TQ Evening Briefing

Markets absorbed institutional stress without selling risk… gold rose, banks slipped, and trust quietly got more expensive.

MARKET STATE

Credibility Is Being Repriced, Not Abandoned

This was not a session about fear.

It was a session about boundaries.

Markets opened facing something they rarely price cleanly in real time:

Uncertainty around how authority is exercised, not whether it exists.

Liquidity stayed available.

Volatility remained controlled.

Price discovery never failed.

Yet beneath the surface, capital quietly adjusted the level of trust it was willing to extend to institutions that had long been treated as insulated.

U.S. equity futures held firm.

Growth leadership survived.

Credit markets stayed open.

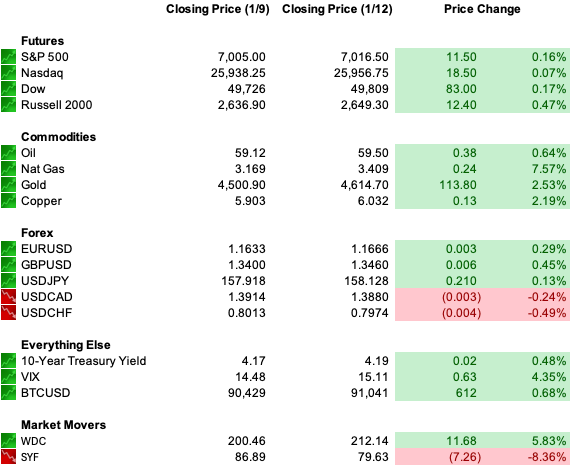

At the same time, gold surged, silver extended, the dollar softened, long-end yields edged higher, and bank stocks absorbed pressure despite stable earnings expectations.

None of those signals alone imply stress.

Together, they describe a repricing of credibility.

This was not de-risking.

Capital did not exit equities.

It rotated toward structures that rely less on discretion and more on permanence.

The market wasn’t questioning whether systems would fail.

It was reassessing how much belief those systems now require to function.

That distinction changes positioning without breaking the tape.

Premier Feature

Nvidia’s Secret Partner... This Is The New AI Chip Powerhouse

I bet you've never heard of it... but this newly public company is set to become key to Nvidia’s seat on the AI throne. And for now... you can get in while it's still cheap.

WHAT’S ACTUALLY MOVING MARKETS

Independence Became A Variable, Not An Assumption

The investigation involving Federal Reserve Chair Jerome Powell was not processed as a personnel issue or a legal development.

It was processed as a boundary test.

For years, markets treated political pressure on the Fed as noise.

Complaints were public.

Outcomes were private.

Independence held.

That pattern trained capital to ignore rhetoric and price continuity.

What changed was not the probability of removal or immediate policy shifts.

Markets are not pricing Powell’s exit.

They are pricing the possibility, however temporary, that institutional independence is no longer untouchable.

Once that boundary becomes contestable, hedging frameworks change.

Gold’s surge, the dollar’s weakness, and higher long-dated yields make sense only in that context.

This was not a safety bid.

It was insurance against discretion.

That is why financials sold off even as macro conditions remained stable.

Banks were not discounted for credit risk.

They were discounted for proximity to policy authority.

Markets didn’t panic.

They adjusted the price of trust.

Geopolitics Reinforced The Signal Without Driving It

Iran and Venezuela mattered… not as catalysts, but as confirmations.

Venezuela remains unresolved beneath the optics of regime change, with access to energy assets increasingly framed as a political decision rather than a commercial one.

Yet crude remained restrained.

Energy equities were selective.

Defense stayed bid without euphoria.

That matters.

If markets believed supply disruption was imminent, oil would be leading.

It isn’t.

Metals are.

The market is distinguishing between risks that can be routed around and risks that cannot.

Supply chains can be negotiated.

Energy flows can be redirected.

Institutional credibility, once questioned, is far harder to substitute.

That is why geopolitics amplified the move into metals rather than triggering a commodity shock.

