TQ Evening Briefing

The new month is already testing risk appetite, with bitcoin volatility, uneven tech flows, and shifting rate expectations steering markets off balance.

After The Bell

Markets steadied on Tuesday, clawing back some of Monday’s tech-and-crypto–led selloff.

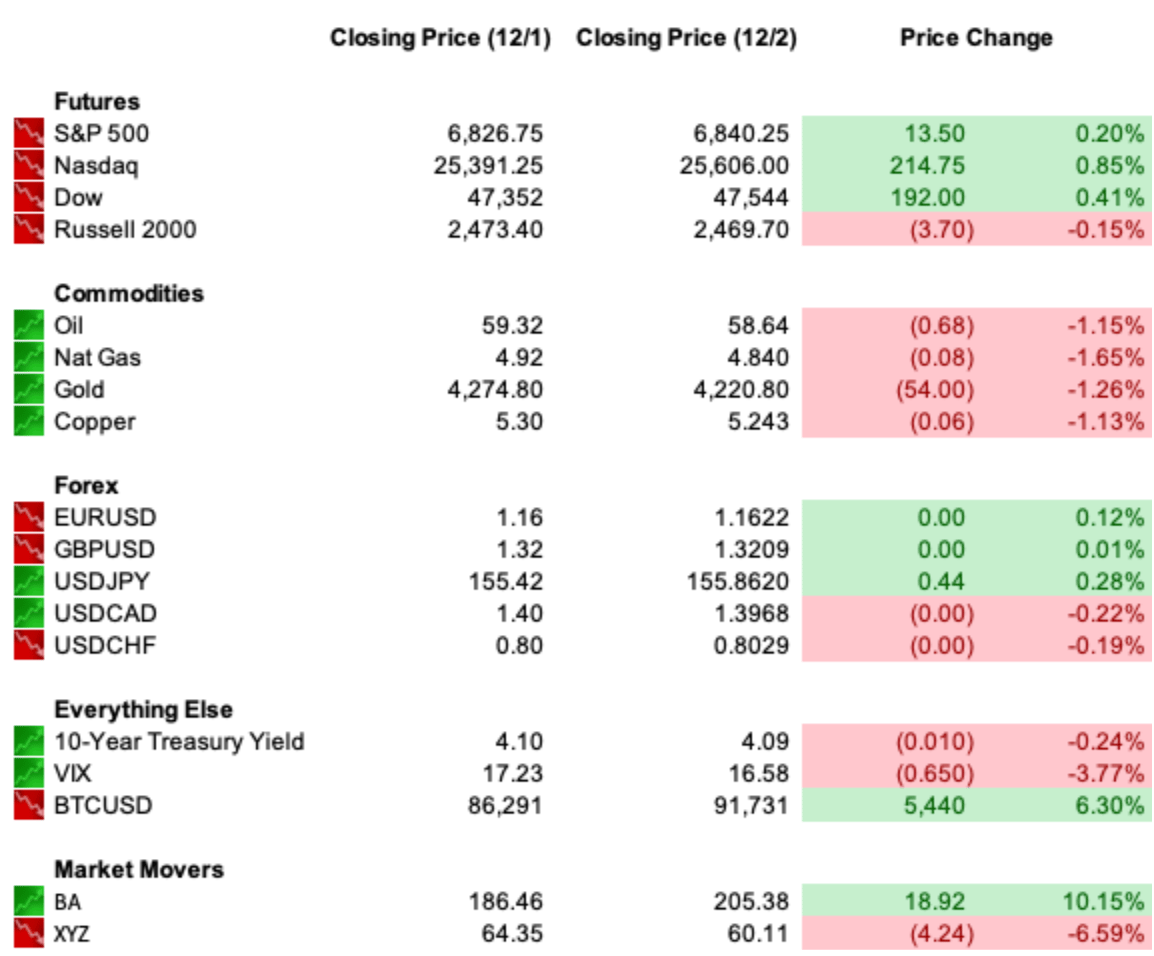

The S&P 500 closed +0.3%, Nasdaq +0.6%, and the Dow +0.3%, helped by a sharp rebound in bitcoin and renewed strength in AI-linked names.

Bitcoin surged ~7%, reclaiming $90K+, which pulled crypto-adjacent equities off the mat: Coinbase, Robinhood, and Strategy all bounced after heavy drawdowns yesterday.

Tech reclaimed leadership.

Nvidia added 1%, Credo Technology ripped 12% to fresh highs on standout earnings, and Apple notched another 52-week high.

Across the S&P, nine names hit new highs, including Applied Materials, Intel, Prologis, and Synchrony.

Industrials joined the rebound.

Boeing jumped ~10%, its best session since April, after guiding to higher 2026 deliveries.

EV-adjacent plays followed, with Beta Technologies +9% on a long-term supply deal with Eve Air Mobility.

Rates markets were quieter.

The 10-year held near 4.09%, as investors continued pricing in an 87–89% probability of a Fed cut on Dec. 10, now the week’s dominant macro anchor.

Commodities were mixed: oil held its modest rebound, copper remained supported by U.S. production headlines, and gold stayed range-bound.

On the data front, the calendar was light, but tariff-sensitive sectors continued to warn about labor cuts into 2026.

Tomorrow brings Marvell, CrowdStrike, and Okta earnings, with positioning already shifting ahead of ADP on Wednesday, jobless claims Thursday, and the delayed PCE on Friday.

