TQ Evening Briefing

The labor data landed firm. Yields adjusted immediately. The system stayed open, but the price of time moved higher.

MARKET STATE

Yields Jumped. Equities Absorbed.

The session opened with momentum and closed with discipline.

Duration repriced first. Equities recalibrated second.

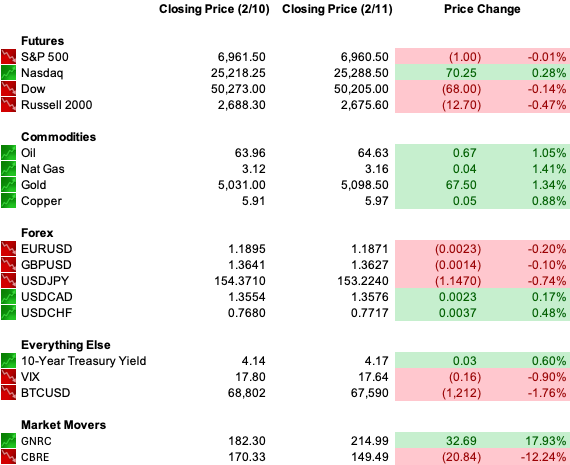

The S&P again struggled near 7,000. The Dow held firmer. The Nasdaq oscillated but failed to extend. Small caps lagged as financing sensitivity resurfaced.

Revisions flattened much of 2025’s perceived hiring strength, keeping growth conviction capped even as the headline cleared.

Liquidity remained intact. Credit spreads did not widen meaningfully. But tolerance tightened.

The tape did not reject strength. It charged more for time.

Trade Implication

Stronger data that pushes yields higher without credit stress favors cash-flow visibility over multiple expansion. Carry exposure, but shorten duration.

PREMIER FEATURE

10 AI Stocks to Lead the Next Decade

AI is fueling the Fourth Industrial Revolution, and these 10 stocks are front and center.

One of them makes $40K accelerator chips with a full-stack platform that all but guarantees wide adoption.

Another leads warehouse automation, with a $23B backlog – including all 47 distribution centers of a top U.S. retailer – plus a JV to lease robots to mid-market operators.

From core infrastructure to automation leaders, these companies and other leaders are all in The 10 Best AI Stocks to Own in 2026.

Free today, grab it before the paywall locks.

WHAT CHANGED TODAY

The Policy Clock Moved Forward

The headline beat delayed easing expectations immediately. March is off the table. June is less certain.

Healthcare accounted for the bulk of hiring. Financial activities and information lost jobs. Revisions erased much of last year’s apparent strength.

This is not acceleration. It is segmentation.

Front-end yields adjusted accordingly. The cost of capital edged higher in real time. Equity multiples did not collapse, but speculative duration thinned.

This was a repricing of patience.

The market is now pricing a longer hold, not a new hiking cycle.

Execution Bias

When payroll strength is narrow and revisions are heavy, treat the data as stable enough to delay cuts but not strong enough to expand multiples.

AI Is Now An Economics Trade, Not A Narrative Trade

Today’s action reinforced the shift from training dominance to inference economics.

Semiconductors such as NVDA and AVGO held relative strength. Enterprise software names remained uneven as investors reassessed subscription durability under automation pressure.

The debate is no longer whether AI spending continues. It is who captures the marginal dollar.

Scale does not guarantee premium multiples. Conversion speed does.

Capital is still being spent. The multiple is what’s being questioned.

Infrastructure beneficiaries with visible demand can hold sponsorship. Platform models dependent on pricing power without margin control will remain volatile.

Trade Implication

Own the picks and shovels with tangible backlog. Be cautious where AI compresses the very margins that support the valuation.

FROM OUR PARTNERS

The Next Breakout AI Stock?

Most investors haven’t heard of this revolutionary AI technology, or the small startup behind it.

But some believe it could be positioned to become one of the next top-performing AI stocks as adoption accelerates.

This isn’t another chatbot or software platform. It’s a different side of AI that’s already being deployed in the real world, and could reshape an entire industry.

Discover why some experts think this little-known company could have the potential to transform everyday investors’ wealth.

Fiscal Optics Improved While Structural Debt Costs Persist

Customs revenue surged, narrowing the monthly deficit and offering a temporary improvement in fiscal optics.

