TQ Morning Briefing

Markets Firm as Services Strengthens and Rate-Cut Odds Surge

From the T&Q Desk

The market finally received a clearer macro signal, and it arrived at the intersection traders have been waiting on for weeks.

A stronger ISM Services print and a meaningful cooling in services inflation landed alongside one of the softest private payroll readings in more than two years, creating a picture of an economy still expanding but no longer carrying enough labor-market momentum to keep the Fed on hold.

That combination, steady activity, softer prices, and weakening employment, has become the cleanest version of the “soft landing” investors have been hoping the data would eventually confirm.

The reaction was fast and broad. Treasury yields eased, the dollar slipped, and cyclical pockets of the equity market firmed as traders leaned into the view that next week’s Fed meeting is no longer a debate over whether to cut, but rather how far the new leadership will be willing to guide expectations once the pivot is formalized.

Markets are effectively trading through the blackout period as though policy is already shifting, even while the committee itself remains internally split on pace and tone. The destination feels increasingly settled. The path is where the uncertainty now lives.

Premier Feature

This former hedge fund manager made $274 million in profits…

Barron's ranked his fund in the top 1% globally…

And he was featured among billionaires in the book Hedge Fund Market Wizards.

Now he's finally revealed the secret to his success. And no one can believe how straightforward it is…

It's just an 18-digit code you can punch into any brokerage account.

Word Around the Street

Wednesday’s tape carried a quiet confidence as U.S. equities advanced on the back of better services data and a labor report that reinforced the rate-cut narrative without suggesting deeper economic fragility.

The ISM Services index rose to its strongest level since February, while the sharp drop in prices paid helped validate the view that disinflation is reasserting itself inside the largest part of the economy.

That backdrop set the stage for the ADP report, which showed a surprising contraction in private payrolls, driven almost entirely by small-business weakness. In a month when the BLS jobs data has been delayed, ADP became the market’s stand-in, and futures pricing quickly moved to assign a near-certain probability to a December cut.

Risk assets responded with selective strength rather than broad momentum. Energy and financials led the day as yields eased, while the Russell 2000 extended its recent outperformance, benefiting from rate sensitivity and renewed interest in cyclicals.

Large-cap tech traded steadily rather than aggressively, and precious metals continued to attract flows as gold and silver printed fresh highs.

Overseas markets provided a mixed backdrop, Japan firmed, China softened, and Europe held steady after a surprisingly strong composite PMI, while Treasuries settled into a gentle rally that kept the ten-year near 4.06 percent.

