TQ Morning Briefing

Markets Hold Steady Ahead of CPI’s Return to the Stage

From the T&Q Desk

Markets drifted higher Thursday as traders braced for the most anticipated data release of the shutdown era: Friday’s consumer price index. The S&P 500 climbed back near 6,750, the Nasdaq pushed toward 23,000, and the Dow and Russell 2000 each closed near their session highs, powered by expectations of steady inflation and a second consecutive Fed rate cut next week.

Momentum names that had stumbled in recent days snapped back in a brisk “buy the dip” trade, with breadth strengthening across nearly every sector.

Defensive health care and utilities have led the market through the government blackout, while financials, particularly regional banks, have lagged under credit concerns.

Bond yields ticked higher, the 10-year settling near 4.0%, and oil spiked on sanctions news, gaining more than 5% to $61.79 after Washington imposed direct sanctions on Rosneft and Lukoil, Russia’s top oil exporters. Gold rebounded sharply to $4,145 an ounce after a volatile week.

The CPI report, due at 8:30 a.m. ET, will offer the first clear view of inflation in nearly a month. Economists expect headline prices to rise 0.4% month-over-month and 3.1% year-over-year, the highest reading since May 2024. Core CPI is seen steady at 3.1%.

Premier Feature

The TRUTH About Trump and Musk?

If you think there's something strange about the "feud" between Trump and Musk…

You need to see THIS jaw-dropping video…

Because it explains what could REALLY be going on behind the scenes…

And how it could hand investors a stake in a $12 trillion revolution.

Word Around the Street

Earnings season has added ballast to the rally. Results so far show S&P 500 profits up 8.7% year-over-year, with 82% of companies beating expectations by an average 6.4% surprise.

Analysts see gains across seven of the eleven sectors, led by technology, financials, and utilities, signaling a healthier profit mix than earlier in the year.

Tesla’s earnings miss drew attention, but overall corporate results have reinforced confidence that growth remains intact even as borrowing costs stay elevated.

The macro backdrop remains supportive. Treasury yields are hovering around 4% and oil prices continue to move higher on the back of new sanctions on Russia. The selling persists in gold after yesterday’s relief rally.

Overseas, Asia finished mostly higher after South Korea held rates steady, while Europe opened mixed as traders awaited confirmation of next week’s Trump–Xi meeting.

Markets enter Friday alert but balanced, positioned for volatility but still betting that the story of 2025 remains one of resilience rather than reversal.

Global Policy Watch

The Federal Reserve heads into next week’s policy meeting navigating blind. With the government shutdown in its twenty-third day, Friday’s CPI is the lone piece of official data available before the FOMC decision.

Futures markets are fully pricing a 25-basis-point cut, with another expected in December.

Longer-term expectations remain anchored, 10-year breakeven inflation sits near 2.3%, suggesting markets view tariff-driven price pressure as temporary. Mortgage rates have slipped to 6.19%, their lowest in a year, reinforcing easier financial conditions even before the Fed acts.

Trade Winds & Global Shifts

The White House confirmed that President Trump will meet China’s Xi Jinping on October 30 in South Korea, a summit framed as both high-stakes and high-reward. It comes ahead of a November 1 tariff deadline that could see duties on Chinese goods jump to 155% if talks stall.

Meanwhile, Beijing struck a conciliatory tone Friday, saying dialogue and cooperation remain “the only right choice” for the two nations.

China’s recent restrictions on rare-earth exports and Washington’s reciprocal sanctions on Russian oil have redrawn the energy and trade map, pushing global supply chains into new alignments.

India, caught between cheap Russian crude and U.S. pressure, is quietly seeking a tariff-cutting trade deal with Washington to offset higher energy costs.

From Our Partners

10 AI Stocks to Lead the Next Decade

AI is fueling the Fourth Industrial Revolution – and these 10 stocks are front and center.

One of them makes $40K accelerator chips with a full-stack platform that all but guarantees wide adoption.

Another leads warehouse automation, with a $23B backlog – including all 47 distribution centers of a top U.S. retailer – plus a JV to lease robots to mid-market operators.

From core infrastructure to automation leaders, these companies and other leaders are all in The 10 Best AI Stocks to Own in 2025.

Free today, grab it before the paywall locks.

D.C. in the Driver’s Seat

The government shutdown stretches into Day 23, with agencies still dark and officials improvising around missing data. Friday’s CPI release carries unusual weight: it informs both Social Security’s 2026 COLA adjustment and the Fed’s next policy decision.

Markets have navigated the blackout with surprising ease. Equity strength has rested on corporate earnings, stable credit spreads, and confidence that the Fed’s easing cycle will cushion any economic slowdown.

Treasury markets are pricing steadiness, not fear: real yields remain low, and inflation breakevens suggest trust in long-term stability.

Still, the data void distorts perception. Investors are trading belief more than evidence, extrapolating from partial signals, earnings calls, private surveys, and commodity price, to gauge growth and inflation. The CPI print will finally anchor that narrative.

