TQ Evening Briefing

All-Time Highs, But the Conviction Is Elsewhere

MARKET STATE

All-Time Highs, But the Conviction Is Elsewhere

This is a record-setting market that still feels managed.

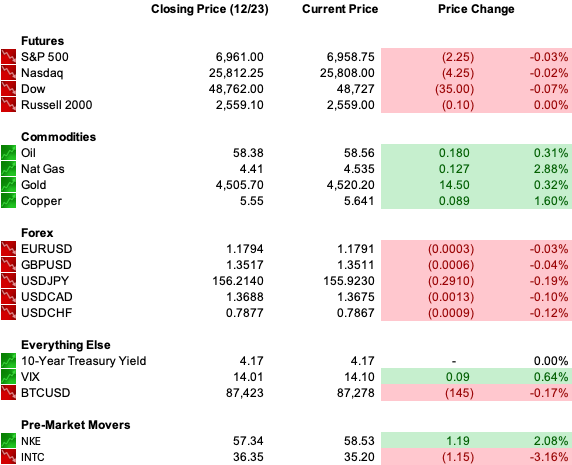

The S&P 500 closed at a fresh all-time high on Tuesday, extending a four-day advance and officially kicking off the Santa Rally window. Futures are flat to slightly lower this morning in holiday-thinned trade. Volatility is compressed. Liquidity is light. The tape looks calm.

Precious metals are again pressing record territory.

Gold is holding above $4,500. Silver is north of $70. Platinum has joined the move.

That matters, not because metals are “still going up,” but because they are doing so without equity stress and without a volatility response. This is not fear. It is insurance.

At the same time, policy signals continue to fragment.

Japan’s rate pressure is feeding global yields.

U.S. enforcement actions against Venezuelan oil flows are escalating from rhetoric into logistics.

And the Fed chair succession process has moved firmly into public view.

None of these are shocks on their own.

Together, they reinforce a market posture that is increasingly clear.

Risk is still on.

But it is being carried with protection layered in.

That posture tends to persist into year-end, when liquidity thins, positioning hardens, and policy paths stop moving together.

Premier Feature

The Crypto Forecast I Wasn’t Supposed to Share

For years, I’ve interviewed billionaire founders, hedge fund managers, and early Bitcoin insiders.

But recently, behind closed doors, they all started preparing for the same thing — an event they believe could trigger the biggest wealth transfer in crypto history.

After 600 insider interviews and 17 million podcast downloads, I finally connected the dots and revealed everything in my new book Crypto Revolution — now FREE.

Inside, you’ll see:

• Why insiders believe Bitcoin could reach $300,000

• The hidden accumulation pattern forming right now

• And the “point of no return” most people won’t see coming

Once this goes mainstream, the early edge disappears.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

WHAT’S ACTUALLY MOVING MARKETS

All-Time Highs Are Real, But Participation Is Narrow

The headline move matters. The S&P is at a record for a reason.

Megacap technology continues to do the heavy lifting. Alphabet, Nvidia, Broadcom, and Amazon remain central to leadership, reinforcing the idea that the market still trusts earnings visibility and balance-sheet scale.

But the character of the advance is telling.

Small caps continue to lag.

Breadth is improving only marginally.

Volume on Tuesday was the lightest of the year.

This is not a breakout that is pulling new capital in.

It is existing exposure being maintained into a favorable seasonal window.

Markets aren’t rejecting risk.

They are rationing it.

Metals Are Acting as the Release Valve

The most important development today is not that gold hit another record. It is how it did so.

Equities held their ground.

Volatility stayed compressed.

Rates moved only modestly.

When insurance assets lead without stress elsewhere, markets are not reacting to danger. They are preparing for uncertainty.

Silver’s outperformance reinforces that this is not just a central-bank bid. Platinum’s strength adds an industrial and supply-constraint layer. Together, the metals complex is signaling allocation, not panic.

This is protection being normalized inside portfolios that remain exposed to risk assets.

Strong Growth Is Complicating Policy, Not Simplifying It

The delayed third-quarter GDP print came in at 4.3%, the strongest pace in two years.

In another cycle, that number would have forced a clean repricing of risk. This time, it did not.

Rate-cut expectations were nudged back, not erased.

The front end held steady.

Equities absorbed the data without urgency.

That response matters. It tells you the market is treating strong growth as backward confirmation, not forward guidance.

The reason is credibility.

Strong growth raises questions about how freely the Fed can ease, especially with labor data softening and political pressure rising simultaneously.

That uncertainty does not break markets.

