TQ Morning Briefing

Fed Meeting Begins With Rates, Chips, and Trade Policy Colliding

From the T&Q Desk

Markets enter decision day with risk assets steady, conviction restrained, and policy gravity once again pulling all price action into its orbit.

The calm across futures and global equity markets masks a tape compressed beneath three overlapping forces: a widely anticipated rate cut from the Federal Reserve, an increasingly politicized policy backdrop, and a global trade environment that continues to fragment under tariff pressure and capital controls.

The cut itself is not the debate. The forward path is.

Investors are positioned for a quarter-point reduction. What they are waiting to hear is whether

Jerome Powell frames December as a waypoint inside a longer easing arc or as the final step before policy freezes.

Growth remains resilient. Inflation remains sticky. Labor softens without fracture. The macro neither breaks nor accelerates.

And that ambiguity is precisely what has kept markets suspended at record levels with remarkably little volume behind the move.

Premier Feature

The Crypto That Survived the Crash—and Came Out Stronger

The recent crash wasn’t just a selloff. It was a stress test. Weak projects cracked. Overleveraged traders got wiped out. Fear ruled the market.

While prices across the market collapsed, this coin’s on-chain activity actually surged—more users, more transactions, more real demand. That kind of divergence doesn’t happen by accident. It’s a signal of strength the market hasn’t fully priced in yet.

We’ve seen this setup before. And it led to gains of 8,600%, 3,500%, and 1,743%.

Now the selling pressure is fading—and the next leg higher could come fast.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Word Around the Street

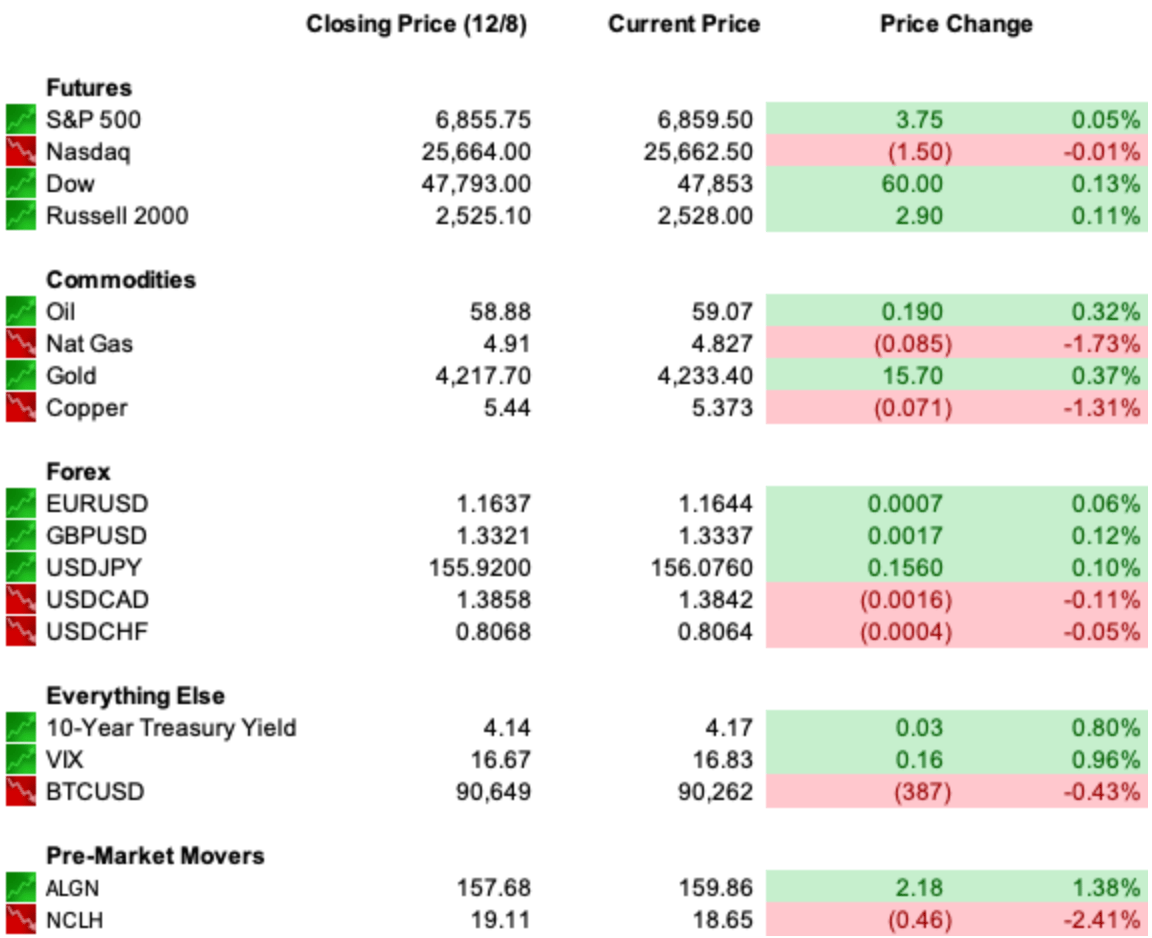

Markets drift sideways into the Fed verdict with equities holding near record territory and volatility waiting for a catalyst.

Futures point to a flat open after Monday’s pullback stalled just shy of recent highs. The S&P 500 remains within a fraction of its peak as investors refuse to front-run what they already assume is coming at the policy announcement.

Rates remain the fulcrum. The 10-year Treasury yield is holding near the upper end of its recent range, reinforcing positioning around a hawkish cut rather than a clean pivot. That firmness in yields continues to cap aggressive equity upside despite strong systematic demand.

