TQ Evening Briefing

One sharp swing showed how fast leadership can return. When yields cool, the tape thins and traders must choose between chasing momentum or respecting the risk.

After The Bell

Markets rewired the narrative by the close.

The AI complex snapped back with enough force to remind everyone that selling the theme is never the same as breaking it.

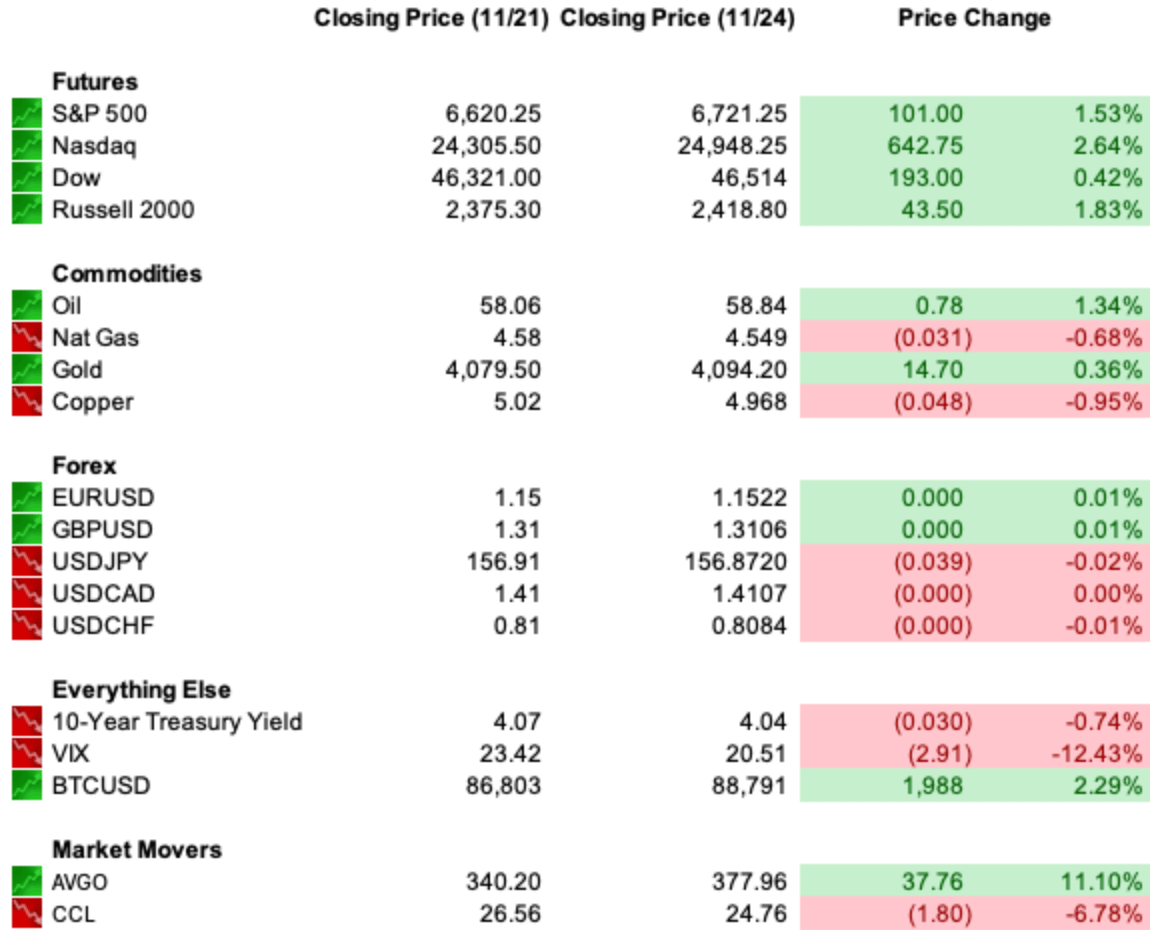

The Nasdaq jumped 2.5%, the S&P 500 rose 1.5%, and the Dow gained 0.5%. Treasury yields eased, while Bitcoin clawed back to $88.7K after last week’s slide.

Tech led the tape from start to finish.

Alphabet surged to fresh highs after unveiling its new Gemini model, pulling semis sharply higher: Broadcom up, Micron up, AMD and Nvidia each adding 5–6%.

The move reflected more than hype.

With rates expectations firming, valuations regained breathing room and cyclicality briefly mattered less than duration.

Sector flows were clean: Tech, Communication Services, and Consumer Discretionary outperformed; defensives lagged.

Europe’s defense slump carried its own message: peace negotiating is no longer theoretical, and every inch of progress pressures the hedges built around escalation.

Investors didn’t dump defense because they hate the trade, they dumped it because the regime that supported it suddenly looks less certain.

Tomorrow’s retail sales and PPI now have more influence than they should.

The rally has thinned liquidity, leaned investors long, and put sentiment back on offense.

One clean number can extend the tape; one ugly one can snap it.

This market may be climbing, but it isn’t climbing with a safety net.

Premier Feature

$50 Billion Says You’ll Want These Names

Wall Street’s big money is already moving — quietly building positions in a handful of stocks before the next rally.

Our analysts tracked the flows and found 10 companies leading the charge.

Some are household names. Others are under-the-radar innovators about to break out.

Together, they form the Post-Rate-Cut Playbook smart investors are following right now.

Monetary Pulse

Markets are treating the rate debate less like a macro call and more like a liquidity puzzle.