It changes where they hedge.

Enforcement Is Replacing Forecasts in Energy Markets

Oil extended its rebound again this morning, supported by Venezuela-related developments.

This is not a demand story.

It is not an OPEC story.

It is an access story.

U.S. actions targeting Venezuelan oil logistics are reframing energy risk around mobility, sanctions enforcement, and shipping routes. Markets are responding in a measured way, pricing friction rather than disruption.

That distinction matters.

Geopolitics is not spiking volatility.

It is shaping where capital feels comfortable operating.

From Our Partners

Trump's Had Enough - He's Coming After These Stocks

Trump is tearing them down once and for all.

I’m talking about one of the most powerful groups in America — a group that’s held enormous influence for more than 40 years, shaping businesses, land, and even housing.

Now Trump says enough is enough.

He’s signed a radical new order to destroy their grip on America. Critics say he’s gone too far. But for investors, the takeaway is clear:

Moves like this don’t happen quietly. They send shockwaves through markets — creating sudden winners and painful losers.

To learn what stocks to buy right away - and which ones to avoid…

TAPE & FLOW

Cross-asset behavior continues to reinforce the message.

Equities are steady near record levels, but follow-through is limited. Futures are marginally lower into an early close. Participation remains selective.

Volatility is low, but not complacent.

Implied levels remain compressed even as demand for protection persists in options markets. That divergence signals comfort, not conviction.

Rates are quietly reasserting themselves.

The 10-year Treasury is hovering around 4.15%, driven less by domestic growth optimism and more by spillover from Japan’s move higher in sovereign yields. This is yield gravity returning unevenly, not bond-market stress.

FX markets are adjusting in an orderly way.

The dollar has softened modestly as traders digest widening central-bank divergence and growing questions around Fed independence. The yen continues to firm on intervention risk rather than yield math alone.

When currencies move on credibility signals instead of rate differentials, governance risk is being priced.

Commodities remain the clearest expression of conviction.

Gold and silver continue to lead. Platinum has joined. Energy is supported on enforcement risk. Copper remains firm.

Across assets, the message is consistent.

Risk is still on.

But urgency is absent.

And protection remains in demand.

POWER & POLICY

Credibility Is Becoming a Tradable Variable

Policy risk is no longer episodic.

It is becoming structural.

In the U.S., inflation is easing, but not decisively enough to force urgency. Fed officials continue to emphasize patience, framing decisions around credibility and labor-market risk rather than near-term market comfort.

In isolation, that stance would be stabilizing.

In this environment, it is not.

The contest to replace the Fed chair is now overt.

Names are circulating. Positions are being staked publicly. Markets are increasingly sensitive not just to where rates go, but to how decisions will be made and how insulated the institution will remain from political pressure.

This is not a rate question.

It is a governance question.

And governance risk carries duration.

Globally, policy divergence is reinforcing the theme.

Japan is tightening into a world still pricing easing. Europe remains cautious. Synchronization has broken down, and with it the assumption of smooth global liquidity conditions.

Markets can function with friction.

But they price it.

That is why dispersion is replacing direction.

And why insurance continues to show up alongside participation.

From Our Partners

Trump's Executive Order 14330: What Wall Street Doesn't Want You to Know

When Trump signed Executive Order 14330, he quietly opened a $216 trillion opportunity to regular Americans. And Trump collects up to $250,000 a month through a little known fund directly tied to this boom.

Now you can access it for less than $20.

ONE LEVEL DEEPER

Why All-Time Highs Can Coexist With Heavy Hedging

The apparent contradiction in this market is not accidental.

You have strong growth prints, resilient consumption at the top end, and an AI-driven capex cycle that continues to support earnings visibility. That keeps equities bid.

At the same time, employment is softening, confidence is weakening, and policy credibility is being questioned. That keeps insurance in demand.

This is how markets behave when uncertainty is persistent but not acute.

They do not de-risk wholesale.

They re-weight.

That dynamic explains why metals can break out while equities hold records, and why volatility can stay low even as protection trades.

MARKET CALENDAR

Data: Weekly Jobless Claims

Hours: U.S. equities close early today, markets closed tomorrow

Overnight: Nikkei -0.14%, Shanghai +0.53%, FTSE 100 -0.22%, DAX +0.23%

U.S. PRE-MARKET

THE CLOSE

All-time highs are the headline.

Precious metals are the signal.

This is not a market chasing belief.

It is a market staying invested while pricing credibility risk.

Risk remains on.

But it is insured.

That tells you exactly how this market wants to be owned.