TQ Morning Briefing

This is a hedged-risk market.

MARKET STATE

This is a hedged-risk market.

Not fear.

Not euphoria.

Selective exposure, with protection layered in.

Markets are reopening after the holiday with risk already in place.

Exposure is being held, not added.

Equity indexes remain elevated.

Volatility is compressed.

Liquidity is returning, but slowly.

That combination matters.

In an environment like this, direction matters less than behavior.

This is a diagnostic session, because how assets behave when nothing forces a decision often reveals more about positioning than conviction.

Year-end mechanics amplify the signal.

Books are largely marked. Rebalancing is mostly complete.

What moves now reflects preference, not necessity, which is why hedges are speaking louder than equities despite calm index levels.

Bottom line: risk is still on.

But it is being insured.

Premier Feature

The Energy Stock Trump Once Called "A Big Mistake" to Mess With

When a U.S. ally tried to tax ONE American energy company...

Trump didn't hesitate to issue a direct warning.

Now this same company is generating over $3 billion in operating income...

And partnering with the hottest AI stock on Wall Street.

Out of 23,281 publicly traded stocks, this is the ONLY one that meets all the "unicorn" criteria.

WHAT’S ACTUALLY MOVING MARKETS

Policy divergence is forcing risk to carry insurance

Precious metals remain the loudest signal.

Gold, silver, platinum, and copper continue to print historic moves.

This is not an inflation panic.

It is not a recession trade.

When policy paths fragment, protection starts leading.

That is not defensive behavior.

It is adaptive.

Investors are staying invested.

They are paying for insurance as uncertainty becomes harder to diversify away.

Liquidity is returning, but participation is rationed

Post-holiday flows are back, but not fully.

Futures are flat.

Weekly gains remain intact.

There is no urgency to add exposure.

This is not a risk-off setup.

It is position maintenance into thinning year-end liquidity.

Markets are not rejecting risk.

They are rationing it.

Geopolitics is re-entering through enforcement, not shock

Energy markets remain steady on the surface.

The driver underneath is enforcement, not demand.

Venezuela supply actions and shadow-fleet interdictions introduce friction into global flows.

They raise routing risk, insurance costs, and execution uncertainty.

This is not a supply shock.

It is a mobility shock.

Geopolitics is not spiking volatility.

It is reshaping where capital feels comfortable operating.

The 2026 question is differentiation, not direction

The next regime inside equities is no longer about whether AI continues.

It is about who pays and who gets paid.

The market is separating monetizers from manufacturers.

Spenders from receivers.

That split explains why indexes can hold records while dispersion quietly builds underneath.

From Our Partners

The #1 Commodity Trade of 2026

Gold bugs are going to hate this. The #1 commodity trade of 2026 isn't gold, silver, oil, or any rare earth metal. It's something far more valuable — something The New York Times says "powers the world's tech."

And America controls over 80% of the world's supply. When Trump restricts exports, Morgan Stanley estimates it could trigger a $10 trillion boom. And you have the rare opportunity to get in on the ground floor.

To continue reading, click here…

TAPE & FLOW

U.S. equity futures are little changed as markets reopen.

The S&P 500 remains near record highs.

Volatility is subdued, with the VIX near cycle lows.

Rates remain contained.

Price stability without volume expansion signals comfort rather than conviction.

Markets are content to hold exposure, but reluctant to press it.

Crypto tells the same story.

Bitcoin remains capped below key psychological levels despite a supportive equity backdrop.

Participation is present.

Urgency is not.

Across assets, the message is consistent.

Risk is still on.

Follow-through is limited.

Protection remains in demand.

POWER & POLICY

Credibility is back on the tape

Recent actions around Venezuelan crude shipments mark a clear shift.

This is enforcement, not diplomacy.

Boarding tankers is not symbolic.

It introduces real friction into energy logistics.

Markets are not pricing a supply shock.

They are pricing execution risk.

At the same time, policy credibility is back in focus.

Signals around central-bank independence, succession dynamics, and uneven tightening paths are increasing the premium investors demand to carry exposure.

This is not a rate story.

It is a governance story.

And governance risk carries a longer half-life.

From Our Partners

Bitcoin Is Running Out—and the Smart Money Knows What Comes Next

For the first time in nearly 7 years, less than 15% of all Bitcoin remains on exchanges. At the same time, institutions are buying faster than new BTC can be mined. ETFs, corporations, and governments are creating a real supply shock.

When demand overwhelms supply, price has only one direction to go. This isn’t hype—it’s math. And the next major crypto move may already be setting up.

That’s why 27 top crypto experts are revealing how they’re positioning ahead of this shift.

For a limited time, you can attend FREE.

ONE LEVEL DEEPER

Metals are the clearest expression of the current regime.

This move is not about inflation expectations or collapsing growth.

It reflects credibility concerns, scarcity, and the rising cost of insuring outcomes in a world where policy and enforcement are less predictable.

It carries hedge characteristics and industrial demand, making it a bridge asset in a market that is simultaneously calm and cautious.

That dual role explains much of the cross-asset behavior we are seeing.

MARKET CALENDAR

Data: No notable releases

Earnings: No notable reports

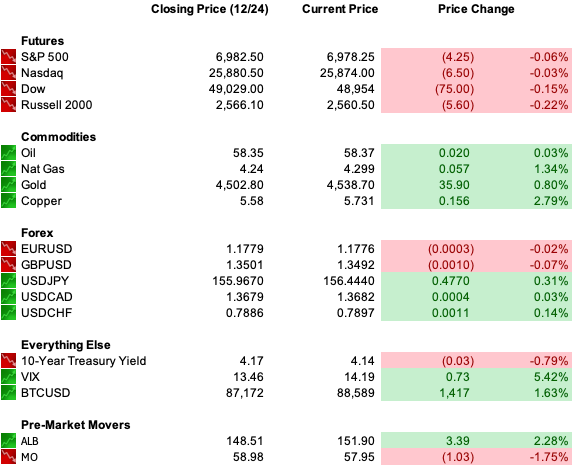

Overnight: Nikkei +0.68%, Shanghai +0.10%, FTSE 100 -0.19%, DAX +0.23%

U.S. PRE-MARKET

THE CLOSE

This is not a market breaking higher on belief.

It is a market staying invested while pricing uncertainty.

Risk remains on.

But it is disciplined.

Leadership is narrow.

Protection is in demand.

As liquidity thins and policy paths continue to diverge, the signal is neither fear nor euphoria.

It is adaptation.

The rally is intact.

But it is being hedged.