TQ Evening Briefing

Capital stayed engaged, liquidity remained accessible, and prices held. What changed was how tightly risk was being evaluated as the next verification window approached.

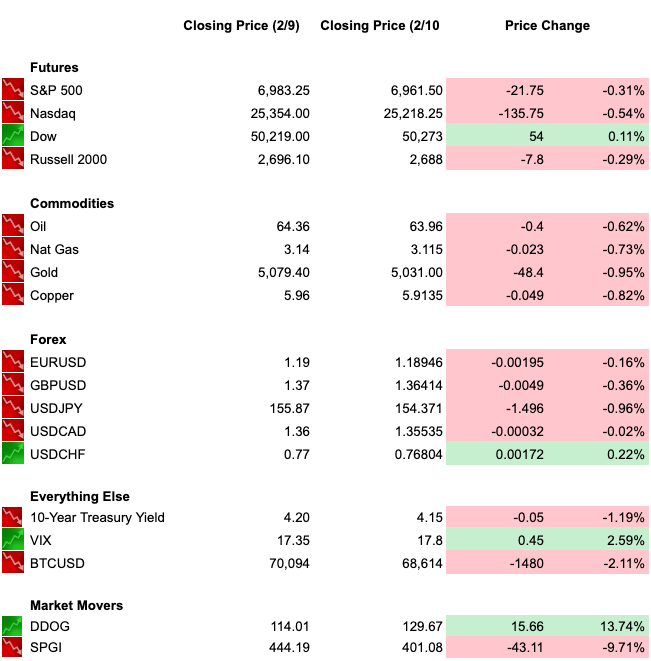

MARKET STATE

Repair Extended. Verification Approaches.

Tuesday’s session extended Monday’s stabilization without converting it into momentum.

Early gains held through the close, but they did not accelerate.

The market resolved the day as continuation rather than confirmation.

Risk assets traded constructively, yet participation narrowed as the session progressed.

Technology retained sponsorship, but flows favored repair over leadership.

The market continued to reference last week’s drawdown as its anchor rather than treating recent strength as a new base.

Rates framed the restraint.

Treasury yields drifted lower following softer retail and cost data, but duration never pressed the market into risk.

The curve stayed orderly, allowing exposure to remain intact ahead of upcoming macro releases without forcing extension.

Cross-asset behavior reinforced discipline.

The dollar softened modestly, supporting demand for real and credibility hedges.

Gold held firm and crypto failed to regain initiative, trading as residual liquidity rather than directional conviction.

By the close, posture was clear.

Risk was tolerated.

Belief was deferred.

Trade Implication

When continuation holds without expansion, assume the market is preserving optionality.

Exposure can be carried, but sizing should respect that confirmation remains outstanding.

Premier Feature

One Altcoin Is Coming for Visa & Mastercard’s $100B Fee Empire

Every year, payment giants collect over $100 billion in transaction fees — skimming up to 3% from every swipe, tap, and online purchase.

But one altcoin has built a faster, secure system that processes payments for pennies, cutting out banks and middlemen entirely.

Now, with the GENIUS Act taking effect and institutions already integrating this technology, the infrastructure for mass adoption is being built right now.

This coin is already handling billions in transactions — and growth could accelerate fast.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

WHAT’S ACTUALLY MOVING MARKETS

Labor Cooling Altered the Cost Structure Without Triggering Fear

The dominant driver beneath today’s price action was a subtle shift in how labor dynamics are influencing capital behavior.

Employment cost growth decelerated.

None of it pointed to collapse, but together it reshaped the operating environment.

Cooling labor costs reduce near-term inflation pressure, easing constraints on policy patience.

At the same time, softer consumption raises sensitivity to asset prices and confidence.

This combination changes how the market prices time.

Capital-intensive models gained flexibility as wage pressure eased.

Labor-dependent businesses lost cushion.

The market adjusted quietly, favoring balance sheets that convert investment into output efficiently while penalizing structures that rely on volume elasticity or wage-driven demand.

This alignment explains why today’s advance stayed narrow.

The environment rewards execution discipline, not exposure breadth.

Execution Bias

When labor pressure eases without demand breaking, markets favor firms with controllable cost structures and short feedback loops.

Avoid positions that require labor acceleration to validate margins.

AI Spending Shifted From Scale Validation to Return Scrutiny

AI remained central to market behavior, but its role continued to evolve.

