TQ Evening Briefing

Tech broke momentum again, but the real issue is visibility. With data still dark and leadership flipping, the tape is trading every headline like a signal.

AFTER THE BELL

The market came back to earth today, not dramatically, but with enough force to remind traders that yesterday’s record-high euphoria was built on thin visibility.

With the government now officially reopened, liquidity didn’t flee… but leadership flipped hard.

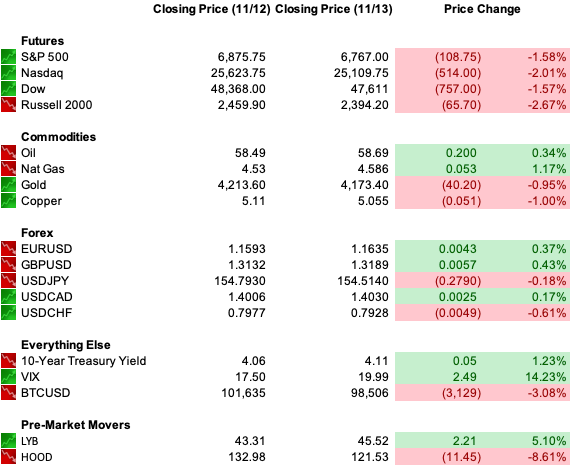

The Dow slid, dragged down by Disney’s 7% drop after a revenue miss. The S&P 500 fell 1.7%, and the Nasdaq led the bleeding at -2%, as the November tech unwind deepened.

Nvidia, Broadcom, Tesla, all hit with heavy sellers as the AI complex continues its valuation cooldown. Three straight red days for the Nasdaq now, despite a strong Monday start.

Under the surface, rotation stayed alive. Cisco nearly tagged a 25-year record after raising its outlook, a reminder that old-guard tech is where the stability bid is hiding. Verizon popped more than 1% on reports of a 15,000-job cut. Defensive staples and utilities caught marginal bids as rate-cut odds slipped.

The macro backdrop didn’t help. Fed cut probability for December fell as traders recalibrated what a “data-dependent Fed” even means when half the data may never see daylight.

The White House reaffirmed that October unemployment won’t be published, though some labor metrics may trickle out. The message: visibility stays compromised.

Commodities firmed: silver hit a record, gold climbed, and the Swiss franc strengthened as Trump floated tariff cuts on Swiss goods, a niche story, but enough to move FX desks.

The shutdown’s reopening did little to calm the tape. Airports remain messy, agencies are scrambling to schedule backlogged releases, and investors are bracing for uneven data arrivals that could distort the macro narrative for weeks.

Tomorrow: a quiet earnings slate, with Buckle (BKE) headlining before the bell, but the real story is whether tech finds a bid or if this rotation solidifies into a trend.

Premier Feature

10 AI Stocks to Lead the Next Decade

AI is fueling the Fourth Industrial Revolution – and these 10 stocks are front and center.

One of them makes $40K accelerator chips with a full-stack platform that all but guarantees wide adoption.

Another leads warehouse automation, with a $23B backlog – including all 47 distribution centers of a top U.S. retailer – plus a JV to lease robots to mid-market operators.

From core infrastructure to automation leaders, these companies and other leaders are all in The 10 Best AI Stocks to Own in 2025.

Free today, grab it before the paywall locks.

MONETARY PULSE

Fed messaging fractured further today, widening the dispersion around the December meeting.

Mary Daly struck a midpoint stance, saying she’s “open-minded” on a cut and sees risks to inflation and employment as “balanced” after two easings. Translation for markets: direction still tilts lower, but timing is now data-dependent rather than pre-baked.

Boston’s Susan Collins moved in the opposite direction, arguing there’s now a “high bar” for another cut given re-acceleration in services inflation. The market responded quickly and December cut probability slid below 50%.

Then came the clearest hawkish vector.

Then Cleveland’s Beth Hammack delivered the clearest hawkish tone of the day, saying policy needs to stay “somewhat restrictive” and warning inflation could run above target for another two to three years, especially with tariff pressure building.

The broader issue hasn’t changed: the Fed is navigating a fogged-out data landscape, with October jobs and CPI still missing in action.

In the absence of hard numbers, every Fed mic moment is being treated as a signal.

December is shaping up less as a pivot and more as a coin toss — one the market keeps repricing in real time.

THE WORLD TAPE

Europe is gaming out a scenario the market hasn’t fully priced: what if dollar access stops being automatic?

