TQ Morning Briefing

Markets Slip as Yields Jump and Crypto Reverses

From the T&Q Desk

December opened with the kind of tone that traders hoped to avoid.

The holiday glide path is gone. What replaced it is a market skittish about rates, uneasy about liquidity, and increasingly sensitive to cross-border policy signals that are pointing in different directions.

The catalyst is not unusual. It is the combination of a hawkish surprise in Japan, a sharp move higher in global yields, a crypto complex that lost its footing for the second time in a week, and another round of thin data visibility as the Fed enters a blackout period.

Markets have conviction on the destination of policy. They do not have conviction on the path.

The Federal Reserve is now one week from a meeting with an unusually divided voting slate. Nearly all of the market is priced for a cut, yet the committee itself is not aligned.

Japan is leaning toward a hike. Europe is waiting for confirmation on disinflation. Treasury markets are reacting first and asking questions later.

Direction exists. It remains reactive, not durable.

Across the desk, traders are treating the early-December tape as a test.

If yields stabilize and crypto regains traction, positioning can extend last week’s run. If not, the next several sessions carry more downside skew than the seasonal playbook would normally suggest.

Premier Feature

$50 Billion Says You’ll Want These Names

Wall Street’s big money is already moving — quietly building positions in a handful of stocks before the next rally.

Our analysts tracked the flows and found 10 companies leading the charge.

Some are household names. Others are under-the-radar innovators about to break out.

Together, they form the Post-Rate-Cut Playbook smart investors are following right now.

