TQ Morning Briefing

Markets Stabilize as Fed Expectations Shift and Diplomacy Stalls

From the T&Q Desk

Tuesday brought a subtle shift, as markets traded with a composure that has been missing even as the calendar turns toward year-end.

The bid wasn’t strong, but it was steady. Tech carried the tape. Industrials followed. Bond yields stayed anchored near four percent. Bitcoin clawed back lost ground.

Alongside the steadier equity trade, policy signals adjusted. A softer dollar, steeper curves, and renewed conviction in a dovish Fed stance shaped positioning through the afternoon. Traders leaned harder into the view that a dovish Federal Reserve is coming, not eventually, but imminently.

The spark came from Washington. The administration abruptly canceled interviews with finalists for the Fed chair job. Trump hinted he had already made his decision and singled out Kevin Hassett as a potential successor to Powell. Markets read that as confirmation that the next Fed will be more inclined to cut than to hold.

Overseas, Japanese bonds stabilized after their sharpest volatility in years, while European assets digested fresh political pressure on central bank independence. And on the geopolitical front, long, difficult talks in Moscow produced no breakthrough on Ukraine, reinforcing the sense that diplomacy will be slow, uneven, and market-relevant.

The session didn’t produce drama, but the broader landscape remains active.

Policy signals are shifting, geopolitics are in motion, and funding markets continue to adjust, a combination that keeps complacency at bay.

Premier Feature

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

Word Around the Street

Equities traded sideways early Tuesday before strengthening into the close. Breadth improved to four-to-three in favor of advancers. Tech led with gains of more than one percent. Industrials matched the move. Communications posted smaller but steady advances. Energy, materials, and consumer staples lagged.

Bond yields were steady, with the ten-year around 4.10 percent and the two-year near 3.51 percent. Funding markets remained a watch point as SOFR and GC repo benchmarks drifted above four percent for the second week, prompting fresh discussion about whether the Fed will need to intervene with reserve-management purchases in early 2026.

Commodities were mixed. Gold faded sharply after touching six-week highs, with February futures falling more than one percent. Oil sank early on supply-glut concerns before geopolitical tension helped trim losses into the afternoon.

Seasonality remains constructive, but flows continue to show a market that wants tech leadership, stable yields, and a clear policy signal before extending risk.

