TQ Evening Briefing

The index looked orderly. The internals did not. AI stopped acting as a tailwind and started acting as a stress test. Capital stayed available. Tolerance narrowed.

MARKET STATE

Equity Indices Decline Sharply As AI Disruption Narrative Transmits Globally

The session opened with stability and deteriorated into targeted selling.

Major averages began in the green and rolled over as the day progressed.

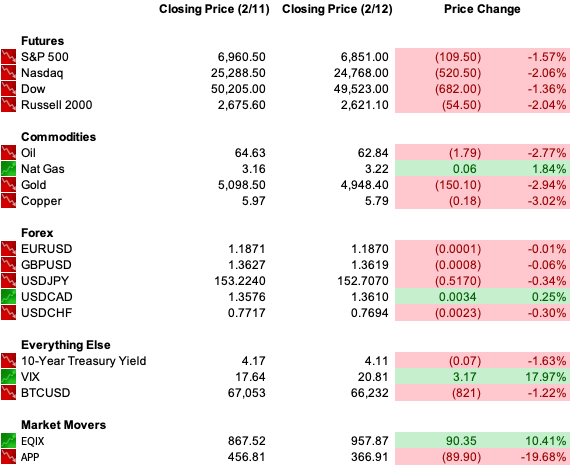

By the close, the Dow had shed more than 600 points, the Nasdaq was lower, and the S&P had given back over 1.5%.

Treasury yields declined and crude dropped sharply.

The bond market absorbed the pressure calmly.

Equities did not.

Coming into today, the question was whether yesterday’s resilience could withstand renewed scrutiny around AI economics.

It could not.

The stress did not originate from macro shock or funding strain.

It emerged from repricing business models exposed to automation risk.

Volatility rose at the single-name level while index liquidity remained intact.

The change from prior sessions lies in the breadth of the AI disruption narrative.

The tape no longer treats it as concentrated risk.

It now transmits across industries.

Trade Implication:

When yields fall and equities decline simultaneously without credit stress, treat the move as equity-specific repricing.

Reduce exposure to vulnerable operating models rather than cutting gross indiscriminately.

PREMIER FEATURE

$50 Billion Says You’ll Want These Names

Wall Street’s big money is already moving — quietly building positions in a handful of stocks before the next rally.

Our analysts tracked the flows and found 10 companies leading the charge.

Some are household names. Others are under-the-radar innovators about to break out.

Together, they form the Post-Rate-Cut Playbook smart investors are following right now.

WHAT ACTUALLY MOVED MARKETS

Duration Offers Temporary Shelter But Fails To Reverse Structural Risk

Treasury yields moved lower during the equity decline, reflecting demand for safety rather than inflation repricing.

The drop in yields did not catalyze a growth rebound.

That divergence matters.

Historically, falling yields during equity weakness provide relief for duration-sensitive equities.

Today, that transmission channel underperformed.

Lower yields failed to rescue sectors facing structural margin pressure.

The rate move expressed caution about near-term growth momentum following soft housing data and elevated volatility.

It did not alter the central narrative around AI-induced competition.

Liquidity remained accessible.

Credit markets did not widen materially.

The adjustment was equity-led.

Trade Implication:

When bonds rally and equities fall without credit deterioration, prioritize earnings resilience over rate beta.

The protective power of lower yields is diminished in structural repricing phases.

Commodity Signals Diverge From Equity Rotation

Crude oil fell nearly 3% as supply projections and easing geopolitical tensions capped near-term demand expectations.

At the same time, energy equities remain among the year’s strongest performers.

Electricity pricing continues to rise faster than headline inflation, driven by data center load growth.

The market is distinguishing between immediate commodity pricing and longer-cycle energy demand linked to AI infrastructure.

Oil trades the marginal barrel and inventory data.

Energy equities are being valued on cash flow, shareholder returns, and structural power demand.

Silver, a crowded retail trade earlier this year, fell sharply.

The unwind added to the risk-off tone but did not reflect systemic stress.

It signaled positioning flush rather than macro alarm.

Commodity action reinforces that capital is discriminating by time horizon.

Short-term oversupply can coexist with long-term structural demand.

Execution Bias:

Separate spot commodity volatility from equity cash flow durability.

Favor energy and utility exposures with pricing leverage over trades reliant on immediate commodity appreciation.

FROM OUR PARTNERS

Trump Backed One Massively Profitable American Company

There’s a new Trump story that could change everything, and it’s not about tariffs, foreign policy, or Congress.

It’s a story most people haven’t seen in the news, on cable TV, or or anywhere else.

Trump has made a public statement about one massively profitable American company, one most people have never heard of yet.

