TQ Evening Briefing

A soft CPI lit the fuse. Tech ripped, yields slipped, and AI found its footing again… but the fine print mattered more than the headline.

After The Bell

Stocks snapped their losing streak as a softer-than-expected CPI gave markets room to breathe.

Treasury yields drifted lower, with the 10-year settling near 4.13%, while the dollar stayed flat.

Commodities told a mixed story... energy prices firmed, gold held steady, and food inflation quietly reasserted itself beneath the headline cooldown.

Leadership rotated decisively back into tech.

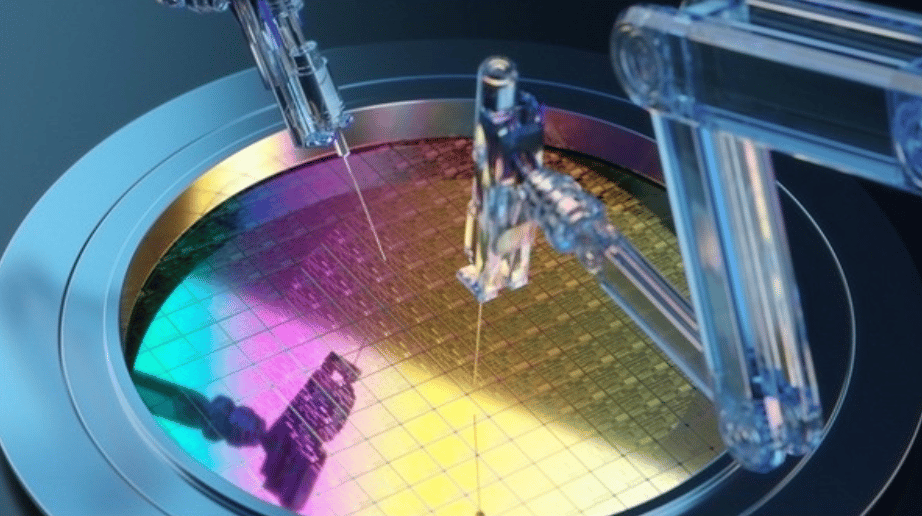

Semiconductors led the charge after Micron delivered blowout earnings and raised guidance, sending the stock up more than 14% and reigniting confidence across AI-linked names.

Nvidia, AMD, Alphabet, and Microsoft followed.

Elsewhere, Trump Media surged over 30% on its fusion-energy merger announcement, while Lululemon jumped after activist interest surfaced.

On the lagging side, pockets of defensives faded as rate pressure eased.

Tomorrow brings another earnings slate, with markets watching whether fundamentals continue to validate today’s relief rally.

Premier Feature

They’ve Cracked the Memecoin Code

What if you could spot the next 8,200% memecoin before it explodes?

Most think memecoin gains are luck — but our team’s proprietary system has repeatedly identified breakout coins that surged 4,915%... 3,110%... even 8,200%.

They’ve just flagged a new pick triggering all their top signals — and it could be the next major move.

That’s why we’re revealing the #1 Memecoin to Own Right Now (time-sensitive).

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Monetary Pulse

Inflation finally printed softer, but markets weren’t fooled.

November CPI cooled to 2.7% headline and 2.6% core, under consensus, yet the celebration was muted.

Investors treated it less as a signal and more as a placeholder. That skepticism showed up quickly.

Treasury yields slipped but stayed orderly, reinforcing the view that this print doesn’t reset the Fed’s path. Policymakers still get another clean inflation read before the next meeting, and no one is rushing to extrapolate a trend from a noisy sample.

Currency markets absorbed the message faster.

The dollar softened as traders nudged up odds of a spring rate cut, while sterling jumped after the Bank of England delivered a narrow, cautious cut of its own.

The ECB held steady, and the global picture sharpened: easing abroad is becoming more visible even as the Fed stays deliberate. Japan remains the outlier, with markets bracing for a BoJ hike.

Politics hovered at the edges.

President Trump reiterated that the next Fed chair will favor meaningfully lower rates, keeping the independence debate in the background… not decisive today, but not irrelevant either.

Today, the pulse favored quality over conviction.

Rate-sensitive sectors like housing remain constrained by long-end yields, while defensives, income, and selective FX trades benefit from softer global policy pressure without a full-on risk pivot.

The World Tape

Security risk is migrating... quietly, digitally, and without a ceasefire.

Iran-linked hackers leaked personal data tied to former Israeli prime minister Naftali Bennett, the latest in a wave of “hack-and-leak” operations targeting Israeli officials and institutions.

The intent isn’t disruption of systems so much as erosion of trust, signaling that cyber pressure remains a low-cost tool in a prolonged shadow conflict.

Energy geopolitics added friction but not fear.

China voiced support for Venezuela after the U.S. ordered a blockade of sanctioned oil tankers, opposing what it called unilateral pressure… without committing aid or intervention.

Beijing’s restraint matters: it keeps crude flows politically tense but fundamentally intact. Markets read it as containment, not escalation.

Europe’s fault lines stayed exposed.

Hungary’s Viktor Orbán declared efforts to use frozen Russian assets to fund Ukraine effectively dead, citing legal and political risk.

With other EU members uneasy, the episode underscores how fragmented consensus limits Europe’s financial leverage, even as funding needs grow more urgent.

Cybersecurity and defense services are prevalent as digital conflict hardens.

Energy equities stay capped by surplus supply and muted Chinese action.

European assets face persistent policy drag, while volatility premiums remain concentrated in security, not commodities.

From Our Partners

The Most Important Company in the World by Next Year?

Silicon is dead. And one tiny company just killed it.

Federal Focus

Washington delivered a familiar mix of spectacle, signaling, and sector-specific consequence.

Quite literally.

The pitch is fusion as a future solution to AI’s exploding energy needs, wrapped in national-security framing and fast-track permitting. Markets treated it as a long-dated option on U.S. energy dominance rather than a near-term cash flow story.

Elsewhere, politics stayed tactical.

Democrats quietly shelved a full public review of their 2024 election failures, choosing message discipline over introspection heading into midterms.

For markets, the takeaway isn’t party strategy, it’s reduced near-term policy noise. Fewer internal battles mean less headline volatility around tax, regulation, and spending priorities in the months ahead.

Regulation did move where it mattered most to traders.

Cannabis stocks ripped higher on anticipation of an executive order reclassifying marijuana to Schedule III. It’s a technical shift with real balance-sheet implications: lower tax burdens, easier banking access, and renewed M&A optionality for an industry left for dead.

Thread it together and a pattern forms.

Capital is rewarding narratives that unlock financing and regulatory relief, while sidelining ideological fights that don’t change cash flows.

Energy infrastructure, speculative power tech, and regulatory-sensitive equities gained oxygen.

Everything else stayed parked, waiting for a cleaner signal.

U.S. Markets Close

From Our Partners

Nvidia’s Secret Partner... This Is The New AI Chip Powerhouse

I bet you've never heard of it... but this newly public company is set to become key to Nvidia’s seat on the AI throne. And for now... you can get in while it's still cheap.

Closing Call

Today was a release valve, not a reset.

A softer CPI gave markets permission to lean back into risk, but conviction showed up only where earnings and demand could carry the weight.

Tech led because Micron proved AI spend is translating into revenue, while yields eased just enough to support equities without signaling policy urgency.

The bond market stayed disciplined, the dollar stayed calm, and commodities reminded investors that inflation pressure hasn’t vanished... it’s just uneven.

Politics hovered, regulation selectively mattered, and capital followed the clearest cash-flow paths.

The message into tomorrow is simple: relief rallies work best when fundamentals show up on time.