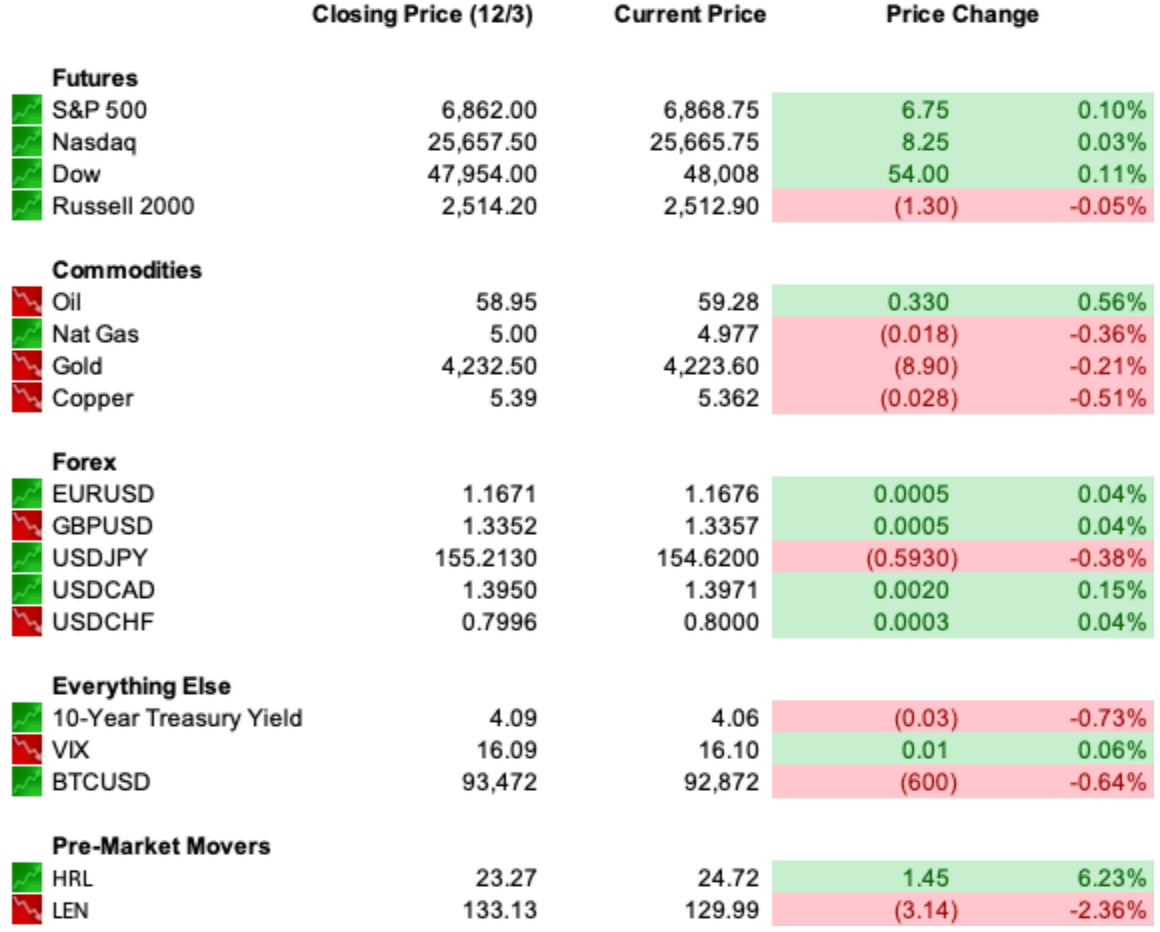

The tone heading into today’s session is cautiously constructive, but still opportunistic rather than committed. S&P futures are essentially flat, Nasdaq futures are modestly higher as traders probe whether megacap tech can extend yesterday’s stabilization, and Dow futures are little changed after a day of cyclical leadership.

It is a steady but unhurried setup, one that suggests participants are willing to carry yesterday’s optimism forward, but not willing to chase it without another catalyst.

Monetary Pulse

The center of gravity for global policy is shifting, and the market is moving faster than the institutions themselves. In the U.S., the combination of weakening employment and cooling services inflation has pushed traders to price next week’s cut as all but certain, leaving the real question centered on communication rather than action.

With Chair Powell entering what may be his final meeting and the transition narrative intensifying, the market is preparing for a shift in tone that it believes will extend well into 2026.

Yet internal FOMC divisions remain visible, creating the possibility that next week’s statement and dot plot introduce more uncertainty before they deliver resolution.

Globally, the divergence grows sharper. Japan continues to signal greater tolerance for policy tightening as yields sit near decade-plus highs, complicating carry dynamics and contributing to the recent volatility in sovereign curves.

Europe, meanwhile, is stabilizing on the back of improving PMI data but remains wary of embedded services inflation that still runs too warm for policymakers to relax. The effect is a cross-current of monetary signals at precisely the moment the U.S. prepares to ease, leaving currency markets sensitive and rate differentials highly reactive.

The Fed may be preparing to lead the next global policy move, but it will not be doing so surrounded by harmony.

Trade Winds & Global Shifts

Geopolitical momentum continues to build around both the financing and diplomacy of the war in Ukraine, with Europe’s effort to unlock more than one hundred billion dollars in frozen Russian assets emerging as the week’s most consequential economic and political storyline.

