TQ Morning Briefing

The Greenland fight cooled, but the damage is real. Europe learned tariffs can be weaponized. ICE is testing the Fourth Amendment. Ukraine is being sold as “one last issue” before anyone sees the terms.

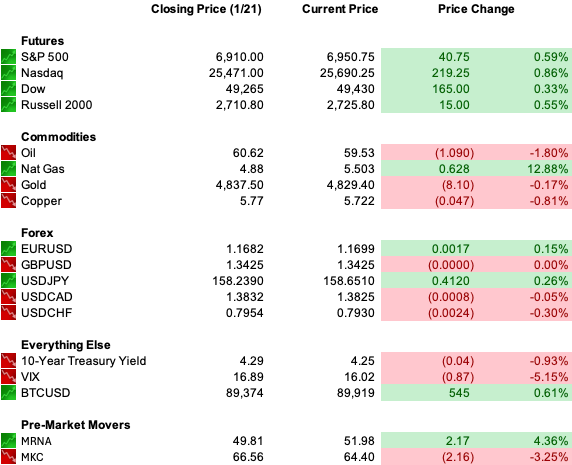

MARKET STATE

De-Escalation Arrived, But The Premium Didn’t Leave

This morning is not about relief.

It is about whether the system can unlearn what it just learned.

The tariff threat paused. The headlines are trying to call it resolved.

But the market does not price words. It prices precedent.

The Greenland episode did not just create volatility.

It taught Europe that alliance friction can appear overnight and arrive in the form of tariffs.

It taught capital that U.S. policy is not just directional. It is improvisational.

That doesn’t break the tape.

It changes the cost of holding it.

So yes, futures can stabilize.

Yes, risk can float.

But the political premium is now embedded in the discount rate.

And that premium does not unwind just because tone improved.

Premier Feature

The 20-Minute Market Window Professional Traders Focus On

Many traders assume opportunity in the market is random. Some professionals argue the opposite — that the market tends to reveal its hand with very specific set ups.

One longtime trader says this repeatable pattern allows trades to be planned calmly, before guesswork and emotion take over. Rather than reacting to headlines or chasing price, the approach focuses on preparation — often requiring less than 20 minutes.

He’s now walking through the logic behind this setup, explaining why it continues to appear and how traders can learn to identify it quickly.

WHAT’S ACTUALLY MOVING MARKETS

Greenland Was Reframed As Security Infrastructure, Not Sovereignty

The U-turn matters. But the framework matters more.

This is no longer about buying Greenland. It’s about converting leverage into access.

The reported framework is simple:

More NATO Arctic posture.

U.S. basing rights and presence.

A right of first refusal on mineral investment to block China and Russia.

And tariffs get holstered as long as the negotiation stays alive.

That is the template shift.

The U.S. discovered it can turn trade pressure into geopolitical compliance and call it a deal.

Europe will take the off-ramp because it has to. But it will also build response capacity because it must.

That is why the EU is openly discussing anti-coercion tools.

Not because they want war. Because they want deterrence.

The market sees the same thing. Not escalation. Optionality.

Ukraine Is Being Marketed As A Near-Term Close

The phrase “one last issue” is not diplomacy. It is positioning fuel.

Zelenskiy arrived in Davos specifically for talks with Trump.

Witkoff says progress is real. Kushner and Witkoff fly to Moscow the same day to meet Putin.

This is a pipeline headline sequence:

Trump meets Zelenskiy, then envoys meet Putin.

If that pipeline produces a credible framework, credit rallies further and Europe catches a bid.

If it stalls, volatility reprices instantly because expectations were pulled forward.

That’s the tell.

Fixed income is trading the probability of cessation before the public sees the terms.

This is how geopolitical regimes shift in markets.

First the bonds move. Then the narrative catches up.

Domestic Rule-of-Law Is Now A Market Input

The ICE memo matters more than people think.

ICE is reportedly asserting authority to enter homes without a judge-signed warrant, relying instead on administrative warrants.

That is not a border policy debate. That is a constitutional boundary test.

Markets don’t trade morality. They trade institutional predictability.

When a government starts stretching Fourth Amendment constraints in the name of enforcement speed, it’s a regime signal:

The state is prioritizing control over procedure.

That carries second-order impacts:

Litigation risk. Local non-cooperation. Corporate speech risk. NGO mobilization.

