TQ Morning Briefing

Global Rates Diverge as Policy, Chips, and Capital Controls Tighten

From the T&Q Desk

Markets enter Friday with risk assets leaning higher, volatility contained, and conviction once again conditional on policy rather than price.

Thursday’s rebound was driven by two forces that do not often coexist: a cooler inflation print that re-opened the rate-cut conversation, and earnings validation from Micron that re-anchored the AI trade in physical demand rather than narrative momentum.

But the overnight impulse did not come from the U.S.

The Bank of Japan’s decision to raise rates to a three-decade high has reintroduced global yield gravity into a market that had grown comfortable pricing synchronized easing.

Japan is tightening as the U.S. debates cuts. Europe is pausing. The result is policy divergence at a moment when liquidity is thinning into year-end.

Relief has arrived. Conviction has not.

Premier Feature

This Crypto’s Price Is Lying

The crypto market is recovering — but not evenly.

Some coins are bouncing on hype. Others are rising because their fundamentals demand it.

I’m tracking one crypto where the divergence is impossible to ignore. During the crash, its network metrics kept climbing — active users grew, transactions increased, and development never slowed.

The fundamentals didn’t just hold… they accelerated.

But the price? Still discounted like the crash never ended.

That gap will close. And when it does, the move could be fast and violent.

We’ve seen this setup before — 8,600% (OCEAN), 3,500% (PRE), 1,743% (ALBT).

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Word Around the Street

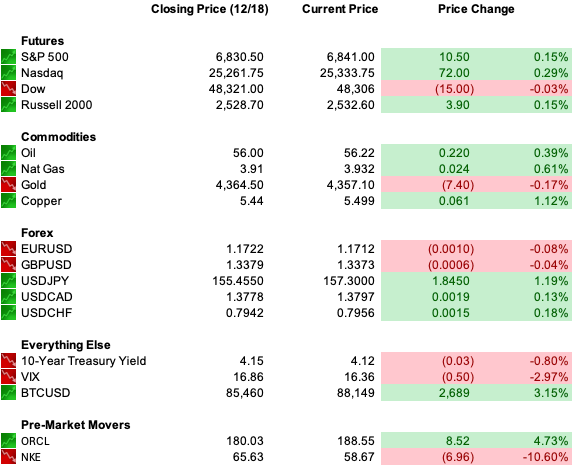

Futures point modestly higher following Thursday’s tech-led rebound, with Nasdaq contracts leading and the S&P 500 hovering just below record territory.

Rates are easing at the margin rather than resisting. The 10-year Treasury is down roughly three basis points this morning to 4.12 percent, signaling that yesterday’s CPI relief is being absorbed as confirmation, not noise.

Yields remain elevated in absolute terms, but the directional move matters: bond markets are no longer pushing back against equity strength. They’re stepping aside.

The dollar is stronger against the yen after Tokyo’s hike disappointed expectations for clearer forward guidance. Gold is softer but remains elevated, oil is under pressure on oversupply fears, and crypto is attempting to re-engage alongside broader risk appetite.

Micron remains the central equity narrative. Blowout earnings and guidance reframed the AI trade away from valuation anxiety and back toward supply constraints.

Memory pricing strength has restored confidence in the capex chain at a moment when investors were questioning whether AI spending would translate into realized throughput.

The contrast elsewhere is telling. Nike’s sharp premarket decline underscores persistent China exposure risk and tariff pressure in global consumer brands.

Oracle’s rally on the TikTok joint venture reinforces where capital continues to flow instead: domesticated, regulated technology infrastructure aligned with U.S. policy priorities.

This is not a broad rally. It is a sorting mechanism.

Global Policy Watch

The Bank of Japan’s 25 basis point rate hike to 0.75 percent marks another step away from ultra-loose policy and introduces a fresh global tightening impulse.

Japanese 10-year yields moved above 2 percent for the first time since 1999, while the yen weakened as markets sold the move in the absence of a clearer tightening path. The message from Tokyo was not hawkishness. It was optionality.

That matters.

