TQ Evening Briefing

Markets tried to celebrate Nvidia’s blowout earnings… and then remembered the bill for the AI boom is coming due. What began as a victory lap turned into a stress test.

After The Bell

The market opened like it wanted a clean rebound and closed like it realized it didn’t earn one.

Futures rallied after Nvidia delivered another blockbuster quarter, demand “off the charts,” and no hint of an AI cooldown.

For two hours after today’s open, the tape behaved like that was enough.

Then reality tapped the brakes.

Tech’s early surge evaporated as traders pivoted back to the same macro tension Nvidia couldn’t outrun: a still-firm labor market and a Fed that may sit tight in December.

The shutdown-delayed September jobs print landed right in the middle, feeding the “no urgency to cut” camp.

Sector boards told the rest of the story.

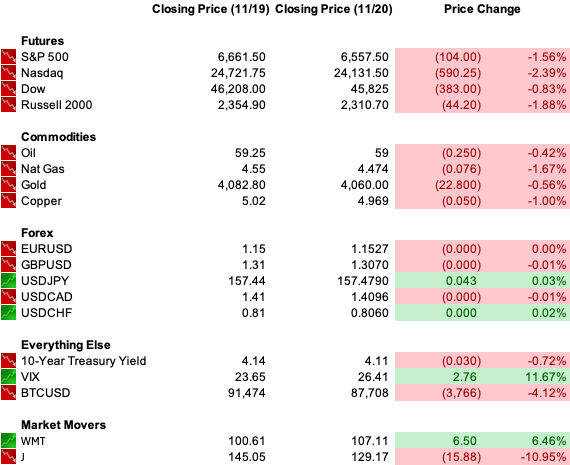

Mega-cap AI reversed hard, pulling the Nasdaq from +2.6% to -2.2%. Oracle, AMD, and Nvidia rolled over together, a reminder that the AI trade is now a single sentiment block.

Meanwhile, Walmart punched higher on guidance and carried consumer staples with it — the day’s only defensive lifeline.

Bitcoin slid under $90K again, crude softened, and staples outperformed as investors rotated toward balance-sheet sanity rather than growth-at-any-price.

Tomorrow brings retail earnings, global PMIs, and the early read on holiday demand.

The tone will hinge on one question: does the market believe Nvidia’s growth story more than it fears its cost structure?

Premier Feature

When the Fed Cuts, These Go First

The rate-cut rally is already taking shape — and our analysts just pinpointed 10 stocks most likely to lead it.

They’ve dug through every chart, sector, and earnings trend to find companies positioned for explosive upside once the Fed eases.

From AI innovators to dividend aristocrats, these are the names attracting billions in early institutional money.

Miss them now, and you’ll be chasing the rally later.

Monetary Pulse

The Fed’s clean read on December just got messier.

The minutes already showed a committee split three ways; today’s delayed September jobs release confirmed why the debate is drifting toward caution rather than conviction.

The headline looked fine on the first pass. Payrolls bounced back with a +119,000 gain in September… more than double expectations.

But the line the Fed cares about moved the other direction: unemployment edged up to 4.4%, the highest since 2021, as nearly half a million people returned to the labor force and only half found work.

It’s the kind of mixed print that weakens the narrative without breaking the trend, which is exactly why yields barely flinched.

What complicated the picture further was the admission that October’s report is gone entirely.

The minutes confirmed the divide. Many officials see no need to cut again this year, several want December left open, and Miran argued for a deeper move.

Without October’s labor read to tip the balance, markets leaned toward the “no rush” camp and lifted the odds of staying put.

Yields held their tone accordingly, reflecting a Fed that would rather avoid easing into a statistical blind spot.

Data-dependence gets trickier when the data forgets to show up and even the Fed’s data dependency is starting to need data.

The broader monetary takeaway hasn’t changed.

Liquidity conditions are stable, yields are range-bound, and any case for near-term easing now rests entirely on November’s numbers, which arrive too late to matter for December.

Markets will price that gap accordingly.

Federal Focus

The domestic tape pushed a different kind of risk premium today: political actors testing institutional lines just as markets are trying to rebuild visibility.

