TQ Morning Briefing

Policy moved first. Markets stayed selective.

MARKET STATE

Policy Noise, Economic Gravity

This is what a market looks like when politics gets louder but price discovery refuses to follow immediately.

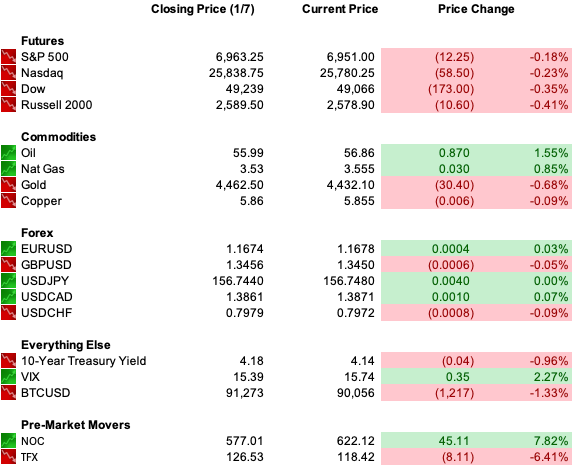

U.S. futures are lower across the board after yesterday’s pullback from record highs. The Dow and S&P are pointing modestly down. The Nasdaq is softer again.

Rates are steady. Oil is flat to lower. Metals are sliding. Volatility remains contained.

Nothing here suggests disorder.

Nothing here suggests chase.

What changed overnight was not sentiment. It was tolerance.

Markets are no longer reacting to geopolitical shock. They are reapplying filters as policy intervention becomes more explicit and more frequent.

That distinction matters, because it tells you this is not fear-driven de-risking. It is standards tightening.

Yesterday’s selloff broke a short opening rally, but it did not unwind positioning. This morning’s price action confirms that interpretation. Risk is being tested, not rejected.

Premier Feature

What Happened to the US Dollar?

In 1950, one U.S. dollar was worth 100 cents.

Today, that same dollar is worth about 3 cents — and Washington keeps printing more.

That loss didn’t happen overnight. It happened quietly, year by year.

While people worked, saved, and planned for retirement, inflation steadily took its share — eroding purchasing power along the way.

What are you worth when the dollar reaches zero?

At Revelation Gold Group, we help Americans protect what they’ve spent a lifetime building — before more is lost.

WHAT’S ACTUALLY MOVING MARKETS

Defense Became a Managed Trade

The headline number was enormous. A proposed $1.5 trillion defense budget would normally read as a clean tailwind for the sector.

The market did not treat it that way.

Defense equities rallied premarket, but the enthusiasm is capped by the same force that lifted them.

The administration is no longer just expanding demand. It is asserting control over capital allocation.

Restrictions on buybacks, dividends, and executive compensation reframed defense from a free-cash-flow story into a politically governed one.

That shift matters more than the budget figure.

Markets can price spending. They struggle to price discretion. Defense is being repriced as policy infrastructure rather than shareholder infrastructure.

That produces volatility, not conviction.

Oil Refused to Play Along

If U.S. control of Venezuelan oil were a scarcity shock, crude would not be sitting near $60.

It is.

That tells you everything. Oil is being priced as administrative flow, not as an incremental supply impulse.

Sanctions mechanics, storage, transport, refinery compatibility, and political sequencing matter more than reserve size. Until those clear, barrels are theoretical.

This is why refiners continue to look better than producers. Heavy crude access is valuable over time, not overnight. The market is refusing to prepay for execution risk.

The signal is not indifference.

It is patience enforced by process.

Metals Unwound on Mechanics, Not Meaning

Gold and silver are selling off sharply, but the reason is visible and contained. Commodity index rebalancing and a firmer dollar are doing the work.

There is no disorderly unwind. No credit spillover. No volatility shock.

Last week priced geopolitical insurance. This week is resizing it. The market is not abandoning hedges. It is recalibrating them now that escalation looks staged rather than abrupt.

Late-cycle markets do not abandon protection.

They right-size it.

From Our Partners

10 AI Stocks to Lead the Next Decade

AI is fueling the Fourth Industrial Revolution – and these 10 stocks are front and center.

One of them makes $40K accelerator chips with a full-stack platform that all but guarantees wide adoption.

Another leads warehouse automation, with a $23B backlog – including all 47 distribution centers of a top U.S. retailer – plus a JV to lease robots to mid-market operators.

From core infrastructure to automation leaders, these companies and other leaders are all in The 10 Best AI Stocks to Own in 2026.

Free today, grab it before the paywall locks.

POWER & POLICY

The Donroe Doctrine Is a Volatility Source, Not a Regime Shift Yet

Between Venezuela, Greenland, housing, defense, and trade, the administration is widening the policy surface area rapidly.

Markets are responding selectively.

Housing rhetoric hit homebuilders and rental REITs hard, but did not leak into credit.

Defense absorbed the budget shock but balked at capital controls. Energy shrugged off geopolitical escalation entirely.

That divergence matters.

Markets are distinguishing between authority and enforceability. Until policy translates into durable legal and economic frameworks, capital will continue to price optionality rather than outcomes.

Prediction markets are racing ahead of equities. Diplomats are reacting faster than traders.

That gap tells you markets still believe escalation, if it comes, will be sequenced and absorbed rather than forced.

ONE LEVEL DEEPER

Where Capital Is Still Willing to Sit

The most important signal this morning is not what sold. It is what stayed held.

Rates remain orderly. The dollar is firm but not disruptive. Credit is calm. Volatility is compressed.

Capital is still willing to sit in exposures where outcomes are governed rather than speculative.

Defense is tolerated because demand is policy-backed, even if returns are capped.

Refiners are held because infrastructure exists even if barrels lag.

Select AI exposure remains supported where demand converts into installed reality rather than narrative.

By contrast, assets that depend on immediate political execution were told to wait.

This is not fear.

It is filtration.

Markets are deciding what they are willing to tolerate next, not what they need to escape from.

From Our Partners

How to Claim Your Stake in SpaceX with $500

Every week Elon Musk is sending about 60 more satellites into orbit.

Tech legend Jeff Brown believes he’s building what will be the world’s first global communications carrier.

He predicts this will be Elon’s next trillion-dollar business.

And when it goes public, you could cash out with the biggest payout of your life.

MARKET CALENDAR

Data: Balance of Trade, Initial Jobless Claims, Nonfarm Productivity

Earnings: RPM International (RPM), SYNNEX (SNX)

Overnight: Nikkei -1.63%, Shanghai -0.07%, FTSE 100 -0.17%, DAX -0.08%

U.S. PRE-MARKET

THE CLOSE

Control Is Still the Theme

This is not a market losing confidence.

It is a market demanding proof.

Policy is visible. Intervention is rising. But capital is still governed by rates, cash flows, and execution timelines. Headlines are being processed, not chased.

Some upside will stall.

Some volatility will persist.

Some narratives will fail to clear the bar.

That is the cost of control.

The system is not accelerating.

It is not breaking.

It is deciding how much discretion it is willing to absorb before repricing risk.