The dollar is little changed with the broader pullback stabilizing. Gold remains elevated above recent ranges while silver continues to extend an historic advance. Energy has cooled modestly after last week’s run while natural gas remains stretched following its multi-week surge.

Crypto remains conspicuously absent from the rally. Bitcoin continues to trade around the 90,000 level as tightening bank reserve liquidity drains marginal risk appetite from the most reflexive corner of the market.

China sits squarely at the center of the global tape. A record trade surplus has reignited tariff pressure across Europe and Asia as rerouted exports flood alternative markets. Protectionist responses are now becoming systemic rather than episodic.

Against that backdrop, one headline continues to ripple through both equity and geopolitical positioning. The U.S. decision to allow Nvidia to resume limited H200 chip exports to China in exchange for a 25 percent government cut has pulled technology, national security, and trade policy into a single tradeable thread.

At the same time, U.S. authorities continue to dismantle multiple chip-smuggling networks tied to China, underscoring the contradiction between enforcement and accommodation now embedded in policy.

Consumer signals remain conflicted. Treasury forecasts near 3 percent GDP coexist with sentiment readings near historical lows. The divergence between confidence and spending persists.

Sector leadership remains narrow within the tape. Technology continues to dominate, semiconductors remain the volatility engine, and healthcare stays in focus following high-impact ASH updates on the treatment of blood cancers. Index reconstitutions continue to drive mechanical flows into year-end.

The tape remains defined by a single tension. Rate cuts support prices. Yields resist. Liquidity tightens. Positioning stretches.

Global Policy Watch

The Federal Reserve delivers its final decision of the year this afternoon with markets assigning near certainty to a 25 basis point cut into the 3.50 to 3.75 percent range.

What matters far more than the cut is the projection path.

Alternative labor data continues to soften at the margins. ADP showed private payroll declines centered in small businesses. Initial claims remain historically low. The Chicago Fed unemployment tracker holds near cycle highs without tipping into acceleration.

Fed officials remain unusually divided. Hawks remain uneasy with inflation still running above target. Doves increasingly prioritize the asymmetric risk of labor deterioration. Several dissents remain a live risk at the statement release.

Global central banks remain largely stationary. Australia signaled that its next move may eventually be higher rather than lower. Canada and Switzerland remain on pause. The ECB continues to walk a narrowing corridor between restricted growth and latent inflation risk.

Currency markets reflect this fragmentation. The euro remains firm. The yen stabilizes following earthquake-driven volatility. The dollar trades without conviction into the announcement.

Trade Winds & Global Shifts

China’s trillion-dollar trade surplus is now the dominant macro imbalance shaping global trade behavior. Tariffs continue to divert exports rather than suppress them. Europe, Southeast Asia, and Latin America are absorbing redirected Chinese supply at an accelerating pace.

Political pressure on Beijing to reform its export-led model continues to mount, but policy momentum remains anchored to production rather than domestic consumption. Markets are slowly repricing a structural ceiling on global manufacturing margins if this imbalance persists.

In Ukraine, diplomacy continues to circle familiar fault lines. European leaders portray negotiations as critical while openly acknowledging that territorial concessions and security guarantees remain deadlocked. Energy, defense, and European currency risk premiums remain hostage to an outcome still beyond reach.

In Southeast Asia, fighting between Thailand and Cambodia has reignited just weeks after a U.S.-brokered ceasefire collapsed. Refugee flows have resumed and regional risk premiums are quietly drifting higher across select ASEAN markets.

From Our Partners

When a U.S. ally tried to tax ONE American energy company...

Trump didn't hesitate to issue a direct warning.

Now this same company is generating over $3 billion in operating income...

And partnering with the hottest AI stock on Wall Street.

Out of 23,281 publicly traded stocks, this is the ONLY one that meets all the "unicorn" criteria.

D.C. in the Driver’s Seat

Policy risk inside Washington continues to rise across energy, defense, and technology.

A federal court has rejected the administration’s attempt to halt federal permitting for wind energy projects, reopening offshore and onshore development pipelines that had been frozen earlier this year. The ruling reinforces judicial constraints on executive-driven energy policy shifts.

On defense, the administration has backed away from releasing footage tied to the controversial Caribbean drug-boat strike, intensifying congressional pressure and placing the Pentagon directly in the political firing line.

On technology, House Democrats have launched a formal AI working group in response to the rapid expansion of industry lobbying and campaign capital flooding into Washington. The divide between state-based AI regulation and national preemption is now hardening into a defining fault line for 2026.

Economic Data

NFIB Small Business Optimism

JOLTS Job Openings

ADP Weekly Employment Change

Earnings Reports

AutoZone (AZO)

Overnight Markets

Asia: Nikkei +0.14%, Shanghai -0.37%

Europe: FTSE 100 +0.05%, DAX +0.25%

U.S. Pre-Market

From Our Partners

Get In On These Robotics Stocks Early

Robotics isn’t “coming”—it’s scaling now across medicine, defense, and logistics.

AI-driven surgery, autonomous platforms, and warehouse automation are exploding in demand, and Wall Street is taking notice. Early movers stand to benefit most.

Inside our FREE report, you’ll discover 3 robotics stocks already executing, drawing institutional attention, and positioned in the heart of a $200B+ market still in its early innings.

Opening Outlook

The market reaches decision day balanced at the edge of conviction.

The cut is fully discounted. The message is not.

If Powell reinforces that December marks the near end of easing, the durability of this rally will be tested by yield gravity and stretched valuations. If projections reopen the door to continued 2026 accommodation, the year-end melt-up narrative survives.

For now, price action reflects restraint rather than fear.

The cut is expected. The path is the trade.