TQ Morning Briefing

Tech Breaks, Small Caps Slide, and the Fed Path Gets Murkier

From the T&Q Desk

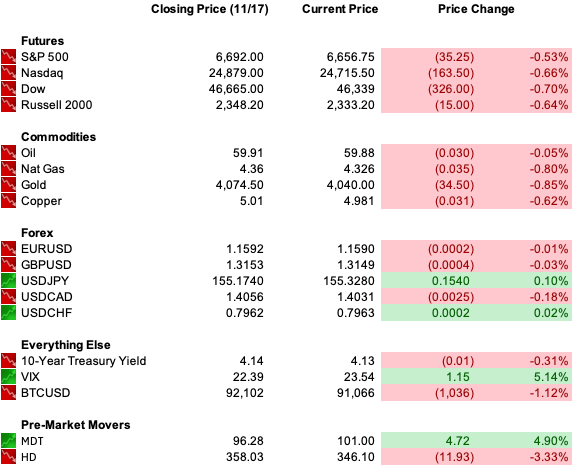

Markets opened the week with a decisive downside break. After two Fridays of resilient rebounds, Monday delivered no such rescue.

A broad selloff pulled the S&P 500 lower by one percent, with more than eighty percent of components finishing red and small caps sliding more than two percent. The Russell 2000 has now shed nearly five percent over the last five sessions, underscoring how quickly risk appetite has faded as December’s policy path turns cloudy.

The technical picture cracked as well. Both the S&P 500 and Nasdaq slipped below their 50-day moving averages three separate times intraday. The first two held. The third failed and unleashed the afternoon decline.

With markets already uneasy about valuations in AI-linked megacap names, the break added fuel to defensive rotation.

Bitcoin continued to unwind, falling below ninety two thousand as the drawdown from its October peak extends past twenty five percent. Crude drifted under sixty dollars, gold softened on a firmer dollar, and bond traders leaned into duration with the ten year yield inching lower while front-end Treasurys underperformed.

The return of delayed federal data will shape the rest of the week, but the message across Monday’s tape was clear. Missing numbers are no longer the only visibility problem.

Confidence in the Fed’s December meeting has fractured just as the economy’s data flow begins to come back online.

Premier Feature

Investors Are Watching This Fast-Growing Tech Company

No, it's not Nvidia… It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Their disruptive tech has helped users earn and save $325M+, driving $75M+ in revenue and 50M+ consumer base. They’ve just been granted the stock ticker $MODE by the Nasdaq and over 56,000 investors participated in their previous rounds.

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors.

Word Around the Street

U.S. equity weakness spilled across global markets. Asia closed broadly lower on cautious China data. Europe opened in a soft posture as investors absorbed the steep rotation out of U.S. tech and back toward defensives.

Utilities, healthcare, and select cyclicals continued to absorb flows as traders unwind crowded positioning in AI and semiconductors. Breadth has improved, but leadership remains fragile.

NVDA’s earnings on Wednesday now loom over the entire AI complex. After a seventy percent rally off the spring lows, megacap tech has dropped more than six percent in November, making this week’s report the sector’s inflection point.

CEO Jensen Huang has already previewed five hundred billion dollars of 2025–26 orders. Investors will want verification rather than aspiration.

Home Depot added another pressure point before the open. The retailer cut its full-year profit outlook after posting a third consecutive earnings miss, citing weaker home improvement demand, softer consumer spending, and a sluggish housing market.

Management noted no near-term catalysts for a rebound, underscoring the drag from high mortgage rates and project deferrals across income levels. Investors will be watching whether HD’s tone spills into broader retail sentiment as WMT, TGT, LOW, and others report this week.

Bitcoin’s slump has added to the risk reset, dipping below $90,000 this morning before regaining some ground. Speculative pockets of the market have struggled to find support without clearer guidance from the Fed.

Global Policy Watch

The fault lines inside the Federal Reserve sharpened Monday.

Governor Christopher Waller publicly backed another December cut, arguing that the labor market’s weakening trend outweighs lingering inflation concerns. His comments placed him squarely in the dovish camp aligned with Governor Stephen Miran.

Vice Chair Philip Jefferson and several regional bank presidents pulled firmly the other way. Boston’s Susan Collins, Cleveland’s Beth Hammack, and others stressed that persistent inflation remains too close for comfort and warned against easing without convincing evidence of disinflation.

This is the most openly divided Fed in years.

The shutdown-deformed data cycle only deepens the split. September payrolls will arrive Thursday but without the household survey for October, and with CPI’s timeline still uncertain.