As Japan tightens and the Federal Reserve debates easing in 2026, global policy dispersion is widening rather than converging. The Bank of England cut rates but signaled caution. The ECB held steady with a hawkish undertone. Markets continue to price Fed cuts as a future event rather than an imminent one.

Currency markets reflect this fragmentation. The dollar firms against the yen, trades sideways versus Europe, and remains sensitive to relative yield rather than growth expectations.

Trade Winds & Global Shifts

Capital controls are no longer theoretical.

The U.S. has formally codified outbound investment restrictions targeting Chinese technology sectors tied to military and surveillance capabilities.

This embeds national security screening directly into capital allocation decisions, affecting private markets, venture funding, and long-term growth assumptions across AI and advanced semiconductors.

At the same time, the TikTok joint venture highlights the alternative path now favored by policymakers: forced localization rather than outright exclusion. Oracle’s role as a trusted U.S. infrastructure partner is not just corporate news. It is a blueprint.

The Nvidia chip review underscores the internal tension inside that framework. Allowing limited H200 exports while maintaining broad enforcement reflects a strategy of managed exposure rather than decoupling.

Markets should expect continued volatility as policy attempts to balance technological dominance against substitution risk.

In Europe, approval of more than €90 billion in Ukraine aid reinforces fiscal commitment at a time when defense spending, energy security, and industrial policy remain tightly linked.

That support is constructive for select industrial and defense names but keeps structural pressure on sovereign balance sheets.

Geopolitics is increasingly shaping where capital is allowed to go.

From Our Partners

Trump’s Exec Order #14154 — A “Millionaire-Maker”

Donald Trump has cheated death.

He’s overcome insane and criminal vote rigging.

And survived every indictment and impeachment thrown at him.

But his next move could make him a legend – and perhaps the most popular president in U.S. History.

Former Presidential Advisor, Jim Rickards says, “Trump is on the verge of accomplishing something no President has ever done before."

And if he’s successful, it could kick off one of the greatest wealth booms in history.

We recently sat down with Rickards to capture all the key details on tape.

D.C. in the Driver’s Seat

Domestic policy developments continue to feed directly into market structure.

The conviction of a sitting state judge for obstructing immigration enforcement reinforces the administration’s posture toward institutional resistance. For markets, this elevates enforcement risk across labor-sensitive sectors, transportation, and public-sector adjacencies.

Congress’s failure to extend enhanced Affordable Care Act subsidies before year-end introduces near-term uncertainty for households and insurers alike.

While markets may assume a retroactive fix, the interim matters. Consumer cash-flow volatility tends to surface first in discretionary spending data rather than headline growth.

Meanwhile, renewed momentum around a congressional stock trading ban and the mandated release of Epstein-related DOJ files contribute to a broader theme of institutional scrutiny.

This does not create immediate selling pressure, but it supports continued investor preference for transparency-aligned assets and skepticism toward political beta trades.

Policy risk is becoming structural rather than episodic.

Economic Data

Existing Home Sales

Michigan Consumer Sentiment

Earnings Reports

Paychex (PAYX)

Carnival Cruise Line (CCL)

Overnight Markets

Asia: Nikkei +1.03%, Shanghai +0.36%

Europe: FTSE 100 +0.03, DAX -0.04%

U.S. Pre-Market

From Our Partners

Wall Street’s Year-End Rally Has Started—Most Investors Are in the Wrong Stocks

After months of volatility, the market just flipped the switch. The S&P 500 logged its best September in 15 years, and momentum is carrying into new multi-month highs. Cooling inflation, strong earnings, and growing odds of Fed rate cuts are fueling the surge.

But this is a selective rally—driven by energy, manufacturing, and defense.

Our analysts just released a FREE report revealing 4 stocks positioned to lead this year-end run as these powerful trends accelerate.

Opening Outlook

Markets open Friday supported but not resolved.

Cooler inflation and Micron’s earnings restored confidence, but global rates have re-entered the conversation at an inconvenient moment. Liquidity is thinning. Positioning is stretched. Policy divergence is widening.

The rally remains intact, but it is conditional.

Relief was granted. Verification continues.