He actively went to bat for it and considers it crucial to the U.S. economy.

Some believe this could be one of the most undervalued stocks in the entire market, with the potential to make shareholders extremely wealthy.

TAPE & FLOW

Index Decline Masks Internal Violence As Single Name Drawdowns Accelerate

The index decline masked internal violence.

Freight and logistics stocks fell double digits after the release of AI-driven optimization tools.

Commercial real estate brokers posted losses typically associated with crisis environments.

Wealth management platforms weakened on fears of margin compression.

Software extended its bear market.

The IGV ETF remains deeply below its recent highs.

Even strong earnings could not prevent sharp declines in advertising and networking names as guidance disappointed.

Defensive sectors attracted inflows.

Consumer staples and utilities outperformed as capital sought earnings visibility.

Walmart and Coca-Cola rose against the tape.

Energy participation held relatively firm despite crude weakness.

These flows confirm preference for tangible cash flow and pricing power.

Index volatility rose moderately.

Single-name implied volatility expanded significantly.

Skew remains bid.

Protection demand persists.

The behavior reflects a dispersion regime.

Investors are not exiting wholesale.

They are reallocating within equity risk toward resilience.

The Dow’s relative outperformance versus the Nasdaq underscores this preference for established balance sheets.

Execution Bias:

In high-dispersion conditions, prioritize risk-adjusted stock selection over index hedging.

Pair long exposure in defensive cash generators with tactical shorts in labor-exposed intermediaries.

POWER & POLICY

Structural Risk Builds In Operational Channels While Utility Prices Accelerate

Structural risk continues to build quietly in operational channels.

Rising utility prices are already outpacing broader inflation, which could filter into consumer and industrial cost structures over the next two years.

Geopolitical tensions remain present but contained.

Naval deployments and Middle East negotiations influence insurance pricing and shipping risk premia without yet altering crude supply materially.

This backdrop supports energy equity valuations even as spot prices fluctuate.

Domestically, political friction intensifies around trade authority, immigration enforcement, and agency funding.

Legislative gridlock introduces planning uncertainty for corporations, particularly in sectors sensitive to tariff enforcement and cross-border capital flows.

Supreme Court deliberations on trade authority remain a latent risk factor.

Capital markets are absorbing a surge in AI-related debt issuance.

Prospects of nearly $1 trillion in tech and infrastructure borrowing this year have not widened spreads meaningfully.

That equilibrium depends on steady demand for credit paper.

A change in appetite would transmit rapidly to equity risk.

Trade Implication:

Model political and infrastructure developments as medium-term input volatility.

Maintain exposure to sectors benefiting from domestic energy security while monitoring credit spreads for early signs of supply fatigue.

FROM OUR PARTNERS

End of America: The Countdown To $40 Trillion

As the national debt hurtles towards $40 trillion, the analyst behind world-famous documentary End of America returns with a new warning:

“Gold Is Money Again”

ONE LEVEL DEEPER

Cisco Decline Crystallizes Current Regime

Cisco’s 12% decline crystallizes the current regime.

In-line earnings and reaffirmed demand from hyperscalers were insufficient to offset concerns about cost pressure and guidance discipline.

The stock trades at a reasonable multiple with stable margins, yet the market demanded acceleration.

Investors are recalibrating acceptable growth rates in AI-adjacent hardware.

High expectations have embedded into valuation.

Even solid results face punishment if guidance lacks incremental upside.

The response also highlights a broader dynamic.

Capital is gravitating toward perceived scarcity—chips, power, land—while discounting network and advisory layers subject to competitive pricing.

Earnings quality now hinges on pricing leverage under automation.

Cisco’s reaction underscores that participation in the AI supply chain does not immunize against scrutiny.

Edge Setup:

If hardware providers deliver margin stability in upcoming quarters while yields remain contained, valuation compression may present tactical entry points.

Invalidation occurs on sustained order deceleration.

U.S. MARKETS CLOSE

THE CLOSE

Market Deterioration Without Systemic Stress As Capital Engages Selectively

The tape deteriorated without systemic stress.

Bonds rallied.

Credit held.

Equities repriced business models.

Two trajectories stand ahead.

Automation-driven margin compression accelerates, widening dispersion and pressuring intermediation sectors further.

Or upcoming inflation data and earnings clarity stabilize expectations, allowing selective recovery in oversold growth.

Structural repricing has begun.

Margin durability now decides leadership.

Position in capital-backed cash flow and fade fragile fee models.

Stay engaged with deliberate allocation.

Lean toward durable cash flow and structural demand.

Use volatility in vulnerable segments as opportunity only with defined risk and clear catalysts.