TQ Evening Briefing

A quiet market day can still shout. Jobless claims hit multi-year lows and positioning tightened across the board. The indices slept, but the rate-cut narrative didn’t.

After The Bell

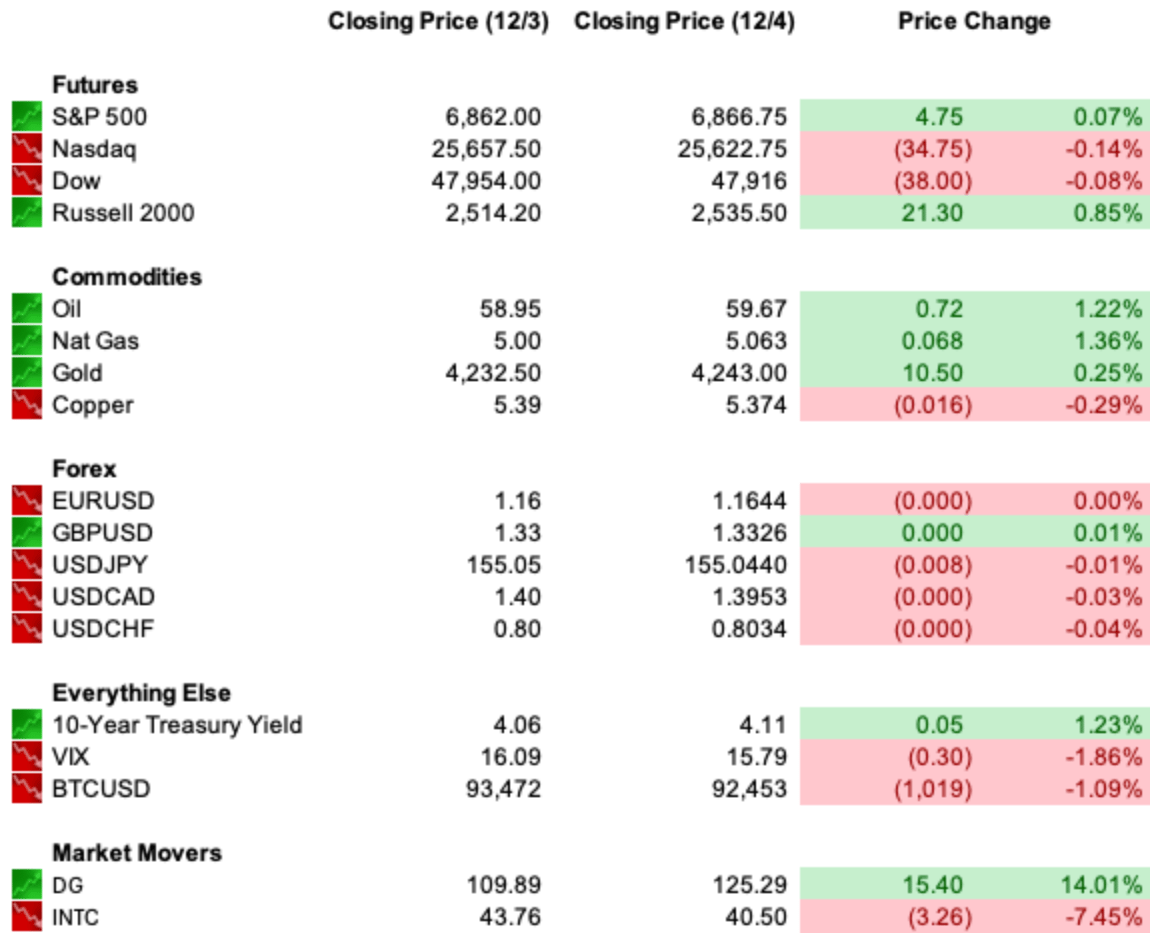

U.S. equities finished nearly unchanged, a quiet close to a session defined more by waiting than reacting.

The S&P 500 and Nasdaq added a touch, the Dow hugged the flatline, and Treasury yields firmed, with the 10-year ending near 4.11% after jobless claims hit a three-year low.

The message?

The labor market may be softening at the edges, but it’s not cracking.

And when claims hit fresh lows right before a Fed meeting, rate-cut odds don’t wobble, they harden.

Sector flows stayed fragmented.

AI still wobbled, natural gas ripped to three-year highs, and single-name stories kept intraday volatility alive even as the indices slept.

Salesforce jumped more than 3% after raising guidance and leaning into an AI-accelerated growth outlook.

SAIC surged 17% on stronger book-to-bill trends and a bump in multi-year earnings expectations.

Kroger slid ~6% after missing on revenue and margins.

Meta gained 4% amid reports of sizable 2026 cuts to its metaverse unit.

Snowflake fell 11% on slowing consumption trends despite a topline beat.

Dollar General gained after lifting full-year sales guidance.

A SPAC backed by Donald Trump’s sons advanced modestly in its debut.

Tomorrow brings PCE (September’s delayed print), the Michigan consumer survey, and earnings from HPE.

Those being the last catalysts before the Fed enters the stage.

Premier Feature

7 Buy-and-Hold Stocks You’ll Wish You’d Found Sooner

Not every great buy-and-hold stock is a household name. Our 7 Stocks to Buy and Hold Forever report includes under-the-radar leaders quietly dominating their niches - alongside global brands with unmatched staying power.

Together, they form a portfolio core that can produce rising income and steady growth year after year.

