TQ Evening Briefing

Loan demand. Tech cracked. Policy friction quietly widened spreads.

MARKET STATE

Heat Was Contained, Friction Became Visible

The market didn’t de-risk today.

It re-sorted.

Liquidity remained open.

Volatility stayed cooperative.

Yet leadership narrowed and dispersion widened, which is how markets behave when growth is real but no longer frictionless.

The economy still looks hot.

Loan demand confirms it.

Retail activity hasn’t collapsed.

But the tape spent the session identifying where heat leaks out once constraints are applied.

Tech weakened.

Energy firmed. Metals stayed bid. Infrastructure refused to give ground.

This was not a verdict on growth. It was a reminder that growth now carries conditions.

Pricing power is being questioned.

Policy credibility is being debated in public.

Physical systems are showing stress points.

And geopolitics is no longer theoretical optionality.

The shift today was not directional.

It was mechanical.

Markets moved from celebrating throughput to auditing permission.

When that happens, capital doesn’t flee.

It becomes selective, slower, and far more demanding about where it compounds.

Premier Feature

Trump's $250,000/Month Secret Exposed

While President Trump's official salary is $400,000 per year... his tax returns reveal he's been collecting up to $250,000 PER MONTH from one hidden source.

Until recently, most Americans couldn't touch the type of investment that makes up this investment. But thanks to Executive Order 14330, that just changed.

If you love investing in disruptive new companies... Discover how to invest in the fund Trump uses to collect this income >>

WHAT’S ACTUALLY MOVING MARKETS

Bank Earnings Proved Demand, Not Valuation Freedom

Bank earnings confirmed the economy is still working.

Loan growth accelerated across the majors, with Bank of America expanding average loans roughly 8% year-over-year.

JPMorgan posted closer to 9% growth.

Credit demand remains intact, households are still spending, and corporate borrowing hasn’t stalled.

That is not recession math.

Yet the stocks failed to respond the way a normal cycle would reward them.

Financials traded heavy because the earnings question is no longer “can they earn,” but “under what rules.”

The 10% credit-card rate cap proposed by the administration is now embedded in the multiple.

JPMorgan CFO Jeremy Barnum warned on Tuesday that such directives would force the bank to "cut back significantly" on credit supply.

If spreads can be administratively compressed, banks don’t reprice with optimism… they reprice with caution.

Underwriting changes.

Credit availability becomes the adjustment valve.

Profitability turns conditional.

The tape is not worried about loan losses.

It’s worried about discretion.

Strong fundamentals can coexist with stagnant valuations when markets are forced to underwrite political optionality alongside balance sheets.

Tariff Pass-Through Turned From Theory Into Timing

The Beige Book shifted the inflation conversation forward.

Tariff costs are no longer stuck at the inventory layer.

Most districts reported firmer pricing dynamics, even as demand remains resilient.

That’s the problem for the hot-economy strategy.

Growth can run.

Credit can expand.

Rates can stay higher for longer.

But tariffs don’t respond to credibility narratives.

They show up in input costs regardless of intent.

Once pass-through begins, inflation stops being a forecast debate and becomes a sequencing problem.

The market doesn’t need CPI to reaccelerate sharply.

It only needs confirmation that inflation isn’t dead.

From here, the questions shift quickly.

How fast does this show up in CPI and PCE?

How tolerant does policy remain?

And how much political room exists if price pressure resurfaces while households already feel stretched?

That uncertainty quietly lifted term premium without breaking the tape.

Fed Messaging Split Introduced A Second Discount Rate

Fed independence traded today as a live variable.

The DOJ served the Federal Reserve with grand jury subpoenas regarding Chair Powell’s 2025 testimony on the $2.5 billion headquarters renovation.

Powell has called the investigation a "pretext" for the administration's attempt to force interest rate cuts.

Public defenses of Powell from global central banks clashed with internal minimization from some officials.

Markets care less about who’s right than what it implies.

When a central bank speaks with one voice, duration is easier to price.

When it doesn’t, term structure adjusts.

Independence becomes probabilistic.

Credibility stops being assumed.

That’s why the dollar lost some of its automatic hedge status.

That’s why metals stayed bid.

That’s why equity multiples stopped expanding.

This isn’t about the next meeting.

It’s about precedent.

If independence can be debated publicly without consequence, markets will charge for that uncertainty the same way they charge for inflation risk… quietly, persistently, and long before panic shows up in the headlines.

EQUITIES IN FOCUS

Dispersion Replaced Momentum As The Signal

Equity leadership fractured in a meaningful way.

Banks confirmed demand but traded like regulated assets.

Tech sold off as AI enthusiasm collided with pricing reality.

Software weakness wasn’t about earnings misses; it was about moat compression as agent-based workflows threaten subscription economics.

Cybersecurity dipped on China headlines, but the market largely dismissed revenue risk, reinforcing that this wasn’t geopolitical fear; it was valuation discipline.

Meanwhile, new 52-week highs clustered in old-economy durability: energy, defense, staples, and materials.

Exxon, Lockheed, Newmont, and BNY Mellon told the same story.

These are businesses that benefit when growth persists but permission tightens.

Infrastructure quietly held its ground.

The massive Verizon outage on January 14, which saw over 200,000 reports of "SOS mode" across the U.S., made the physical layer visible at exactly the wrong moment for abstract narratives.

Connectivity matters again.

Power matters again.

This wasn’t rotation for excitement.

It was rotation for survivability.

