TQ Morning Briefing

The calendar turned. The structure didn’t.

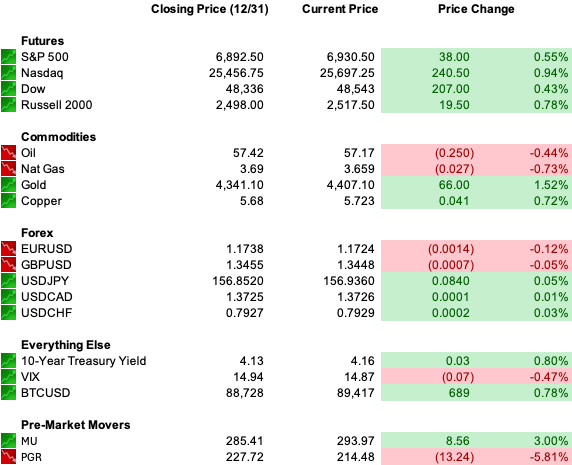

MARKET STATE

Risk Reopens With Familiar Leadership

The new trading year opens with risk back on the table.

Not exuberant. Not tentative. Familiar.

Global equities are higher to start 2026, led again by technology and artificial intelligence exposure.

U.S. futures are firm, with Nasdaq strength outpacing the Dow and S&P 500.

Asia set the tone overnight, where Hong Kong equities logged their strongest first session of the year in more than a decade on renewed AI optimism and IPO momentum.

This is not a regime shift.

It is continuity.

Markets are reengaging the same leadership that carried 2025, but without acceleration. Participation is selective. Volume remains light. The bid is present, but measured.

The early message is straightforward. Risk is being reopened, not re-rated.

Premier Feature

7 Income Machines Built to Make You Rich

These are blue-chip companies with fortress balance sheets, elite dividend track records, and the staying power to outperform in bull and bear markets alike.

Some are Dividend Kings, others are on the path there, and all are proven wealth compounding machines.

WHAT’S ACTUALLY MOVING MARKETS

AI Leads the First Trade of the Year

Artificial intelligence is once again doing the heavy lifting.

Chinese technology stocks surged overnight after Baidu’s AI chip unit filed confidentially for a Hong Kong listing, reigniting enthusiasm around domestic semiconductor capability and capital formation tied to AI infrastructure.

Shanghai Biren Technology more than doubled in its trading debut, reinforcing the sense that demand for AI-linked exposure remains deep on both the retail and institutional side.

That momentum carried into U.S. premarket trade.

Nvidia, Broadcom, Micron, Intel, Tesla, Alphabet and Microsoft all moved higher early, extending the same leadership profile that defined much of last year’s gains.

This is not new information.

It is renewed confirmation.

The AI trade is not being abandoned at the turn of the calendar. It is being reaffirmed, at least at the margin, as capital reopens books and redeploys into known winners.

Tariff Delay Adds Marginal Relief

Trade policy provided a secondary tailwind.

President Trump delayed scheduled tariff increases on upholstered furniture, kitchen cabinets and vanities by a year, while also sharply reducing proposed duties on Italian pasta.

The move relieved pressure on furniture importers and select consumer discretionary names that were hit during last year’s tariff volatility.

The market takeaway is not about furniture.

It is about policy posture.

Tariffs remain a tool, but one that is increasingly toggled, staged, and negotiable.

That reinforces the market’s working assumption that trade policy will continue to inject episodic volatility, but not sustained directional damage, unless and until enforcement becomes fixed rather than flexible.

Metals Rebound After Constraint Reset

Precious metals are higher again after one of the most volatile stretches of 2025.

Silver futures jumped roughly 5 percent in early trade, with gold, platinum and palladium also higher. The move follows last week’s margin driven liquidation, which flushed leverage rather than belief.

This rebound does not invalidate the constraint story from year end. It confirms it.

The market cleared excess positioning, then stabilized. That pattern continues to define late cycle behavior across assets.

From Our Partners

The $300 Crypto Smart Money Is Targeting for January

This isn’t a hype-driven flyer.

It’s a DeFi protocol trading near $300 that our research suggests could have a realistic path toward $3,000+, based on fundamentals institutions care about.

