TQ Evening Briefing

A split Fed, a softer labor signal, and yields sliding back toward calm... the market finally got a cut, but the reaction told the real story.

After The Bell

Markets closed with a risk-on tilt after the Fed delivered its third straight quarter-point cut and hinted that policy may now sit near neutral.

That single shift in tone powered equities.

Treasury yields fell to ~4.16% as the curve recalibrated for a slower, steadier path ahead.

Sector rotation showed up quickly.

Regional banks rallied on the prospect of easier funding, small caps surged toward a new high, and cyclicals picked up momentum as Powell flagged deeper labor-market risks.

Silver extended its record run, closing above $60, while crude slipped and the dollar softened.

Corporate moves added their own texture.

Oracle’s results kept it in the AI bellwether seat, and takeover chatter around Warner Bros. pulled media into the spotlight.

Economic data was light, but expectations weren’t: traders leaned into the idea that the door for cuts in 2026 remains open, even if the Fed won’t say so outright.

Tomorrow brings more earnings and key jobless claims… a fresh test of whether today’s dovish tilt can sustain the rally.

Premier Feature

The Year-End Rally Has Gone Selective — Most Traders Are Positioned Wrong

After months of violent chop, the market has quietly shifted regimes.

Momentum models are now confirming a multi-month trend acceleration — but this is not a broad-market melt-up.

Capital is rotating aggressively into just a few areas: energy, manufacturing, and defense.

Our analysts just released a FREE report revealing 4 stocks positioned to lead this year-end run before the move gets crowded.

Monetary Pulse

The Fed delivered the expected quarter-point cut, but the real story was the split.

Three dissents, a cautious dot plot, and Powell signaling rates are now “within neutral” all point to the same message: policy is easing, but not freely.

Markets read it as a gentle green light, not a runway.

The committee lifted 2026 growth forecasts, acknowledged stubborn inflation, and admitted the labor data arriving after the shutdown is still incomplete.

Powell even flagged expected downward revisions to payrolls… a quiet admission that the job market may be weaker than the headline series shows.

That’s why equities rallied.

The cut was priced, but the tone leaned less restrictive than feared.

Liquidity also re-entered the frame.

The Fed will resume buying short-term Treasuries, starting with $40B in bills to calm funding markets.

It’s reserve management, but investors remember 2019: when the Fed steps back into the plumbing, volatility tends to compress in the near term and migrate into risk assets.

Overlay the political backdrop — Powell nearing the end of his term, Trump signaling a preference for a more accommodative successor — and the market takeaway is policy risk widening, but easing is still alive.

For positioning, that means duration stays supported, equity dips get bought, and the path forward hinges not on the cut itself, but on whether today marked the start of a pause… or just a slower descent.

Federal Focus

Washington spent the day redefining the edges of U.S. authority, and each move changes where investors see pressure building.

The sharpest line was drawn around the ICC.

The administration is pushing for amendments that would guarantee Trump and senior officials immunity from future prosecution, while demanding the court drop probes into Israeli leaders and U.S. troops.

It’s a legal fight, but the market read is geopolitical.

When Washington signals it’s willing to escalate, defense names, sanctions-adjacent sectors, and cross-border lenders quietly adjust for higher long-tail risk.

One of those moments where the law books move volatility screens.

At the border, the proposed rule requiring foreign tourists to disclose five years of social-media history pulls in a different direction… friction, not confrontation.

Tourism, airlines, entertainment venues, and local hospitality rely on easy inflows.

More paperwork means slower throughput, and slower throughput means tighter operating leverage for a sector already managing uneven consumer demand.

Political sentiment added another data point.

Miami’s mayoral flip, the city’s first Democratic win in decades, won’t move futures, but it does flag where policy debates are shifting: affordability, transit, and land use.

Developers, regional banks, and insurers watch those signals closely because they shape permitting, density, and capital deployment in 2026.

And for agriculture, Trump’s $12B aid package landed as a lifeline, not a fix.

Losses in soybeans, corn, and specialty crops still exceed $35B-$44B, keeping rural lenders and producers in a tight liquidity loop.

Different stories, consistent theme.

Federal decisions are flowing directly into sector stress, earnings setup, and where capital wants to take shelter next.

The World Tape

Washington and Europe spent the day redrawing lines… some economic, some geopolitical, all relevant for risk pricing.

The U.S.–Switzerland tariff deal stands out first.

Rolling Trump’s 39% tariff back to a 15% ceiling doesn’t just reopen trade lanes, it hands exporters and buyers something markets crave right now: the ability to plan without flinching.

Switzerland’s pledge to invest $200B in the U.S. adds a deeper layer: capital flows follow certainty, and this deal restores it.

For markets, that’s one less trade flashpoint in a year full of them.

On Europe’s eastern edge, Russia’s push toward Donbas intensified, but Ukrainians refused to leave.

It’s not headline-driving for global assets, but it reinforces why defense spending, and the suppliers tied to it, remains structurally supported.

And in a softer corner of politics, Iceland pulled out of Eurovision after the EBU cleared Israel’s participation.

It signals the cultural spillover from geopolitical divides, something consumer brands and media companies now navigate carefully.

Across the Pacific, the U.S. backed Japan after Chinese fighter jets targeted Japanese aircraft with radar.