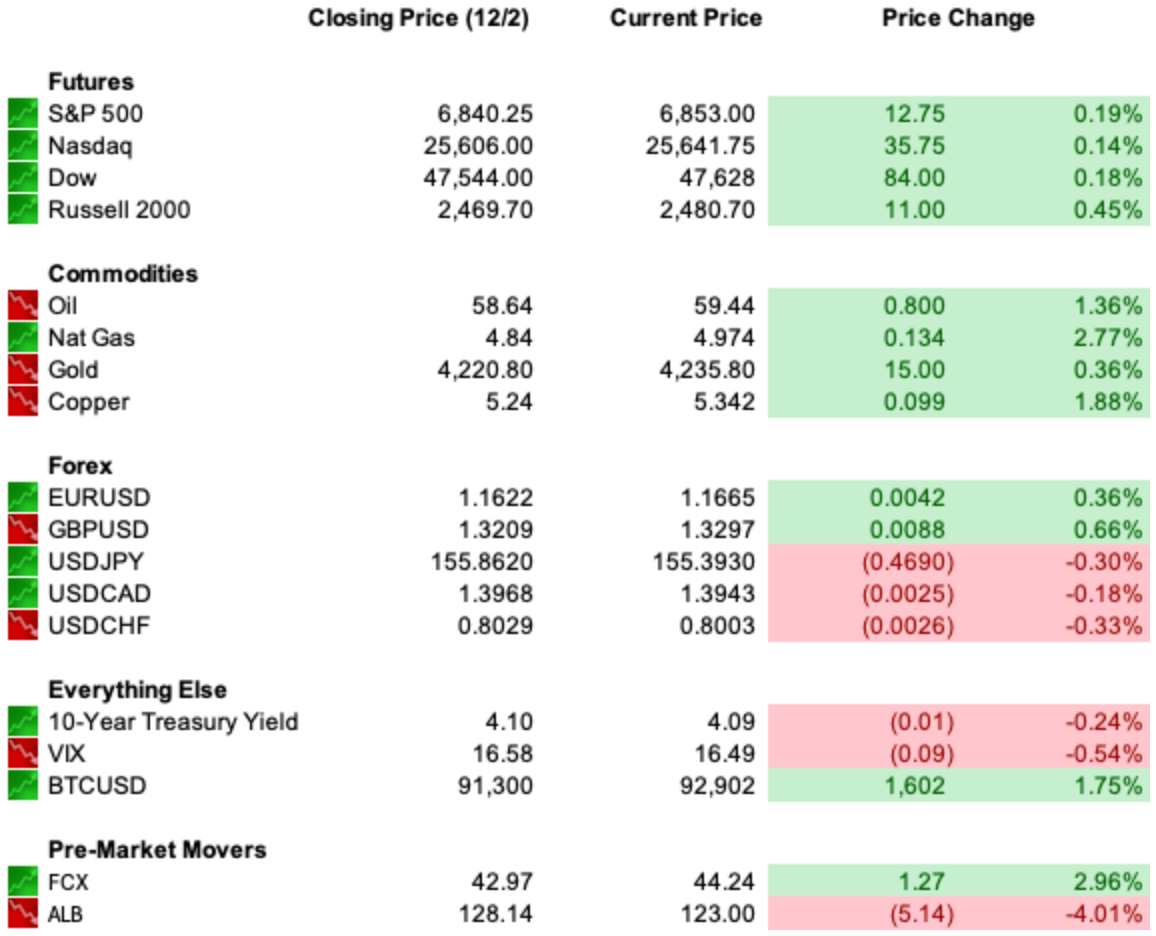

Futures were modestly higher overnight, recovering part of Monday’s slide as crypto stabilized and large-cap tech regained leadership. Bitcoin jumped back above ninety-one thousand after hitting lows in the mid-eighties, lifting Coinbase, Strategy, and Robinhood in pre-market trade.

Global Policy Watch

The Fed enters next week’s meeting with a market that now assigns almost ninety percent odds to a December cut. The committee remains far more divided.

That division widened after the White House canceled Fed chair interviews and Trump spotlighted Hassett as a leading contender.

Traders took it as further evidence that the next chair will lean toward faster easing. The dollar weakened for the ninth straight session. Curves steepened. Risk assets strengthened.

Abroad, central-bank independence became a headline issue. The ECB urged Italy to reconsider a proposal asserting public ownership of the Bank of Italy’s gold reserves, warning that the measure risks violating EU treaty protections. Sterling climbed on expectations that the Bank of England may slow its path of future cuts as UK growth outperforms forecasts.

Japan’s bond market, the source of global volatility earlier this week, was more orderly, though ten-year JGB yields remain near their highest levels since 2008.

Visibility is still limited. The Fed will not have official October or November labor data until December sixteenth. ADP’s report this morning carries unusual weight but unreliable predictive value.

The committee’s decision will unfold against delayed data, tighter funding conditions, and the most uncertain leadership transition in years.

Trade Winds & Global Shifts

Five hours of talks in Moscow produced no progress toward a Ukraine deal.

Putin reiterated that Russia will not accept any agreement that does not include Ukrainian withdrawal from contested territory. Witkoff and Kushner described the discussions as useful and constructive, but acknowledged major gaps remain.

The Kremlin dismissed European counterproposals as unacceptable and warned that it is “ready” for conflict with Europe if provoked. Ukraine maintains it will not surrender land outside Russian control. Internal debate in Kyiv is intensifying as corruption probes and constitutional constraints complicate the negotiation room.

