TQ Morning Briefing

Data Fog, Fed Doubt, and an Uneasy Tape

From the T&Q Desk

Markets stumbled on Thursday as investors absorbed the disappointment around December rate cut odds and the realization that the post shutdown data flow will be incomplete for some time.

The Dow fell nearly eight hundred points, the S&P 500 dropped more than one and a half percent, and the Nasdaq lost more than two percent as stretched valuations in technology and renewed scrutiny of AI spending drove another day of selling across growth leadership.

Breadth weakened sharply into the close and small caps led the downside as investors shifted out of higher beta trades and took advantage of gains built through the past two months.

The rotation theme continued with health care, consumer staples, and energy showing the most resilience while discretionary and technology lagged. Gold eased back after early strength while oil steadied on expectations of rising supply and a potential post shutdown uptick in economic activity.

Sentiment indicators reflected the shift. The AAII bull bear spread moved sharply negative while the Fear and Greed Index continued to rebound.

Investors appear to be balancing profit taking with the recognition that delayed data will complicate the Fed’s December meeting and leave the market vulnerable to any surprises.

Premier Feature

AI's NEXT Magnificent Seven

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

Word Around the Street

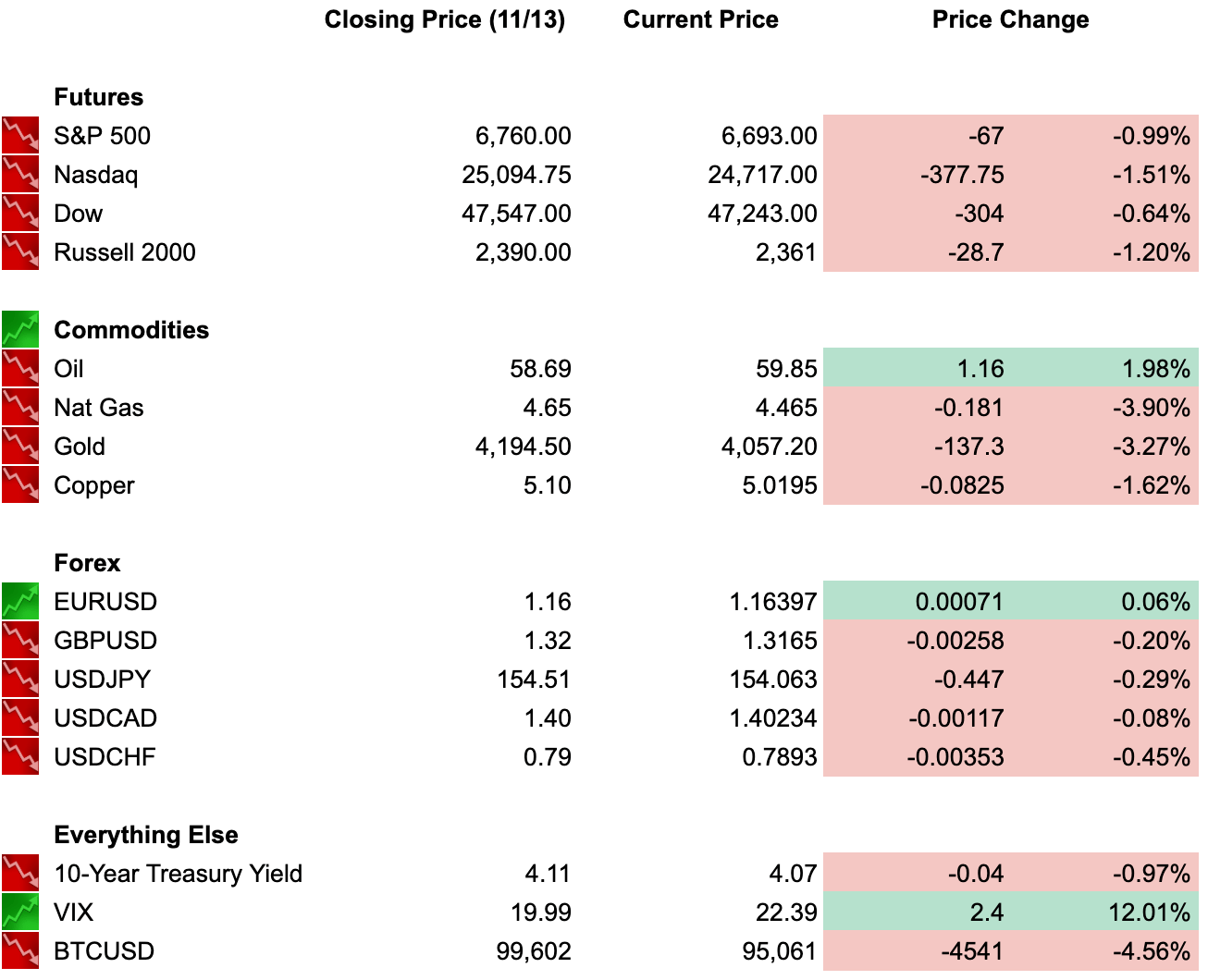

Equity futures are soft again this morning as markets continue to process yesterday’s selloff and brace for more volatility linked to the data blackout.