Yet interest expense continues to absorb a growing share of federal outlays.

Treasury supply expectations remain anchored to issuance realities rather than revenue surprises.

Tariff-driven cash inflows alter distribution but do not reduce uncertainty around trade policy or global retaliation risk.

The more relevant signal lies in funding conditions.

As interest costs climb, fiscal flexibility compresses.

That constraint works gradually through duration markets and sovereign risk pricing rather than through immediate equity reactions.

Capital markets are enforcing arithmetic.

Revenue headlines do not override the trajectory of debt servicing.

Execution Bias

Treat improvements in fiscal receipts as short-horizon relief.

Monitor term premiums and credit spreads for evidence that financing conditions are tightening beneath stable index levels.

INSIDE THE ROTATION

Sorting, Not Stress

Semiconductors outperformed within tech. Software lagged again. Financials failed to capitalize on higher yields, reflecting AI disintermediation anxiety.

Small caps did not confirm early momentum. Financing sensitivity remains embedded.

Equal-weight briefly outpaced cap-weight before leadership reconcentrated into megacap names as yields climbed.

The VIX faded into the close, but single-name implied volatility stayed elevated. Skew remained bid.

Investors are not de-risking. They are reallocating toward balance sheets that can convert under higher real yields.

Conviction is tactical.

Execution Bias

When index volatility declines but dispersion persists, alpha comes from earnings durability and balance sheet strength.

POLICY PRESSURE POINTS

Geopolitical Risk Widened While Domestic Policy Friction Intensified

Geopolitical risk widened at the margins.

Defense posture in the Middle East escalated incrementally as additional naval assets prepared for deployment.

Energy prices stayed contained, yet insurance and shipping sensitivity remain embedded in forward curves.

Domestic political friction intensified through hearings and tariff authority disputes.

Procedural uncertainty is accumulating without direct economic disruption.

Markets are absorbing the headlines calmly, but funding channels would react quickly if legal or trade frameworks shift materially.

Trade policy remains a latent variable.

Tariff revenues are rising, and Supreme Court deliberations could alter enforcement authority.

That optionality creates asymmetry.

Corporations must plan for multiple outcomes, compressing planning horizons and capital deployment decisions.

Infrastructure vulnerabilities surfaced again during the recent cold snap, underscoring grid fragility and power constraints.

For AI infrastructure and manufacturing, energy reliability is no longer a background condition.

It is a binding input.

None of this is forcing repricing yet. But it raises the floor on uncertainty.

Trade Implication

Geopolitical and regulatory risk should be modeled as funding and input volatility rather than headline shock.

Position energy, infrastructure, and industrial exposures with awareness that operational constraints can surface quickly.

FROM OUR PARTNERS

REVEALED: America just unlocked a $500 trillion asset

Everyone's talking about AI stocks but almost no one is talking about what AI actually runs on.

Nickel. Copper. Cobalt. Manganese.

America just secured exclusive rights to the largest untapped supply on Earth.

One company is already in position and this could be one of the most important AI infrastructure plays heading into 2026.

THE HIDDEN ADJUSTMENT

The Yield Sensitivity Threshold Has Shifted

The 10-year approached the upper boundary of its recent range without triggering equity liquidation.

That matters.

Positioning was not fully hedged for a strong print. Duration sold first. Equities recalibrated rather than capitulated.

Equities are less fragile to incremental yield increases than they were last year.

Financing costs still matter. The instability threshold is simply higher.

If yields stabilize below recent highs, cyclicals and infrastructure beneficiaries can extend. A sustained breakout in yields would reset that tolerance quickly.

Edge Setup

Lean into cyclicals if yields consolidate. Rotate toward cash-flow defensives if yields accelerate.

U.S. MARKETS CLOSE

THE POSITIONING REALITY

The System Cleared. The Cost Of Time Increased.

Strong data did not break the tape.

Yields repriced. Equities absorbed. Credit stayed orderly.

Two paths remain.

If data continues to surprise upward, the restrictive window extends and valuation tolerance narrows.

If revisions accumulate and growth remains narrow, duration pressure returns from a different direction.

Capital is deployed.

Time is more expensive.

Duration is no longer subsidized.