From Our Partners

Will Your Bank Be Affected By S.1582?

It authorizes a select group of companies to mint an entirely new form of government-authorized money.

The Treasury Department warns this shift could pull $6.6 trillion out of traditional banks… while Forbes calls it a $10 trillion opportunity.

Investors who make the right moves before January 15th could make up to 40X by 2032…

But those who fail to prepare will be blindsided by this sea change to the U.S. dollar.

TAPE & FLOW

Strong Systems, Higher Standards, Narrower Rewards

The tape stayed orderly for a reason.

There was no cascade selling, no credit event, and no volatility spike forcing repositioning.

Index losses reflected choice, not stress.

Capital rotated rather than fled, which is what functional markets do when constraints increase but growth remains intact.

Banks were the cleanest example.

Loan growth and net interest income validated economic momentum, yet stocks behaved as if profitability is now subject to review rather than reward.

That isn’t bearish.

It’s conditional.

Tech weakness followed a different logic.

Software sold off not because demand disappeared, but because pricing power is being renegotiated in real time.

If AI agents flatten interfaces and unbundle workflows, long-duration multiples deserve scrutiny.

The tape adjusted accordingly without drama.

Rates drifted.

The long end held onto premium.

Gold consolidated rather than surged.

Energy firmed as the U.S. and UK began evacuating personnel from Al Udeid Air Base in Qatar amid rising Iran tensions.

None of this signals fear.

It signals discipline.

Markets are no longer paying for narratives that require perfect execution and stable rules.

They are paying for assets that function under stress, tolerate interference, or sit upstream of political discretion.

That’s why dispersion widened.

That’s why leadership narrowed.

That’s why records can still print even as hedges stay bid.

This is not a broken market.

It’s a selective one.

POWER & POLICY

Authority Shifted From Background To Input

Policy is no longer an overlay.

It’s an input.

U.S. personnel movements, Iranian escalation signals, and execution rhetoric pulled probability mass into the tail without forcing immediate repricing.

That’s how option premiums rise quietly.

Greenland discussions added another layer.

Strategic minerals, infrastructure access, and geopolitical leverage are moving from abstract positioning to capital-linked negotiations.

Markets treat that as durable risk, not noise.

At home, the Fed remains the fulcrum.

Minneapolis Fed President Neel Kashkari noted today that it is "way too soon" to cut rates, despite political pressure.

This isn’t about dovishness or hawkishness.

It’s about legitimacy.

When authority is questioned, markets slow down.

They demand proof.

They shorten duration.

They prefer assets that don’t rely on smooth coordination between institutions.

That doesn’t break growth.

It taxes it.

The policy environment today didn’t shock markets.

It forced them to price friction — legal, political, and geopolitical — into assets that previously assumed clean execution.

That’s a higher hurdle, not a collapse signal.

From Our Partners

This Crypto Call Could Ruin My Reputation

I’ve never been more nervous to hit “send.”

What I’m about to share could destroy my standing in crypto.

Critics will say I’ve lost it. Some colleagues may walk away.

But I don’t care.

I uncovered something so important about the 2025 crypto market that I stopped everything and wrote a book about it — a roadmap to what I believe could be the biggest wealth opportunity of the decade.

The evidence is so strong, I’m giving the entire book away for free.

If I’m right, this will change how you see crypto forever.

ONE LEVEL DEEPER

Hot Economies Fail At The Margins First

The system is still working.

Loan growth is real. Earnings are printing. Consumers are spending.

Nothing today suggested imminent breakdown.

But markets rarely fail at the center.

They fail at the edges.

Policy discretion hits multiples before it hits earnings.

Geopolitical risk widens distributions long before barrels stop flowing.

That’s what today revealed.

The hot economy can run. The question is how tradable it remains.

When constraints leak into pricing, capital doesn’t panic.

It hedges.

It narrows leadership.

It demands resilience over aspiration.

That’s not fear. That’s preparation.

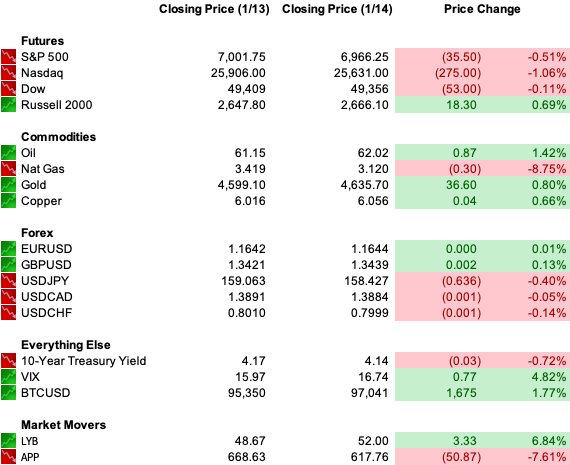

U.S. MARKETS CLOSE

THE CLOSE

Growth still works, but it isn’t free.

Today didn’t challenge the growth narrative.

It priced its conditions.

Banks proved demand.

Tariffs proved pressure.

Tech proved valuation matters again.

Policy proved credibility now carries a premium.

The tape didn’t break.

It charged a toll.

Markets are no longer trading outcomes as guaranteed.

They’re trading the stability of the systems that produce them.

That keeps volatility contained, leadership narrow, and discipline high.

This is how late-cycle strength looks when constraints return.

If you understand that, you don’t need to chase noise.

You just need to know where permission still exists, and where it doesn’t.