Word Around the Street

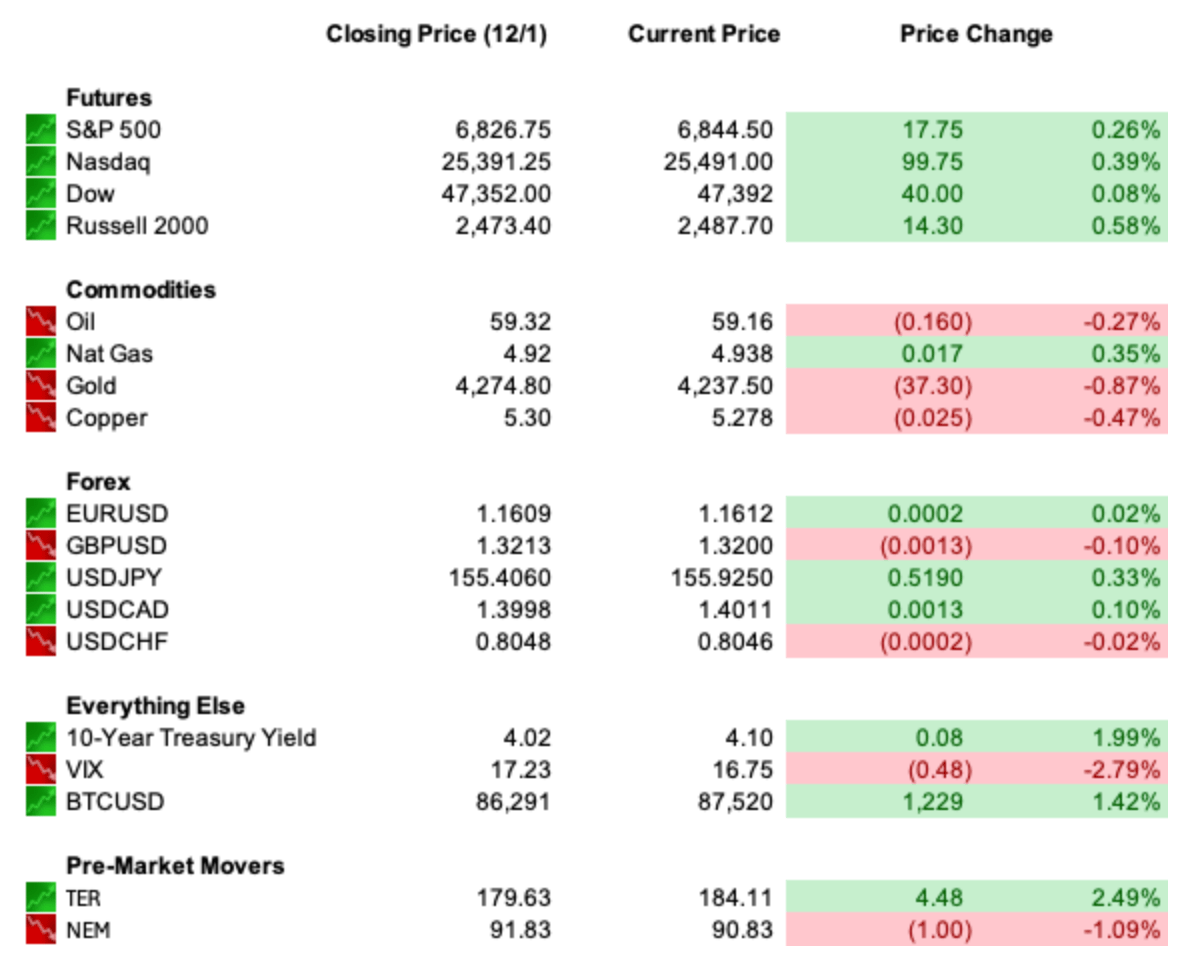

U.S. equities slipped to start the month, giving back part of last week’s rebound as higher yields and a defensive tone weighed on risk appetite.

The S&P 500 fell half a percent, the Nasdaq declined modestly, and the Russell 2000 underperformed following an eight percent surge over the prior five sessions. Volume was thin, with most desks describing a sluggish post-holiday return.

Rates remained the dominant pressure point Monday. The 10-year Treasury yield climbed to 4.09 percent after comments from the Bank of Japan triggered a global sell-off in government bonds.

The move briefly eased after weak U.S. manufacturing data, but the relief was short-lived. The dollar weakened against the euro but stabilized versus the yen as traders adjusted carry positions.

Crypto added another layer of stress. Bitcoin tumbled more than six percent intraday, briefly breaking below eighty-four thousand before recovering part of the move. The decline pushed several systematic strategies into de-risk mode and kept futures positioning in crypto proxies defensive heading into today’s open.

Sector performance was uneven. Energy was one of the few bright spots after OPEC plus reiterated plans to pause output increases and geopolitical tension lifted supply risk. Utilities, industrials, REITs, and healthcare fell more than one percent, reflecting duration pressure and earnings sensitivity.

Precious metals continued to firm as gold hit six-week highs and silver extended its sharp year-to-date outperformance.

Stock futures are attempting a modest rebound after Monday’s risk-off start. Dow futures are up roughly one-tenth of a percent, S&P futures are higher by about two-tenths, and Nasdaq futures are up four-tenths as traders probe for stability in megacap tech following yesterday’s slide.

The tone is constructive but not convincing, with positioning still light and overnight liquidity thin. Treasury futures reflect continued upward pressure on yields, and crypto-linked futures remain under strain after yesterday’s drawdown.

The market enters December carrying strong seasonality, but traders are navigating a tape that is no longer aligned with the statistical comfort that December usually provides.

Global Policy Watch

Washington is driving this week’s central-bank narrative. President Trump signaled he has chosen the next Fed chair, with prediction markets placing Kevin Hassett as the clear favorite.

Traders read his rise as a shift toward easier policy, reflected in the near-ninety percent probability of a December rate cut. But the committee remains divided, and Treasury Secretary Scott Bessent’s call to “simplify” the Fed’s mandate, including a rethink of regional presidents and their public signaling, adds another layer to an already uncertain transition.

The global backdrop is tightening. The Bank of Japan’s more hawkish tone pushed JGB yields to their highest level since 2008, sparking a broader sell-off across sovereign curves and forcing a reassessment of yen carry trades.

The Bank of England added its own warning, saying financial-stability risks have risen through 2025, with stretched AI valuations and nearly one hundred billion pounds of leveraged gilt exposure concentrated in a handful of hedge funds.

