TQ Morning Briefing

The economy is being run hot. The market is starting to price the heat leaks.

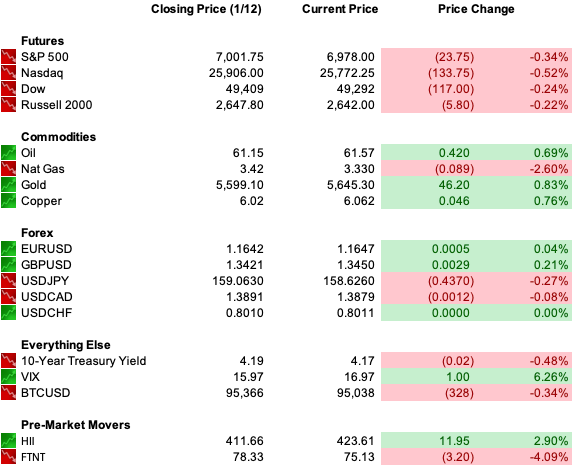

MARKET STATE

Stimulus Is Coordinated, But Credibility Is Not

This morning is less about a single catalyst and more about a regime alignment that markets rarely get for long.

Fiscal is accelerating.

Credit is loosening.

That is pro-growth in the near term and it is exactly what risk assets want to hear.

But it also changes the market’s risk architecture.

When growth, credit and rates are being pushed in the same direction by political intent, the upside is faster activity.

The downside is that inflation, institutional independence, and policy credibility become the constraint variables.

The tape is not breaking.

It is re-pricing what matters.

Not “will we grow,” but “what will be sacrificed to keep growth running.”

Premier Feature

The $300 Crypto Smart Money Is Targeting for January

This isn’t a hype-driven flyer.

It’s a DeFi protocol trading near $300 that our research suggests could have a realistic path toward $3,000+, based on fundamentals institutions care about.

Real, growing revenue

$60+ billion in total value locked

Institutional adoption accelerating

Token supply shrinking through buybacks

With new regulations opening the door for institutional capital, trillions in managed assets can now access this protocol. That’s why we believe this could be the #1 crypto to own heading into January.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

WHAT’S ACTUALLY MOVING MARKETS

Trump Turned Pressure On DOJ Into An Operating Directive

The White House event with U.S. attorneys wasn’t just an outburst.

It was a signal to the system about tempo.

That matters because it turns prosecutorial discretion into a political instrument with deadlines.

The Fed subpoenas arriving right after that meeting reads as cause and effect, even if the paperwork says otherwise.

And it reframes the Powell investigation from a one-off probe into an institutional contest.

If the executive branch can apply legal leverage to monetary policy posture, markets have to price something they’ve avoided for decades: the independence premium becoming unstable.

The Hot Economy Strategy Is Real, And It Is Likely To Work

The Greg Ip framework is the cleanest way to understand what is happening.

The administration is pulling three levers at once.

Fiscal stimulus is landing through withholding changes and expanded deductions.

Credit policy is shifting through deregulation and easier bank operating assumptions.

And monetary policy is being pressured toward dovishness even before the chair turns over.

The near-term result is predictable.

More demand, easier lending, and lower discount rates.

If inflation cooperates, the market gets an upside glidepath that can persist far longer than people expect.

The cost is also predictable, just delayed.

Debt trajectory worsens.

Asset prices stretch.

And the political cost of inflation becomes more acute because it will be harder to stop without breaking something later.

Iran Is A Real-Time Case Study In What Happens When Banks Become The Regime

Ayandeh’s collapse is not just an Iranian corruption story.

It is the classic failure mode of a system that finances insiders first and stability second.

Bad loans to the connected.

Printing money to cover insolvency.

Currency confidence cracking.

And then public legitimacy failing with it.

It matters this morning because markets are increasingly sensitive to institutional credibility as a tradable asset.

When confidence breaks, it does not unwind gradually.

It gaps.

And once the public believes the plumbing is rigged, the currency becomes a referendum.

That lesson is not “America is Iran.”

It is that financial systems always fail through governance before they fail through math.

From Our Partners

America’s Top Billionaires Quietly Backed This Startup

When billionaires like Jeff Bezos and Bill Gates back an emerging technology, it’s worth paying attention.

That’s exactly what’s happening with a little-known company founded by an ex-Google visionary. Alexander Green calls it “one of the most overlooked opportunities in AI right now” — and he’s even an investor himself.

He’s now sharing the full story, including why early investors are watching closely and why he believes widespread adoption could be just one announcement away.

TAPE & FLOW

Banks Are Printing, But Policy Risk Is Sitting On The Multiple

Bank of America beat expectations this morning and the bank tape is still structurally healthy.

