington now appears to be “taking Russia’s position into account.”

The Kremlin still insists key issues need “serious analysis,” and Putin reiterated that Ukrainian forces must withdraw from “key areas,” but the shift is meaningful: Moscow is now engaging the plan rather than dismissing it.

Kyiv has already tentatively backed the structure after talks in Abu Dhabi, and President Zelensky said Ukraine is prepared to advance the framework. The next pivot arrives next week when U.S. envoy Steve Witkoff travels to Moscow.

Markets are beginning to price the possibility that a genuine peace sequence is forming.

In Western Europe, the E3 is resurging with Macron, Merz, and Starmer evolving their countries into a de facto European core, coordinating on Ukraine strategy, Trump management, and a shared view that Europe must take responsibility for its own security.

The new trilateral axis has become the continent’s “working muscle,” giving Europe a coherent diplomatic backbone for the first time since the Merkel–Sarkozy era.

Across the Pacific, China’s tech landscape is undergoing its own realignment. Baidu’s chip unit Kunlunxin is rapidly filling the gap left by Nvidia’s export limits, securing early domestic orders and emerging as one of Beijing’s best-positioned AI hardware suppliers.

Analysts now expect Kunlunxin sales to increase six-fold by 2026.

From Our Partners

“Elon’s #1 AI Stock” Is Set to Soar

Our Black Friday sale expires soon and with it, your chance to get VIP Unlimited access for $79 and uncover Elon's #1 AI Stock to Buy ASAP!

Forget ChatGPT.

Musk's new AI is built to be 100x more powerful, working in the real world.

Join now to get the full report + all 6 bonuses before the sale ends.

D.C. in the Driver’s Seat

Deal flow is back in a big way under the current administration.

Antitrust enforcement has dropped sharply, with only three merger-blocking lawsuits this year compared with six annually under Biden.

Corporate tie-ups worth more than $10 billion have doubled, deal value is up more than 40 percent year over year, and transactions that would have been unthinkable two years ago, Union Pacific with Norfolk Southern, Nexstar with Tegna, are now viable.

The Justice Department has increasingly favored settlements over litigation, and the White House has shown a willingness to bless deals even when regulators hesitate. For investors, it means consolidation tailwinds, fewer regulatory cliffs, and more latitude for strategic mergers into 2026.

Meanwhile, Washington moved from simmer to full boil on Thursday after a National Guard member died from an ambush blocks from the White House, an attack investigators say was carried out by an Afghan national admitted under the 2021 resettlement program.

The terrorism probe widened quickly as the FBI searched multiple properties and seized devices tied to the suspect, a former member of a CIA-backed Afghan unit. Trump blamed Biden-era vetting failures and used the moment to launch the most aggressive immigration shift of his presidency.

Within hours, the administration ordered a full review of asylum approvals under Biden, suspended processing for Afghan cases, and signaled that Green Cards from nineteen countries would face new scrutiny.

By evening, Trump went further, vowing to “permanently pause” migration from “Third World Countries,” end federal benefits for non-citizens, and pursue denaturalization for migrants deemed security risks. DHS officials described the pivot as the opening phase of a broad “reverse migration” agenda aimed at sharply reducing both legal and illegal inflows.

Security, politics, and policy are now moving in the same direction — fast.

Economic Data

No notable releases

Earnings Reports

No notable reports

Overnight Markets

Asia: Nikkei +0.17%, Shanghai +0.34%

Europe: FTSE 100 +0.18%, DAX +0.20%

U.S. Pre-Market

(Reflecting CME disruption and limited actionable data)

From Our Partners

The Energy Stock Trump Once Called "A Big Mistake" to Mess With

When a U.S. ally tried to tax ONE American energy company...

Now this same company is generating over $3 billion in operating income...

And partnering with the hottest AI stock on Wall Street.

Opening Outlook

The post-Thanksgiving tape steps into Friday with the kind of uneasy calm that markets only manage once or twice a year.

Futures are frozen after the CME outage, liquidity is a fraction of its normal depth, and yet the broader mood carries a quiet upward drift born of relief. Relief that the week’s data finally gave the Fed cover to cut, relief that geopolitical risk has edged toward negotiation rather than rupture, and relief that the tape has stitched together four straight sessions of recovery just when sentiment seemed ready to break.

Still, the market is juggling more crosscurrents than the opening screens suggest. The CME shutdown has removed one of the market’s core signaling mechanisms at the exact moment global risk appetite is recalibrating around a tentative Ukraine framework.

Oil is sliding toward year lows. Gold is climbing. Rate-cut odds are locked near eighty-five percent. And tech leadership is splintering in ways that matter, with Alphabet still surging even as semiconductors struggle to retake control of the AI narrative.

Thin liquidity has a way of amplifying whatever matters most. Today, that means three things: whether peace headlines continue to deflate the energy premium; whether the Fed’s anecdotal Beige Book evidence hardens the dovish camp into a December majority; and whether the CME outage injects more noise into a market already trying to navigate frozen futures, missing data, and a holiday-thinned tape.

The market wants calm. What it has is a fragile version of it, and every catalyst sitting just close enough to the surface to test how long the calm can hold.