TQ Evening Briefing

The rally held its footing. But the system tightened. Power and credibility moved from background assumptions to active pricing inputs.

MARKET STATE

Risk Held While The Market Redrew Its Guardrails

This session didn’t undo the morning setup.

It refined the conditions around it.

Risk assets stayed supported. AI leadership remained intact.

On the surface, nothing looked fragile.

Underneath, the market made its position clearer.

Growth is no longer being priced in an open field.

It’s being priced inside a narrowing system.

Power is political.

Credibility is conditional.

Policy is constraint.

Institutional credibility is no longer assumed.

Policy is showing up less as guidance and more as constraint.

That doesn’t end the rally.

It defines how expensive participation becomes.

This is why equities can remain constructive while hedges refuse to cheapen.

Capital is adapting to a regime where outcomes still matter, but pathways matter more.

The market is still willing to carry risk.

It just wants proof the system can withstand pressure without improvising the rules.

Premier Feature

The Fed Just Flipped the Switch — This Coin Could Benefit Most

The Fed is cutting rates. Liquidity is rising. The money printers are humming again—and historically, that’s when crypto prices move.

But not all coins benefit equally when liquidity floods the market. The biggest winners tend to have real fundamentals, real utility, and real adoption.

One altcoin stands out right now, with strong on-chain metrics, institutional-grade infrastructure, and a growing user base—yet it’s still trading at prices that look like a discount relative to where it could go.

When liquidity hits crypto, this is the type of coin that tends to move first.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

WHAT’S ACTUALLY MOVING MARKETS

Electricity Crossed From Input Into Constraint

The PJM intervention matters because it forces the AI buildout to absorb costs it has largely deferred.

Capacity pricing reached politically unacceptable levels, and the response wasn’t price smoothing or market patience.

It was administrative redesign.

Emergency procurement.

Accelerated generation timelines.

Direct cost assignment to hyperscalers.

That’s a structural pivot.

Electricity is no longer a background assumption. It’s becoming a gated resource.

Scale is no longer guaranteed by demand alone; it requires funding, permitting, and political tolerance.

This doesn’t cap the AI buildout.

It stratifies it.

The winners are no longer just the fastest growers.

They’re the players who can finance their own capacity and survive scrutiny when affordability collides with expansion.

That’s not bearish.

It’s selective by design.

Institutional Credibility Shifted From Free To Variable

Chair succession is no longer a distant personnel question. It’s a live distribution being priced in real time.

Hassett’s visibility and Warsh’s momentum matter not because of ideology, but because the market is reassessing how insulated the institution actually is.

Layer in the ongoing Powell probe, and credibility stops being binary. It becomes conditional.

At the same time, tariffs being framed explicitly as enforcement tools sends a broader signal: policy is becoming transactional.

Alignment carries benefits. Noncompliance carries cost.

Markets can trade through that.

But they don’t ignore it.

This is why hedges stayed firm even as risk held.

It’s not fear.

It’s recognition that governance volatility has returned as a tax on capital.

Credibility used to be free.

It now carries a premium.

EQUITIES IN FOCUS

Leadership Tightened Around Assets That Tolerate Friction

Equity leadership remained intact, but it narrowed with intent.

AI-linked names continued to lead because they sit upstream of demand and can justify capex even as system costs rise.

Semiconductors remain the cleanest expression of that logic.

Compute demand doesn’t vanish when constraints appear. It concentrates.

Banks held together because fundamentals are real.

But the sector still traded like confirmation, not propulsion.

Strong prints don’t expand multiples when rule stability is in question.

Anything dependent on institutional harmony to sustain valuation stayed capped.

That’s governance sensitivity.

Infrastructure-linked equities continued to earn their place because they operate where the system tightens, not where it assumes smooth flow.

JPMorgan’s new Private Capital Advisory and Solutions team is a signal.

Private capital is becoming the default path for companies that want funding and liquidity without IPO timing risk.

From Our Partners

DOGE Phase 2?