Trading activity has been strong.

Consumers have not collapsed.

Credit has not blown out.

But the problem for financials is no longer operational.

It is political.

A credit-card rate cap changes the business model at the margin.

Restrictions on buybacks change capital return math.

Housing affordability policy changes what lenders can monetize.

And when policy starts targeting spreads and fees directly, banks stop trading on earnings power alone and start trading on exposure to discretion.

That is why good results don’t automatically translate into leadership.

This is a tape where banks can be profitable and still trade heavy because the rulebook is being rewritten in public.

The Housing Trade Is Back, But The Wild Card Is Forced Supply

Homebuilders are ripping because the setup is finally getting easier.

Rates are drifting down.

Consumers are stabilizing.

Confidence is improving.

But the administration’s housing push introduces a new risk.

If policy shifts from “support demand” to “force supply,” builder margins become the pressure valve.

That keeps the rally vulnerable to headlines.

The market wants the housing recovery.

It just doesn’t want housing to become an enforcement target the way banks are starting to feel.

AI Infrastructure Is Turning Into A Power Market Trade

The most important AI story today is not models.

It’s electricity.

This is a step change.

These companies are starting to behave like utilities.

Not as a branding exercise, but because power availability is now a strategic constraint.

That is why the market keeps rewarding the infrastructure complex even when software narratives stall.

The winners are the ones that can secure capacity.

And the losers will be the ones that assumed capacity would appear on schedule.

POWER & POLICY

The Supreme Court Is The Next Fed Catalyst, Not The Next Meeting

Next week’s Supreme Court hearing on Lisa Cook is the real hinge point for Fed independence.

Not because Cook matters more than Powell as a person.

Because the ruling determines the precedent.

If the White House wins, the probability of forced removal rises materially.

If the White House loses, the conflict shifts into a longer standoff that keeps uncertainty alive through Powell’s May transition and possibly beyond.

Markets aren’t panicking yet.

They are hedging duration risk and credibility risk at the margin.

That shows up in a softer dollar, firmer metals, and an unwillingness to fully sell vol.

Greenland Is A NATO Cohesion Test Disguised As A Resource Fight

The Greenland showdown is about strategic posture, not just minerals.

Trump’s threats have turned an alliance issue into a sovereignty issue.

Denmark is warning that escalation could rupture NATO.

Europe is rallying around Greenland publicly.

And the White House is pressing anyway.

Even if nothing happens tomorrow, this matters because it signals that U.S. leverage will increasingly be applied directly to strategic geography.

That is a risk premium problem.

It raises the cost of trust across alliances.

And it changes how markets think about the durability of postwar institutional arrangements.

China Is Recalculating Latin America, But The Tradeoff Is Taiwan

The Maduro ouster forced Beijing to confront something uncomfortable.

The Western Hemisphere is being treated as enforceable again.

China’s internal discourse shifting toward “fine, then Taiwan is ours” is the key read-through.

Not as immediate action.

As strategic bargaining logic.

This is a credibility era.

Every strong move becomes precedent.

Every precedent becomes a negotiating chip.

From Our Partners

How to Claim Your Stake in SpaceX with $500

Every week Elon Musk is sending about 60 more satellites into orbit.

Tech legend Jeff Brown believes he’s building what will be the world’s first global communications carrier.

He predicts this will be Elon’s next trillion-dollar business.

And when it goes public, you could cash out with the biggest payout of your life.

ONE LEVEL DEEPER

The Market’s New Question Is Who Controls The Constraints

In 2025, markets mostly traded outcomes.

Growth, inflation, earnings, rates.

In 2026, markets are trading constraint control.

Who controls the Fed.

Who controls credit pricing.

Who controls housing affordability rules.

Who controls energy capacity.

Who controls alliance posture.

That is why you can have bullish growth policy and rising institutional risk in the same week.

Stimulus makes the tape faster.

But it also makes credibility more valuable.

The economy can run hot.

It probably will.

The question is whether the system stays trusted while it does.

MARKET CALENDAR

Data: PPI, Retail Sales, Existing Home Sales, Business Inventories

Fed Speakers: Paulson, Miran, Bostic, Kashkari, Williams

Earnings: Bank of America (BAC), Citigroup (C), Wells Fargo (WFC)

Overnight: Nikkei +1.48%, Shanghai -0.31%, FTSE 100 +0.32%, DAX -0.45%

U.S. PRE-MARKET

THE CLOSE

The administration is turning growth into a policy objective with all three levers pointed the same way.

That is bullish until inflation or credibility becomes the binding constraint.

The tape is not fighting stimulus.

It is building insurance against the cost of forcing it.