TQ Evening Briefing

The first session of 2026 showed where conviction still lives, and where patience has expired.

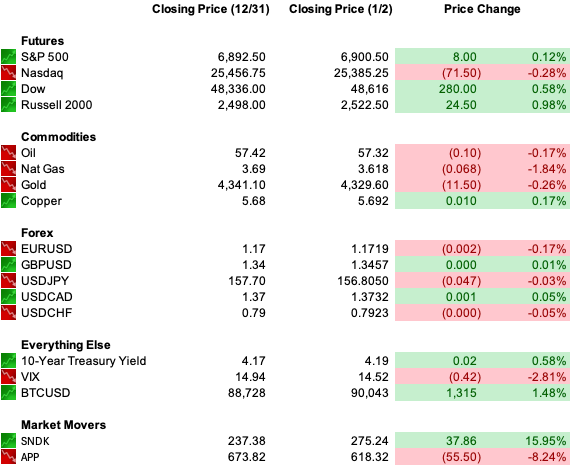

MARKET STATE

Risk Reopens With Familiar Leadership

The first session of 2026 didn’t introduce a new regime.

It reaffirmed the existing one.

Technology led again, anchored by AI infrastructure, while broader participation stayed measured.

Early strength met supply quickly, not because conviction failed, but because positioning was already set.

The Dow found support in industrials and value-linked exposure.

The S&P oscillated without urgency.

The Nasdaq struggled to extend as leadership narrowed rather than rotated.

This was not indecision.

It was calibration.

Markets remain willing to hold risk, but only where visibility still clears.

Elsewhere, capital is cautious about paying up without confirmation.

Liquidity is improving, but appetite is gated.

That combination matters early in the year.

This is a market that understands its own boundaries.

It will engage selectively, defend gains aggressively, and wait for data or policy to justify repricing.

The structure held.

The details now matter.

Premier Feature

Whales Are Buying the Dip — Retail Is Panicking

When markets turn red, retail investors sell first.

But on-chain data shows crypto whales are doing the opposite — quietly accumulating millions during the recent pullback.

These aren’t guesses. We’re seeing multiple eight-figure buys show up on-chain.

Whales understand something most don’t: crashes are temporary. Fundamentals aren’t.

Right now, one crypto is seeing unusual whale accumulation, signaling smart money positioning before the next leg higher.

Our team has followed similar setups before — including moves that led to 8,600%, 3,500%, and 1,700%+ gains.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

WHAT’S ACTUALLY MOVING MARKETS

AI Infrastructure Still Clears Capital Budgets

Semiconductors carried the session because funding visibility remains intact.

The rally across memory, logic, and equipment names reflected budgets already approved, contracted demand, and buildouts already underway.

That distinction keeps infrastructure exposure bid even as broader growth struggles to follow.

AI is no longer being priced as optional upside.

It’s being treated as operating necessity.

Software told the opposite story.

Pressure persisted across platforms and high-multiple names where AI benefits remain harder to quantify in margins.

The market is no longer paying in advance for operating leverage that hasn’t shown up.

Cost structures, pricing power, and earnings durability now matter more than adoption headlines.

Capacity, returns, and balance sheet tolerance are.

Leadership remains intact, but expansion is no longer automatic.

Tesla Forces Separation Between Vision And Funding

Tesla functioned as a macro proxy rather than a single-name story.

This wasn’t a rejection of long-term ambition.

It was a reminder that transformation narratives still require cash flow to finance them.

Tesla remains valued on future platforms, but the market is reasserting that present operations matter more when policy support fades.

BYD overtaking Tesla in global EV sales mattered less symbolically than structurally.

Scale, cost curves, and manufacturing discipline are now decisive variables again.

Subsidies are no longer masking execution gaps.

That reframes the trade.

Tesla is still an AI and robotics story, but the path between here and there is being scrutinized more tightly.

The market isn’t exiting the story.

It’s compressing the timeline premium.

Policy Clarity Rewards Cash Flow, Not Growth Hope

Tariff relief produced one of the clearest reactions of the session.

Not because demand improved, but because friction was removed.

That distinction is important.

Markets are rewarding certainty more than imagination.

Reduced policy uncertainty improves cash flow visibility, and that alone is enough to attract capital in this environment.

The reaction was immediate, contained, and rational.

The same logic showed up overseas.

The FTSE 100 crossed 10,000 without AI leadership.

Banks, miners, defense, and healthcare did the work.