Musk's days in politics aren't over yet.

That's according to tech legend Jeff Brown, who believes Musk and Trump may be working on DOGE Phase 2…

And, this time, it could cause a $12 trillion market megashift.

If recent market swings caught you off guard…

TAPE & FLOW

A Functional Market That Refused To Get Loose

Flow stayed calm, but it wasn’t generous.

Rates behaved.

The dollar stayed anchored.

Volatility remained contained.

Every technical condition required for risk to function was present.

And yet, the tape never invited indiscriminate exposure.

This remains a market that filters rather than chases. Capital is underwriting systems, not stories.

Assets that can function through disruption without relying on institutional perfection continue to attract flow.

Those that can’t are capped, regardless of growth optics.

That’s why leadership stays narrow without breaking.

And why hedges stay bid without signaling stress.

The system is open.

But participation now comes with tolls.

That’s not bearish.

It’s disciplined.

POWER & POLICY

Enforcement Is Becoming The Dominant Policy Language

The unifying theme across today’s policy signals was intent.

Power markets weren’t nudged. They were restructured.

Trade tools weren’t softened. They were weaponized.

Institutional credibility wasn’t reaffirmed. It was debated publicly.

This isn’t about a single administration or headline. It reflects a broader shift toward enforcement-driven governance.

Rules still exist, but compliance now carries explicit consequences.

For markets, that changes how risk is priced. Not because outcomes deteriorate, but because pathways narrow.

The Fed narrative shows how quickly credibility can be repriced.

Tariffs show how economic tools migrate into leverage.

None of this shuts markets down.

But it raises the bar for participation.

From Our Partners

Wall Street’s Biggest Trades Don’t Show Up on Your Screen

Open any popular stock and look at Level 2 data.

You’ll see small buy and sell orders—100 shares here, 200 there.

Looks harmless.

But those trades can be “iceberg orders,” where institutions quietly buy millions of shares beneath the surface using dark pools. By the time the price moves on public charts, whales may already be up—and late traders are chasing.

That’s why TradeAlgo built a proprietary dark-pool scanner tied to real-time SMS alerts.

When unusual volume hits, you get the ticker instantly.

It’s free to join.

ONE LEVEL DEEPER

Authority Reentered The Pricing Equation

What today reinforced is that authority is no longer abstract.

For years, markets assumed institutions would absorb stress quietly.

That assumption is weakening.

Growth can still exist in that environment.

But it doesn’t get a free pass.

Capital will continue to flow, but it will favor systems with redundancy, control, and resilience.

That’s why constraint assets lead.

That’s why hedges stay sticky.

That’s why rallies survive without broadening.

The market isn’t scared.

It’s relearning how to price power.

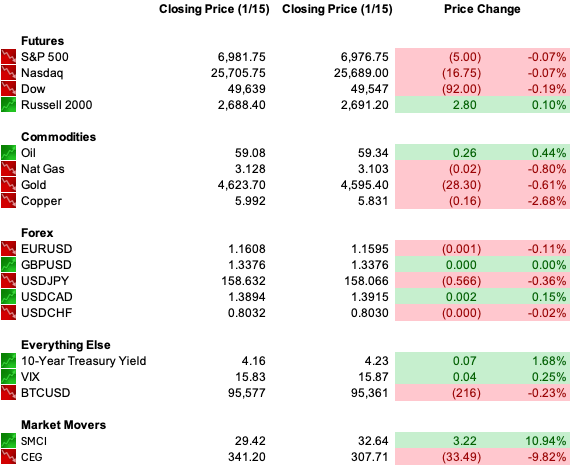

U.S. MARKETS CLOSE

THE CLOSE

The rally didn’t fail today.

It defined its cost.

Growth is still being bought.

AI still leads.

But power access, institutional credibility, and enforcement risk are no longer background noise.

They’re explicit inputs.

The tape didn’t roll over.

But the market raised the admission price.

The edge is identifying who can still scale when the terms tighten.