It may look symbolic on the surface, but markets have learned the hard way that symbols are often the earliest form of volatility.

Defense names stay bid, and energy traders watch the Taiwan corridor with tighter volatility assumptions.

Any misread signal can shift shipping routes.

One trade pact, one alliance signal, one conflict flare, one cultural protest.

Together they shape sentiment around stability… the asset class investors still pay a premium for.

From Our Partners

#1 Memecoin to Own Right Now

Two of our top analysts have done the impossible — they’ve consistently spotted memecoins before they exploded.

I’m talking gains like 8,200%... 4,915%... and 3,110%, all triggered by a proven system that’s delivered 20+ big wins.

Now they’ve uncovered a brand-new memecoin showing the same explosive signals — and it could be next.

That’s why we’re revealing the #1 Memecoin to Own Right Now (time-sensitive).

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

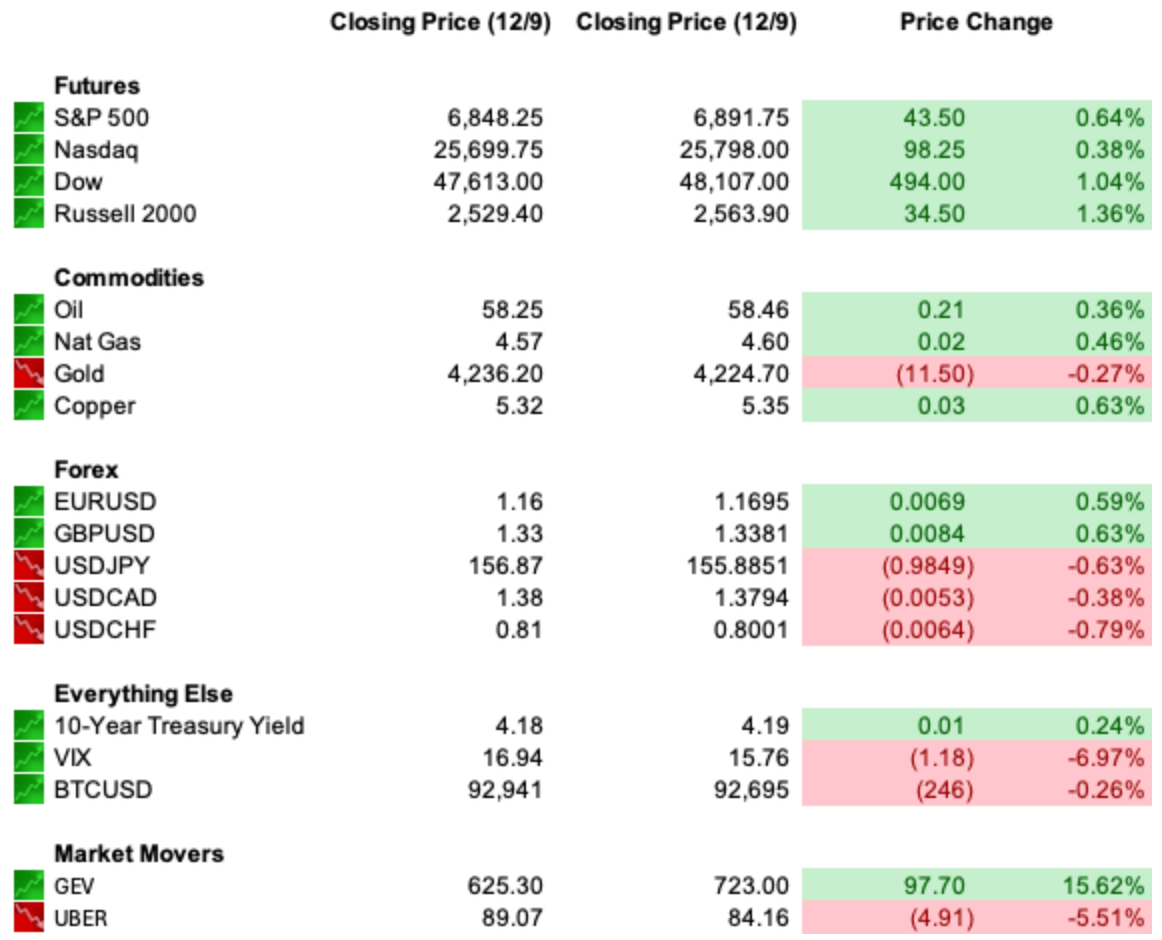

U.S. Markets Close

From Our Partners

10 Stocks for Income and Triple-Digit Potential

Why choose between growth or income when you can have both?

Our new report reveals 10 “Double Engine” stocks — companies built for rising dividends and breakout price gains.

Each has the scale, cash flow, and catalysts to outperform as markets rotate after the Fed’s pivot.

These are portfolio workhorses — reliable payouts today, compounding gains tomorrow.

Closing Call

Markets drifted into the close, reshuffling risk rather than taking it.

JPMorgan’s expense shock weighed on the Dow, silver’s surge rewired commodity screens, and a steady JOLTS print kept the labor story “slowing but intact.”

Tech held firm, small caps tagged another record, but conviction stayed muted with yields pressing higher.

The broader backdrop explained the hesitation.

It all fed into the same setup: risk appetite is there, but no one wants to front-run tomorrow’s message.

The cut is priced.

The tone is the catalyst.