The result is a policy environment defined by divergence: a U.S. Fed preparing for leadership change, a BOJ moving toward its first potential hike in years, and a BOE highlighting market fragility even as it trims bank capital requirements. Incoming data will carry disproportionate influence as all three navigate the final stretch of the year.

Trade Winds & Global Shifts

Ukraine diplomacy accelerated. White House envoy Steve Witkoff and senior adviser Jared Kushner arrived in Moscow for the next round of negotiations, following weekend talks in Florida with Ukrainian officials on revised terms for a potential cease-fire framework.

The updated framework includes election-linked benchmarks, land-swap contours, and security guarantees. Russia and Ukraine both acknowledged progress, but neither signaled readiness to compromise on core territorial positions.

European skepticism is intensifying. Leaked transcripts suggested Washington may be positioning itself as a mediator rather than an ally within NATO structures, raising concern over the long-term implications of any U.S.-brokered deal. European capitals are pushing for adjustments to the plan before any cease-fire contours are finalized.

Elsewhere, Russia and India are preparing to deepen defense and energy ties ahead of Putin’s visit to New Delhi. The agenda includes renewed arms discussions, S-400 components, and expanded oil flows at a time when India’s imports of Russian crude have dipped under the pressure of U.S. sanctions.

Both theaters feed into a broader year-end macro backdrop where geopolitical risk premia are no longer isolated to single regions.

From Our Partners

The David to Nvidia's Goliath: Tiny Startup Solving AI's Biggest Challenge

While Nvidia grabs the headlines, a little-known company is quietly reshaping the AI landscape.

Their cutting-edge technology is tackling the biggest bottleneck in AI adoption, attracting customers like Intel, AMD, Microsoft, and more.

As the AI boom accelerates, this tiny startup could be the ultimate winner.

D.C. in the Driver’s Seat

Scrutiny is mounting over the September maritime strike in the Caribbean after reports indicated that a second missile was fired at surviving passengers from an alleged drug-running vessel.

Lawmakers from both parties raised concerns that the described sequence could meet the legal definition of a war crime.

The White House defended Defense Secretary Hegseth, saying Admiral Bradley acted within the authority granted to him. Trump said he did not want a second strike and believes Hegseth did not authorize one. Bradley is expected to brief congressional committees in classified sessions this week as oversight expands.

The debate comes amid broader legal challenges to Trump-aligned appointments. A federal appeals court ruled that Alina Habba was unlawfully appointed as acting U.S. attorney in New Jersey, a decision that could affect numerous active cases. Similar rulings in Virginia, California, and Nevada have intensified scrutiny on the administration’s approach to temporary federal prosecutors.

Separately, Costco joined a growing list of companies suing the administration over emergency tariffs, seeking eligibility for refunds if the Supreme Court strikes the measures down.

Domestic political risk is becoming a more persistent part of the market narrative.

Economic Data

No notable reports

Earnings Reports

CRWD

Overnight Markets

Asia: Nikkei 0.00%, Shanghai -0.42%

Europe: FTSE 100 +0.36%, DAX +0.79%

U.S. Pre-Market

(Reflecting CME disruption and limited actionable data)

From Our Partners

Bitcoin’s Pullback Just Triggered a Crypto “Fire Sale”

The smartest traders I know are loading up on altcoins like crazy right now. Bitcoin’s recent dip didn’t just pull prices down — it created a rare fire-sale setup across the entire market.

While BTC rose 13% this year, altcoins crashed 25–30%… the same pattern that led to 155,555% on XRP, 40,000% on SOL, and 19,043% on MATIC. Ethereum supply is plunging as investors prepare for a major rebound.

The spring is coiling. The question is: will you be positioned when it releases?

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Opening Outlook

Markets enter the second session of December carrying a different tone than they brought into Monday. Yields are rising. Crypto is unsettled. Japan has forced global rate expectations wider. The Fed remains divided heading into next week’s meeting.

The strength of Friday’s rally still matters.

The stability behind it remains in question.

The next few sessions will determine whether December builds on that momentum or resets it.