And an overall rise in domestic friction that reduces policy legibility.

The market doesn’t need to take a side to price it.

It only needs to understand that rules are becoming discretionary.

From Our Partners

Legendary Wall Street Stockpicker Names #1 Stock of 2026

The legendary stockpicker who built one of Wall Street’s most popular buying indicators just announced the #1 stock to buy for 2026.

His last recommendations shot up 100% and 160%.

Now for a limited time, he’s sharing this new recommendation live on-camera, completely free of charge. It’s not NVDA, AMZN, TSLA, or any stock you’d likely recognize.

TAPE & FLOW

Risk Can Hold, But The Market Now Requires Confirmation

The tape is not breaking.

It’s narrowing.

When geopolitics becomes transactional and domestic governance becomes more aggressive, capital rotates toward things that can survive interference.

You can feel it in the posture trade:

Defense and security premiums don’t cheapen.

Infrastructure and chokepoints keep winning.

Duration stays sensitive because term premium is now political premium.

This is why you can get a flat index day with a tense market underneath it.

It is not fear.

It is a higher bar for confidence.

POWER & POLICY

Affordability Politics Is The Next Front

This is the second narrative forming under the tape: profit vs public pressure.

Insurance is the early case study. Home and auto insurers are near peak profitability again, while households are still eating rate hikes.

Now governors and lawmakers are floating profit caps and refund triggers.

This matters because it sets the tone for the next phase of policy.

The White House is clearly reading the same polling.

Trump is now talking like an affordability hawk: credit-card caps, banning institutional single-family buying, and populist gestures that sound bipartisan.

That creates an unusual market tension.

The growth story can stay intact. But margin structures start getting dragged into politics.

That is not a recession setup. It is a profitability ceiling risk.

CEOs Are Starting To Speak Carefully Again

Jamie Dimon publicly criticizing enforcement optics at Davos is a signal.

It wasn’t a broad attack.

It was a narrow line: control the border, but don’t turn the interior into spectacle.

The bigger point is the climate: business leaders still want predictability, and they’re scared of being dragged into the machine.

When CEOs choose caution over clarity, it’s another institutional tell.

The system becomes less communicative, which increases uncertainty.

And uncertainty is always a spread.

ONE LEVEL DEEPER

The U.S. Is Becoming A Two-Sided Trade

For years the global bet was simple: Long U.S. growth and long U.S. stability.

Now those are decoupling.

You can still believe in earnings power.

You can still believe in AI capex.

You can still believe in the American consumer.

But you also have to price that alliances can be coerced, rules can be stretched, and policy can be improvised.

That creates a two-sided trade: Long American productivity, short American predictability.

That mix is not bearish. It is more expensive.

From Our Partners

Wall Street’s Biggest Trades Don’t Show Up on Your Screen

Open any popular stock and look at Level 2 data.

You’ll see small buy and sell orders—100 shares here, 200 there.

Looks harmless.

But those trades can be “iceberg orders,” where institutions quietly buy millions of shares beneath the surface using dark pools. By the time the price moves on public charts, whales may already be up—and late traders are chasing.

That’s why TradeAlgo built a proprietary dark-pool scanner tied to real-time SMS alerts.

When unusual volume hits, you get the ticker instantly.

It’s free to join.

MARKET CALENDAR

Economic Data: GDP Growth Rate, Initial Jobless Claims, PCE Price Index, Core PCE Prices, Personal Income, Personal Spending

Earnings: P&G (PG), General Electric Aerospace (GE), Abbott (ABT), Intuitive Surgical (ISRG), Intel (INTC), Capital One Financial (COF), CSX (CSX), Freeport-McMoran (FCX), Xcel Energy (XEL), Rockwell Automation (ROK)

Overnight: Nikkei +1.73%, Shanghai +0.14%, FTSE 100 +0.45%, DAX +1.22%

U.S. PRE-MARKET

THE CLOSE

Greenland calmed down. But the lesson didn’t.

Europe just learned tariffs can be used as sovereign leverage. That’s not a trade story. It’s a regime story.

Ukraine is being pulled forward into a near-term close, and the market is already trading it in credit.

At home, enforcement is testing constitutional boundaries and affordability politics is moving from rhetoric into proposals.

The tape can still hold.

But it is holding with a higher political premium.

This is still a growth market.

It just takes more confirmation to stay long.