Premier Feature

#1 Memecoin to Own Right Now

Two of our top analysts have done the impossible — they’ve consistently spotted memecoins before they exploded.

I’m talking gains like 8,200%... 4,915%... and 3,110%, all triggered by a proven system that’s delivered 20+ big wins.

Now they’ve uncovered a brand-new memecoin showing the same explosive signals — and it could be next.

That’s why we’re revealing the #1 Memecoin to Own Right Now (time-sensitive).

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Monetary Pulse

The bond market is quietly absorbing its next structural headwind: the AI build-out.

BlackRock’s shift underweight long Treasuries lands with weight because it frames AI not as a tech story, but as a financing story.

One that lifts issuance, fattens term premiums, and makes “lower for longer” an outdated instinct.

When the world’s largest asset manager says the long end needs a higher clearing yield, duration allocators listen.

Meanwhile, the consumer refuses to blink.

Cyber Week’s $44B haul shows households are still price-sensitive but far from retrenching.

Strong demand supports risk assets and Q4 earnings, but it also keeps the disinflation path bumpy… exactly the kind of backdrop that keeps the Fed patient even with December’s cut nearly priced in.

Yields barely moved.

The 10-year hovering near 4.08%, front-end odds implying an 89% chance of easing next week.

But the stability masks the growing tension between a softening manufacturing cycle (ISM slipped again) and a still-resilient service economy fueled by spending.

The next catalysts are straightforward.

ADP, claims, and the long-delayed PCE print.

Together they’ll determine whether the Fed can cut beyond December, or whether strong demand and rising capex force markets to accept that the cost of capital isn’t done recalibrating.

Federal Focus

Washington opened the week by testing federal muscle across agencies, and the through-line is simple.

The administration is pressing its leverage harder, and everyone — states, courts, corporates — is recalculating risk.

The sharpest move came from USDA Secretary Brooke Rollins, who threatened to cut SNAP administrative funding to blue states refusing to hand over program data.

It’s a technical dispute with political voltage, but the market read is clearer: federal–state conflict over entitlement oversight often bleeds into budget timelines.

If this escalates, it adds another variable to an already-fragile appropriations picture heading into year-end, where shutdown fatigue has already increased policy-volatility premia.

That tension carried straight into Trump’s Cabinet meeting, where the administration faced growing bipartisan scrutiny over the “double-tap” boat strike.

Defense isn’t exactly a slow-beta sector, and expanded oversight, even if symbolic, can slow procurement and complicate timelines for contractors who rely on predictable authorizations.

One quip floated privately on the Street: nothing breaks a rally faster than Congress discovering the process.

And while all this unfolds, DOJ is reshaping the immigration bench by removing over 100 judges since January.

Operationally, that bottlenecks an already strained system. Economically, slower adjudications mean slower labor-force regularization, which feeds back into wage tightness narratives heading into 2026.

Federal power is moving more assertively, and markets are recalibrating where those frictions become economic.

The World Tape

Power politics is back on the tape, and this round carries real market implications.

Washington’s renewed push to force an endgame in Ukraine has Europe bracing for a settlement shaped less by security principles and more by great-power arithmetic.

Brussels fears the “ugly deal” scenario.

For markets, that’s future deficits, higher EU issuance, and a stickier geopolitical risk premium.

Moscow’s timing is calculated.

As U.S. envoy Steve Witkoff arrives, the Kremlin is amplifying claims of capturing Pokrovsk, the kind of battlefield narrative designed to raise Moscow’s leverage before talks.

Even if the reality is murkier, investors read it as a reminder that any negotiated pause may not reduce volatility; it may only shift it from the front line to the policy front.

In Asia, India’s fight with Apple over a mandated state-run cyber-tracking app is triggering a separate kind of friction.

Apple’s refusal to preload it sets up a standoff that could shape market access, compliance costs, and the broader playbook for how multinational tech navigates increasingly interventionist governments.

Sovereigns are asserting control, and markets are being reminded that politics can still move prices long before policy formally changes.

From Our Partners

On December 18th, a powerful new law signed by President Trump will trigger a radical shift in America’s money system...

When a small group of private companies — not the Fed — will perform a major mint of a new kind of money.

And those who act before this new system fully kicks in could see gains as high as 40X by 2032.

But those who fail to prepare will be blindsided by this sea change to the U.S. dollar.

U.S. Markets Close

From Our Partners

AMD-OpenAI Deal Reveals Hidden Opportunity With This Tech Darling

AMD soared 32% after partnering with OpenAI, but the real winners could be the companies turning the data that fuels AI into income.

That’s Mode Mobile, paying users for data and screen time, driving 32,481% growth and $325M+ in payouts to 50M+ users.

With Nasdaq ticker $MODE secured, accredited investors can still get pre-IPO shares at $0.50 – plus up to 120% bonus. Get in before the next AI wave hits.

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors.

Closing Call

The market broke the two-day skid, but not the pattern. Tuesday was less about conviction and more about undoing the worst of Monday’s unwind.

Crypto snapped back, AI found its footing, and dip buyers finally stepped into the industrials. It was a stabilizer, not a signal.

The tone into tomorrow hinges on two elements.

First, whether bitcoin’s rebound has real follow-through or simply resets positioning before the next volatility round.

Second, how traders reposition ahead of ADP, jobless claims, and Friday’s long-delayed PCE, the data trio that will decide whether the Fed’s near-90 percent cut odds hold or start to slip.

The tape wants a December rally. It just needs validation. Between now and the December 10 meeting, every print carries more weight than the move it produces.