Cheap, cash-generating assets responded to governance visibility.

This is not a growth renaissance.

It’s a clarity premium.

Assets that benefit from reduced policy risk are being repriced quietly, while those reliant on optimism are being forced to wait.

Capital is choosing durability over reach.

From Our Partners

Trump's $250,000/Month Secret Exposed

While President Trump's official salary is $400,000 per year... his tax returns reveal he's been collecting up to $250,000 PER MONTH from one hidden source.

Until recently, most Americans couldn't touch the type of investment that makes up this investment. But thanks to Executive Order 14330, that just changed.

If you love investing in disruptive new companies... Discover how to invest in the fund Trump uses to collect this income >>

TAPE & FLOW

Risk Is On, But Narrow

Flow dynamics reinforced restraint rather than enthusiasm.

Breadth improved gradually through the session, with equal-weight indexes outperforming cap-weighted benchmarks.

Rates stayed controlled.

The 10-year Treasury drifted higher but remained firmly rangebound, signaling stability rather than duration stress.

Credit spreads stayed calm.

Volatility ticked up briefly, then settled back into compression.

Margin adjustments flushed leverage, not conviction.

The trade compressed without breaking.

Bitcoin reclaimed the 90,000 level quietly, without leverage spikes or speculative follow-through.

Across assets, coherence held.

Risk remained present, but selectively carried.

Pullbacks concentrated where valuation, leverage, or positioning had stretched too far.

Elsewhere, prices stabilized quickly.

This is late-cycle tape behavior.

Flows matter more than narratives.

Rules matter more than momentum.

Nothing here suggests disorder.

It suggests supervision.

Capital is still deployed, but it’s being managed with discipline rather than urgency.

The tape is not confused.

It is enforcing boundaries.

POWER & POLICY

Geopolitical headlines intensified.

Markets barely reacted.

U.S.–Iran rhetoric escalated.

Venezuela reopened energy dialogue.

Middle East tensions lingered.

Geopolitics has become a background variable rather than a volatility trigger.

Markets are treating it as duration risk, not shock risk.

Governance is where attention is quietly shifting.

Treasury yields edged higher.

Focus is moving toward institutional credibility rather than immediate policy action.

Federal Reserve leadership transitions are approaching.

Fiscal math remains unresolved.

Policy continuity matters more than direction.

Markets aren’t pricing a mistake.

They’re pricing process.

That distinction is critical.

These are not panic hedges or crisis trades.

They are duration adjustments based on confidence in governance.

Globally, policy paths remain fragmented.

Japan’s tightening pressure continues to leak into duration markets, creating friction without instability.

Markets are absorbing it rather than resisting it.

The system isn’t breaking under policy weight.

It’s adjusting exposure to reflect how long uncertainty may persist.

That posture favors assets with cash flow, visibility, and balance sheet resilience.

From Our Partners

President Trump Just Privatized The U.S. Dollar

A controversial new law (S.1582) just gave a small group of private companies legal authority to create a new form of government-authorized money.

Today, I can reveal how to use this new money… why it's set to make early investors' fortunes, and what to do before the wealth transfer begins on January 15th if you want to profit.

ONE LEVEL DEEPER

The AI trade has entered its constraint phase.

Demand isn’t the issue.

Capacity is.

Power interconnection timelines remain long.

Turbine supply is booked years out.

Data center infrastructure is capital-intensive and finite.

That reality reshapes leadership.

It favors semiconductors tied to funded projects.

Infrastructure providers with contracted demand.

Companies with balance sheet durability.

It pressures narrative-driven software, unprofitable AI adjacencies, and models dependent on continuous capital access.

This is how late-cycle leadership evolves.

Momentum gives way to discipline.

Expansion slows, but durability improves.

AI isn’t ending.

It’s maturing.

Ownership will migrate from excitement to selectivity.

The winners won’t be the loudest stories.

They’ll be the ones that clear constraints quietly.

U.S. MARKETS CLOSE

THE CLOSE

The first session of 2026 didn’t demand new positioning.

It confirmed existing ones.

Risk reopened where it already had clearance.

Leadership held.

Boundaries stayed intact.

Capital remains deployed, but it is no longer paying for anticipation.

Visibility matters.

Cash flow matters.

Policy process matters.

This is not a market searching for direction.

It is enforcing standards.

The calendar moved forward.

The system didn’t.

2026 will reward exposure that clears constraint and punish stories that don’t.

The difference won’t be decided by narratives.

It will be decided by durability.