Trump’s very public clash with Marjorie Taylor Greene isn’t about personalities for traders, it’s about message discipline inside the GOP fracturing at the exact moment fiscal coordination will matter for 2026 budgets.

When affordability is the only political issue that reliably moves voter sentiment, a party distracted by internal policing generates the one thing markets hate: drift.

It keeps consumer-facing sectors exposed and narrows the odds of smooth stimulus or tax clarity next spring.

The CDC’s pivot toward RFK Jr.’s vaccine stance adds a separate layer.

Whatever the science debate, markets trade the trust component.

When a core federal health agency signals a break from evidence-heavy consensus, insurers price more uncertainty, hospitals prepare for uneven guidance, and employers reassess absentee-risk assumptions heading into winter.

It’s a small shift with a wide footprint.

And Trump’s call to arrest Democrats over their “illegal orders” video raised the regulatory-risk flag again.

Not because arrests are likely, but because the rhetoric reinforces what desks are already modeling: agencies don’t have a stable planning horizon.

That’s how political noise becomes macro noise—small escalations that widen tail risks on regulation, defense procurement, and federal contracting.

Domestic politics didn’t shock markets today, but it tightened the bandwidth they’re trading inside.

From Our Partners

Apple’s Starlink Update Sparks Huge Earning Opportunity

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone hit 50M+ users even before global satellite coverage.

With SpaceX eliminating "dead zones", Mode's earning technology can now reach billions more, putting them a step closer to potential IPO.

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors.

The World Tape

Washington spent the day tightening two pressure points in the Middle East at once.

The U.S. moved ahead with plans to sell F-35s to Saudi Arabia, but only in a dialed-down configuration that preserves Israel’s legal military edge. Riyadh gets the airframe; Israel keeps the advantage.

The message underneath is simple: Washington wants regional normalization, but it won’t rebalance the security hierarchy to get it.

Defense traders read it the same way… cooperation moves forward, but capability gaps stay wide enough to limit the risk premium.

That matters because Iran is trying to use that same U.S.–Saudi alignment as a diplomatic lever.

Tehran quietly asked Riyadh to reopen the nuclear channel with Washington, signaling how worried it is about another Israeli strike and how strained its economy has become.

Saudi Arabia is willing to play mediator, partly because its own nuclear ambitions require Washington’s blessing.

The region’s political liquidity runs through one gatekeeper, and that gatekeeper isn’t Oman or Qatar anymore.

Ukraine sits on the other end of the geopolitical ledger.

Zelenskiy received a U.S. draft peace plan that includes painful concessions and expects to hash it out with Trump soon.

Europe is already signaling resistance.

Markets only take one thing from this: the world’s frozen conflicts aren’t thawing, they’re trading hands.

Great-power diplomacy now assumes everyone wants peace, just preferably on their own terms.

U.S. Markets Close

From Our Partners

4 Stocks Poised to Lead the Year-End Market Rally

The S&P 500 just logged its best September in 15 years — and momentum carried through October, pushing stocks to multi-month highs.

Cooling inflation, strong earnings, and rising bets on more Fed rate cuts are fueling the move.

But this rebound isn’t broad-based — it’s being driven by energy, manufacturing, and defense sectors thriving under new U.S. policy and global supply shifts.

That’s why our analysts just released a brand-new FREE report featuring 4 stocks we believe are best positioned to benefit as these trends accelerate into year-end.

Closing Call

Today was the kind of session that tells you where the real stress lives.

Nvidia proved AI demand isn’t slowing, yet the market still sold it… not because the numbers disappointed, but because valuations no longer get the benefit of the doubt when the Fed’s next move is drifting out of reach.

The jobs data didn’t break anything, but it pulled December rate-cut hopes below 40% and forced traders back into a familiar posture: managing risk, not chasing upside.

Defensive flows won the afternoon, growth names lost altitude, and volatility re-priced higher even without a macro shock.

Tomorrow won’t reset that mood, but it will sharpen it.

Retail earnings, early holiday signals, and the shifting rate path will determine whether today was a shakeout… or the start of a broader rotation.

The rally didn’t die today, it just remembered it has to earn its keep