TQ Evening Briefing

Markets spent the day pricing the cost of clarity: AI capex, political noise, and a data calendar still catching up, leaving traders hedging into Nvidia rather than betting on it.

After The Bell

The market opened uneasy and closed with the same message: positioning is finally catching up to the AI buildout narrative.

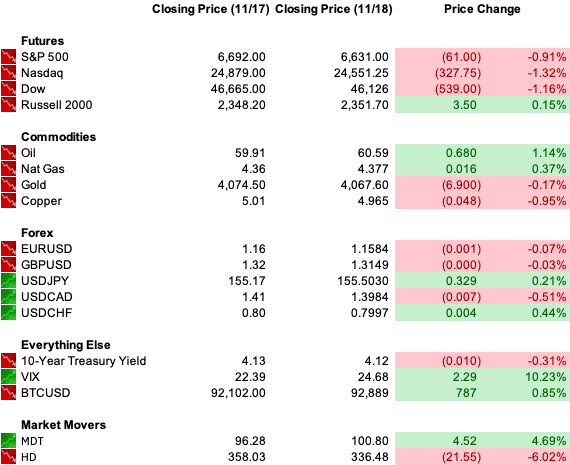

The majors extended their slide: Dow -1.2%, S&P -0.9%, Nasdaq -1.32%, marking a fourth straight red session, with early 1.5–2% drawdowns trimmed but not reversed.

NVIDIA again led the pressure ahead of tomorrow’s earnings, with Amazon and Microsoft slipping in sympathy. Even the day’s headline, the Microsoft/Nvidia/Anthropic partnership, couldn’t lift sentiment.

When capex is the concern, more capex doesn’t offer relief.

Home Depot weighed on the Dow after cutting its outlook and flagging weaker home-improvement demand, subdued consumer spending, and a lack of storm-driven sales. Lowe’s now becomes Wednesday’s read-through for the category.

META provided one of the few bright spots after a legal win against the FTC removed an antitrust overhang. It didn’t turn the sector, but it softened the tape at the margin.

Treasuries steadied late in the day, with the 10-year holding near 4.13 percent as earlier dips faded. Bitcoin bounced back above 91,000 after slipping under 90,000 overnight, a reminder that risk appetite is sensitive, not broken.

Gold drifted lower and crude sat near sixty dollars, underscoring that today’s move was about equity positioning, not macro repricing.

Sector boards told the story: tech and discretionary led the drag, communication services caught a lift from META, and utilities picked up a modest safety bid. With Thursday’s delayed jobs report and NVIDIA tomorrow, traders reduced exposure rather than wait for clarity to arrive.

Premier Feature

Trump’s Exec Order #14154 — A “Millionaire-Maker”

He’s overcome insane and criminal vote rigging.

And survived every indictment and impeachment thrown at him.

But his next move could make him a legend – and perhaps the most popular president in U.S. History.

Former Presidential Advisor, Jim Rickards says, “Trump is on the verge of accomplishing something no President has ever done before."

And if he’s successful, it could kick off one of the greatest wealth booms in history.

We recently sat down with Rickards to capture all the key details on tape.

Monetary Pulse

Fed politics moved from background noise to front-of-tape today after Trump said he “already knows” his next Fed chair and would fire Powell now “if people weren’t holding me back.”

It wasn’t a policy signal. It was a reminder that the central bank is operating inside a tightening political corridor while facing incomplete data and open dissent on both sides of the December rate debate.

Treasury Secretary Scott Bessent has narrowed the chair search to Waller, Bowman, Warsh, Hassett, and BlackRock’s Rick Rieder. Trump hinted the list may include “surprising” names but also suggested he could “go standard,” which markets read more as optionality than conviction.

Whoever gets the job inherits a fourteen-year term and a mandate that now includes delivering lower rates without risking credibility.

Rate-cut odds have slipped into the mid-40s. Hawks are leaning on tariff-linked inflation risk; doves are leaning on weakening labor. Jefferson’s cautious remarks yesterday exposed the gap. Today’s chair-search theatrics widened it.

The December meeting won’t just be about whether the Fed cuts, it’ll be the last decision before markets begin pricing a new regime at the top of the institution.

The World Tape

Global signals tightened today around the same theme: credibility and control.

Ukraine took the hardest hit.