The focus moved further away from whether spending will occur and toward whether returns will arrive on usable timelines.

Financing availability was acknowledged, but valuation adjusted for execution friction, depreciation drag, and infrastructure intensity.

This shift reframed AI from a category bet into a sequencing problem.

Capital is still flowing into the buildout, but it is increasingly sensitive to who controls throughput, pricing power, and timing.

Survivability is now being priced ahead of scalability.

That distinction explains why some technology exposures stabilized while others continued to trade heavy despite headline relief.

The market is underwriting efficiency, not ambition.

Trade Implication

In capital-heavy cycles, valuation follows return visibility, not spend velocity.

Favor exposure where conversion paths are explicit and balance sheets absorb delay without dilution.

From Our Partners

The Most Important Company in the World by Next Year?

Silicon is dead. And one tiny company just killed it.

TAPE & FLOW

Selectivity, Not Suppression

Technology continued to attract capital, but leadership remained uneven.

Software advanced where earnings repair and funding visibility aligned, while other segments lagged despite index strength.

Industrials and infrastructure-linked exposures held sponsorship without dominance.

Financials showed dispersion as margin compression concerns resurfaced.

Energy drifted, reflecting geopolitical calm without resolution.

Breadth improved relative to last week but failed to validate index gains.

Equal-weight participation lagged.

Small caps participated tactically without asserting leadership.

Volatility remained suppressed at the index level while staying elevated in individual names.

Skew stayed bid.

Protection was retained.

This was not a chase or capitulation.

The tape reflected internal rotation under constraint.

Execution Bias

When single-name volatility persists inside calm indexes, positioning must be precise.

Broad exposure functions, but weak structures lose sponsorship quickly.

POWER & POLICY

Pressure Builds Where Enforcement Is Credible

Policy risk accumulated quietly rather than erupting.

Trade authority debates, regulatory posture, and geopolitical pressure points remained unresolved, but none forced immediate repricing.

Energy markets reflected this balance.

Shipping, insurance, and funding conditions would react faster than equities if conditions deteriorate.

In Washington, procedural uncertainty around trade enforcement continued to widen the discount applied to assumptions that rely on policy stability.

Markets are not pricing outcomes.

They are pricing friction.

Globally, Japan remains the clearest case study.

Political clarity produced immediate yield response, reinforcing that credibility is enforced through capital markets, not headlines.

Optionality remains wide.

Enforcement is incremental.

Trade Implication

Treat policy developments as latent constraints rather than catalysts.

Position for volatility that arrives through funding and duration rather than equity headlines.

From Our Partners

Ticker Revealed: Pre-IPO Access to the "Next Elon Musk" Company

We’ve found The Next Elon Musk… and what we believe to be the next Tesla.

It’s already racked up $26 billion in government contracts.

Peter Thiel just bet $1 Billion on it.

And you can get exposure — pre-IPO — through a 4-letter ticker symbol revealed in this free briefing.

ONE LEVEL DEEPER

Capital Productivity Replaced Labor as the Shock Absorber

The most durable signal emerging is structural.

AI accelerates this shift.

Investment is flowing into compute, infrastructure, and automation while hiring slows.

Earnings resilience is coming from capital leverage rather than workforce expansion.

That changes how risk propagates.

Labor once absorbed shocks through wage growth and employment stability.

That buffer is thinner now.

Asset prices carry more weight in sustaining demand.

Execution errors hit margins faster.

This explains the market’s intolerance.

Durability is being repriced ahead of earnings.

Timing is overtaking storytelling.

Edge Setup

Favor businesses where capital converts rapidly into cash flow and pricing power.

Be cautious with models that rely on labor elasticity or long adjustment cycles to defend margins.

U.S. MARKETS CLOSE

THE CLOSE

Risk remains available.

Patience is no longer subsidized.

Tuesday did not resolve uncertainty.

It demonstrated how the market intends to carry it.

Liquidity functions.

Credit clears.

Capital is deployable, but only under tighter terms.

Two paths remain open.

Verification supports what has been priced, or selectivity intensifies and forces further internal rotation.

No decision was made today.

Only the framework was reinforced.

This is a market that rewards discipline, not conviction.

Execution will decide duration.

Treat upcoming data as a gatekeeper.

Carry exposure with defined invalidation and respect that tolerance now expires faster than trends.