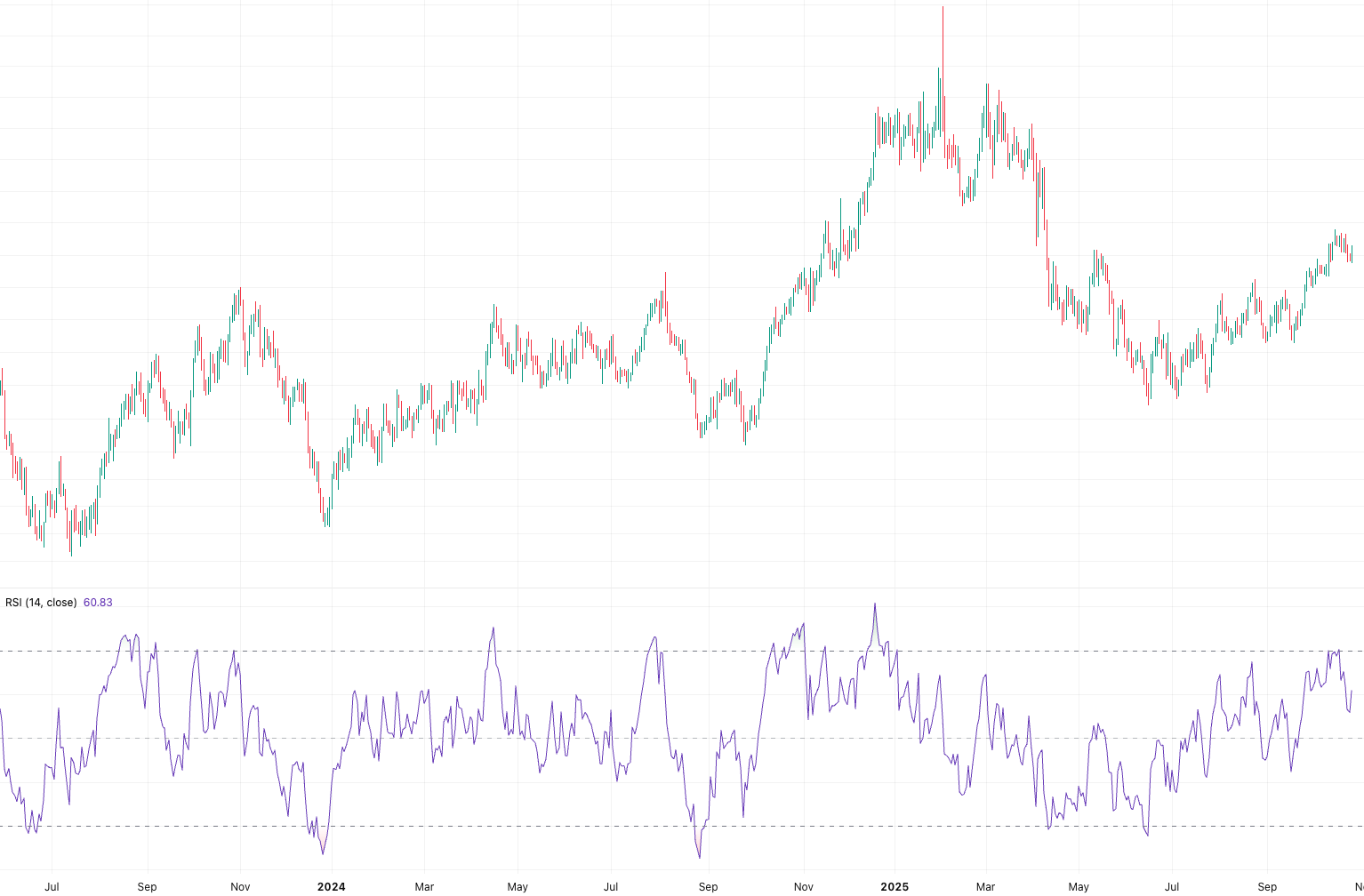

Friday Chart Check

Are you a buyer, seller, or staying away?

No deep dive, no overthinking, just a quick pulse check of market sentiment.

Cast your vote below to find out what’s behind the chart!

Find out what's behind the chart.

Economic Data

CPI

S&P Global Flash PMI

Earnings Reports

PG

HCA

GD

ITW

Overnight Markets

Asia: Nikkei +1.35%, Shanghai +0.71%

Europe: FTSE -0.11%, DAX -0.09%

U.S. Pre-Market

From Our Partners

Read This if you Trade Zero-Day Options

How would you like 3–5 handpicked 0DTE alerts sent straight to your phone every day?

I’ve spent more than three decades trading with the precision it takes to consistently outsmart the market — and that same approach drives every alert I send.

Of course, we don’t make reckless promises when it comes to trading…

But today’s FREE 0DTE pick is ready — and you can get instant access right here.

Opening Outlook

Investors head into Friday balancing optimism and restraint. The rally remains fueled by broad earnings strength, expectations of Fed support, and cautious confidence that Washington and Beijing will find an off-ramp from escalation.

Whether belief continues to outpace reality may hinge on one number at 8:30 a.m.