TQ Morning Briefing

Alphabet Reawakens the AI Trade

From the T&Q Desk

A strange thing happened on the way into a holiday-shortened week.

After three straight weeks of AI exhaustion, a shaky tape, and positioning stretched thin, tech didn’t just bounce on Monday, it reasserted control.

What changed wasn’t the macro data. The Fed still has no CPI or labor reports before the December 10 meeting. Growth expectations haven’t meaningfully shifted. But the psychology did.

Then the Fed’s most influential voices, Williams, Waller, and Daly, stepped out with coordinated arguments for a December cut. With no incoming data to contradict them, traders treated their comments as the closest thing they’ll get to official guidance.

The result was a sentiment reset. AI conviction never disappeared; it simply needed a permission structure. Alphabet supplied one. The Fed supplied another.

The open question now is whether this was the beginning of a real rotation back into Tech leadership or a thin-liquidity holiday chase that fades the moment real data hits the tape next week.

Into Thanksgiving, the market is trading psychology more than fundamentals, and that cuts both ways.

Premier Feature

Forget AI, This New Tech is Projected to Grow 3x Faster

Forget AI.

President Trump himself called it a "big innovation"…

And said that it represents "American brilliance at its best."

Click here to see the details because the market for this tech…

Is projected to grow more than THREE times FASTER than AI in the coming years.

Word Around the Street

U.S. equities opened strong on Monday and never let up.

The Nasdaq rallied 2.7 percent, the S&P 500 gained 1.5 percent, and the Russell 2000 jumped nearly 2 percent, marking its strongest two-day stretch since August.

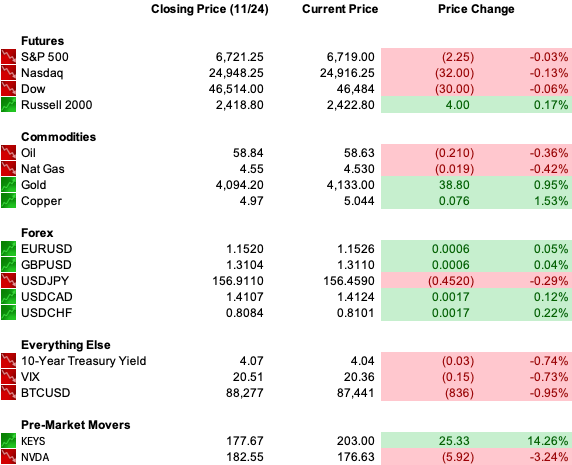

Volatility bled out of the system with the VIX sliding back below 21, reversing more than half of last week’s fear spike. Treasury yields drifted three basis points lower, extending bonds’ best year since 2020. Gold held above 4,100 dollars an ounce, and oil bounced back to the high-fifties.

Alphabet was the gravitational center of the tape. A powerful two-session surge put shares on the verge of a four-trillion-dollar valuation. The catalyst was a combination of Gemini 3 momentum and reports that Meta may lean on Google’s AI chips.

That read-through ignited the broader AI supply chain: Broadcom ripped more than eleven percent, Celestica and Lumentum printed double-digit gains, and a suite of quantum-computing names caught fire.

The rally broadened materially. Banks, airlines, and consumer discretionary stocks joined in. Healthcare logged another quiet record, with the Vanguard Health Care ETF closing at fresh highs.

Even Bitcoin stabilized near $88,500 after suffering its worst stretch since February and a drawdown of more than thirty percent from last month’s peak.

What powered the rotation wasn’t new data, it was rate expectations. Futures markets repriced December cut odds from roughly 35 percent to nearly 80 percent in just a few days, following dovish signals from Williams, Waller, and Daly.

That pivot lit up small caps, high beta tech, and the most speculative corners of the tape.

Ahead of Tuesday’s open, futures are softer, Nvidia is under pressure as the AI-semis landscape recalibrates around Alphabet’s momentum, and traders are preparing for a heavy slate of delayed economic data, including retail sales and PPI, that will shape the Fed’s December path in the absence of CPI or labor reports.

The market enters the session with improved sentiment, but holiday liquidity, uneven leadership, and a crowded bet on a December cut could make for choppy action.

Global Policy Watch

Central banks remain the dominant macro driver.

Fed Governor Christopher Waller reiterated that inflation is cooling, labor is softening, and the December meeting should be used to “provide additional insurance” against a sharper deterioration.

San Francisco Fed President Mary Daly echoed the view, warning that the job market is more vulnerable to sudden weakening than inflation is to sudden acceleration.

New York Fed President John Williams already laid the groundwork Friday, noting room for a “near-term” policy adjustment that won’t compromise the inflation path.

But the committee is far from united. Boston Fed President Susan Collins, Kansas City’s Jeffrey Schmid, and St. Louis’s Alberto Musalem all signaled discomfort easing again this year.

