TQ Evening Briefing

The Index Can Print New Highs, but the Market is Still Deciding How Much Risk it Wants to Carry

MARKET STATE

Records were set again, yet conviction remained absent.

This is a year-end tape, defined less by discovery than by restraint.

Not fear.

Not euphoria.

The market showed it clearly.

That pattern reflects positioning already in place, with no new catalyst forcing capital to reallocate.

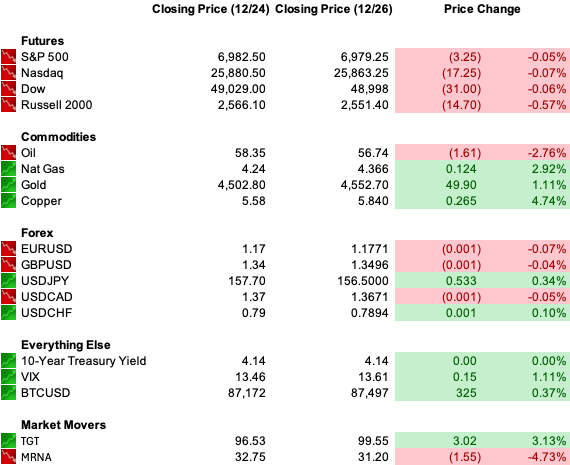

The Dow stayed modestly lower.

The Nasdaq hovered near unchanged.

This is what low-information sessions look like when liquidity returns but urgency does not.

The more instructive signal remains off the index.

Metals continue to extend higher, drawing incremental flows even as equities hold altitude.

Stocks are stable at elevation, but the stronger bid remains for protection.

That posture says more about how investors are thinking about 2026 than today’s record print ever could.

Premier Feature

Nvidia’s Secret Partner... This Is The New AI Chip Powerhouse

I bet you've never heard of it... but this newly public company is set to become key to Nvidia’s seat on the AI throne. And for now... you can get in while it's still cheap.

WHAT’S ACTUALLY MOVING MARKETS

Metals Are Leading Because Insurance Is Being Repriced

Precious metals extended higher again in thin holiday conditions, but the persistence of the move matters more than the velocity.

yet the tape continues to accept higher prices without equity stress.

That combination is important.

This is not an equity panic hedge.

It’s a currency and credibility hedge.

A softer dollar and light liquidity help, but they don’t explain why capital keeps paying up for protection while risk assets hold near records.

When insurance leads alongside stable equities, it usually signals investors are staying invested while actively managing uncertainty rather than reducing exposure.

Index Strength Is Not Being Confirmed Beneath the Surface

The S&P 500 can make new highs with narrow leadership, and today was another example.

Decliners outpaced advancers, and the Nasdaq continued to show a mix of new highs and new lows.

That internal split matters.

It points to rotation, not expansion.

This is not breakdown behavior, but it is selective participation.

The index looks calm because weight is concentrated, not because risk appetite is broadening.

AI Is Splitting Into Economics, Not Narratives

The market is no longer trading AI as a single story.

As 2026 approaches, investors are separating infrastructure spenders from cash-flow recipients.

Balance-sheet capacity, funding durability, and return profiles are beginning to matter more than adoption headlines.

That differentiation is how bull markets mature without collapsing.

Leadership changes, even when the index doesn’t.

Energy Is Losing Its Premium Today

Oil sold off as surplus expectations regained volume.

Peace-process headlines matter at the margin, but the dominant input is arithmetic.

Supply is expected to exceed demand, and geopolitical risk has not been enough to offset that imbalance.

Enforcement risk remains real.

But today’s price action says the surplus narrative is louder.

From Our Partners

Legendary Wall Street Stockpicker Names #1 Stock of 2026

The legendary stockpicker who built one of Wall Street’s most popular buying indicators just announced the #1 stock to buy for 2026.

His last recommendations shot up 100% and 160%.

Now for a limited time, he’s sharing this new recommendation live on-camera, completely free of charge. It’s not NVDA, AMZN, TSLA, or any stock you’d likely recognize.