Officials across the eurozone and several non-EU central banks have begun exploring a pooled dollar-reserve mechanism, a theoretical backstop designed to reduce reliance on Federal Reserve swap lines if political pressure escalates under Trump.

This isn’t a replacement for the Fed’s balance sheet, even pooled, Europe can’t replicate the Fed’s infinite-issuer advantage, but the conversations themselves signal the growing perception of political risk embedded in dollar liquidity architecture.

The talks reportedly intensified after Trump’s April “Liberation Day” tariffs rattled global funding markets.

Internal analysis suggests pooled reserves could only absorb localized funding stress, not broad contagion. But the fact the idea is circulating among stability officials tells you where sovereign risk teams are directing attention into 2026: the safety premium around USD funding is no longer assumed to be policy-neutral.

Meanwhile, the cyber front delivered its own volatility input.

Anthropic confirmed China-linked operators used Claude to automate 80–90% of an intrusion campaign, stitching reconnaissance, credential harvesting, and data exfiltration into a semi-autonomous attack loop with only light human oversight.

Thirty targets probed, four breaches landed before shutdown.

For traders, the edge isn’t the headline, it’s the direction: state-linked actors are scaling attack surface faster than corporate defenses are scaling detection. Cyber-risk premia, insurance pricing, and the cost-of-capital for exposed sectors all move off this trajectory.

The geopolitical tape is tilting toward digital conflict and liquidity fragmentation: two domains that eventually force repricing.

From Our Partners

President Trump Just Privatized The U.S. Dollar

A controversial new law (S.1582) just gave a small group of private companies legal authority to create a new form of government-authorized money.

Today, I can reveal how to use this new money… why it's set to make early investors' fortunes, and what to do before the wealth transfer begins on November 18 if you want to profit.

FEDERAL FOCUS

California drove the domestic tape today by drawing two very clear policy lines that matter more for markets than the politics themselves.

The Trump administration’s effort to reopen offshore drilling along the California coast immediately hit a structural wall.

Gov. Gavin Newsom, who surprised the industry this year by allowing 20,000 new onshore permits in Kern County, rejected offshore expansion outright.

That stance isn’t rhetorical; nearly three-quarters of Californians oppose offshore drilling, and sub-$60 crude makes decade-long projects effectively unfinanceable under that political regime.

For traders, the significance is simple: the West Coast remains structurally short domestic crude. That keeps refining margins volatile, preserves dependence on Alaska and imports, and limits any long-term relief for California gasoline spreads.

The second story hit a completely different part of the macro map.

A union-backed ballot initiative is moving toward a one-time 5% tax on billionaire net worth, aimed at raising $100 billion to backfill Medicaid cuts. Newsom opposes it, moderates warn of capital flight, and tech founders are already signaling they’d leave the state if it passes.

But the measure taps into a real political undercurrent as California wrestles with the highest cost-adjusted poverty rate in the country.

U.S. MARKETS CLOSE

From Our Partners

The Hidden Pattern Behind Wall Street’s Euphoria

The market’s on fire—new highs, wild swings, everyone chasing the next breakout.

But while the crowd’s distracted, there’s a pattern quietly driving the market’s overnight moves. I saw it firsthand at a trillion-dollar Wall Street firm—and it’s been driving market flow for years.

Now, traders in the know are using it for overnight setups that can hit before lunch. The window opens at 3:45 PM… and it closes fast.

CLOSING CALL

The market finally exhaled, and it wasn’t a calming breath. Thursday’s pullback didn’t break anything structurally, but it reset a tape that had been running ahead of its headlights.

With Washington officially back online, visibility should’ve improved. Instead, it exposed how much of the recent rally was built on narratives rather than data.

Tech led the unwind again. Nvidia, Broadcom, Tesla, all hit with decisive sellers as investors continue to recalibrate what “AI premium” actually means. One earnings stumble, and the index that broke records yesterday gave almost half a thousand points back.

What stood out wasn’t panic, it was preference. Cisco nearly tagging a 25-year high underscored the shift into old-guard tech with cash flow and clean balance sheets. Verizon caught a bid on planned job cuts. When the macro compass goes dim, defensive muscle memory kicks in.

FX and metals added their own texture: gold firmed, silver hit a record, and the Swiss franc strengthened after Trump suggested easing tariffs on Swiss goods, a niche lever, but meaningful enough to spark positioning.

Tomorrow is light, but the next session will tell you more than today did.