TQ Evening Briefing

The market spent the day doing what policymakers are doing globally… pricing the absence of clarity. With the U.S. institutions grinding through their own fractures, traders stopped assuming stability.

AFTER THE BELL

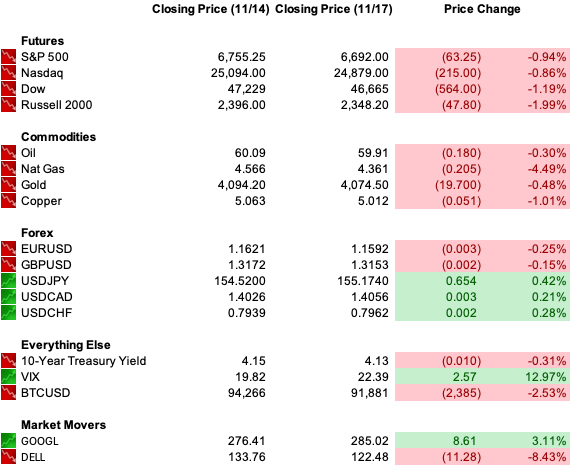

What started as a firm open flipped into a broad fade as Jefferson’s “move slowly” line hit a tape already uneasy about the data vacuum and the rotation under the surface.

By afternoon, the Dow was off 700 points, the S&P slipped below its 50-day, and the Nasdaq logged another controlled bleed as AI leadership lost footing ahead of Nvidia’s print.

The sector rotation matched last week’s, but without the late-day resilience: tech cracked, banks followed, and cyclicals failed to hold early bids. Defensives rallied as traders leaned to safety.

Alphabet’s bounce couldn’t offset the tech leadership unwind. Small caps tracked the shift lower, confirming the risk-off skew rather than contradicting it.

Treasuries barely moved as positioning, not macro, drove most of the pressure.

With delayed labor and inflation data landing over the next ten days, investors are trimming exposure rather than guessing the Fed’s December math in the dark.

The morning’s stability gave way as the afternoon session priced what visibility gaps actually mean when markets stop pretending they don’t matter.

And the pressure in the tape pointed directly at where the fault line is widening: the Fed.

PREMIUM FEATURE

4 Stocks Poised to Lead the Year-End Market Rally

The S&P 500 just logged its best September in 15 years — and momentum carried through October, pushing stocks to multi-month highs.

Cooling inflation, strong earnings, and rising bets on more Fed rate cuts are fueling the move.

But this rebound isn’t broad-based — it’s being driven by energy, manufacturing, and defense sectors thriving under new U.S. policy and global supply shifts.

That’s why our analysts just released a brand-new FREE report featuring 4 stocks we believe are best positioned to benefit as these trends accelerate into year-end.

MONETARY PULSE

Fed policy is drifting without hard data, and the committee is splitting along that fault line.

Philip Jefferson leaned into that uncertainty, saying the balance of risks “underscores the need to proceed slowly” on additional cuts.

It wasn’t guidance; it was a hedge, and it landed as such. Rate-cut odds for December slipped toward the mid-40s, a sharp reset from the 90% pricing before the shutdown froze core indicators.

Inflation-focused officials, boosted by tariff-pressure forecasts, argue that holding steady is the only way to avoid locking in another multi-year overshoot.

Labor-focused governors, largely Trump appointees, warn the opposite risk is rising: tightening into a cooling job market without the data to prove it.

Powell is walking into a meeting where dissent is the baseline, not the outlier.

And while the Fed wrestles with its own blind spots, the global tape is shifting in ways the committee can’t afford to ignore.

THE WORLD TAPE

Poland dealt with a sharper signal today after an explosion damaged the Warsaw–Lublin rail corridor, a route that moves Western aid into Ukraine.

Officials called it an unprecedented act of sabotage, and investigators found additional tampering along the line.

The pattern fits the broader uptick in gray-zone pressure across Eastern Europe, where drone intrusions and infrastructure probes have been rising for months. For markets, the headline isn’t the blast, it’s the direction: Europe’s logistics spine is becoming a target.

London moved the same direction, tightening migration policy in ways that reshape labor flow and social-spending expectations, mirroring the actions taken across Europe.

At the U.N., the Security Council is poised to approve the U.S. plan for Gaza’s postwar architecture.

The resolution would authorize a stabilization force through 2027 and hand reconstruction to a temporary governing board.

Russia and China are expected to abstain, clearing the path, but implementation is the risk vector: disarmament, governance, and statehood remain open fields with no defined enforcement mechanism.

Passage gives Washington a diplomatic win, but not a roadmap.

Deliveries will stretch over years, but the signal is straightforward: Kyiv is locking in airpower capacity for a conflict that shows no sign of compressing.

The same theme carried stateside, where political and institutional channels amplified volatility rather than absorbing it.

FROM OUR PARTNERS

This Makes NVIDIA Nervous

NVIDIA’s AI chips use huge amounts of power.

But a new chip, powered by “TF3” — could cut energy use by 99%…

And run 10 million times more efficiently.

They control the only commercial foundry in America.

And at under $20 a share, it’s a ground-floor shot at the next tech giant.

FEDERAL FOCUS

Institutional friction added to the domestic backdrop.

The sharpest hit came from the Comey case, where a federal magistrate said the indictment may be compromised by prosecutorial misstatements, privilege issues, and irregularities inside the grand jury room.

Ordering full release of grand jury audio is an extraordinary step and signals the court’s concern about how politically charged cases are being driven through federal machinery.

That same erosion of internal ballast showed up in FEMA.

Acting administrator David Richardson resigned after six months amid backlash over the agency’s response to catastrophic Texas flooding.

Meanwhile, President Trump reversed course on the Epstein files, where he’s now urging House Republicans to back full release.

The House vote is expected to clear easily; the Senate remains the bottleneck. Transparency pushes like this tend to widen intra-party fractures, which is what played out next.

Parallel to the political crosscurrents, a 17% drop in new international student enrollment added another brick to the structural picture.

Visa delays, denials, and tighter screening have created a bottleneck that universities say will spill into 2026–27.

The common thread: systems that usually smooth political noise — courts, Congress, immigration channels — are instead reflecting it back into the domestic landscape.

U.S. MARKETS CLOSE

FROM OUR PARTNERS

See Wall Street’s Cards Before They Play

Imagine sitting at a poker table where your opponents are forced to flip their cards before you make your move.

That’s exactly what happens in the market every single day.

The biggest players on Wall Street are constantly making massive buy and sell orders to protect their positions — and those massive orders reveal everything. I know, because I used to be on the inside.

Now traders like you can finally see those same institutional moves unfold in real time… and act before the stock reacts.

CLOSING CALL

Today tightened the line between price action and uncertainty rather than breaking it.

Jefferson’s hedge didn’t create new information; it exposed how little the committee can anchor without data.

The selloff in banks and AI didn’t signal rotation fatigue; it signaled positioning recalibrating around a Fed meeting where consensus is structurally impossible.

Add the geopolitical drift, the domestic fractures, and a calendar that won’t normalize for another week, and you get a market trading the absence of visibility as its own catalyst.

Tomorrow brings Home Depot, then Nvidia on Wednesday, and the first batch of delayed releases on Thursday.

The next session won’t settle the narrative, but it will show whether today’s unwinding was a repricing, or the start of the market treating the fog as direction.