A sweeping corruption scandal at Energoatom revealed a $100M embezzlement ring touching senior allies of President Zelensky, complete with aliases, cash drops, and evidence that some funds moved toward Russia. Two ministers are already facing dismissal, and Kyiv officials warn the next targets may sit even closer to the presidency.

The market read is mechanical.

Ukraine needs roughly $100B a year to stay in the fight. Partners already jittery about war fatigue now have a fresh narrative to slow disbursements.

That widens the risk premium on front-end European credit and keeps defense spending trajectories front-loaded rather than tapered.

The quip for the day: it’s hard to ask for more ammo when auditors are finding golden toilet bowls.

That credibility gap carried into Washington’s meeting with MBS. Trump again defended the crown prince over the Khashoggi killing, saying he “knew nothing,” and pivoted quickly to tout weapons sales and the bilateral reset.

Riyadh framed the criticism as an attempt to fracture the partnership.

For markets, the signal is straightforward: Washington is re-anchoring the U.S.–Saudi axis around defense and energy leverage, not rights or optics.

That keeps Gulf capital engaged and stabilizes the long end of the crude curve more than any OPEC communiqué does.

Both stories push the same direction: geopolitical alignments are shifting toward transactional durability.

That supports defense names, complicates EU cohesion, and keeps volatility elevated in every corridor tied to supply chains, energy, or military spend.

Domestically, the political machinery added another set of moving parts, widening the band of outcomes traders have to price.

From Our Partners

Get In On These Robotics Stocks Early

AI-driven surgery, autonomous platforms, and warehouse automation are exploding in demand, and Wall Street is taking notice. Early movers stand to benefit most.

Inside our FREE report, you’ll discover 3 robotics stocks already executing, drawing institutional attention, and positioned in the heart of a $200B+ market still in its early innings.

Federal Focus

Domestic politics added another layer of uncertainty, widening the band of outcomes traders have to price.

The day started with a fresh crack in GOP control. A federal court blocked Texas’s new congressional map, the one expected to deliver up to five additional Republican seats, forcing Texas back to its 2021 lines heading into the 2026 cycle.

For positioning, it means House arithmetic is less predictable than assumed. The appeal goes straight to the Supreme Court, pulling redistricting into the same legal fog already shaping expectations for fiscal leverage next year.

That instability spilled into the Epstein-files vote, where the House passed disclosure legislation 427–1 after weeks of fractures inside the GOP. Trump reversed his opposition at the last minute, clearing the way for leadership to fall in line.

The story here is not the bill, it’s what the split says about internal control.

When a governing coalition can’t set the pace on an issue this charged, markets read more shutdown risk, more negotiation drift, and a wider band of fiscal outcomes.

That same drift underpinned the administration’s move to hollow out the Department of Education by redistributing its core programs to other agencies.

The open question, what happens to the $1.6T federal student loan portfolio, carries real market weight. Any shift toward privatization touches credit channels, consumption, and sentiment at the margin.

Together, the domestic tape is trading like a system shedding buffers just as the macro requires more of them.

U.S. Markets Close

From Our Partners

The DeFi Play Wall Street Is Quietly Loading Up On

The flash crash cleared the weak hands — and now the real opportunity begins.

While retail chases hype, institutional money is quietly accumulating one DeFi protocol dominating its sector. It generates real revenue, massive volume, and consistent value for holders — exactly what Wall Street wants.

Trading at a steep discount, this “boring” altcoin could be Q4’s breakout.

Closing Lens

Today clarified the selloff.

Investors finally priced the cost of the AI buildout — valuation stress, debt-funded data centers, and delayed monetization — and treated the MSFT/NVDA/Anthropic deal as confirmation of that tension.

That psychology kept volatility firm, kept yields stable, and kept the floor under risk-off flows.

The market now enters a two-day stretch where catalysts actually matter.

Home Depot’s reset hinted at softer household demand. META’s win showed regulators can still miss. Bitcoin’s round-trip under $90K showed risk tolerance is thin but alive.

All of that feeds into tomorrow’s twin inflection points: Lowe’s and Nvidia.

If Nvidia delivers the growth analysts expect, and signals a timeline for capex turning into revenue, the tape gets breathing room.

If it doesn’t, this four-day slide becomes the start of a deeper valuation rerate.

For now, traders are positioning for volatility.

The fog hasn’t lifted; it’s just better lit.