The Fed is heading into year-end without the two data points that normally anchor policy: October CPI and a full labor read.

With the hard numbers missing, traders are forced to price tone instead of trend — one soft signal flipped December odds from 30% to nearly 80% in a week.

In a data blackout, language becomes the macro.

That vacuum is magnifying the divide inside the committee.

One camp keeps pointing at 3% inflation and argues the easing door isn’t open; the other sees a cooling labor market and wants insurance.

Until one side produces proof strong enough to move the entire board, curves will stay twitchy and December trades are more like a volatility event than a policy decision.

The uncertainty is bleeding into the market’s wiring.

Tech has reclaimed leadership as rate-cut odds firmed, but valuations are stretched and the big AI-capex cycle still has to justify its cost.

That’s why positioning feels sturdy at the surface but fragile underneath.

One sharp macro read can still reset the whole stack.

FX desks are watching the dollar grind sideways while the yen sits close to intervention lines, the kind of setup where thin holiday liquidity can turn a small move into a quick spike.

The through-line is a scarcity of clean signals.

Every asset class is trading the absence of information rather than the presence of conviction.

The edge now goes to desks that can separate policy uncertainty from policy intent.

The fog lifts once the November data finally lands; until then, traders are pricing the space between the numbers.

Federal Focus

Washington spent the day testing the edges of institutional discipline, and each thread carried a market angle whether it intended to or not.

The funding story started in the plumbing: banks still hesitate to touch the Fed’s standing repo facility, worried that a routine liquidity backstop will look like distress two years from now when usage becomes public.

That stigma keeps repo rates jumpier than they should be, which matters because year-end balance-sheet cleanups are about to collide with heavier Treasury supply.

When the pipes creak, rate volatility becomes the first asset-class equalizer.

Across the aisle, the Obamacare tax-credit fight turned into another tug-of-war over purchasing power.

Republicans are pitching cash-to-HSA transfers instead of renewing the enhanced subsidies, a shift that would put more out-of-pocket risk on middle-income households right as premiums reset.

For markets, the takeaway is simple.

If consumers absorb more medical costs, discretionary spending softens, and rate-cut optimism has a harder time feeding through to cyclicals.

Healthcare insurers already priced in a clean extension; anything less complicates their 2026 visibility.

And the Pentagon’s probe into Sen. Mark Kelly injected a different kind of uncertainty: command-and-control risk.

The legal debate isn’t market-moving on its own, but the political temperature it reflects matters for volatility.

A Congress fighting over military obedience in an election-heavy year keeps headline risk elevated and pushes investors toward the safer parts of the curve.

Washington doesn’t need new catalysts to move markets, but it keeps finding them anyway.

The through-line is constraint.

Banks won’t tap the tool built for them, consumers may shoulder more health costs, and political actors are edging into institutional boundaries.

Traders don’t need to read it as drama; they just need to price how much frictions pull liquidity, spending, and sentiment off their current tracks.

From Our Partners

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

The World Tape

Geopolitics fed directly into positioning this week as the Ukraine peace process shifted from closed-door drafting to visible disagreement.

Washington and Kyiv are trying to align around a revised framework, Europe has circulated its own counter-proposal, and Moscow has already dismissed the EU version as unworkable.

The market read isn’t about which draft prevails; it’s that the negotiation now has three centers of gravity.

When allies diverge on terms and timing, traders widen European risk premia and treat diplomacy as a source of event-risk rather than relief.

That caution was reinforced by the latest battlefield news.

Strikes on Kharkiv and renewed drone exchanges signal that neither side is preparing for an imminent freeze, keeping Eastern European FX heavy and limiting how far European equities can stretch on days when global risk appetite is firm.

At the same time, the G20 delivered a rare moment of multilateral unity, but without the United States.

South Africa rallied nearly all members behind a declaration Washington opposed, a reminder that the global policy ecosystem can still function even when the U.S. sidelines itself.

EM traders took it as permission to ease some hedges, though the relief stayed tactical, not directional.

China then added a strategic wrinkle with an unusual move: Xi personally called the White House to push for a bigger role in the Ukraine talks and to restate Beijing’s line on Taiwan.

Taken together, the geopolitical landscape didn’t settle; it stratified.

You now have peace talks with competing drafts, a G20 rebuking the U.S. from the outside, and China stepping forward just as Western unity wobbles.

That combination is enough to keep volatility floors elevated and ensure geopolitics remains a tradable input, not background noise.

U.S. Markets Close

From Our Partners

Inside the A.I. That Trades Like a Human, Only Faster!

For the first time, traders have access to an A.I. that doesn’t just react to markets — it masters them.

Born from breakthroughs in machine learning, this system trained itself on millions of price patterns until it could read the market like a seasoned pro.

It builds its own rules, learns from every outcome, and executes with machine-level precision — no emotion, no hesitation.

Each session makes it sharper, faster, and more confident.

Closing Call

A textbook relief rally into thin November liquidity.

One phone call between Trump and Xi was enough to soften geopolitical edges and reopen the AI trade, while Waller’s push for an “imminent” cut re-anchored front-end pricing.

Markets didn’t need conviction, they just needed direction.

The question for Tuesday is simple: does the data confirm the move or complicate it?

Retail sales and PPI land into a market running light on shorts and heavy on narrative.

If stagflation signals creep in, this bounce can stall fast.

If not, the path into the holiday is calmer than it looked just 48 hours ago.

For now, the tape belongs to tech, the curve belongs to the Fed, and the next 24 hours belong entirely to the data.