TAPE & FLOW

Price Action Stayed Elevated, but Conviction Didn’t Travel with It

Price action stayed elevated, but conviction didn’t travel with it.

Markets noticed a familiar year-end pattern where strength shows up as drift rather than extension.

This is what markets look like when exposure is already in place and there’s little incentive to press it further.

Index dispersion reinforces that read.

The Dow finished modestly lower while the Nasdaq held slightly higher, leaving the tape directionless at the surface even as volatility ticked up marginally from compressed levels.

Nothing here signals stress.

But nothing signals urgency either.

Volume tells the same story.

Trading was light, though not absent, and the absence of volume expansion matters.

Price stability without participation usually reflects comfort, not new risk-taking.

Capital is holding ground, not reallocating aggressively.

Sector behavior adds clarity.

Technology continues to do the lifting, with materials also firm, while most other groups faded.

That imbalance keeps the index supported while internals remain mixed.

This is maintenance, not accumulation.

Single-name flows were more revealing than sectors.

Nvidia advanced on deal headlines…

highlighting how the market is differentiating execution credibility within the same theme.

Target’s move on activist interest fits the late-December playbook, where idiosyncratic repricing works better than macro narratives.

Bitcoin softened while other assets held steady, reinforcing that capital remains selective and confirmation-dependent.

Across markets, the message is consistent.

Risk is still being carried.

Follow-through remains limited.

And protection continues to be valued alongside exposure.

POWER & POLICY

This Tape Is Not Responding to News, It’s Responding to Authority

This tape is not responding to news.

It’s responding to authority.

Markets are navigating an environment where policy paths are no longer moving together and credibility has become an active variable rather than a background assumption.

With liquidity thinning, positioning doing most of the work, and the calendar compressing decision-making, even subtle shifts in governance matter more than headlines.

But elsewhere, the message is less forgiving.

Markets aren’t being guided.

They’re being managed.

When authority feels diffuse and enforcement shows up selectively, capital adapts by carrying exposure while demanding compensation for uncertainty.

That’s not defensive behavior.

It’s rational behavior in a system where policy outcomes matter less than policy reliability.

From Our Partners

The Greatest Stock Story Ever?

I had to share this today.

A strange new “wonder material” just shattered two world records — and the company behind it is suddenly partnering with some of the biggest names in tech.

We’re talking Samsung, LG, Lenovo, Dell, Xiaomi… and Nvidia.

Nvidia is already racing to deploy this technology inside its new AI super-factories.

Why the urgency?

Because this breakthrough could become critical to the next phase of AI. And if any tiny stock has the potential to repeat Nvidia’s 35,600% climb, this might be it.

ONE LEVEL DEEPER

How Late-Cycle Markets Protect Themselves Without Capitulating

This is how late-cycle markets protect themselves without capitulating.

Index strength is being sustained by stability, not expansion.

Leadership is narrowing.

Participation is thinning.

Insurance continues to work even as volatility remains compressed.

That combination is not accidental.

It’s intentional.

When the market believes uncertainty will persist rather than resolve, it chooses dispersion over direction.

It rotates internally.

It favors resilience over reach.

And it allows prices to drift higher without rewarding aggression.

This doesn’t mark an end.

It marks a transition.

If 2026 begins with uneven leadership, selective conviction, and assets priced more for durability than upside, this is where that structure starts.

Not in today’s highs, but in today’s restraint.

U.S. MARKETS CLOSE

THE CLOSE

A Market Choosing Control Over Conviction

The market offered another record.

It withheld confirmation.

Equities are stable, but leadership remains selective.

Volatility is quiet, but not absent.

Insurance continues to outperform confidence trades.

This is not a rally built on belief.

It’s a market choosing control over conviction.

Risk is still on.

But it’s being carried carefully.

That posture doesn’t disappear overnight.

It persists, until something forces a decision.

And today, nothing did.