At sea, Ukraine escalated its campaign against Russia’s shadow fleet, striking tankers and a major Black Sea oil terminal tied to the Caspian Pipeline Consortium. The attacks hit infrastructure that handles more than one percent of global oil shipments, briefly lifting crude prices and raising insurance costs tied to Russian exports.

China, meanwhile, is leveraging U.S. retrenchment to expand its diplomatic reach. Beijing views Trump’s pivot toward the Western Hemisphere as an opening to deepen influence across Asia and the Global South.

Chinese analysts openly describe the moment as a structural shift in U.S. strategy and a validation of China’s growing soft and hard power.

In South Asia, India prepares to host Putin despite punitive U.S. tariffs on Indian exports. New Delhi is intent on preserving its relationship with Moscow, expanding trade from sixty-nine billion dollars to one hundred billion by 2030, and pursuing cooperation in civil nuclear technology and defense procurement.

The geopolitical backdrop into year end remains defined by stalled diplomacy, assertive power plays, and a shifting map of global influence.

From Our Partners

4 Stocks Poised to Lead the Year-End Market Rally

After a volatile summer, markets are roaring back.

The S&P 500 just logged its best September in 15 years — and momentum carried through October, pushing stocks to multi-month highs.

Cooling inflation, strong earnings, and rising bets on more Fed rate cuts are fueling the move.

But this rebound isn’t broad-based — it’s being driven by energy, manufacturing, and defense sectors thriving under new U.S. policy and global supply shifts.

That’s why our analysts just released a brand-new FREE report featuring 4 stocks we believe are best positioned to benefit as these trends accelerate into year-end.

D.C. in the Driver’s Seat

Domestic politics returned to the center of the market narrative.

Trump escalated his rhetoric on immigration, targeting Somali communities in Minnesota ahead of an anticipated federal operation focusing on individuals with deportation orders.

The remarks drew criticism from state leaders and renewed national debate over the administration’s approach to legal immigration.

On Capitol Hill, bipartisan scrutiny intensified over alleged war crimes tied to the boat-strike campaign in the Caribbean and Pacific.

Lawmakers warned that ordering a second strike against shipwreck survivors would violate the laws of armed conflict. Hegseth defended the mission’s legality and shifted responsibility for tactical decisions to operational commanders.

Trump also declared he would terminate all pardons and legal documents signed by Biden using an autopen, a claim legal scholars say has no basis in constitutional law.

The move underscores rising tension between the White House and federal agencies as election-year politics converge with legal authority.

Political volatility is feeding into market expectations and shaping the policy narrative as the Fed approaches its most consequential meeting of the year.

Economic Data

ADP Employment Chang

Import/Export Prices

Industrial Production

ISM Services PMI

Earnings Reports

CRM

Overnight Markets

Asia: Nikkei +1.14%, Shanghai -0.51%

Europe: FTSE 100 -0.18%, DAX +0.17%

U.S. Pre-Market

From Our Partners

Investors Are Watching This Fast-Growing Tech Company

No, it's not Nvidia… It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Their disruptive tech has helped users earn and save $325M+, driving $75M+ in revenue and 50M+ consumer base. They’ve just been granted the stock ticker $MODE by the Nasdaq and over 56,000 investors participated in their previous rounds.

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors.

Opening Outlook

Markets open Wednesday with a steadier tone. Futures are firmer, crypto has found its footing, gold is easing, and yields are unchanged.

Focus now turns to the data that will guide expectations into next week’s Fed meeting. Jobs data this morning and tomorrow give the market its first clean look at activity after the shutdown, landing at a moment when investor confidence in a December cut is high while Fed messaging has been mixed.

Beyond the data, diplomacy around Ukraine and a busier week in domestic politics are adding inputs for markets to monitor. None are directional by themselves, but together they create a fuller set of considerations as the week progresses.