TQ Evening Briefing

Markets just delivered a rally that feels less like relief and more like a test. Every tick higher now increases the cost of being wrong about December.

AFTER THE BELL

It was a slow build into strength, not euphoric, not fragile, but deliberate.

Stocks reversed early losses today and closed with a broad, orderly rally as rate-cut expectations firmed and yields slipped toward 4%.

Tech set the tone again.

Underneath the rally, the tape is recalibrating leadership.

Alphabet’s chip momentum and Nvidia’s stumble forced a rethink of AI dominance, which matters because AI is the liquidity engine of this market. When AI leadership recalibrates, the entire market’s liquidity profile shifts with it, because AI isn’t just a trade, it’s the cash-flow and capex architecture of the bull market.

When the hierarchy shifts, multiples shift with it.

Semis were mixed, but software and cloud names held gains.

Cyclicals outperformed as traders priced a cleaner easing path.

Retailers led the charge; all raised guidance, pushing discretionary higher and lifting the XRT nearly 4%.

Shutdown-delayed data filled in some blanks: retail sales rose 0.2% in September, PPI edged up 0.3%, and private-sector jobs continued to cool.

None challenged the market’s conviction for a December cut.

The psychology is simple. Hope is creeping ahead of confirmation.

And until the Fed makes the next move, the market is pricing what it wants to see, not what it’s seen.

Tomorrow brings more retail results, another batch of inflation readings, and thinner holiday liquidity.

With positioning leaning long and volatility low, the next data print will matter more than usual.

PREMIUM FEATURE

The countdown is on… and millions will miss this

Right now, Nate Bear is offering:

4 weeks of his Monday Profit Surge livestream

4 trade recommendations

Full training vault

Aftershock Scanner

Chatroom access

If you sit it out, someone else will take your seat.

MONETARY PULSE

The clearest signal in the macro tape right now isn’t coming from the data — it’s coming from the fact that the data is starting to bend psychology.

Housing is the tell.

Sellers are yanking listings at an eight-year high because they don’t like the bids, which is another way of saying price discovery is getting uncomfortable.

That’s not a crash story; it’s a liquidity story.

When homeowners pull supply, shelter inflation stays sticky, and sticky shelter keeps the Fed from declaring victory.

Traders know the loop all too well. Less housing turnover → firmer inflation components → stickier cuts.

Retail is sending the same message from the demand side.

Markets won’t frame this as recession risk yet, but they will treat it as a reason the Fed can’t lean too hard into dovishness without tripping over its credibility.

Soft spending with sticky prices is the exact combination that keeps curves indecisive and volatility pockets alive.

And over it all sits the political wildcard: a new Fed chair possibly named before Christmas.

Bessent’s timeline is fast enough to matter for positioning because the candidates span the spectrum from quietly dovish to structurally hawkish.

Traders don’t care about the personalities, they care about the reaction function.

A chair who “simplifies the Fed” sounds benign until you remember that simplifying usually means tightening discretion and narrowing tolerance for inflation drift.

The thread across all of it is constraint.

Consumers are tightening, sellers are retreating, and the Fed may soon be led by someone who treats ambiguity as a risk, not a tool.

The result is the same across the curve: cuts remain possible, but conviction stays scarce.

FEDERAL FOCUS

Washington spent the day stress-testing institutional boundaries, and markets had to price the political risk rather than the theatrics.

The FBI’s move to interview six Democratic lawmakers over their video on unlawful military orders looks like a niche legal fight, but it hits a market-sensitive nerve: command stability.

When the Pentagon threatens to recall a sitting senator to active duty and the White House accuses lawmakers of sedition, investors don’t track the drama, they track the signal.

Disorder at the top of the chain of command raises volatility floors, pushes money toward the front end of the curve, and keeps defense names from building meaningful conviction in either direction.

When institutions wobble, liquidity follows. Money moves first when rules feel fluid.

That same theme, politics pressing into the market’s wiring, showed up in the Justice Department forcing Sen. Jim Justice to settle a $5 million tax case.

It’s not the amount; it’s the enforcement trend.

High-profile tax actions in an election cycle lean into the broader debate around wealth, regulation, and capital mobility.

Real-estate and private-credit desks read it as another step in tightening discretionary scrutiny, a mild headwind for leverage and dealmaking.

Then the AI lobby made its own move.

A super PAC backed by Silicon Valley launched a $10 million campaign to force Congress into a single national AI standard that overrides state rules.

That’s not political noise, it’s regulatory consolidation.

A uniform regime lowers compliance drag for mega-caps, raises the barrier for startups, and concentrates sector pricing power.

If the White House wedges this into must-pass bills, AI policy becomes a liquidity story, not a legislative one.