S&P 500 and Nasdaq futures are down between 0.8 percent and 1.2 percent with investors hesitant to reengage until there is more clarity on inflation and labor conditions.

The pressure on technology continues overseas. SoftBank shares dropped sharply for a third session and semiconductor names across Asia traded lower as concerns around AI infrastructure spending and valuation excess spread through the region.

TSMC, SK Hynix, and Samsung all posted sizable losses. European indexes followed with the FTSE 100, CAC 40, and DAX each opening lower and trading with a cautious tone.

Bitcoin remains under heavy pressure, falling below one hundred thousand dollars and entering a technical bear market. The dollar softened toward ninety nine, sterling climbed to a two week high, and gold continued to drift lower after failing to hold early overnight strength.

Investors remain focused on today’s lineup of Fed speakers and the schedule for resuming delayed economic releases. September jobs and inflation data are expected next week. The White House has confirmed that the October unemployment rate will not be published.

Global Policy Watch

A hawkish tone from several Federal Reserve officials continues to weigh on markets. Policymakers have emphasized the need for greater clarity on inflation and labor trends and have suggested patience before considering additional easing.

Futures now price only a fifty percent chance of a December cut, down from the near certain expectations in early October.

Japan’s currency pressures are intensifying. The yen is trading near nine month lows as Prime Minister Takaichi signaled discomfort with additional rate hikes despite the Bank of Japan’s warnings about persistent inflation. Markets increasingly expect a slower pace of tightening which reinforces downward pressure on the currency.

In Europe, the Bank of England landscape remains volatile as shifting tax expectations moved gilt yields higher. Investors anticipate more details ahead of next week’s budget. The euro traded steady near recent highs as the dollar pulled back.

Trade Winds & Global Shifts

The United States and South Korea released further details on their trade agreement, outlining a one hundred fifty billion dollar commitment to U.S. shipbuilding and an additional two hundred billion dollars in industrial investments.

The deal also includes U.S. approval for South Korea to build nuclear powered submarines and expanded cooperation on nuclear fuel capabilities. The agreement is expected to ease tariff burdens and stabilize currency flows.

U.S. national security officials continue to monitor Russian troop movements around Pokrovsk while European defense officials signaled concern about the outlook for winter negotiations. In Asia, semiconductor supply chain pressures remain in focus as Taiwan and South Korea navigate U.S. restrictions and domestic political considerations.

Latin American equities saw renewed interest from global funds this week with Brazil, Mexico, and Colombia attracting flows as investors seek relative stability outside the U.S.

From Our Partners

Nvidia’s CEO Issues AI Warning

If you’ve been worrying about AI being a bubble…

He said we’re “reaching an inflection point."

But it’s not what you think.

And I believe he is….

A lot of people are actually about to get rich from the coming AI convergence.

D.C. in the Driver’s Seat

Federal agencies are returning to full operations but the data delays will take time to resolve. The Bureau of Labor Statistics signaled that the release schedule is still being determined and that some October data may never be published. Markets are preparing for a staggered resumption next week starting with the September releases.

Back pay for furloughed federal workers will begin hitting accounts over the weekend and early next week with agency timing varying. Air traffic operations are still normalizing and the FAA expects continued delays in staffing and routing through next week.

Congress has adjourned for the weekend and the White House is expected to maintain focus on cost reduction initiatives including tariff exemptions for key food imports.

Friday Chart Check

Are you a buyer, seller, or staying away?

No deep dive, no overthinking, just a quick pulse check of market sentiment.

Cast your vote below to find out what’s behind the chart!

Find out what's behind the chart.

Economic Data

Fed Speaker: Scmid, Logan, Bostic

Earnings Reports

CPRT

Overnight Markets

Asia: Nikkei -1.77%, Shanghai -0.97%

Europe: FTSE 100 -1.59%, DAX -1.53%

U.S. Pre-Market

From Our Partners

#1 Memecoin to Own Right Now

Two of our top analysts have done the impossible — they’ve consistently spotted memecoins before they exploded.

I’m talking gains like 8,200%... 4,915%... and 3,110%, all triggered by a proven system that’s delivered 20+ big wins.

Now they’ve uncovered a brand-new memecoin showing the same explosive signals — and it could be next.

That’s why we’re revealing the #1 Memecoin to Own Right Now (time-sensitive).

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Opening Outlook

Friday opens with a cautious tone as investors navigate the combination of incomplete economic data, renewed pressure on technology valuations, and shifting expectations for the December Fed meeting. The rotation into value, health care, materials, and financials remains intact while momentum and AI linked names continue to experience heavier selling.

Bond yields are steady near 4.12 percent, oil is holding near recent lows, and gold continues to consolidate below the early week highs. Traders will focus on Fed commentary, currency volatility, and early signals on how quickly federal agencies can restore normal data collection and publication. With the market flying partially blind until mid next week, risk appetite is likely to remain muted.