The proposal has triggered warnings from Moscow that such a move could amount to a justification for war and has exposed rifts within the EU over legal exposure and burden sharing.

The debate arrives as Kyiv faces a widening multi-year funding gap and as the U.S. pushes for renewed diplomatic movement across several fronts.

At the same time, U.S. relations in Central America took a surprising turn after President Trump pardoned former Honduran President Juan Orlando Hernández, who had been serving a forty-five-year sentence for running a narco-state.

The pardon, delivered after months of behind-the-scenes lobbying, jolted regional politics, complicated U.S. antidrug messaging, and triggered confusion among allies who worked on the original case. The move has already started reshaping the dynamics of Honduras’s elections and is being closely watched across the hemisphere.

Europe’s regulatory pressure on U.S. tech added another layer to the global policy backdrop after the European Commission opened a fresh antitrust investigation into Meta’s WhatsApp AI access rules.

Regulators argue the company may be restricting competition by limiting how third-party AI tools interact with the platform. Meta calls the claim baseless, but the inquiry adds to a year marked by large fines and escalating tension between Washington and Brussels over the governance of digital platforms.

From Our Partners

Former Illinois Farmboy Built a Weird A.I. System to Expose His Wife's Killer…

After his wife's untimely death, he used Artificial Intelligence to get sweet revenge...

But what happened next could change everything... while making a select few early investors very rich.

D.C. in the Driver’s Seat

Scrutiny over the administration’s counternarcotics campaign is intensifying as new details emerge about the September maritime strike in the Caribbean.

Admiral Frank Bradley is preparing to tell lawmakers that two survivors of the initial attack remained legitimate targets because they were attempting to continue their drug-running operation, a position that challenges legal experts who argue they should have been considered hors de combat.

The briefing is poised to become a pivotal moment for congressional oversight, particularly as questions mount over Defense Secretary Pete Hegseth’s authorization process and the broader legality of the strike sequence.

Internal Pentagon friction also resurfaced after reports confirmed that Hegseth had asked Admiral Alvin Holsey to resign earlier in the fall, ending his tenure less than a year into the role overseeing U.S. military operations in the Caribbean.

The departure followed disagreements over the speed, scope, and legal grounding of the administration’s emerging maritime strategy. The timing of the ouster, against the backdrop of ongoing operations, has drawn bipartisan concern over decision-making dynamics inside the building.

Elsewhere in Washington, domestic policy took a sharp turn after President Trump moved to dismantle the Biden-era fuel-efficiency standards, proposing to lower the 2031 target to roughly thirty-four miles per gallon from the previously mandated fifty.

Automakers and energy groups welcomed the shift, arguing that the prior framework forced the production of models consumers were unwilling to buy, while critics warned the rollback risks slowing the EV transition. The announcement adds a new dimension to the administration’s broader realignment of environmental and industrial policy.

Economic Data

Initial Jobless Claims

Factory Orders

Earnings Reports

Kroger (KR)

Overnight Markets

Asia: Nikkei +2.33%, Shanghai -0.06%

Europe: FTSE 100 +0.21%, DAX +0.79%

U.S. Pre-Market

From Our Partners

Robots Are Quietly Replacing Humans—and Wall Street Knows It

While most investors chase AI hype, institutions are quietly piling into the infrastructure behind automation.

Defense contracts. Surgical robotics. Fully automated fulfillment centers.

This $200B+ robotics boom is already reshaping entire industries—and the biggest gains often go to those positioned before the headlines hit.

Our FREE report reveals 3 robotics stocks already:

Pulling in institutional capital

Winning major contracts

Sitting at the center of this automation surge

These aren’t concepts. They’re real companies with real momentum.

Opening Outlook

The market enters Thursday with an unusual degree of clarity for a week still waiting on its main event.

Activity is firm. Inflation is easing. Labor is weakening. And the Fed now looks poised to validate what markets have already priced.

The tone is constructive, but the next several days will determine whether this week’s calm builds into a sustainable December trend or simply sets the stage for a more volatile reaction once the Fed finally speaks.