Monetary Pulse

Yields drifted higher, but the real story was the labor tape turning contradictory at the worst possible moment.

Jobless claims collapsed to 191,000, the lowest since September 2022, yet the same week delivered ADP’s sharpest payroll drop in over two years and independent trackers showing outright job losses.

Markets read the clash the only way they can.

Claims are holiday-distorted, the weakness is real enough, and nothing disrupts the near-90% expectation for a December cut.

Layoff data echoed the split.

Planned cuts fell 53% in November, but total layoffs this year still pushed past 1.17 million, with tech carrying the weight as AI integration trims headcount and tariffs pressure small businesses.

Continuing claims holding near 1.94 million reinforce a market that’s stalled, not spiraling, a backdrop that nudges the Fed toward insurance, not urgency.

China added a second macro layer.

State-owned banks stepped in to slow the yuan’s rally by buying dollars and tightening dollar liquidity, a shift meant to raise the cost of long-yuan bets.

For global desks, that means a firmer floor under the dollar and less room for Treasuries to rally on weak data alone.

Mixed labor signals, managed currency adjustment, and a Treasury curve that still trades like easing is coming… but not easily.

The World Tape

Geopolitics stayed loud, but markets mainly tracked how each move shapes risk channels rather than the theatrics themselves.

Russia reset the tone early

Putin signaled he intends to take the rest of the Donbas “militarily or otherwise” and tied that stance to ongoing U.S. back-channel discussions.

The message for markets is clearer than the diplomacy.

The conflict is not drifting toward resolution, which keeps a floor under defense spending, energy volatility, and Eastern European risk premia.

China added a pressure point with its largest maritime deployment yet, massing more than 100 naval and coast-guard vessels across the Yellow Sea, East China Sea, and South China Sea.

The clustering comes amid a sharp dispute with Japan, Taiwan’s extra $40 billion in defense spending, and Beijing’s frustration with talk of Japanese military involvement in a Taiwan scenario.

The scale matters more than the intent: concentrated drills tighten the risk backdrop for shipping, semis, and insurers exposed to Asia-Pacific supply lines.

India played the counterweight narrative.

Putin’s visit to New Delhi underscored how both countries are trying to diversify and rebalance trade, with Russia seeking more Indian goods and India looking for markets after Trump’s tariffs hit exports.

Expanding flows of machinery, electronics, and food goods won’t move global markets overnight, but it signals a shift in trade corridors that could reshape EM positioning over time.

Across all three regions, persistent geopolitical friction keeps volatility premiums from collapsing, even as macro data pulls yields lower.

Federal Focus

Washington pushed very different levers today, but they all pointed to the same market takeaway.

Policy friction is rising, and the cost of navigating D.C. risk just got a little higher.

The sharpest jolt came from the H-1B overhaul.

Consular officers are now asked to comb through applicants’ LinkedIn pages for any work tied to content moderation or “censorship,” a definition broad enough to sweep in compliance teams, trust-and-safety units, and even fact-checking.

Tech hiring pipelines (already stretched) now face an additional chokepoint.

Markets won’t price catastrophe, but they will price delays.

That’s slower onboarding, higher wage stickiness, and one more variable for tech margins heading into 2026.

Oversight pressure climbed too.

Lawmakers reviewing the follow-on strike on a Venezuelan drug boat came away questioning targeting decisions and communication practices, especially after learning some battlefield coordination occurred on encrypted personal apps.

Defense contractors won’t feel this tomorrow, but increased scrutiny lengthens authorization cycles and tightens legal review… a soft cap on how much geopolitical risk defense stocks can monetize.

Then came the corporate-political nexus.

Democrats pressed Nvidia, Apple, Meta, Microsoft, Amazon, and others for details about donations tied to President Trump’s new White House ballroom.

The companies all have major federal decisions in play, from antitrust to mergers to procurement, which means traders will keep a wider headline band around deal spreads and regulatory-sensitive names.

And Congress revived momentum behind a full stock-trading ban for lawmakers and their families.

Symbolic as it sounds, cleaner governance tends to lower policy-risk premia at the margins. Investors like clarity, even when it arrives through restriction.

Trade, labor, defense, and governance all tightened a notch.

None move markets alone, but together they raise the background noise that keeps volatility from truly deflating.

From Our Partners

Amazon's $794M Bombshell: Nvidia's Secret Partner Revealed

Amazon has quietly poured $144 million into a secretive AI chip company — and has already committed to purchasing a staggering $650 million worth of their product. Why? Because this obscure startup holds the key to unlocking the full potential of Nvidia’s revolutionary Blackwell chip.

U.S. Markets Close

From Our Partners

When a U.S. ally tried to tax ONE American energy company...

Trump didn't hesitate to issue a direct warning.

Now this same company is generating over $3 billion in operating income...

And partnering with the hottest AI stock on Wall Street.

Out of 23,281 publicly traded stocks, this is the ONLY one that meets all the "unicorn" criteria.

Closing Call

The market spent the day marking time, not making decisions.

Claims came in soft, ADP remained weak, and layoffs crossed a million, but nothing altered the consensus: a 25-bp cut on Dec. 10 is still the baseline.

With global yields nudging higher and tech’s leadership wobbling, traders are letting the tape move sideways into the meeting.

Tomorrow’s PCE gives the final read before the Fed, and the last chance for the data to surprise a market that has already priced the outcome.