TQ Evening Briefing

Late-cycle markets didn’t flinch. Rules enforced boundaries, capital stayed deployed, and uncertainty was carried methodically rather than traded emotionally.

MARKET STATE

Risk Is Being Reduced Without Being Removed

This was not a liquidation. It was a leverage reset.

Equities eased lower into the close, extending early-session pressure without accelerating it.

The decline stayed contained, directional but controlled.

More importantly, it stayed isolated.

The real adjustment happened where constraints tightened.

Credit stayed calm. Rates remained orderly.

Volatility lifted, but only modestly, and remained pinned near the lower end of the year’s range.

When markets absorb sharp moves in a single pocket without destabilizing funding, duration, or broader risk, the message is not fear.

It’s enforcement of discipline.

Rules changed. Positions adjusted. The system held.

This is how deleveraging looks when it’s supervised rather than forced.

Risk is being reduced where tolerance narrowed, not removed from the system.

Capital is still present, but it’s being managed more tightly as year-end approaches and liquidity thins.

This is not a market losing confidence.

It’s a market enforcing boundaries.

Premier Feature

The Greatest Stock Story Ever?

I had to share this today.

A strange new “wonder material” just shattered two world records — and the company behind it is suddenly partnering with some of the biggest names in tech.

We’re talking Samsung, LG, Lenovo, Dell, Xiaomi… and Nvidia.

Nvidia is already racing to deploy this technology inside its new AI super-factories.

Why the urgency?

Because this breakthrough could become critical to the next phase of AI. And if any tiny stock has the potential to repeat Nvidia’s 35,600% climb, this might be it.

WHAT’S ACTUALLY MOVING MARKETS

The Map Is Starting to Price In

Japan isn’t being discussed as a political ally anymore, it’s being discussed as terrain.

Bases, missile reach, refueling windows, island chains.

When markets start absorbing geography instead of rhetoric, positioning changes quietly.

You don’t see panic.

You see preference.

Capital drifts toward preparedness, redundancy, and assets that function when surprise disappears.

Over time, that bias reshapes portfolio construction:

Longer-duration defense exposure, infrastructure-linked supply chains, and insurance assets gain structural relevance, while pure growth narratives face a higher burden of proof.

Diplomacy Is Stretching the Timeline, Not Closing It.

Ukraine talks are advancing on paper while remaining unresolved where it counts.

Security guarantees are still mismatched, territorial questions untouched, and escalation risk remains one-sided.

This is uncertainty being carried forward, not discounted away.

Markets respond by normalizing friction as a background condition.

That favors assets designed to absorb ambiguity, keeps volatility structurally suppressed, and encourages continuous hedging rather than episodic repositioning tied to headlines.

Equity Softness Is About Placement, Not Belief.

There’s no narrative break, just exposure being adjusted into the close of a strong year.

Energy holding firm and defensives quietly outperforming tell the story.

Participation remains selective.

Returns concentrate where balance sheets, cash flow, and policy tolerance intersect…

while momentum-only trades face tighter supervision into the next quarter.

From Our Partners

This Is What Smart Crypto Investors Buy During Panics

While the crowd panics and dumps, a smaller group of investors quietly buys bargains. The result: altcoins are trading at steep discounts — even as fundamentals begin improving in the background.

This isn’t hype. It’s a classic buy-low setup that has historically rewarded patient investors — and opportunities like this don’t come around often.

The Crypto Retirement Blueprint shows how to identify the coins with the potential for outsized gains — even if you start small.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

TAPE & FLOW

Orderly, Selective, and Rule-Driven

The session was shaped by restraint, not stress.

Decliners outpaced advancers, but the damage stayed localized.

Pullbacks concentrated where positioning had become extended, not where conviction failed.

Materials rolled as precious-metal miners tracked the bullion unwind, while energy quietly led, holding gains without drawing attention.

Mega-cap tech softened at the margin.

None of it disrupted the structure.

It simply reminded the tape that upside at these levels requires patience, not pursuit.

Rates stayed composed.

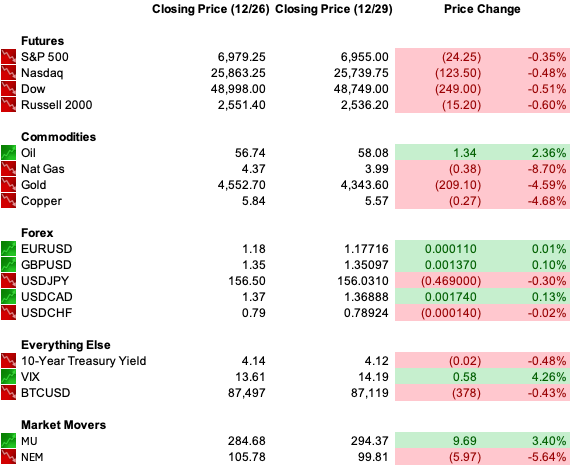

The 10-year drifted near 4.12%, consistent with steady policy expectations and absent any growth or duration anxiety.

Volatility nudged higher but remained compressed.

Credit stayed calm.

Liquidity is thin, which amplifies mechanical moves, but the market’s ability to absorb them hasn’t degraded.

This is late-December tape: orderly, selective, and rule-driven.

Flows are doing the work.

Momentum is being supervised.

Risk is still present, just carefully carried.

POWER & POLICY

Calibration of Credibility: Governance Risk Is the Quiet Variable

Rates continue to anchor the system.

Treasuries stayed orderly, curves behaved, and nothing in duration suggested a loss of control.

The signal wasn’t about where policy goes next.

It was about who governs the path and how insulated that process remains.

Not by pricing error, but by re-weighting credibility.

Globally, policy remains uneven.

Japan’s tightening pressure continues to leak into duration markets, creating friction without instability.

The system isn’t resisting it.

It’s absorbing it.

On the geopolitical front, diplomacy is stretching rather than snapping.

Trump’s follow-up call with Putin kept negotiations alive even as accusations resurfaced.

Kyiv is preparing broader coordination with U.S. and European security officials ahead of January talks.

The timeline is extending.

Resolution is deferred.

Markets are treating uncertainty as something to carry, not escape.

From Our Partners

Nvidia’s Secret Partner... This Is The New AI Chip Powerhouse

I bet you've never heard of it... but this newly public company is set to become key to Nvidia’s seat on the AI throne. And for now... you can get in while it's still cheap.

ONE LEVEL DEEPER

When Leverage Meets Governance

Low volatility doesn’t mean nothing is happening.

It means rules are doing the work.

Silver’s sharp decline, the largest in years, occurred without contagion.

Margin constraints forced mechanical deleveraging.

Valuation discipline cooled momentum trades.

Constraint tightened, but confidence didn’t fracture.

With indexes on track for a third straight annual gain and one of the longest monthly winning streaks in decades, preservation matters more than acceleration.

Late-cycle markets don’t unravel when stories change.

They recalibrate when governance asserts itself.

Risk remains on.

But it’s conditional now, sized, supervised, and priced with discipline.

U.S. MARKETS CLOSE

THE CLOSE

Supervising the Future

This was not a market rejecting risk.

It was a market supervising it.

Exposure remains in place, but it is being held more carefully.

Leverage is being extracted from trades that ran too far, too fast.

Geopolitics is adding baseline friction without forcing wholesale repositioning.

As year-end approaches and liquidity thins further, the dominant behavior is not aggression or fear.

It is discipline.

Capital stayed deployed.

Valuations got watched.

Rules got enforced.

That posture tends to persist until something—data, policy, or catalysts—forces a different decision.

And today, nothing did.