Minutes from the October meeting showed broad concern about cutting too quickly with core inflation sticky and services prices re-accelerating.

The complication is structural: the shutdown wiped out major data, and the Fed will not receive CPI or labor reports before December 10. That leaves PPI, retail sales, durable goods, and the Beige Book as the only available breadcrumbs. The Fed is effectively steering without headlights.

Markets are leaning dovish anyway.

Trade Winds & Global Shifts

Geopolitics thickened overnight as Thanksgiving week opened with three parallel crises.

The Ukraine peace push continues to churn behind closed doors after last week’s leak of the 28-point draft plan. U.S. Army Secretary Dan Driscoll met Russian officials in Abu Dhabi on Monday after days of hurried consultations in Kyiv and Geneva.

The plan is being reworked under pressure from Europe and Kyiv, with several pro-Russia clauses already stripped or softened. Trump maintains optimism. Markets remain skeptical but attentive, given the implications for oil, defense spending, and European risk.

China-Japan tensions escalated again after Beijing demanded that Japanese Prime Minister Sanae Takaichi retract her remarks about defending Taiwan. Takaichi refused.

Xi Jinping pressed Trump directly during their Monday call to rein in Tokyo. Washington’s silence since the call is unsettling allies, even as Trump confirmed a Beijing visit for April.

In Venezuela, the U.S. designated the Cartel de los Soles a foreign terrorist organization, widening the legal basis for targeting smuggling networks and raising the probability of expanded U.S. operations in the region.

Markets are juggling all three flashpoints at a moment when liquidity is thinning and Fed expectations are the primary anchor for risk.

From Our Partners

10 AI Stocks to Lead the Next Decade

AI is fueling the Fourth Industrial Revolution – and these 10 stocks are front and center.

One of them makes $40K accelerator chips with a full-stack platform that all but guarantees wide adoption.

Another leads warehouse automation, with a $23B backlog – including all 47 distribution centers of a top U.S. retailer – plus a JV to lease robots to mid-market operators.

From core infrastructure to automation leaders, these companies and other leaders are all in The 10 Best AI Stocks to Own in 2026.

Free today, grab it before the paywall locks.

D.C. in the Driver’s Seat

Domestic politics remain tense.

House Speaker Mike Johnson warned the White House that extending enhanced ACA subsidies is a non-starter for most Republicans. With premiums set to spike more than one hundred percent for twenty-plus million enrollees next year, the administration is testing fallback options, including direct HSA-style cash accounts.

Senate Republicans have floated alternative structures built around Bronze-plan subsidies, HSAs, and income caps, but no path has emerged.

Separately, a federal judge dismissed the Justice Department’s cases against James Comey and Letitia James, ruling that prosecutor Lindsey Halligan was unlawfully appointed. The DOJ plans to appeal, but the rulings represent another institutional shock in a month filled with them.

A new X account-transparency feature exposed that several MAGA-aligned influencer accounts are based abroad, igniting a partisan digital firestorm before the company quietly pulled the data back for accuracy issues.

And across the workforce, Amazon’s fourteen-thousand-person corporate layoff and leaked robotics strategy revived questions about AI-accelerated labor displacement. The economic narrative is beginning to merge with the political one: who benefits from efficiency, who absorbs the adjustment, and how fast can the system adapt.

Economic Data

ADP Employment Change (Weekly)

PPI

Retail Sales

S&P/Case-Shiller Home Price

Pending Home Sales

Business Inventories

Earnings Reports

ADI, DELL, ADSK, WDAY, ZS

Overnight Markets

Asia: Nikkei +0.07%, Shanghai +0.87%

Europe: FTSE 100 +0.34%, DAX +0.03%

U.S. Pre-Market

From Our Partners

Former Illinois Farmboy Built a Weird A.I. System to Expose His Wife's Killer…

After his wife's untimely death, he used Artificial Intelligence to get sweet revenge...

But what happened next could change everything... while making a select few early investors very rich.

Opening Outlook

The market entered Thanksgiving week with a clean upside surprise. Alphabet reignited the AI trade, the Fed opened the door for a December cut, and positioning finally allowed risk to breathe after three weeks of exhaustion.

But holiday rallies are notoriously fickle.

What matters now is whether buyers follow through once liquidity normalizes.

Today, watch three things.

Whether Alphabet’s surge broadens or narrows as the tape digests the size of Monday’s move.

Whether rate-cut odds hold near the high seventies or fade as second-tier economic data hits.

Whether Ukraine-Russia negotiations, China-Japan tensions, or Venezuela headlines tighten risk appetite into the thin holiday tape.

Markets wanted a catalyst. They got one. The next few sessions tell us whether it was spark or froth.