Powell has likened the situation to “driving in fog,” and that metaphor now defines the policy landscape. Markets have followed: Fed-dated odds now point to a small majority favoring no cut in December.

Trade Winds & Global Shifts

President Trump confirmed the U.S. will sell F-35 fighters to Saudi Arabia, signaling full political rehabilitation of Crown Prince Mohammed bin Salman ahead of Tuesday’s White House meeting.

The sale raises questions about Israel’s qualitative military edge and Washington’s use of leverage in future normalization talks. Congress will need to be notified; lawmakers are already pressing for assurances that F-35 tech will not bleed toward China, Riyadh’s largest trading partner.

The United Nations Security Council approved the U.S.-drafted resolution formalizing Trump’s Gaza plan, authorizing a transitional governance body and an international stabilization force charged with demilitarizing the enclave and overseeing reconstruction.

The resolution introduces a clearer diplomatic framework than at any point since the conflict began, though Israel faces domestic political frictions over language referencing a potential future pathway to Palestinian statehood. This remains a high-stakes, fluid development with meaningful implications for regional security and defense markets.

On the U.S.–China front, caution deepened. A new Congressional advisory report warned that Beijing’s dominance in rare earths, biotech ingredients, quantum components, and legacy semiconductors remains a critical vulnerability.

China controls ninety nine percent of heavy rare earths and eighty percent of basic pharmaceutical ingredients. The panel recommended a consolidated “economic statecraft” arm inside the Commerce Department, strengthened enforcement, and accelerated diversification of U.S. supply chains.

The U.S.–China trade detente also showed early signs of strain, with China purchasing less than three percent of the soybeans Washington says were pledged under the October agreement.

Both sides continue taking steps to reduce strategic dependence, keeping the detente fragile and highly sensitive to implementation risk.

From Our Partners

President Trump Just Privatized The U.S. Dollar

Today, I can reveal how to use this new money… why it's set to make early investors' fortunes, and what to do before the wealth transfer begins on November 18 if you want to profit.

D.C. in the Driver’s Seat

Washington opened the week with multiple pressure points on the administration. Trump’s grip inside the GOP showed rare strain, with House conservatives breaking from the White House on the Epstein files vote and key statewide allies in Indiana and Kansas resisting his push for new district maps.

Senate Republicans also dismissed his call to eliminate the filibuster, underscoring limits to his leverage.

The split set the stage for a bipartisan revolt over the Epstein records, where a discharge petition forced a vote Trump could not block. He ultimately reversed course and encouraged Republicans to back the measure, sidestepping a public defeat but not the broader erosion of party discipline.

Elsewhere, institutional turbulence spread. FEMA’s acting administrator resigned amid an ongoing agency overhaul, while Larry Summers stepped back from public roles after the release of Epstein-related emails intensified pressure from Harvard faculty and lawmakers.

On policy, Senator Cassidy introduced a pre-paid HSA alternative to expiring ACA premium credits, though bipartisan skepticism leaves the proposal with an uncertain path. And in the courts, a federal judge sharply questioned prosecutorial conduct in the Comey indictment, pausing a release order for grand-jury materials and signaling potential further scrutiny.

Economic Data

Initial Jobless Claims

ADP Weekly Employment Change

NAHB Housing Market Index

Factory Orders

Fed Speaker: Barr

Earnings Reports

HD, PDD

Overnight Markets

Asia: Nikkei -3.22%, Shanghai -0.81%

Europe: FTSE 100 -1.22%, DAX -1.23%

U.S. Pre-Market

From Our Partners

Your Entire Portfolio is Dangerously Exposed…

Original Mag Seven turned $7,000 into $1.18 million.

But these seven AI stocks could do it in 6 years (not 20).

Now, the man who called Nvidia in 2005 is revealing details on all seven for FREE.

Opening Outlook

Markets start Tuesday on uncertain footing after a broad selloff that pushed the S&P 500 and Nasdaq through their 50-day moving averages and sent small caps into a deeper slide.

Futures are stabilizing modestly, but sentiment remains fragile as traders weigh weakening tech leadership, fading expectations for a December Fed cut, and the return of long-delayed economic data.

Bond markets are signaling the same unease. Long-duration Treasurys continue to attract cautious demand while the front end struggles, reflecting a market that no longer trusts its read on the policy path.

The dollar is firmer, crude is steady near sixty dollars, and gold is under pressure as risk appetite resets across asset classes.

The day ahead will be shaped by two forces: the rotation into defensives that accelerated Monday and the first clean pieces of macro data expected later this week. Until those numbers land, positioning rather than conviction is likely to drive the tape.