The issue isn’t scarcity.

It’s governance.

Gold Is Pricing Rules, Not Recession

Gold is not responding to growth fear.

It is not responding to inflation prints.

It is not responding to equity stress.

It is responding to rule uncertainty.

When authority becomes less predictable, capital seeks assets that do not require interpretation, permission, or institutional continuity.

Gold fits that profile.

So does silver.

So do industrial metals tied to long-cycle infrastructure rather than short-term demand.

Private capital is now aligning with the same framework.

This is not speculative enthusiasm.

It is structural hedging.

Gold is not pricing collapse.

It is pricing governance risk.

From Our Partners

Why 2026 Could Be Crypto’s Biggest Year

The macro setup for crypto is snapping into place.

The Fed is printing again. More rate cuts are coming. And a new, likely dovish Fed chair takes over in May. That’s three major catalysts — all pointing the same way.

Wall Street keeps saying it’s “priced in.” History says otherwise.

When liquidity rises and policy loosens, risk assets surge — and crypto tends to lead. We’ve seen this cycle before, and it’s setting up again now after crypto’s strong start to 2026.

I’ve laid out the full playbook — Fed policy, capital flows, and how to spot altcoins with the biggest upside — in a book my advisors told me not to give away.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

TAPE & FLOW

Growth Still Works, Trust Just Costs More

The most important signal in the tape was what did not happen.

Equities did not break.

AI leadership held.

Liquidity stayed functional.

Volatility never demanded intervention.

Credit spreads remained calm.

If this were a confidence crisis, none of that would be true.

Instead, markets are holding two conditions simultaneously:

Growth can persist, and rules can weaken.

When that happens, capital doesn’t flee risk.

It reallocates toward durability.

It discounts institutions exposed to political interpretation.

That is why banks sold while metals rallied.

It is not contradiction.

It is adaptation.

Risk remains on.

It is just being carried differently.

POWER & POLICY

Discretion Is Now A Tradable Input

Trump’s call for a one-year, 10% credit-card interest cap was not market-moving because of its feasibility.

Most analysts agree it lacks legal authority and congressional support.

That wasn’t the signal.

The signal was that direct price intervention is politically acceptable again.

Markets didn’t wait for legislation.

They didn’t need a timeline.

They simply adjusted the probability distribution around discretion.

That hit consumer-facing financials immediately, even as earnings expectations remained intact.

The same logic applies to the Powell investigation, to Venezuela, and to Iran.

Markets are responding less to outcomes and more to how authority is being exercised.

That kind of shift doesn't break markets overnight.

It reshapes them gradually.

From Our Partners

$50 Billion Says You’ll Want These Names

Wall Street’s big money is already moving — quietly building positions in a handful of stocks before the next rally.

Our analysts tracked the flows and found 10 companies leading the charge.

Some are household names. Others are under-the-radar innovators about to break out.

Together, they form the Post-Rate-Cut Playbook smart investors are following right now.

ONE LEVEL DEEPER

Why Metals Lead While Oil Waits

This session highlighted a classic horizon mismatch.

Metals benefit from long-cycle narratives:

AI infrastructure, grid constraints, capital intensity, and institutional hedging.

They do not require near-term disruption to move.

Oil prices barrels.

Near-term supply remains flexible.

Geopolitical risk adds optionality, not scarcity.

That keeps crude anchored even as energy equities price longer-dated opportunity.

Gold and copper don’t need clearance.

They need conviction.

Right now, that conviction exists.

U.S. MARKETS CLOSE

THE CLOSE

Order Still Exists, But It Isn’t Free

This was not a market under stress.

It was a market updating assumptions.

Authority was tested.

Liquidity held.

Growth leadership survived.

But the price of trust moved higher.

Gold reflected that.

Silver reinforced it.

The dollar adjusted.

Banks absorbed it.

The signal was not fear.

It was recalibration.

Order still exists.

But belief now carries a premium.

And that premium is being priced… quietly, deliberately, and without panic.