Real, growing revenue

$60+ billion in total value locked

Institutional adoption accelerating

Token supply shrinking through buybacks

With new regulations opening the door for institutional capital, trillions in managed assets can now access this protocol. That’s why we believe this could be the #1 crypto to own heading into January.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

TAPE & FLOW

Risk Is On, But Narrow

Technology leads. Semiconductors lead technology. AI remains the center of gravity. Small caps lag. Defensive assets are not being abandoned, but they are not in demand.

Global equity strength is broad but uneven. South Korea closed at a record. The FTSE 100 crossed the 10,000 mark for the first time.

Europe is higher, supported by banks, defense and value rotation rather than growth exuberance.

Rates are steady. The 10 year Treasury yield sits near 4.16 percent, reflecting easing expectations without urgency. Volatility remains contained. Credit is calm.

Crypto mirrors the same posture. Bitcoin trades near 89,000, higher on the session, but still struggling to regain momentum seen earlier in the cycle.

This is participation without chase.

POWER & POLICY

Geopolitics Gets Louder, Markets Do Not

Macro headlines are intensifying. Markets are not reacting in kind.

President Trump warned Iran against violently suppressing ongoing protests, saying the United States is prepared to intervene if demonstrators are killed. Tehran pushed back rhetorically while signaling both restraint and resolve.

Venezuela’s leadership, meanwhile, floated the possibility of renewed talks with Washington and offered expanded access to oil investment.

The common thread is escalation in language, not in pricing.

Oil prices are steady after their worst annual loss since 2020. Treasuries barely moved. Risk assets did not flinch. This is not indifference. It is normalization.

Geopolitical friction is now part of the baseline, not a shock input.

Governance Risk Moves Forward on the Calendar

Attention is also shifting back toward U.S. institutional credibility.

The dollar enters 2026 after its worst annual performance since 2017, weighed down by narrowing rate differentials, fiscal concerns, trade policy uncertainty, and growing focus on Federal Reserve leadership.

Markets are increasingly sensitive not just to where rates go, but to how decisions will be made.

That theme extends beyond monetary policy.

Social Security’s projected insolvency date of 2032 is no longer an abstract problem. It now sits squarely inside the next Senate cycle, turning long ignored fiscal math into an unavoidable policy constraint.

None of this is being priced as imminent crisis.

It is being priced as duration risk.

From Our Partners

The New #1 Stock in the World?

A tiny company now holds 250 patents tied to what some call the most important tech breakthrough since the silicon chip in 1958.

Using this technology, it just set a new world speed record, pushing the limits of next-generation electronics.

Nvidia has already partnered with this firm to bring its tech into advanced AI systems.

This little-known company could soon become impossible to ignore.

ONE LEVEL DEEPER

The AI Trade Enters Its Constraint Phase

2026 is not about whether artificial intelligence demand exists. It does.

Data center demand remains strong into the first half of the year. Memory and compute orders extend into 2027.

Constraints remain. Power interconnection timelines stretch years. Gas turbine manufacturers are sold out through 2029.

Private capital has poured into AI startups that remain deeply unprofitable and dependent on continuous funding to pay hyperscaler cloud bills.

This does not end the trade.

It changes how it is owned.

The next phase is less about adoption narratives and more about capacity, cost of capital, and physical limits.

Markets will continue to reward AI exposure, but increasingly discriminate between scalable infrastructure and speculative excess.

That shift favors discipline over momentum.

MARKET CALENDAR

Data: ISM Manufacturing PMI

Earnings: No notable reports

Overnight: Nikkei -0.37%, Shanghai +0.09%, FTSE 100 +0.50%, DAX +0.27%

U.S. PRE-MARKET

THE CLOSE

Risk Reopens, Structure Holds

This is a constructive open to the new year.

But it is not a reset.

Risk is back on. Leadership is familiar. Participation is selective. Markets are choosing continuity over reinvention.

The same forces that shaped 2025 remain in place entering 2026. AI leadership. Policy constraint. Geopolitical noise without repricing. Capital deployed, but supervised.

The year is starting with optimism.

It is being carried with experience.