The connection across all of it is simple: power struggles are turning into market inputs.

And the more Washington tests its limits, the more traders have to price the cost of uncertainty.

FROM OUR PARTNERS

4 Stocks Poised to Lead the Year-End Market Rally

The S&P 500 just logged its best September in 15 years — and momentum carried through October, pushing stocks to multi-month highs.

Cooling inflation, strong earnings, and rising bets on more Fed rate cuts are fueling the move.

But this rebound isn’t broad-based — it’s being driven by energy, manufacturing, and defense sectors thriving under new U.S. policy and global supply shifts.

That’s why our analysts just released a brand-new FREE report featuring 4 stocks we believe are best positioned to benefit as these trends accelerate into year-end.

THE WORLD TAPE

Abroad, leverage, not ideology, defined every major move.

Global politics spent the day tightening pressure points that feed directly into market risk.

Washington’s push on Europe to “reconsider” its digital rules wasn’t about tech policy, it was about leverage.

Tying steel-and-aluminum tariff relief to Europe easing up on Apple, Meta, and Google is the clearest signal yet that digital regulation has become a trade instrument, not a regulatory debate.

For markets, that means tech isn’t just an earnings story this quarter.

It’s now collateral in a tariff negotiation that can swing sector multiples if Brussels digs in.

At the same time, the Ukraine peace framework moved from speculative chatter to actionable politics.

Kyiv signaled it’s ready to advance the U.S. plan, with Zelenskiy willing to take unresolved issues straight to Trump — territory, NATO, security guarantees.

Russia is playing coy but open.

That three-way dynamic shifts the risk calculus.

European defense names just learned how fast diplomatic momentum can erase a premium, and commodities felt it too, with crude slipping on the prospect of a ceasefire window.

The U.S. leaning on Army Secretary Dan Driscoll as the negotiator adds another wrinkle.

Military-fronted diplomacy implies urgency, compressed timelines, and a higher probability of executable outcomes.

Positioning around Eastern European FX and energy is already adjusting to that.

Beyond the geopolitics, Canada offered a micro-signal of capital appetite returning.

If listing velocity picks up, it reinforces the broader rotation toward risk that’s been quietly building under the surface.

Put together, the tape got clearer.

The disputes shaping markets now are about leverage, not ideology, which is exactly when volatility starts to misprice the next move.

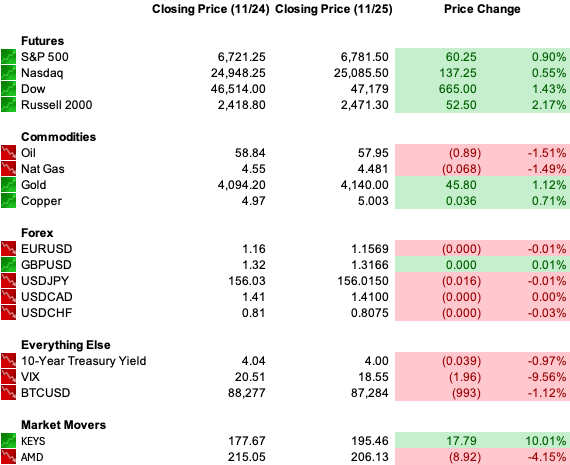

U.S. MARKETS CLOSE

FROM OUR PARTNERS

The 7 Stocks Built to Outlast the Market

Some stocks are built for a quarter… others for a lifetime.

Our 7 Stocks to Buy and Hold Forever report reveals companies with the strength to deliver year after year - through recessions, rate hikes, and even the next crash.

One is a tech leader with a 15% payout ratio - leaving decades of room for dividend growth.

Another is a utility that’s paid every quarter for 96 years straight.

And that’s not all - we’ve included 5 more companies that treat payouts as high priority.

These are the stocks that anchor portfolios and keep paying.

This is your chance to see all 7 names and tickers - from a consumer staples powerhouse with 20 years of outperformance to a healthcare leader with 61 years of payout hikes.

CLOSING CALL

A steady rebound into the close restored calm after a shaky start, with lower yields and stronger retail results giving the market its cleanest session in a week.

The rate-cut narrative hardened, tech held leadership despite rotation under the surface, and cyclicals added support at a key moment for sentiment.

The setup heading into Wednesday is straightforward.

The market wants confirmation.

Retail earnings, fresh inflation data, and pre-holiday liquidity will determine whether this rally broadens or stalls.

The tape has momentum, but December still needs to validate it.

The market has momentum, but it still needs the data to justify following it.

The Fed owns the curve, tech owns the leadership, and the next 48 hours will decide whether investors can carry this move into month-end.